Bitcoin consumes so much energy, are we going to continue to support it?

Logically, this is sensible, that is, first make sure you can breathe, so that your child can breathe with your help. The same principles apply to the coordination function of money in a particular economy and the resources needed to protect it.

What is currency? How does it work? How should it work? What is its role in society?

- Analyst: The probability of breaking $20,000 at the end of Bitcoin is 7%, and $10,000 is becoming the new bottom.

- August 28th market analysis: the disk is nothing new, the risk is greater than the opportunity

- Forbes: China's central bank digital currency first launched in November this year

If you don't figure out these issues, then you can't understand the importance of the problem Bitcoin wants to solve. If you don't realize this, the energy cost of Bitcoin will never get positive!

Many worried spectators warn about the energy consumed by the Bitcoin network. Their concern stems from the idea that the energy consumed by the Bitcoin network can be used for more efficient functions, or that harmful. But both ignore the importance of bitcoin energy consumption .

In the long run, perhaps the biggest and most important use of energy is to ensure the integrity and constructiveness of the currency network, as well as for Bitcoin. Although this does not prevent those who do not understand it from raising their so-called concerns.

–"Guardian"

“In an environment of climate change, wildfire, and hurricane, we need to ask ourselves some sharp questions about the environmental impact of Bitcoin. ”

Bitcoin energy consumption

Mining nodes perform similar tasks, but also generate, resolve, and transfer blocks to other places in the network by performing bitcoin workload proof functions.

By performing this work, the miner verifies the transaction history and provides a "clearing" function for the current transaction, after which other nodes in the network verify the validity of the transaction.

We can compare it to the clearing function performed by the New York Fed, but the “clearing” performed by miners is done on average every 10 minutes in a decentralized manner .

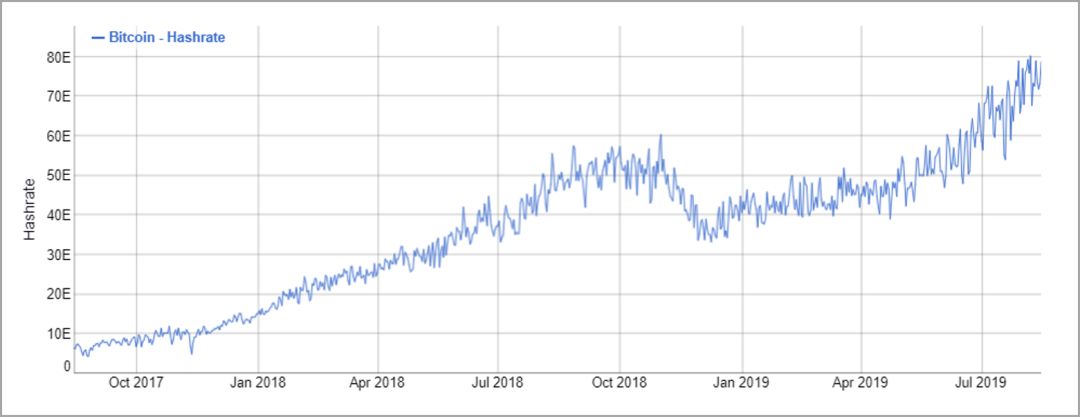

This work requires miners around the world to continuously provide a large amount of computing power 24*7, which requires energy consumption. Specifically, if the computing power of the Bitcoin network is 75 exahashes per second, then the bitcoin network consumes approximately 7-8 gigawatts of power per second, if each kWh is calculated at a marginal cost of 5 cents (rough estimate), The Bitcoin network consumes about $9 million a day (equivalent to about $3.3 billion a year) of energy .

In order to alleviate the suffering of environmentalists, we often put forward a series of views that compete with it, making Bitcoin more acceptable:

- A large part of Bitcoin's energy consumption comes from renewable resources.

- Bitcoin will drive innovation in renewable energy technologies and resources.

- How the energy consumed by Bitcoin is used elsewhere, it will burn into the atmosphere (causing air pollution).

