Report | Bitcoin market decline expected to increase, the lowest drop to $9500

Previous review

BTC: Bitcoin will remain sideways or even weaker next week. The BTC fell to a minimum of $9,500, a drop of up to 20%.

ETH: ETH may not be able to generate further upside momentum if risk aversion is not sustainable. ETH fell to a minimum of $175, a drop of up to 15%.

XMR: If no new funds are entered, Monroe may soon see a wave of decline. The XMR fell to a minimum of $74, a drop of over 20%.

Current report

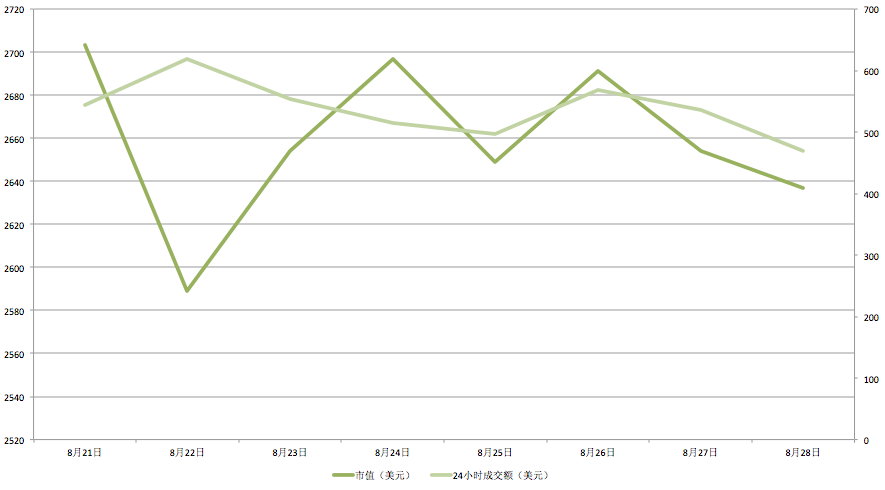

As of the release date of the report (August 28, 2019), the total market value of global digital currency assets on Wednesday was US$ 263.678 billion, a year-on-year decrease of US$ 6.667 billion, a decrease of 2.47%. The 24-hour market turnover was US$46.932 billion, a year-on-year decrease of US$7.434 billion, a decrease of 13.67%. The market value of the market has a large amplitude, and the 24-hour turnover has become a downward trend of fluctuations, and the overall fluctuation is high. It indicates that there is a large difference in market sentiment and long-term, and there is an inconsistency in the direction of future trends.

Source: Standard Consensus, CoinMarketCap

- Bystack: Looking for killer "assets" (on)

- The macro economy basically faces the potential impact of bitcoin prices

- Trading Robot for Encrypted Assets: How to Understand? How to choose?

