Read the cryptocurrency wallet pattern and future development

Today's content includes:

1. Overview of the cryptocurrency wallet pattern

2. The second layer of solutions and the next wave of innovation

3. Securities token (STO) update in the third quarter of 2019

- The future of credit, currency and digital currency

- Gartner: Blockchain is listed in the top ten strategic technology trends of 2020, against one of the highlights of deepfake

- 2019 Will it be the "year of DAO"? A text on the past and present of the centralized autonomous organization

4, xDdai's non-inflation stable Staking design

5, the new side chain design of Bitcoin

1. Overview of the cryptocurrency wallet pattern

1Confirmation's latest work by Richard Chen, an overview of the cryptocurrency wallet.

Wallets are a key infrastructure for cryptocurrencies. The behavior of each cryptocurrency (whether it is buying or selling cryptocurrencies, holding cryptocurrencies, sending cryptocurrencies, etc.) depends in some way on the wallet. Just as a web browser is the gateway to the Web2 Internet, the wallet is also the gateway to Web3. Given its importance, the wallet business has so far received nearly $400 million in financing, including Ledger ($88 million), Blockchain ($70 million), BRD ($54 million) and Abra ($35.5 million).

In addition to the basic wallet layout and the introduction of the Web3 wallet, the author also introduced:

Web3 wallet

From a user's perspective, the main difference between Web2 and Web3 applications is that Web3 applications require a wallet in the browser. The Web2 wallet is useful if you only want securities to store cryptocurrencies, send and receive transactions, and buy and sell cryptocurrencies. However, they are not very useful for interacting with Web3 applications.

Metamask is the clear leader of the Web3 wallet.

Hedgehog is a desktop Web3 wallet developed by the Audius team to replace Metamask.

Coinbase Wallet and Trust Wallet are two online mobile web3 wallets.

Wallet SDK

The SDK wallet is similar to a Web2 login with a username and password. Users do not need to download a separate extension to use the application, nor do they need to click a pop-up window each time the user wants to send a transaction. In addition, the wallet itself is integrated into the website and is supported on all devices and browsers.

Smart contract wallet

The contract account is just the code that always exists on the Ethereum blockchain, and there is no private key to access the funds in the account. With contract accounts, smart contract wallets get rid of the notion of fully managing private keys for users. Representatives include Gnosis Safe and Dapper.

Meta-transaction

Meta-transaction is an emerging design model pioneered by Austin Griffth, which greatly reduces the barriers to large-scale adoption of dApp. Around this idea formed a passionate community, largely driven by the work of MetaCartel.

The development of the wallet field:

In the past year, UX has had many major breakthroughs. But the field of cryptocurrency wallets has encountered a dual development.

Existing cryptocurrency users seem to be able to use Metamask (or at least adapt to their UX issues) and have no strong incentive to move to other wallets.

The new encrypted user does not understand that the Web3 application requires a Web3 wallet and is rejected when the website says it is not compatible with Web3. UX (rather than killer applications) will be the biggest bottleneck for large-scale adoption and resolution of dApps, and this will lead to the next wave of cryptocurrency adoption.

Full text link: https://thecontrol.co/an-overview-of-the-crypto-wallet-landscape-533a18bcd124

2. The second layer of solutions and the next wave of innovation

Bitcoin is often described as a digital commodity, but its potential may be even greater. In this article, we introduce the two most promising directions for a second-tier solution.

The first is a small payment.

One of the new features of the author's favorite lightning support is Pollofeed. At first glance, this seems like a trivial app – feeding chicken through the internet. However, at a deeper level, it demonstrates how software extensions can be combined with existing software and hardware to extend the development of new unlicensed features. Micropayments will not only use encrypted e-commerce, they will also open many new applications that are not available today.

New technologies are usually just a combination of prior technologies. Pollofeed is just a robotics technology and a webcam, but now because Bitcoin has a value shift.

The second is the game, the game may be the perfect use case for encryption:

The game is built locally from the software and has a large number of players who are familiar with the hardware of the game.

The concept of digital assets and digital values has become the basic mastery of the Z generation and the millennial generation.

The economic activity of participants who send small payments back and forth between participants can create a closed economy in which cryptocurrencies can prove their value by enabling unique activities rather than trying to replace the traditional statutory economy. activity.

We have begun to see similar concepts built entirely on Turing's complete smart contract platform. But the point is that not every application needs to be completely decentralized. For some use cases, a payment system alone is sufficient.