- Bitcoin only consumes the energy that the free market can afford at a free market price.

- The energy resources consumed by Bitcoin, if these resources are not consumed, there will be no economic development.

- The nature of Bitcoin's energy needs will improve the efficiency of the transmission network.

These considerations help to explain why the idea that bitcoin's energy consumption is necessarily a waste, or necessarily harmful to the environment, cannot stand firm. But these considerations are not enough to overthrow people's concerns .

If you don't realize the seriousness of the currency problem Bitcoin wants to solve, the marginal cost of energy consumption will never be defended .

Bitcoin represents a solution to the systemic problems inherent in our traditional monetary framework and works by relying on energy consumption.

Economic stability depends on the function of the currency, and Bitcoin provides a more robust currency framework, which is why there is nothing more important than long-term energy use to protect the Bitcoin network .

Therefore, rather than detailing those that compete with mainstream concerns (such as those listed above), it is better to focus on this primary issue itself: the issue of traditional currencies, or the issue of global quantitative easing .

Currency function

We must have a better way! But in order to determine the solution, you must first see and understand the problems. The problem is our currency, and its impact on society is very common.

This article does not elaborate on the specifics of what the currency is (readers can read Saifedean Ammous's book The Bitcoin Standard [1] and Nick Szabo's article " Shelling Out: The Origins of Money " [2]), but we can Simply describe the functions and roles that money plays in society .

Money is a commodity that promotes economic coordination between the parties. Without money, there is no basis for cooperation between the parties. In short, it is the commodity of money that makes society work . It allows us to accumulate capital and make our lives better. These capitals serve different people in different forms.

There is a saying that money is the source of all evil, but as the well-known British economist and political philosopher Hayek described more appropriately in his Road to Serfdom , money is the agent of freedom .

– Hayek, " The Road to Serfdom "

Our modern economy is based on the freedom of money provided, and the end result of money is a highly complex and specialized system .

To simplify this concept, the famous American economist Milton Friedman illustrates this by explaining the complexity of the pencil making process [3].

He elaborated on the inability of any single person to produce standard pencils, because countless workers participated in the production of a pencil, from wood processing, graphite production to lead, rubber rubber, brass rings. Yellow paint, glue, etc. have all gone through the efforts of a large number of workers.

Friedman explained that making a pencil requires the coordination and cooperation of thousands of people, including those who don't speak the same language, people who may believe in different religions, and even people who hate each other when they meet. He said that the ability to coordinate cooperation is a function of the price system and the economic goods we call money .

Abstracted from the pencil example, consider the complexity of our modern economy. From cars to airplanes, from the internet to mobile phones, to your local grocery store. Modern supply chains are so complex and specialized that they require the coordination of millions of people to achieve these basic functions . Coordination of all these activities that drive global trade can only be achieved through the function of money .

A living example: Venezuela

Venezuela is one of the world's richest oil countries, but the net result of its currency devaluation is the recent over-expansion of Venezuela's currency. With the depreciation of the country’s legal currency, its basic economic function has collapsed to the point where buying food or basic health care at a grocery store is no longer a benchmark.

This is a comprehensive humanitarian crisis that fundamentally makes Venezuela no longer have a stable currency to coordinate economic activities and produce a function of goods that the country needs to trade in the global economy.

What does this have to do with bitcoin and its energy consumption?

