The future of credit, currency and digital currency

Author: Kay's Story

The history of mankind is a constant repetition.

The previous article, "The Future of Bitcoin in the Great Depression of the World," has caused a lot of heated discussions. The points of intense discussion are mainly concentrated on two: one is time and the other is concrete.

Coincidentally, Buffett now holds $122 billion in cash, more than half of its stock market value. When this data appeared in history, it was generally the eve of the crash. Of course, the market itself is distorted, that is, the market will always be slower than people think. It means that it often lags behind when the market reacts, which is why people often can't notice when the market crosses the highest point.

- Gartner: Blockchain is listed in the top ten strategic technology trends of 2020, against one of the highlights of deepfake

- 2019 Will it be the "year of DAO"? A text on the past and present of the centralized autonomous organization

- Google claims to achieve "quantum hegemony", IBM, V God, Bitcoin developers have come to refute

Another well-known is the Buffett index, which reached 145% when the Internet bubble burst in 2000, and 135% before the 2008 subprime crisis. Today, we suddenly found that the indicator has reached 140%. Do you still remember the famous Buffett quote?

Others greedy me with fear, others fear me greedy.

Recently, a more interesting news broke out. CNBC, The Wall Street Journal and other people familiar with the matter said that Softbank took over the negotiation of the shared office startup WeWork (now renamed The We Company), which is nearing completion and Softbank plans to WeWork reinvested between $40 and $5 billion and eventually held 80%.

This turned Softbank into $15 billion and bought an 80% stake in a company with a valuation of less than $8 billion. Isn't this a joke? The most real thing is that the rich are also cut from wool. Who is behind the vision fund? It is a Saudi sovereign fund. One of the richest families on earth has been cut amaranth, which is a joke.

We must always remember that the world is progressive and fragmented. The middle class is desperately trying to preserve its value and seat in the middle of society. The people at the bottom are suffering, and the wealthy people are just angering why today's service is not as good as yesterday's.

When the richest group is also sheared, it means that this round of social wealth game drums is about to stop.

This round of social wealth game drums and flowers has almost come to an abrupt end.

Today, we look at Hong Kong. Is this an isolated case? Around the world, we see riots everywhere and even fires almost every day at a speed visible to the naked eye. From Asia to Europe, from the Middle East to South America, it is everywhere.

The violent demonstrations in Catalonia, Spain, have entered the fourth day. The demonstrators not only launched actions to block roads and occupy the airport, but also arson on the streets and smeared the Spanish flag. The British BBC directly used the expression of “thugs”.

Just this past weekend, India and Pakistan opened fire in Kashmir, killing at least 10 people. This is one of the most serious casualties in the exchanges between India and Pakistan this year. On Sunday, the US troops withdrew from Syria to Iraq, and they were greeted by rotten potatoes thrown by angry civilians. Just a few days after President Trump announced a sudden withdrawal from the northern part of Syria earlier this month, the Turkish army and Turkish-backed Syrian armed forces launched an offensive against the Kurdish armed forces.

As I said in my last article, the death knell will ring in 2020. In the near future, riots will appear inside the United States.

The topic I want to talk about today is actually money.

