Research Report | There are more newcomers in the stable currency market, and the “institutional giants” are rushing to the beach.

Foreword

In view of the recent Libra white paper published by Facebook and the announcement of the “Star” program to push the stable currency to the headlines and investment, the whole article will start with the development history of stable currency, and by reviewing the concept and value of stable currency, The history of stable currency development since 2014, and then analyze the current stable currency situation, and look forward to the future development of stable currency.

1.2 The value of stable currency: the link broker with stable price

1.2.1 The large-scale landing of blockchain technology requires a pass that can be used for reimbursement to support the value scale of money.

1.2.2 Trading scenarios with a certain time difference, especially borrowing, need to stabilize the currency to ensure price stability within a certain period of time

- Economic Daily: Blockchain expands the real economy application scenario

- From the Internet yesterday, look at the blockchain tomorrow

- Deconstructing Chinese Digital Currency in the Patent Library: How to Solve Policy Transmission and Liquidity Traps

1.2.3 Stabilizing currency is the basic bridge linking the blockchain and the legal currency world, with certain investment value.

Second, the history of stable coins

2.1 Budding period: a transitional product of investment demand

2.1 Initial: Improvement of traditional economic payment settlement methods

2.3 Development period: ecological economic layout needs

Third, the current pattern of stable currency: institutional giants enter, compete for a place

3.1 Implementation of stable currency stability

3.2 Main categories of stable coins

3.3 The current pattern of stable currency: the oligarchy dominated by the French currency faction

3.3.1 The number of global stable currency issuance is increasing year by year, and the issuance period is mostly concentrated in the second half.

3.3.2 Stabilization mode and basic classification of major categories, forming a factional pattern based on USD and other legal currency systems

3.3.3 There are a large number of emerging inbounds, but the oligarchic pattern is still very obvious.

3.3.4 Traditional institutional giants have entered the market, and stable currency has become a battleground for the military.

Fourth, the future of stable coins

Chapter 1 The Generation and Value of Stabilizing Coins

1.1 The generation of stable coins: the need to stabilize the price of the certificate and maintain the ecological economy

Speaking of stable currency, we must first clarify the meaning of the stable currency. Stabilizing the currency does not mean the special certificate assets that are “completely stable in currency value”, but refers to the fact that the certificate is anchored to currency or specific assets and is widely invested. Approved to form a certain consensus stability.

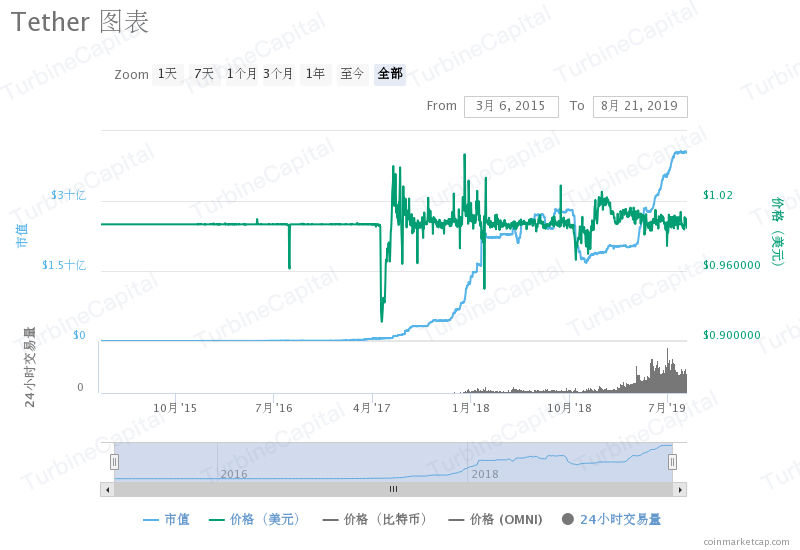

Figure 1 Comparison of stability between BTC and USDT, data source: coinmarketcap

The generation of stable currency mainly includes two aspects. First of all, due to the rapid development of the pass-through assets represented by Bitcoin and Ethereum, it has caused widespread concern around the world. However, digital passbooks naturally lack national credit endorsements, and their intrinsic value and control means are missing, resulting in prices in the secondary market. The volatility is too large, and many of the certificates face difficulties in multiple scenarios such as payment and circulation. Secondly, the investors who entered the blockchain industry earlier mainly used digital pass as an investment tool rather than a payment instrument. The existence of a large number of speculative activities increased the price fluctuation of digital pass. The concept of stable currency has been proposed because the CV participants hope that such a type of certificate can have a relatively stable price level to maintain the balance and benign development of the CB economic ecosystem.

The proposal of stable currency borrowed the old currency concept. In the long process of human development, the history of currency development has experienced various forms such as physical currency, metal currency, paper money and electronic money. All of them belong to the role of material in forming a certain participant consensus, but the issuer is diversified. Gradually developed into a central bank centralized monopoly. The stable currency, if based on a sufficiently broad consensus, can be equivalent to the bank notes issued by commercial banks at the beginning, but the currency form has changed, but different stable currencies can form a situation of full competition.