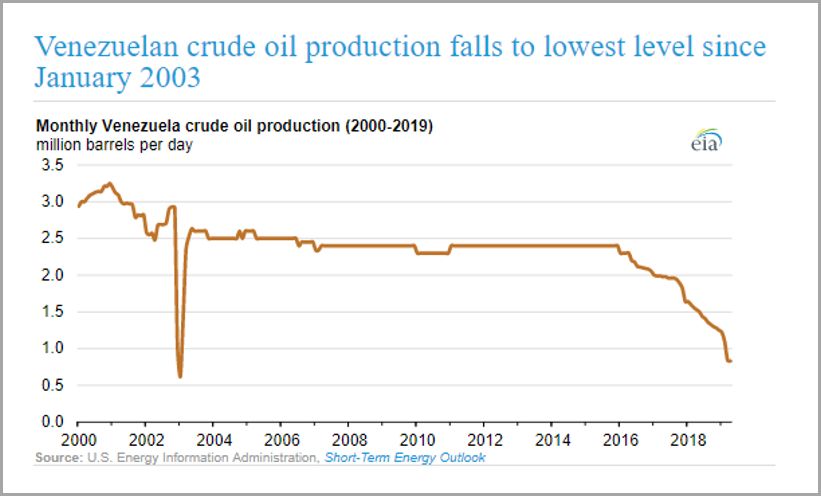

As an energy-rich country, oil in the past (and now) is Venezuela's main export commodity, or more precisely, oil is the country's goods for trade. Although Venezuela is one of the most energy-rich countries in the world, its oil production has plummeted .

Currency devaluation distorts the price mechanism of money, causing economic imbalances. As the currency deteriorates in economic coordination functions, the complex supply chain is disrupted and the supply of actual commodities (such as goods on the shelves, oil production, etc.) is reduced, resulting in an imbalance between supply and demand.

As more fiat money is created, real goods become relatively scarce compared to the money supply, which leads to the collapse of the function of the currency. As real commodities become scarcer, individuals' motives for holding money are getting weaker. On the contrary, they will choose to sell the currency as soon as possible, causing the snapping of basic necessities and causing excessive inflation. The government’s manipulation of the currency has led to a deterioration in the country’s economy .

Situation in developed countries

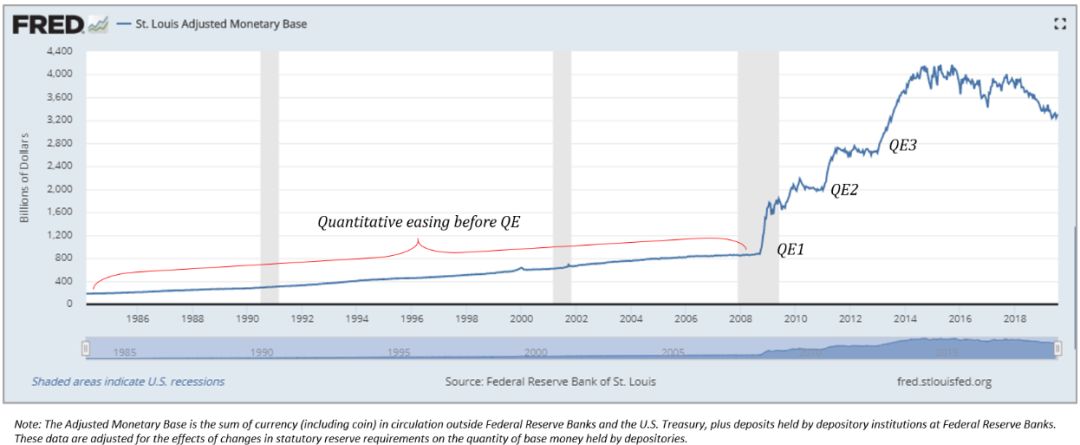

Whether or not people fully understand it, the market structure of Viva in Venezuela or the peso in Argentina is the same as that in the US dollar, euro or yen. Perhaps the Fed, the European Central Bank or the Bank of Japan (for now) are better at managing stability than Venezuela or Argentina, but this does not change the fact that the basis of all fiat currencies is the same .

If you think that the situation in developed countries is not as unstable as Venezuela and is not subject to a similar monetary base like Venezuela, I would like to respectfully point to these “zero patients”: the Federal Reserve, the European Central Bank and the Bank of Japan.