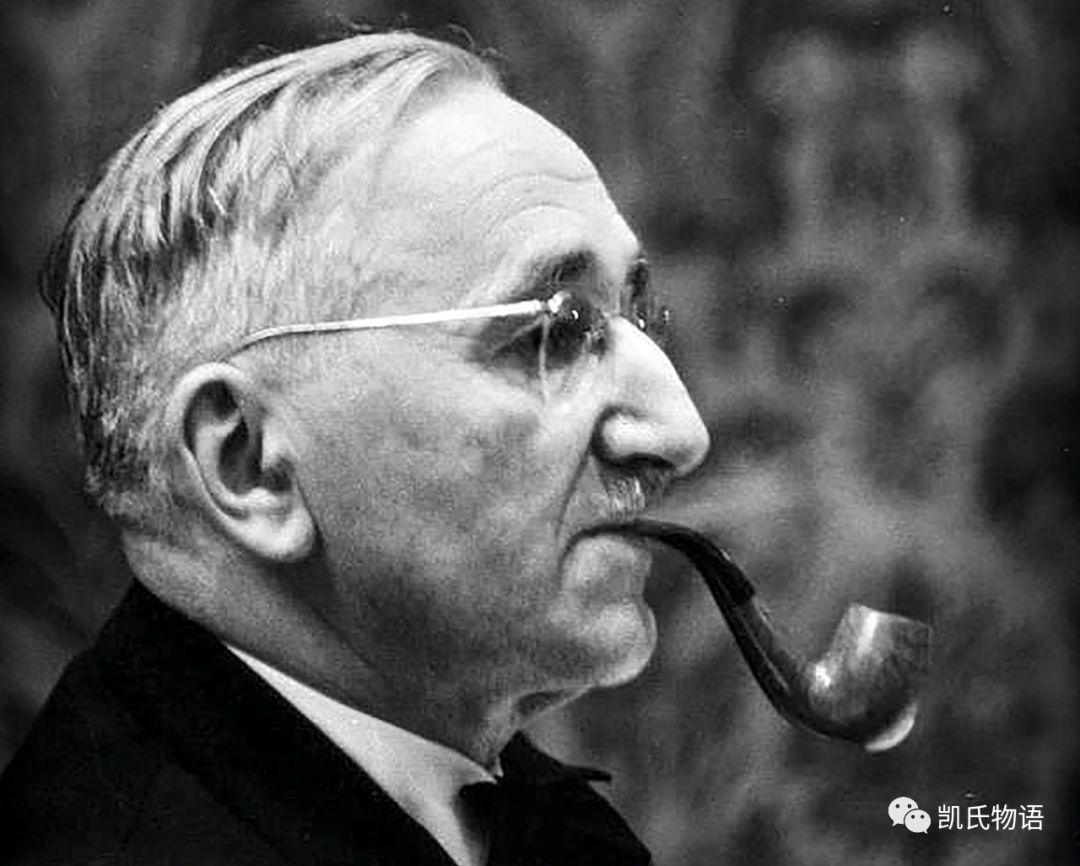

In "The Wealth of Nations", Adam Smith put forward a question. What makes the currency exchange value? Finally, he came to the conclusion that it is the hard work of mankind. Because of the time and labor costs, it has a value scale. But Hayek does not think so.

Hayek studied the theory of money and economic cycles in his early years. He believes that money is only a means of circulation and a unit of calculation, and has no effect on the operation of the economic system. However, in order to maintain this nature of money, the total amount of money must be kept constant. He used this to oppose the policy of regulating currency to stabilize the economy. He also believes that the capitalist economy itself has a function of self-stabilization.

The cause of the economic depression is excessive investment and insufficient money supply. But as long as it is natural, the fall in prices caused by the economic depression will change the trend of the decline in the savings rate, so that the situation of insufficient money supply will be reversed and the economy will naturally recover. . It is thus asserted that the state’s intervention in economic life is superfluous and even disadvantageous.

In other words, Hayek’s core view is the currency neutral theory. The increase and decrease of currency does not affect the development of the economy.

At this time, we found another famous person in the economy, called Cantillon. Cantillon was the first economist to recognize that the increase in the amount of money would result in inconsistent price increases for different commodities and factors. He further believes that the different effects of changes in the amount of money on the real economy depend on the way the money intervenes in the economy and who is the holder of the new currency. This was called the Cantillon effect by later generations.

Cantillon stood on the complete opposite of Hayek and insisted on the currency non-neutral theory.

The issuance of currency will be accompanied by a process of redistribution. Those who get the money first will push the price of social products up, and those who get money or even get the money will bear the consequences of inflation. In other words: the issuance of money will lead to an increase in the gap between the rich and the poor or an imbalance in the market.

In the past decade, we have clearly seen that currency inflation has had a different effect in China and the United States. China has entered large-scale real estate and infrastructure construction since 2008, which is like putting the additional currency into a huge reservoir. Effectively control the flow of money.

Of course, any redistribution of wealth will have problems first come and then come. It is normal for someone to get rich first. Real estate and infrastructure construction are relatively low-liquidity investment products, which help the RMB to hedge the risk of the upcoming Great Depression.

