Why do bitcoin futures break through the bitcoin bubble?

Source: Zero Finance

In a recent interview, Christopher Giancarlo, former chairman of the US Commodity Futures Trading Commission (CFTC), revealed that the US Trump administration had smashed the bitcoin bubble at the time by allowing the introduction of bitcoin futures products in 2017.

“One of the less well-known news in the past few years is that CFTC, the Treasury, the SEC, and the then National Economic Council Director, Gray Cohn, believe that the launch of Bitcoin futures will break the bitcoin bubble, and the result is indeed,” Giancarlo said. To.

- Blockchain industry distribution survey: 42% of practitioners are exchange employees

- Deutsche Börse and German commercial banks use DLT technology to settle tokenized securities

- Zuckerberg's 6-hour hearing is a full review: criticism of the controversy coexists, creating "imaginary enemies" holding tight supervision of the thigh

Before and after the bitcoin bubble burst

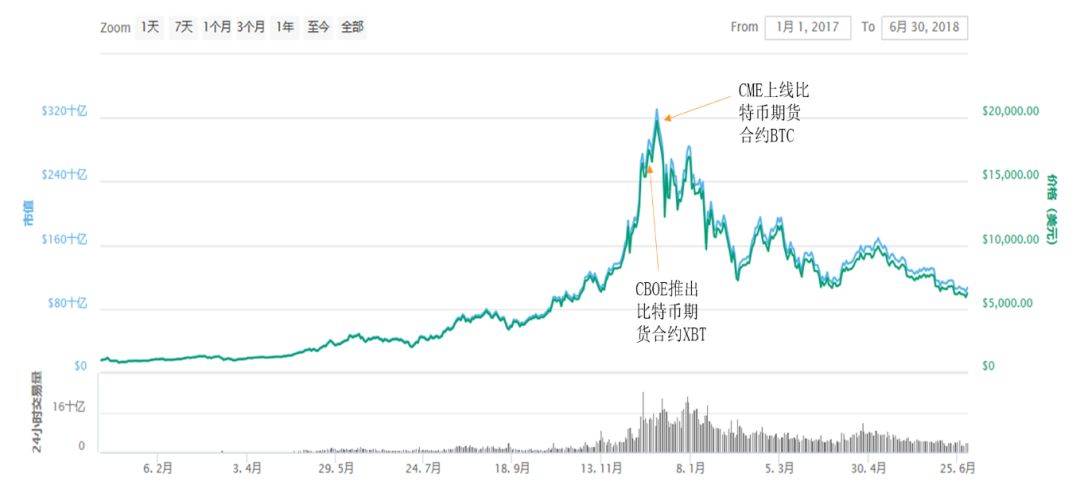

After nearly a year of skyrocketing, bitcoin prices have risen from $1,000 at the beginning of the year to around $17,000, and the market is in a frenzy. Many Bitcoin believers even believe that bitcoin breakthroughs of $100,000 may be about to become a reality.

At the end of this carnival, accompanied by the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME). On December 1, 2017, the US Commodity Futures Trading Commission (CFTC) formally approved the CME, CBOE, and Cantor exchanges for Bitcoin futures listing requests. (Note: The CFTC committee consists of five members for a five-year term, and all members of the CFTC are directly appointed by the President of the United States.)

Subsequently, CBOE and CME announced the launch of the Bitcoin futures contract within a week of the difference. This was seen at the time as a recognition by some mainstream institutions for the cryptocurrency that had been in the gray zone, and it undoubtedly gave the avid market a stimulant.

Source: CoinMarketCap, Zero Financial Chart

On December 11, CBOE took the lead in launching the Bitcoin futures contract XBT. "These derivatives are real game changers that will revolutionize the traditional financial sector and increase the acceptance of cryptocurrencies. In the next 10 years, the cryptocurrency market will explode in terms of assets and currencies involved," CBOE Worldwide Market COOs evaluate the significance of Bitcoin futures.

The hot scene on the first day of the line seems to verify people's previous expectations. As the rate of increase far exceeded expectations and fluctuated greatly, the three times triggered a blow on the day, closing at $18,545, up nearly 20%, and the first day contract was over 4,100. The excessive traffic even caused the CBOE page to collapse. At the same time, the spot price of Bitcoin is approaching $18,000, and it has risen nearly 79% in early December, the biggest increase in four years.

On the 18th, CME officially launched the Bitcoin futures trading, and the opening price exceeded $20,000.

But after the carnival, it is often ushered in infinitely deserted. What many people didn't expect at the time was that on the 17th of the past, the spot price of Bitcoin had touched the highest point so far – $19,142.