Full text link: https://www.collaborativefund.com/blog/second-layer-solutions-and-the-next-wave-of-innovation/

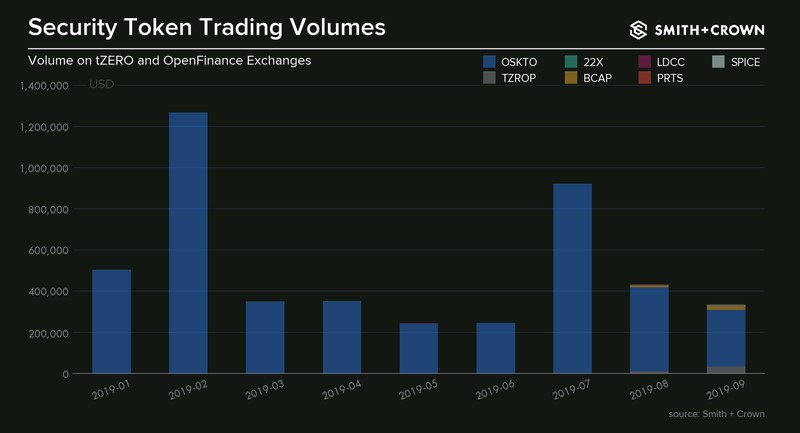

3. Securities token (STO) update in the third quarter of 2019

The amount of STO activity in the third quarter was modest, but this poor performance masked the ongoing development of core securities infrastructure relative to the initial commitment.

Securities tokens are seen by many as almost inevitable outcomes, including increased liquidity, reduced transaction and distribution costs, segmentation of ownership, programmable compliance, and the ability to democratize access to a wide range of non-traditional assets. And the ability to ultimately create new investment vehicles and corporate structures. All in all, these advantages have been repeatedly described as actually ensuring that securities are playing a central role in the future of the capital markets.

The securities vision has not yet been realized. There is no significant increase in the volume and size of transactions, and it is still dwarfed by traditional cryptocurrencies and their external fundraising methods. To be fair, the infrastructure needed to achieve this vision is still incomplete. Despite this, many developments and announcements have been witnessed in the past quarter, indicating that the foundations of the securities-based token ecosystem are still being laid.

Broad-based infrastructure development

- BnkToTheFuture announced that it will launch an STO service focused on corporate financial advisory. I-NX Limited aims to launch an independent STO trading platform and will be registered as a brokerage transaction and alternative trading system (ATS). For the first time in the sale of securities-based tokens registered with the US Securities and Exchange Commission (SEC), INX tokens will be sold, giving the holder the right to receive 40% of INX's net operating cash flow and enjoying securities-based token transaction fees. 10% discount. The offering is open to all investors but must follow the KYC process.

- MERJ, the Seychelles National Stock Exchange, has launched its stake through the blockchain-IPO token-based sale. The 1.65 million shares will be issued at a price of $2.42 per share and the company is valued at $25 million. As of November 2019, these stocks can be purchased by broker dealers Jumpstart, custodian Prime Trust and MERJ.

- Securitize is a leading technology provider for issuing securities-based tokens and has been approved by the US Securities and Exchange Commission (SEC) to act as a transfer agent for securities tokens. Securitize also announced a $14 million Series A round of financing with strategic international investors. The list of supporters also includes the Tezos Foundation and Algo Capital VC, which are involved in the collaboration of digital securities into the Tezos and Algorand blockchain.

- The six major brokers in Japan formed the STO Association to develop rules and guidelines for issuing securities-based tokens and to conduct lobbying work. The association will complement the work of existing trade associations, such as the Japan Security Token Business Association, which was established in January, and the Japan Security Token Association, which was established in May.

- Harbor, which recently switched from securities tokens to existing securities, issued ERC-20 tokens representing real estate fund stocks worth $100 million, previously managed by iCap Equity. According to the legal structure of iCap, tokens cannot be traded for 1 year. Harbor plans to promote brokerage dealer networks to perform secondary transactions within the first year, after which they will be able to trade freely.

future

Although the suffocating promise of securities-based tokens to change the financial market's potential has not yet been fulfilled, this space deserves attention as some of these trends continue to evolve. Pessimistically, securities-type tokens may not even have much room for development if there are no signs of iconic development in recent months.

Full text link: https://sci.smithandcrown.com/research/q3-2019-security-token-update-continued-modest-issuances-masks-reality-ongoing-core-infrastructure-development