However, just as there is an impossible trilemma in traditional economics (Mundell-Fleming's trilemma), stable coins also have their own trilemma. Currently, they can only choose among three expected states. Two kinds:

◆ Decentralization: How open the network is, without the central authority to issue, the variability of the verifier and the distribution of the confirmation power)

◆ Capital efficiency : collateral with 100% or less stable currency

◆ Asset collateral : occurs when the borrower defaults on the initial loan and mortgages the asset to the lender as a right of recourse.

At present, most of the digital certificates in the blockchain industry have severe price fluctuations, which leads to the lack of sufficient motivation for individuals and institutions to accept such certificates as payment currency, because this means the wages and entities used in exchange for personal labor. The income from the exchange of goods or services may shrink sharply. At least in the near term, there is a high probability of shrinking in the short term.

The biggest obstacle to using cryptocurrency as a medium of exchange and value storage is speculative price volatility and the lack of perceived advantages over traditional payment systems, which are very effective for most consumers in developed economies. The reason why the French currency and the cryptocurrency fluctuate is because they have no support except for the "full government trust" or the utility of the network. Most cryptocurrencies have been proven to lack liquidity. Stabilizing the currency helps to make the cryptocurrency exist in a balanced form. Although the fiat currency and other asset classes are not completely risk-free, the volatility of the cryptocurrency is significantly higher, and the risk exposure of the Black Swan event is higher; that is, it is highly impossible to calculate in the model and cause a huge victory/loss. High-level events.

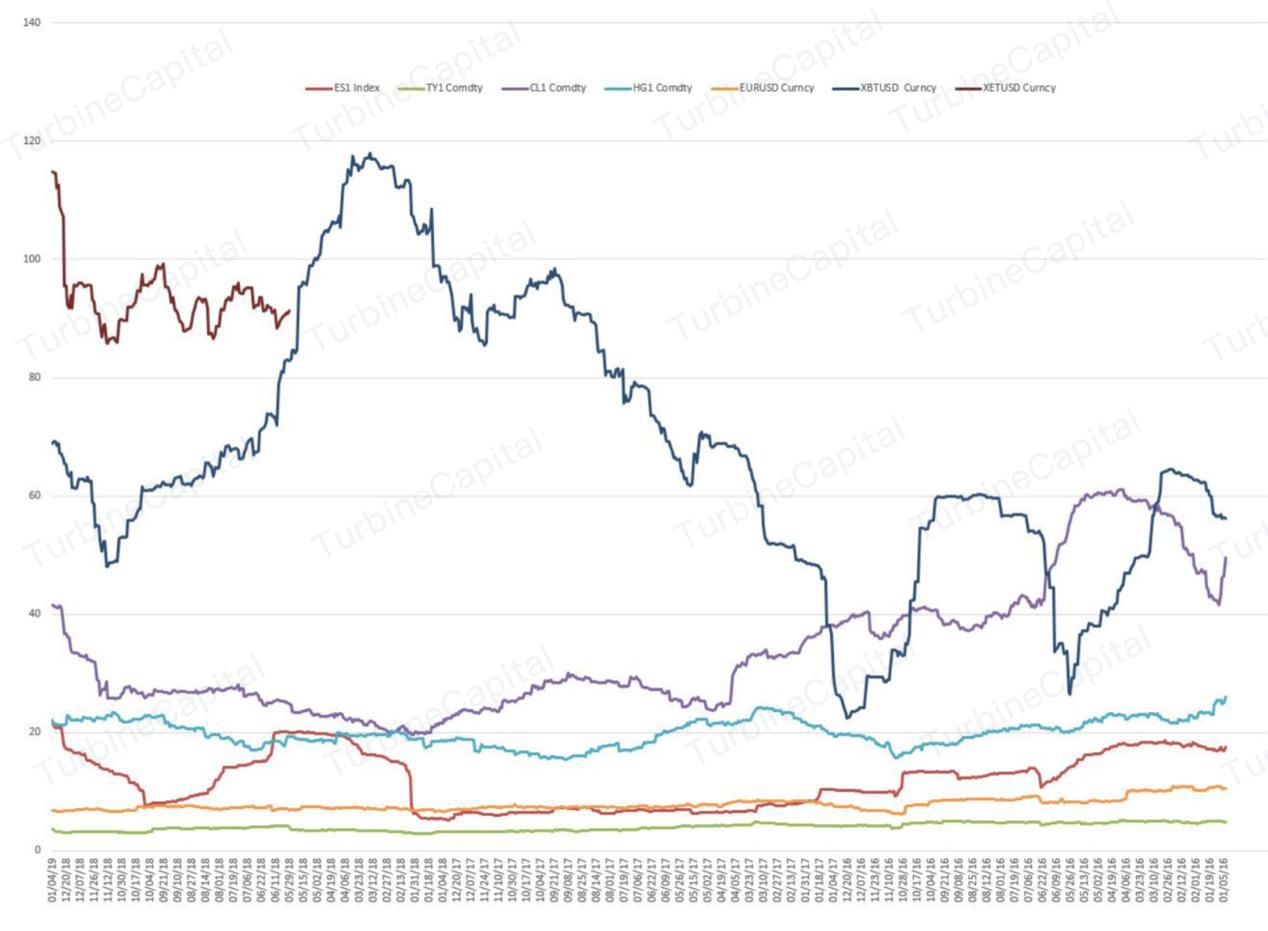

As a background, the chart below shows the volatility of Bitcoin and Ethereum in the recent years with the Standard & Poor's 500 Index, 10-year bonds, commodities (West Texas Crude Oil and Copper) and the Euro:

The benign development of any application requires a stable currency value, or at least a relatively low currency value to maintain, especially for trading scenarios with a certain time difference, such as using derivatives, remittances, loans, etc., within the confirmation interval of a block. The price changes may result in great asset losses, and all commercial and financial derivative activities based on price scales will be greatly constrained by the sharp changes in currency values.