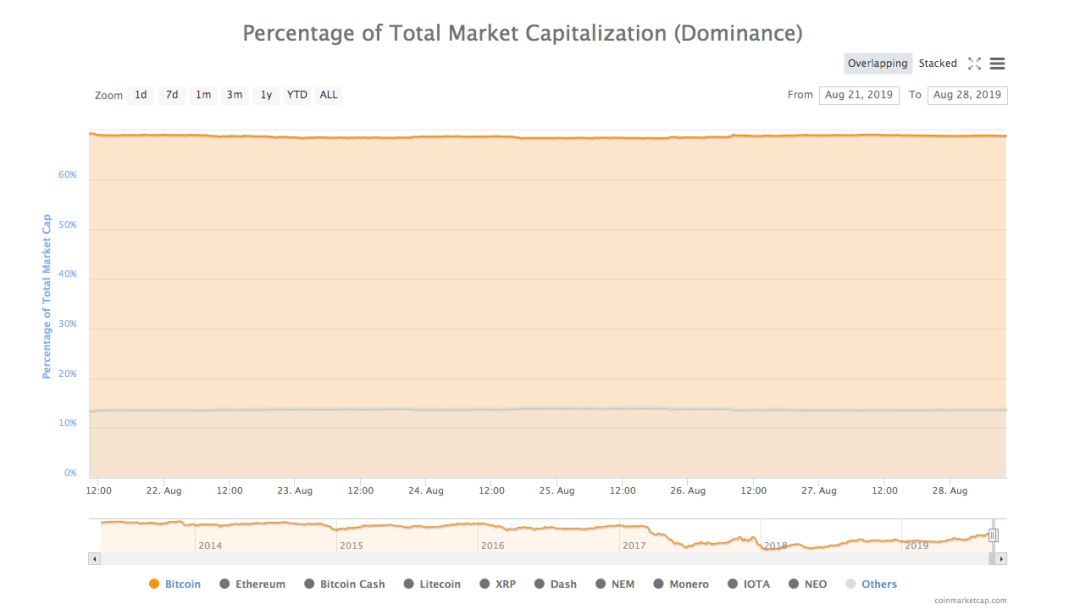

According to the standard consensus sentiment index, the current market sentiment is stable, the latest index is 0.84, the market sentiment index is gradually decreasing, the trading volume is relatively stable, the overall market operation is relatively stable, there is no sign of panic or fanaticism, and the overall trend has been fluctuating. At the same time, according to the ratio of bitcoin to total market capitalization, the market value of bitcoin has no significant change, only 0.49% lower than the same period of last year. The market value of bitcoin is still above 65%, which is in absolute control of the market; It rose to a certain extent, up 0.26% year-on-year. BTC is still in the absolute dominance of the market, and the rise and fall of BTC will continue to affect the market trend.

Source: Standard Consensus, CoinMarketCap

According to the standard consensus halving countdown index, BTC's current block height is 592,060, and there are still 252 days from the next halving. It will take some time for BTC to achieve a halving of expectations. However, investors should pay attention to the halving of BTC. When the next halving approach, BTC prices will once again enter a fast-rising cycle.

Review and analysis of the trend of BTC, ETH and LTC

According to CoinMarketCap data, BTC's average daily turnover rate was 8.98% on the 7th, which was 2.62% lower than the average daily turnover rate in three months, and 0.28% higher than the average daily turnover rate in the previous week. BTC has a certain increase in trading volume this week, but the market demand for entering funds is still low, and the overall funds are still mainly outflows. At present, the BTC fluctuates around $10,000, and the price is near the bottom support level of the falling triangle, which has a certain rebound demand. However, the BTC's price rebound volume is weak, and the market capital will not be strong. Prices are still dominated by a downward trend, and when the BTC price falls below $9,000, it will open the downside.

According to CoinMarketCap data, ETH's average daily turnover rate was 33.18% on the 7th, which was 2.28% higher than the average daily turnover rate in three months, and rose by 0.99% from last week's average turnover rate. ETH is still in the downtrend channel, but the volume has increased to some extent. It shows that market funds have diverged in the process of falling ETH prices, and there are constantly funds to enter for bargain-hunting. However, the long-term willingness to hold is not strong, and the strength and duration of the rebound are weak. If ETH can't break the $205 resistance level, the price will drop to $170 again.

According to CoinMarketCap data, LTC's average daily turnover rate was 56.18% on the 7th, which was 0.46% lower than the average daily turnover rate in three months, and 2.87% higher than the average daily turnover rate in the previous week. LTC is $145 higher than the highest point and has fallen by only 50%. On the one hand, due to the completion of the halving, it is expected to be cashed; on the other hand, it is due to the profit of the previous funds. The two reasons have jointly promoted the fall of LTC. At present, LTC is in a phased bottom shock. If the volume is still unable to form an effective enlargement, the price will further bottom. LTC focuses on whether the amount of energy can be stabilized and enlarged. If it continues to shrink, the price will test the support of $60.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Report | 2018-2019 China Blockchain Business Environment Assessment Annual Report

- Mutual Gold Association opens a special seminar to push the blockchain + supply chain financial application

- Twitter Featured | Ruibo CEO: We are setting industry standards, XRP inflation rate is much lower than BTC, ETH

- Is CSW penalized 550,000 BTCs, is this important?

- The central bank’s digital currency is gradually clearing, and Shenzhen will become an innovative experimental field.

- Who is Bitcoin and Ethereum who died first? V gods and Bitcoiner have a confrontation debate

- Bitcoin’s average cost of holding money has reached a new high, and the market value has exceeded 100 billion US dollars for the first time.