The United States is different. The stock market and the bond market have undertaken the work of the dollar currency inflation reservoir. The corresponding result is that the poor can not enjoy the benefits of money growth, the middle class bears the consequences of the 2008 subprime mortgage crisis, and the rich class enjoys the practical benefits of money growth and the illusion of social progress.

In the past 100 years, the economists who have been deeply affected by capitalist countries are Cairns. Keynes advocated that the currency is not neutral. It is believed that the government should use fiscal and monetary policies to offset the negative impact of the short-term economic cycle on people's employment and income.

Keynes's theory was put forward in the 1930s. At that time, during the Great Depression, there were not only long-term and large-scale unemployment problems, but also deflation problems. Therefore, monetary policy could not stimulate economic recovery. Keynes therefore believed that it would be necessary to expand the fiscal policy of government spending. Solve the economic depression. However, Keynes’s policy also creates a government budget deficit, which has become the focus of questioning and controversy.

Keynes believes that in order to reduce the serious unemployment problem, the fiscal deficit can be tolerated. When the economy recovers, production, employment and income will naturally increase, and the government's tax will also increase, and the fiscal deficit will be solved. Keynes believes that the people will suffer because of economic depression and unemployment. This is inevitable, so Cairns’s famous saying: In the long run, everyone is dead.

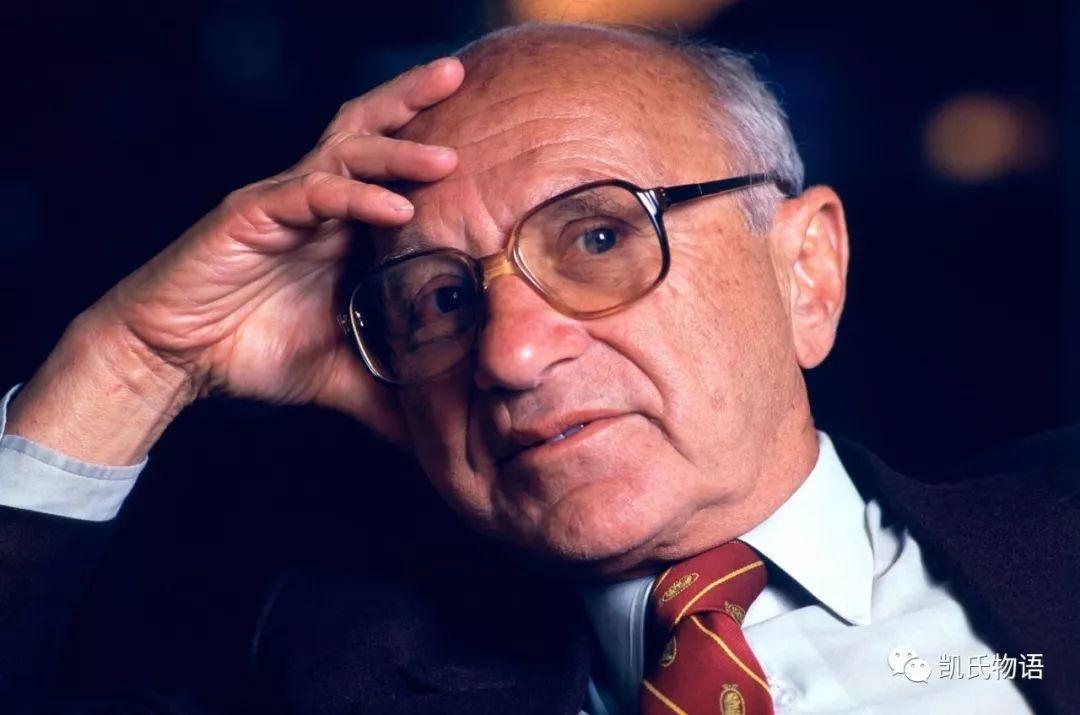

Until the 1970s, the Great Depression of the last round of the Kangbo cycle, the United States broke out of a serious stagflation crisis due to Keynesianism. Everyone began to re-examine monetary policy. At this time, Friedman, the father of modern monetary theory, stood on the stage of history.