Some companies, including Microsoft, Overstock, and Virgin Galactic, accept bitcoin and other cryptocurrencies, either directly or through payment services such as BitPay. However, these companies did not save their money in cryptocurrency, but immediately converted it back to legal tender. This is mainly because these companies do not engage in speculation on the price of cryptocurrencies. Companies are required to pay fees and do not wish to bear any additional currency and volatility risks, including foreign exchange risk and bitcoin price volatility. Some companies, such as Steam Platform, the largest digital distribution platform for personal computer games, stopped accepting Bitcoin due to the volatility of Bitcoin.

Despite these problems, consumer demand drives the payment methods that companies are willing to accept. If consumers want to pay with bitcoin or other cryptocurrencies, these companies will certainly adapt, despite the additional risks and complexities. However, Bitcoin and other cryptocurrencies face significant challenges in their widespread adoption.

Although Digital Pass provides some short-term investment opportunities, it lacks the necessary connection with the legal currency world, resulting in a lack of value anchors, hindering the application and development of blockchain technology in the legal currency world. Therefore, it is necessary to stabilize the currency as a foundation bridge. Go to link the two worlds. As a kind of link intermediary, stable currency has the functions of media and pricing, and has the investment value different from ordinary assets.

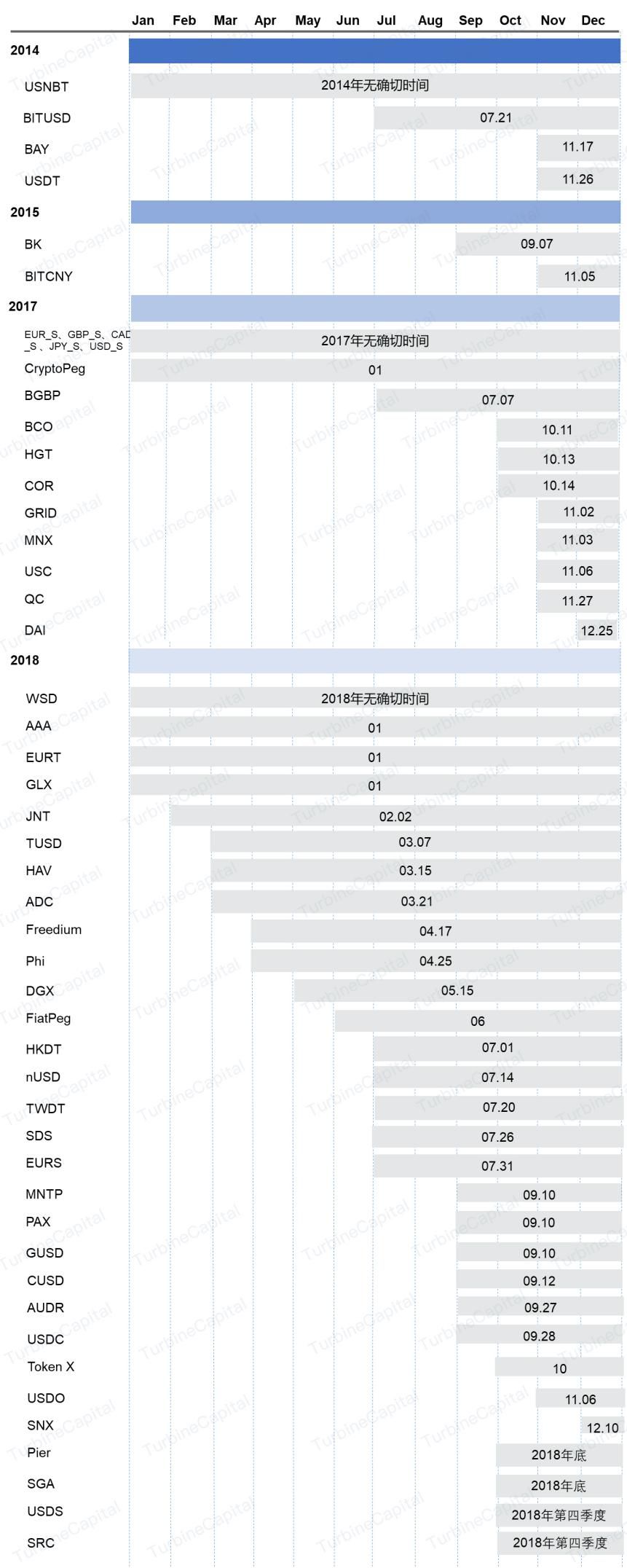

The stable currency first took shape in 2014, but the stable currency development during this period was slower and the number was smaller. Until September 2018, the stable currency began to enter the investor's field of vision because of its unique role of maintaining value and value. The stable currency during this period was mainly used to solve the problem of the investment in the pass, and the regulatory environment was The development of stable coins has been promoted.