In 2018, bitcoin prices began to fall, and both spot and futures trading volume declined significantly: spot trading volume shrank by more than 80%, and CBOE bitcoin futures contract products did not exceed $1 billion.

On December 17, 2018, after a full year of hitting a peak of $19,142, bitcoin prices were only $3,280, a drop of more than 83%.

The time-to-market for Bitcoin futures contracts is highly coincident with the time node where bitcoin prices have reached their all-time highs, which is difficult to describe with just a coincidence.

Bitcoin futures contracts curb optimists' "believers market"

Many people have long recognized that the greatest value of futures lies in value (price) discovery and risk hedging. Although volatility is the essence of the trading world, futures can gradually return a value of investment from the current stage to its value, and the two-way trading market also allows investors to have more investment choices.

But in the bitcoin futures market, this seems to be not obvious.

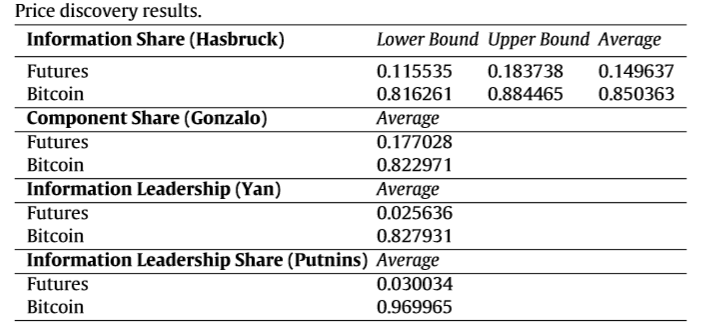

When Shaen Corbet et al. studied the effects of bitcoin futures contracts in 2018, they found that the bitcoin futures market increased the volatility of bitcoin prices. The results of the study show that since November 29, 2017 (the first two days of the announcement of the introduction of Bitcoin futures), the volatility of bitcoin prices has increased significantly, and the distribution of price returns has also changed significantly. In addition, the price discovery function of the Bitcoin futures market is significantly weaker than the spot market, which is quite the opposite of many people's feelings.

Source: "Bitcoin Futures – What Use are They?"

The Bitcoin futures contract does not seem to have played its previously expected role. On the contrary, after the launch of the Bitcoin futures contract, the bitcoin market began to enter a long bear market.

A report released by the Federal Reserve Bank of San Francisco under the Federal Reserve Bank in May last year showed that bitcoin prices have fallen since December 2017 and are inextricably linked to the launch of Bitcoin futures.

The report believes that futures provide a simple and liquid channel for Bitcoin investors, which largely steals funds from the Bitcoin spot market. Before the Bitcoin futures went public, the Bitcoin market was just a “believers market” composed of optimists. Optimistic expectations are the only reason for the soaring bitcoin price, but pessimists have no suitable way to short bitcoin and bet on falling prices to make a profit. Therefore, after the Bitcoin futures market, pessimists can switch from the bitcoin market to short-selling bitcoin in the futures market, causing the spot demand to fall and the bitcoin price to fall.

The CFTC chairman's remarks are basically consistent with the views in the report. Both believe that the emergence of Bitcoin futures contracts has curbed the bitcoin spot market dominated by optimists.

At the end of 2017, the Trump administration allowed the introduction of Bitcoin futures products to break the bitcoin bubble at the time. It is not necessarily a bad thing from the long-term development of Bitcoin. But Giancarlo's statement itself reveals a lot of information: on the one hand, people see the political power behind the launch of the Bitcoin futures contract, and the US's close attention and great influence on the cryptocurrency market; on the other hand, it also shows Bitcoin as The cryptocurrency market represented by itself is fragile and immature. Even after the development, the price of Bitcoin lacks real value support, and the situation that is easily affected by market expectations has not changed.

Of course, it is not sensible to attribute the cause of the plunge that began in late 2017 to the Bitcoin futures contract transaction. Various factors such as the tightening of global regulation and the rise of other cryptocurrencies may be one of the reasons for the breakdown of the “bubble” of Bitcoin.

How can all this be said now?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin flash crash is not accidental? Analysis says that bitcoin network activity slows down

- Coinbase has received transaction revenues of nearly $2 billion so far, and the company decided to support Libra.

- The most complete resumption: what happened in the market 14 hours ago, what the analysts interpret

- Traditional corporate gospel, accounting giant officially launched blockchain practical tools

- US Treasury: Endorses the need to monitor Libra and question regulators' ability to regulate Libra

- After the suffering of the 9/25 tragedy, the 10·23 plunge and how many wealth dreams

- Getting Started In addition to financial innovation, how will daily life benefit from blockchain technology?