Friedman believes that the currency is neutral but long-term non-neutral. Because according to Fisher's suggestion that when the amount of money increases, people will produce a "currency illusion" of real income growth and demand expansion, which will then affect the expansion and contraction of the market, and finally generate fluctuations in the economic cycle.

The core of the currency illusion is humanity. That is to say, there is no good or bad point in the currency itself, but the person who controls the currency “heart-to-heart” has produced a butterfly effect and finally becomes a huge social cycle. Friedman proves that in a very short period of time, excessive money supply will blind people's eyes and create an illusion of economic prosperity, but the market will soon wake up and adjust, economic output will not increase, only Bring higher prices.

In the 1960s, Friedman said the famous saying: "There is no free lunch in the world." If the government spends one dollar, the dollar must come from the producers and laborers in the private economy. There is no magical multiplier effect brought by the so-called high-capacity Peter's one dollar to low-capacity Paul. .

He expressed an unprecedented view: money is an asset and, more importantly, money has a trading function.

It turns out that everyone thinks that money is only a special commodity, and it is a general equivalent. But if money is an asset with trading functions, then whether it is gold, silver or bronze, shells, banknotes or bitcoin or Ethereum can be a currency. This short sentence has already expressed the soul of the currency.

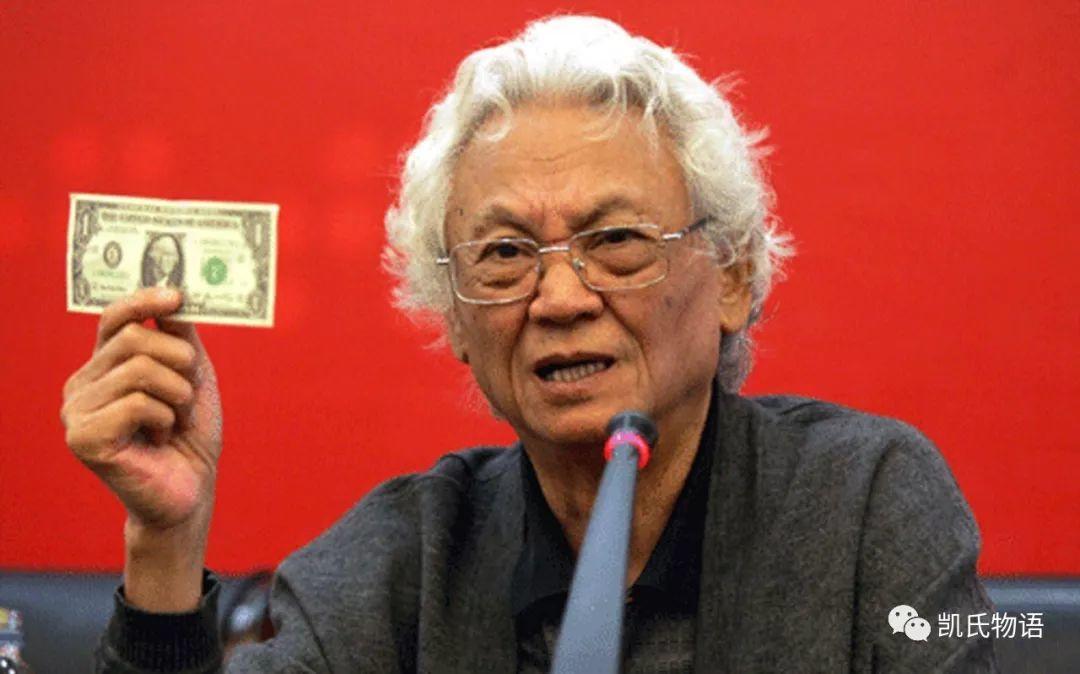

Friedman is almost infinitely close to the essence of money, and the person who finally wears this gauze is Professor Zhang Wuchang. Professor Zhang Wuchang believes that the currency must first have a trading function because of the transaction costs in the commodity exchange. Currency can significantly reduce transaction costs.

But the same, it means that people who issue or manipulate money will have a lot of power, and power can be abused. Because money is used as a trading medium, saving transaction costs can bring huge benefits, so deception will occur. Further, after the collapse of the Bretton Woods system in the 1970s, the dollar-dominated currency was an anchor currency without an anchor.