Figure 2 List of stable coins and release time in the budding period, data source: chain, coinmarketcap, non-small and public data

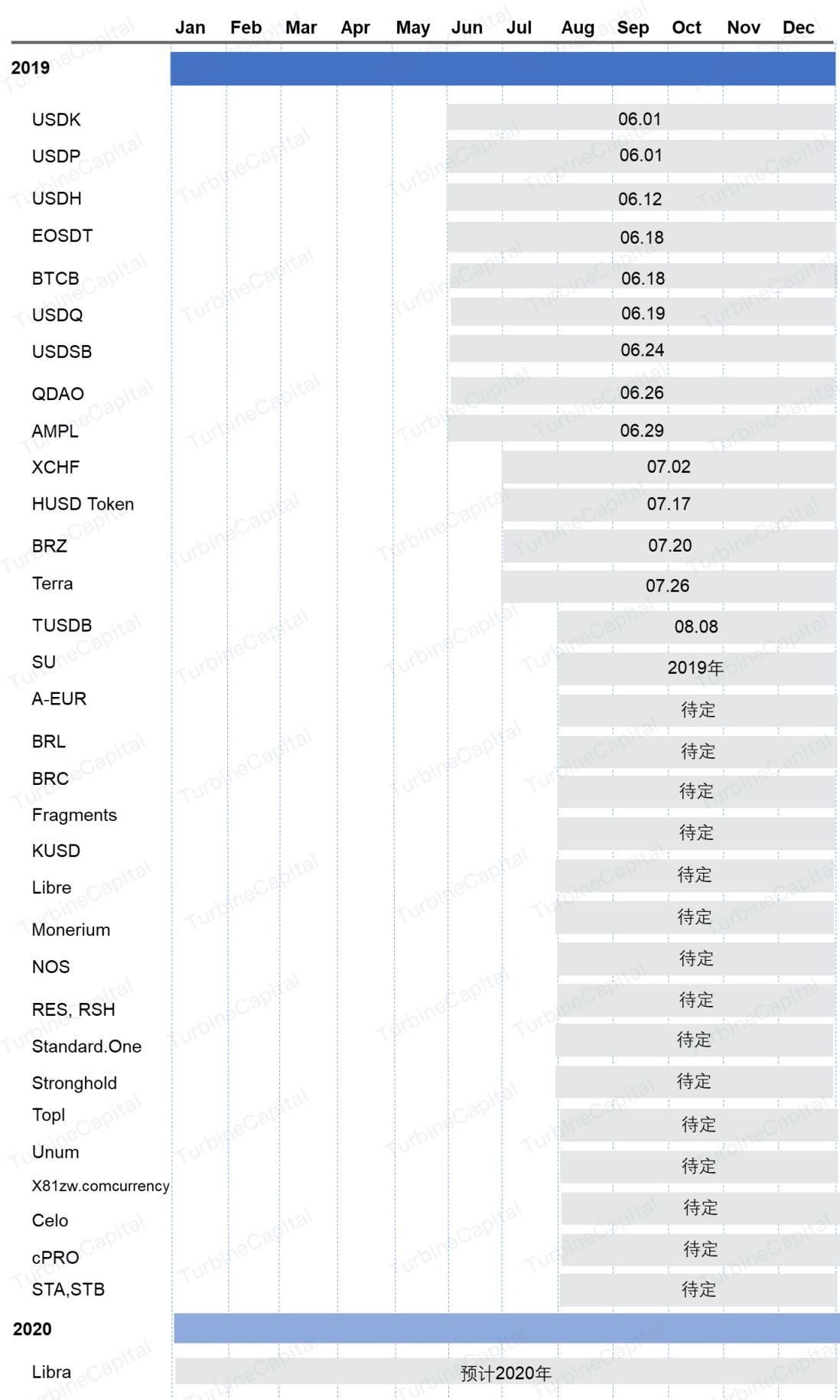

At the beginning of 2019, the stable coins issued by JP Morgan and Mizuho of Japan brought the climax of a new wave of stable coins, although the stable coins issued by the two world-renowned commercial banks were essentially based on the efficient and convenient technology of the blockchain. The bank's original “remittance, exchange, deposit, and loan” business has a huge impact on changing investors' perceptions of the blockchain industry and reflecting the improvement of the blockchain technology in the payment and settlement field.

Figure 3 Initial stable currency and release time list, data source: chain, coinmarketcap, non-small and public data

With the development of the DeFi project and the further improvement of infrastructure such as the public chain, the blockchain finance and business ecology are rapidly emerging. No matter what kind of Dapp in the chain, it needs a value scale and trading medium with stable purchasing power. At this point, the value of the stable currency is more inclined to recycle within the ecological closed loop, and to revitalize the same public chain or even cross-chain Dapps

Figure 4 List of stable currency and issue time during the development period, source: chain, coinmarketcap, non-small and public data

Chapter 3 : The current pattern of stable coins : institutional giants enter the market and compete for a place