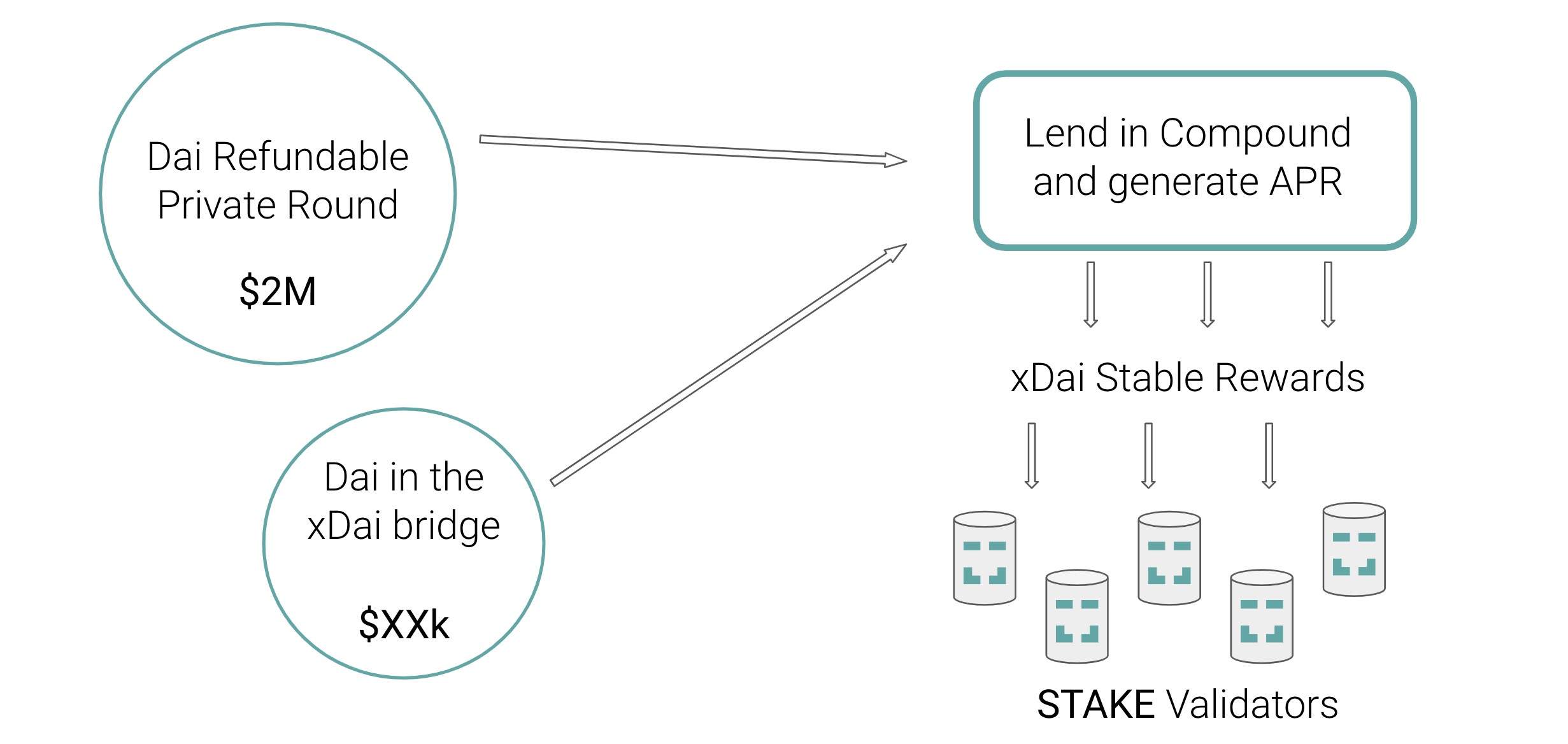

4, xDdai's non-inflation stable Staking design

This is the October update of xDAI, which includes the Staking design for their update, and their anti-inflation multi-chain stable Staking model is still very interesting.

A lot of PoS tokens and Staking systems were introduced in 2019, but as the market weakened, Staking made many people in the community uneasy.

In the design of xDai, you will be pledged and the proceeds will be the stable currency xDai reward. Then their private placement rounds offer a 100% refundable amount because they plan to put the raised funds on the Compound, and this round of participants can choose a refund after one year.

The specific design is not very detailed, but it is still very interesting to see these points. I hope to see more similar innovations and make our currency investment environment better.

Full text link: https://prospectus.xdaichain.com/updates/october-update-up-to-100-refund-and-stable-staking

5, the new side chain design of Bitcoin

tBTC is a bitcoin hook recently announced at Ethereum. The purpose of a cross-chain is to copy assets from another one in a chain while maintaining as many attributes as possible. In other words, a cross-chain pin can turn any blockchain into a bitcoin side chain.

In this paper, we take tBTC as an example to comprehensively explore the design of cross-chain nails. The ideal characteristics of such a nail may be:

– Anti-censorship: Anyone can create, redeem and use tokens regardless of their identity or jurisdiction.

– Resistance to confiscation: The custodian and any other third party cannot seize the coins in the deposit.

– Price stability for Bitcoin: The proxy token closely tracks the price of Bitcoin, thus inheriting its currency attributes.

– Acceptable operating costs: The system can provide services at a price that attracts users and custodians.

By looking at the ideal attributes associated with operating costs, we find that systems like tBTC can achieve higher securities by insuring each step of the bond, and bonds can be cut or confiscated due to misconduct. Now, whether this kind of extra securities is worth the price of users is easy to become the core issue in the field of encryption.

Full-text link: https://blog.deribit.com/insights/a-new-sidechain-design-for-bitcoin/?utm_campaign=1confirmation%20Newsletter&utm_medium=email&utm_source=Revue%20newsletter

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Google claims to achieve "quantum hegemony", IBM, V God, Bitcoin developers have come to refute

- Dutch International Group (ING) Releases White Paper: Corda Blockchain Security and Privacy Improvement Solution

- Why do bitcoin futures break through the bitcoin bubble?

- Blockchain industry distribution survey: 42% of practitioners are exchange employees

- Deutsche Börse and German commercial banks use DLT technology to settle tokenized securities

- Zuckerberg's 6-hour hearing is a full review: criticism of the controversy coexists, creating "imaginary enemies" holding tight supervision of the thigh

- Bitcoin flash crash is not accidental? Analysis says that bitcoin network activity slows down