Under the credit currency system, the power to manipulate money is often misused, and the policy of the central bank or the Federal Reserve will bring huge information spreads, that is, knowing in advance that monetary policy will likely obtain more money.

However, this does not affect the issuance of credit money or bonds. In the whole society, even if credit currency has many inconveniences and defects, it is still widely used artificially. This further extends the essence of money.

From the price theory, the starting point of money is this: If a society does not have any transaction costs, there will be no arbitrage space in the market for items to change goods, and money will not appear. In such a society, each member will professionally produce according to the relative price of the item and the comparative advantage theorem, and then trade exchange. So small to individual to individual, medium to organizational to organizational, as large as the state does not need money as a trading medium.

The reality is that money exists because society has transaction costs . The currency that appears because of the existence of transaction costs is a unit of calculation that assists in the calculation of transactions and the calculation of wealth accumulation. But the currency has a very important essence in addition to the unit of calculation of the trading medium:

Currency is the contract.

Yes, whether it is a banknote, a check or a bond, it is essentially a contract. The US dollar bill is printed with this note is legal tender for all debts, and the banknotes are printed with Promises to pay the bearer on demand. The renminbi is not the same. The People's Bank of China is printed on it. This is a contractual guarantee. Because banknotes existed in ancient China as early as the relationship between the bank and the ticket number. So this tradition has been preserved.

Therefore, whether the currency is gold or silver, banknotes or bitcoin is not important. What is important is that currency as a contractual proof of transaction can solve the problem of liquidity, whether it can play a media role, and whether it can reduce transaction costs.

The contract with the lowest transaction cost is the best currency.

So how can we achieve the lowest transaction costs? It is to stabilize the value of the currency. Only when the value of the currency is relatively stable, the two parties are willing to make the currency an intermediate medium for value exchange.

Before 1970, currency neutrality was not really important. Because money cannot be arbitrarily expanded due to product or metal properties. That is to say, the currency can remain relatively stable without a debt crisis. Since the collapse of the Bretton Woods system, whether the currency is neutral or not has become extremely important in the anchorless credit currency system.

Interestingly, Friedman published a passage through the times as early as 1999: there is still one thing missing, but it will soon be developed, that is, reliable electronic cash. In this model, transactions can be made on the Internet through A to B funds transfers, but AB does not know each other's identity before. With this method, I can hold a $20 bill and hand it to you, but I can't find the source of the bill. You may not know my identity either. This kind of thing is about to appear on the Internet.

At this point, let us rethink the development of human civilization in 10,000 years. From the 10,000-year-old Babylonian Empire and ancient Egyptian civilization, we began to worship gold, thus casting gold into various ornaments and decorations to store value. Gold is the most valuable commodity in the human world with both value storage and financial attributes. It is a descriptive tool against the abuse of credit money.

Silver, which began thousands of years ago, is the core of the economic development of ancient imperial civilizations. Silver has both value storage attributes and financial attributes as well as industrial attributes. Financial attributes allow prices to follow gold. At the same time, as an industrial variety, the price of silver is closely related to the level of inventory – high stocks, low silver prices; low stocks and high silver prices.

Then in the history of mankind, the earliest alloy, bronze, appeared, which opened the era of human copper coins. Bronze is well cast, wear resistant and chemically stable. Thus, in ancient times, it has been a stable financial property and the most widely used application scene in the human world.

Finally, two hundred years ago, China emerged as the prototype of modern currency – the ticket number, and the unanchorized currency that modern society emerged from the collapse of the Bretton Woods system in the 1970s, which is the credit currency.

In the true sense of human history, only four types of currency appear: value storage currency, operating system currency, application system currency, and stable value currency.

In the past 30 years of the rise of the entire Internet, we have actually seen the gradual progress of these four non-monetary patterns. From the global network database starting from the World Wide Web, to the operating systems of Microsoft, Apple and Linux, to the Android and IOS applications, until the WeChat payment and Alipay payment, the stable digital payment model of anchoring the RMB appeared.