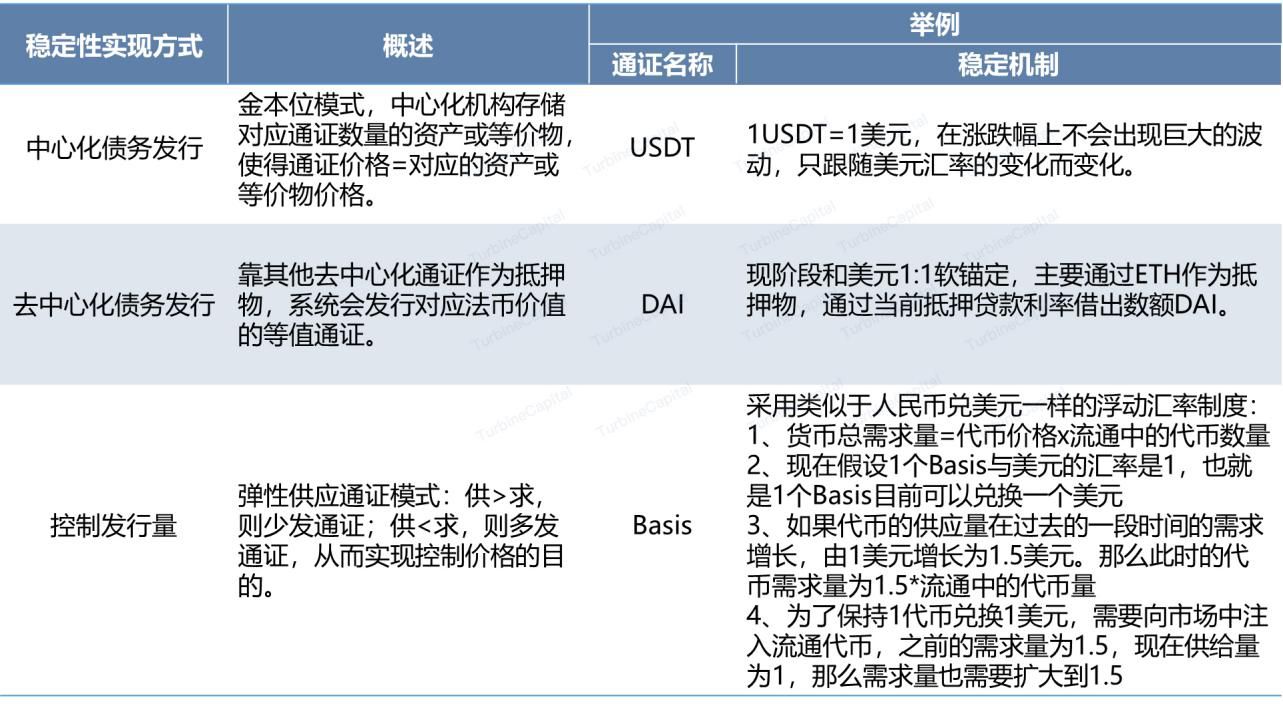

There are three main ways to achieve stable currency stability.

Table 1 Three ways to stabilize the stable currency mechanism, data source: public data