Often, people's trust in these institutions is blind, which makes people ignore basic principles and common sense. But after the financial crisis, the Fed is creating a new $3.6 trillion in new currency as part of a quantitative easing policy, but an economist based in the Federal Reserve responded by:

“What I want to emphasize is that I think there is a huge gap in understanding the interaction between the financial sector and the physical sector. ”

If we look back at history honestly, we will find how impatient the temperament of those who manage our economy through central command. While there is a need to acknowledge that there is a huge gap in their ability to understand the impact of actions on the real economy, their response is to continue on the same path (ie) and to go on a larger scale. It also refreshes people's definition of madness .

Our current choice is to choose between two distinct options:

- A) the central plan currency form intended to depreciate, or

- B) Decentralized currency with a fixed supply

The latter generates costs in the form of energy consumption, but brings long-term economic stability .

Economic stability through energy consumption

Everything we consume in our daily lives requires some energy input, and the coordination of these energy inputs depends on the reliability and stability of the currency we use.

Forget about your morning coffee and think about some basic things: clean water, sanitation, food, medicine, basic health care, and more. The coordination of the resources that provide these basic services depends on an efficient monetary system.

When a monetary system like Venezuela collapses, social coordination and even social structures begin to collapse. If all trade is based on energy, if we need money to coordinate trade, then the highest and best use of energy should first be to protect the monetary system.

First put on your "oxygen mask" and then help your child. First ensure the basis of the transaction (ie the monetary system) and then focus on all derivatives .

Any concern about bitcoin consumption or how much energy will be consumed is diverting people's attention. This is not to say that we should sacrifice electricity that can power homes. On the contrary, if we do not have a reliable monetary system to coordinate economic activities and mobilize resources, we will never be able to provide electricity to these families.

In fact, Bitcoin does not compete with energy resources needed to drive basic production and construction of the economy; instead, Bitcoin's function as a currency system will ensure that these energy needs continue to be met.

What is harmful to society is that more countries have deteriorated into economic and humanitarian disasters like Venezuela, making it impossible to reliably provide basic health and public services. And this is not a harsh illusion or a dystopian future, but rather to clarify the importance and interrelationship of monetary function and energy consumption in highly specialized and complex economies .

“If Bitcoin can prevent hyperinflation in countries such as Venezuela, then its energy consumption will be the most cost-effective transaction ever made by mankind. ”

Bitcoin represents an alternative to the current global financial architecture and will soon be its main engine. Apart from the systemic risks that currently plague our financial system, Bitcoin is fundamentally a more robust monetary system .

Moreover, bitcoin is protected by the production and consumption of energy. You don't need to think that the future of the dollar will be the status quo of Bolivar, and you can recognize the importance and interaction between the stability of money function and the energy production that provides basic economic necessities. And in the face of the potential risks of hyperinflation, Bitcoin's energy consumption is not worth mentioning .

Bitcoin will consume the necessary energy to secure its currency network, which is essentially driven by the basic needs of holding bitcoin. The more people value the long-term stability provided by Bitcoin, the more energy it consumes.

Ultimately, this energy consumption will ensure that all other energy-consuming derivatives will continue to be met, which is why there is nothing more important than long-term energy use to protect the Bitcoin network.

The economic stability and economic freedom provided by Bitcoin's stable monetary system is the real reason why Bitcoin should and will continue to consume energy .

[1]: https://saifedean.com/the-book/

[2]: https://nakamotoinstitute.org/shelling-out/

[3]: https://www.youtube.com/watch?v=67tHtpac5ws

Author | Parker Lewis

Compile | Jhonny

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How does Bitcoin reach $25,000? Analyst: Waiting for the US stock market crash

- CEO open letter | imToken is very pure, even the egg lottery has to play purely

- Eight questions and eight answers, Japanese Prime Minister Shinzo Abe sees Libra like this

- Promoting oil coins, Venezuela has not given up: this is the only way to prevent the depreciation of income

- BCH develops the Cashscript language to build a specific decision-making scheme for autonomous decision-making

- Proof of capacity PoC: Or will "recreate a PoW"? The new project Lava is about to come out

- Inventory | What are the main blockchain applications in the medical industry?