Back in the blockchain, where digital currency is more valuable than money, it is precisely because its transaction costs are extremely low, and it is very stable, and trust relationships can be formed through machine networks. Smart contracts are important because smart contracts hit the soul of the digital economy. Digital currency is a smart contract. Let us reorganize the idea of digital currency here. What is digital currency? Here I give a complete definition:

Digital currency is a data asset with a very low transaction cost for an executable smart contract with trading capabilities.

From this perspective, we re-examine a piece of news on October 16 last year: the $190 million bitcoin big transfer miner costs only $0.10. Will get a very positive answer: Bitcoin as digital gold is not actually used for regular payments, but for data assets for large value storage and transfer.

In the same way, when we re-observe Ethereum, we will also see that Ethereum as the operating system's greatest value is not used for regular payment, but as a different standard value storage, transfer, development, implementation of protocol standards The intellectual property of the smart contract exists.

When we saw the stable currency, we just saw the scene of such a super-issued US dollar and QE quantitative easing, that is, the USDT constantly surpassed the form of currency in each public chain.

But I don't think that USDT over-extension will affect the price of digital currency, because the credit currency of the human world is a stock market. The excess currency brings stock competition. The final result is necessarily the redistribution of wealth, and often the currency. The closer the person gets, the bigger the benefit. It has also formed a growing gap between the rich and the poor in the world. The digital currency is a market for demographic dividends. It has just begun, and it is far from reaching the level of stock competition.

The super-stable stable currency will only accelerate the conversion of the credit currency of the human world stock to the machine network digital currency.

Many people are looking for blockchain 3.0. In fact, as long as you understand the history of human currency, you can easily understand what will happen in the future.

The core of the big bull market in 2013 is to establish Bitcoin as a digital gold, which is the value of a value-preserved currency. However, it was not until 2017 that a large number of forked coins were continuously produced and died, and the status of digital gold was gradually established.

In 2017, the big bull market should establish Ethereum as the digital silver, which is the status of operating system currency. Since Ethereum's overall upgrade to 2021 ended, it also extended the confirmation time, which led to many competitors.

What is being established between 2017 and 2018 is the status of stable currency. As I said in the article a year ago, there are only two stable coins in the future. One is a completely decentralized stable currency, which may be USDT; the other It is a digital currency endorsed by a large national central government. Only China has the conditions, that is, the CBDC that will appear.

The upcoming bull market is bound to accompany Bitcoin as a digital gold to the human currency stock market. Ethereum has been officially confirmed as an operating system, and two stable coins have coexisted at the same time.

The core of the upcoming bull market must be the rise and determination of the application-based currency, which is the blockchain 3.0 in the true sense.

In many articles in the past, I have clearly mentioned a point: in 1995, now the blockchain, we are close to the bubble burst for nearly five years. In the past two rounds of digital currency, the big bull market has actually been observed for a longer period of time, far less than the current big bull market in this round, such as volume, speed and depth.

The four infrastructure currencies of the blockchain world will be fully defined when the current round of digital currency bull market opened by the application-based currency brings a huge bubble.

This is why Hebrian HYN is important: all location-based blockchain services and data applications will require application support.

And opened in 2024, will be the first year of the composite application ecology. Whether it is the public chain or Dapp, with the help of the four infrastructure currencies of the blockchain, the blockchain is gradually opened to a large extent. By 2029, at the end of the current Kangbo cycle, the core of the next round of the Kangbo cycle, the blockchain will unite AI artificial intelligence and IOT Internet of Things to open a big era of intelligent digital assets.

Don't fall on the eve of the huge wave of human transformation into digital assets.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dutch International Group (ING) Releases White Paper: Corda Blockchain Security and Privacy Improvement Solution

- Why do bitcoin futures break through the bitcoin bubble?

- Blockchain industry distribution survey: 42% of practitioners are exchange employees

- Deutsche Börse and German commercial banks use DLT technology to settle tokenized securities

- Zuckerberg's 6-hour hearing is a full review: criticism of the controversy coexists, creating "imaginary enemies" holding tight supervision of the thigh

- Bitcoin flash crash is not accidental? Analysis says that bitcoin network activity slows down

- Coinbase has received transaction revenues of nearly $2 billion so far, and the company decided to support Libra.