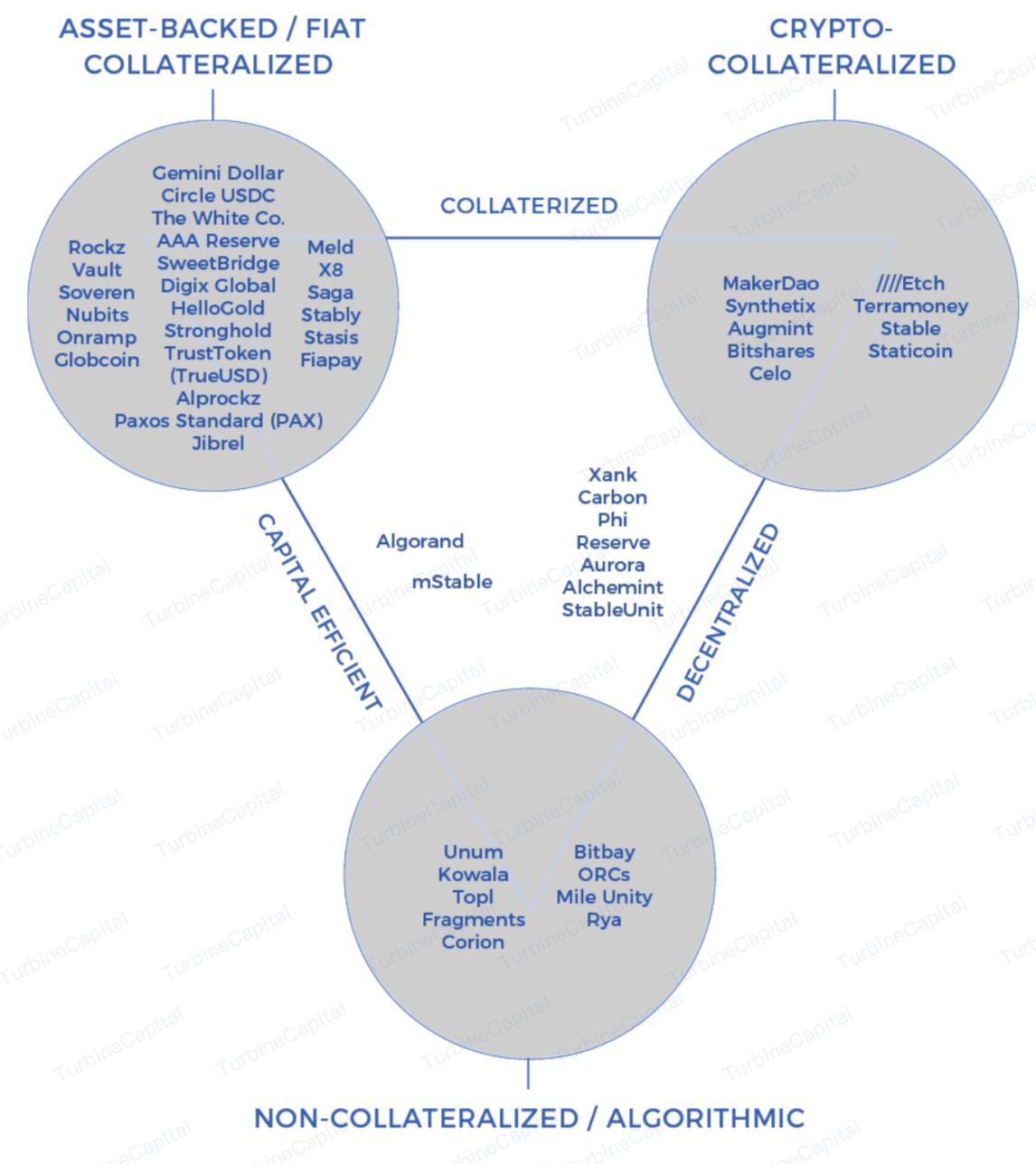

Just like most of today's stable coins, they also have their own impossible dilemma (only two of the three can be built when building a project). These three aspects include: (1) mortgage (2) decentralization (3) capital efficiency. As shown in the figure below, moving along a triangle will make the project eligible for one of three stable asset classes: Fiat/Asset Backed, Chain Crypto Collateralized or Coinage Tax Collareralized.

The main categories of stable coins are based on three ways of achieving stability, and are subdivided into five major stable currency categories based on reference equivalents or adjustments to total issuance.

Table 2 Five main types of stable coins, data source: public information

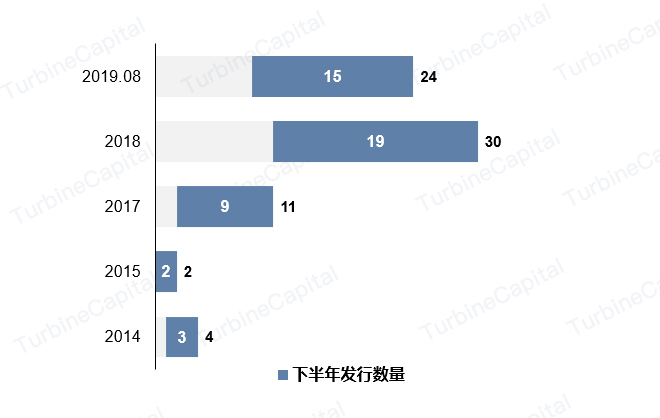

3.3.1 The number of global stable currency issuance increases year by year, and the issuance period is concentrated in the second half of the year.

Figure 5 Comparison of the number of stable currency issued in the world in recent years and the number of issued in the second half of the year

According to the analysis of the stable currency data published by the market, there are currently more than 90 kinds of stable coins, including many stable coins used for circulation within the enterprise, stable coins that have been shut down, and many stable coins that have not been counted. It can be judged that there are currently hundreds of stable coins on the market. On the whole, the number of stable currency issuance shows an upward trend year by year, and the issuance time is concentrated in the second half of each year.

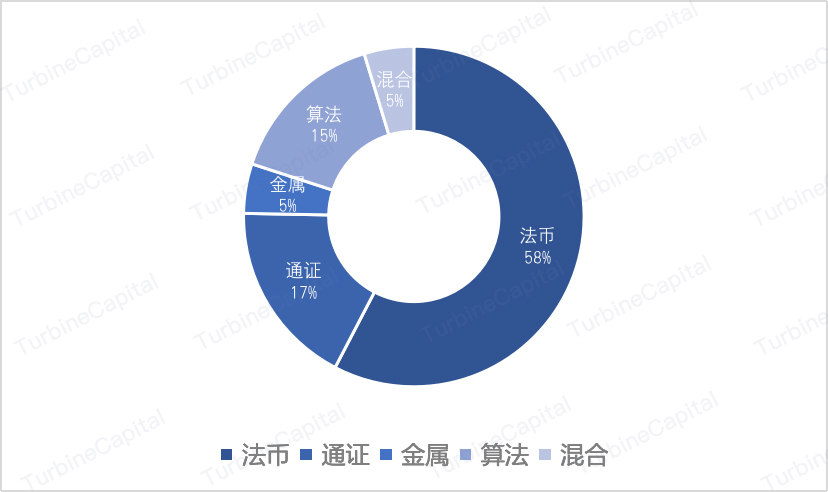

At present, all the stable currency forms on the market are nothing more than the five types mentioned above. Basically, they have been finalized. It is difficult to have other innovation models. Other categories such as chain mortgage, chain mortgage and algorithmic mortgage are just another angle. Sort the stable currency.

Figure 6 The proportion of each category of stable currency

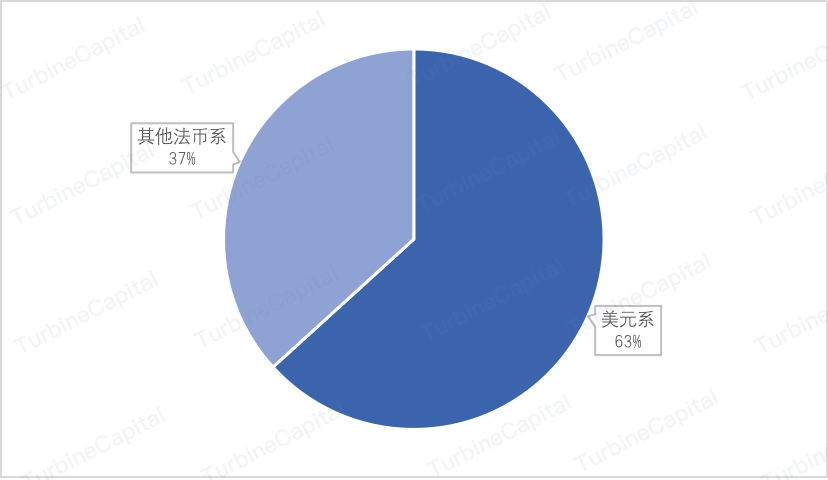

Figure 7 US dollar comparison with other legal currency

As can be seen from the above figure, the stable currency currently on the market has formed a “factional pattern” based on French currency. According to incomplete statistics, the stable currency of legal currency as collateral is as high as 57%, which exceeds the sum of the remaining four types. Among them, the stable currency with the US dollar as the asset collateral accounted for the vast majority, about 63% of the legal currency.

3.3.3 There are a large number of emerging inbounds, but the oligarchic pattern is still very obvious.

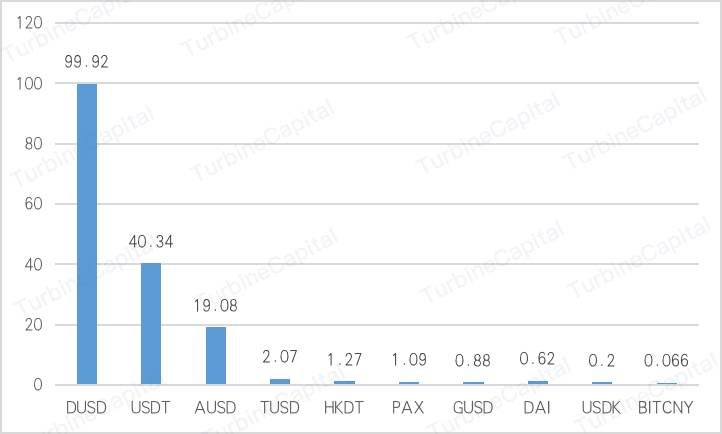

Figure 8 Market capitalization of the top ten mainstream stable currencies (unit: billion US dollars), data source: non-small

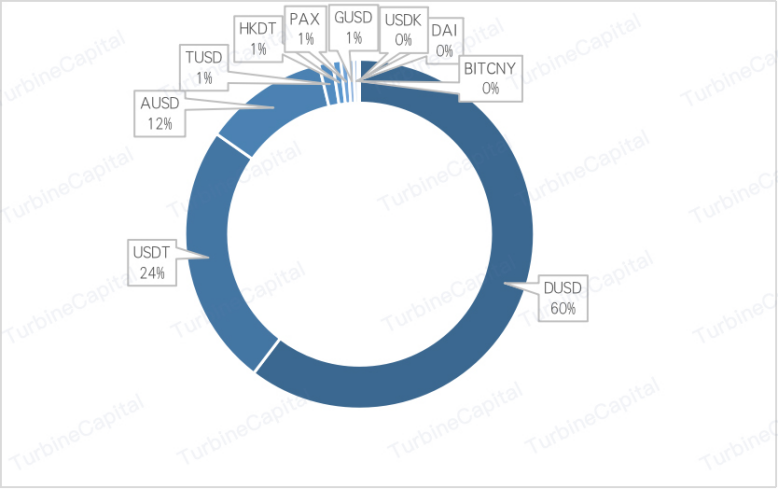

Figure 9 Market share of the top ten mainstream stable currencies, data source: non-small

As of August 22, we can see that the total market value of the digital pass market is 262.251 billion US dollars, of which BTC has an absolute dominant position, about 68.5%. The total market value of the digital currency market other than BTC is about 82.343 billion US dollars. We analyze the top 10 stable currencies as the mainstream stable currency, and the total market value of the 10 mainstream stable currencies has reached approximately 16.554 billion US dollars, accounting for only 6.3% of the digital pass market; and among the 10 mainstream stable currencies The market value of DUSD is as high as 9.992 billion, accounting for 60.36%, USDT ranks second, with a market value of about 4.034 billion, less than half of the market value of DUSD, accounting for 24.37%, and the market value of the remaining 8 mainstream stable currencies. And the ratio is only 15.27%. Among them, the USDT has fallen from over 70% of the previous year to 24% today. After all, the violent incidents caused by over-issue, spamming and opaque value endorsements have caused frequent declines in investor trust.

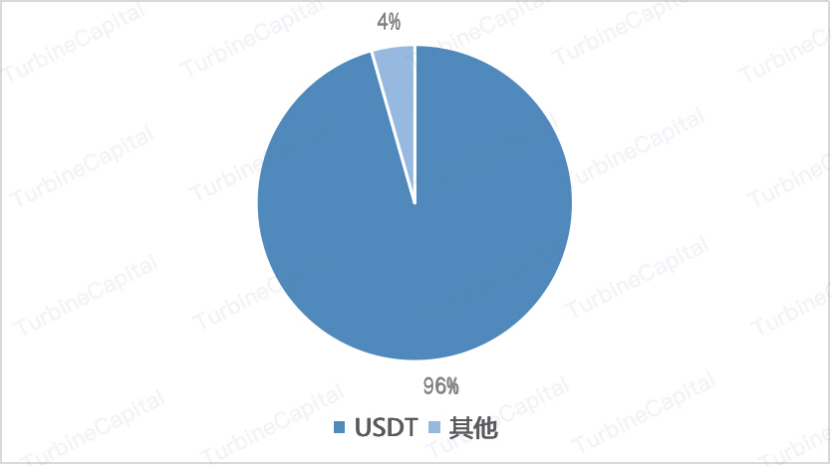

Figure 10 Market share of the top ten mainstream stable currencies, data source: non-small

From the 24-hour market volume on August 22, the total transaction volume of the digital pass market was 58.377 billion US dollars, and the total volume of 10 mainstream stable currencies was 10.897 billion US dollars, accounting for 18.67%. Among them, USDT's total transaction volume reached 10.416 billion US dollars, about 95.59%, which stabilized the top spot of the stable 24-hour trading volume. Therefore, although the number of new stable coins has increased since 2017, the overall oligarchic pattern is very obvious.

Judging from the current status of mainstream stable currency, the model of 1:1 anchored French currency is most widely accepted, with the US dollar anchoring being the most popular. Eight of the top ten mainstream stable currencies are anchored in US dollars, including The top two mainstream stable currencies occupying nearly 85% of the market. Therefore, the current market is not only the mainstream stable currency types, including the mortgage method and collateral, which show a relatively obvious oligarchy.

Table 3 The status of the top ten mainstream stable currencies, data source: non-small, online public information

Table 3 The status of the top ten mainstream stable currencies, data source: non-small, online public information

This year, Facebook's Libra white paper has made Stables, a blockchain segmentation track, even more interesting. After Facebook, Wal-Mart and other giants have entered the market, major traditional financial giants have also indicated that there will be significant progress in the digital pass, including Fidelity Investment, the world's largest asset management company, and the second largest Internet in the US. Brokerage TD Ameritrade. Although the focus of major institutions is different, such as JPMcoin mainly inter-institutional circulation, used to open up the original business of the bank, and Libra and others are more focused on payment, develop the original Facebook ecosystem, but because of the influence of these institutions, Aroused the attention of the industry.

The original institutions in the blockchain industry, such as the head exchanges such as Firecoin and OKex, are also brewing their own stable currencies. At present, they are mainly for their exchanges and public chain ecological services, but the currency is in The "Stars" plan put forward on August 19th is to put the eyes on cross-border payment and want to do "One Belt One Road Libra".

As of July 26, 2019, the total market value of stable coins has reached 4.9 billion US dollars. In the past three months, the overall market value has also increased by about 1.5 billion US dollars, an increase of 44.5%, and it is still growing. Undoubtedly, the further expansion of the market has attracted more traditional institutions to enter. These institutions have their own self-owned capital and a wide audience. This is a big challenge for the existing blockchains. It may also be a challenge. Will break the existing blockchain pattern, but the oligarchic pattern of stable coins will still exist, but the head position is reserved for whoever sits.

Chapter IV The Future Value of Stabilizing Coins

It is foreseeable that not only Facebook, Wal-Mart and other giants will participate in the issuance of stable currency. In the future, there will be more institutional giants optimistic about stable currency and even digital pass, but whether it is a country or a company, stable currency and digital pass. The issuance of certificates is not only a simple payment tool, but also the use of the influence of the state or the enterprise itself to endorse the digital certificate issued to obtain the trust of users.

Another alternative to the stable currency to consider is the concept of “national digital currency”, the digital currency issued by the central bank. The concept is simple: the government or central bank will issue its own dollar-backed digital currency. There are several major benefits that affect the government or the central bank to do this:

◆ Improve resilience

The Fed currently has one of the largest and most important books in the world. The Fed uses a system called Fedwire to maintain all transactions. Fedwire is only maintained by three intensively: one in New Jersey, one in Richmond, and one in Dallas. If for some reason these three locations are destroyed, the entire system will collapse. By developing electronic money or federal reserve currency issued by a central bank, governments, including the United States, will be able to take advantage of distributed networks operated by thousands of different nodes.

◆ Reduce costs

More likely, running a distributed ledger would be much cheaper than maintaining billions of banknotes in circulation. Banknotes cover a wide range of expenses, including the design and printing, collection, processing and storage of banknotes, as well as the constant prevention of counterfeit currency. Having a distributed ledger can reduce these costs. If the Fed's coins can slowly replace cash, the cost of the Fed will fall, and its profits will rise, thus benefiting taxpayers.

The coins issued by the Fed will adopt the concept of the coinage tax share, and other cryptocurrencies are testing this concept. The Fed will have special powers to create and destroy digital currencies, while also providing two-way physical exchange between banknotes and national digital currencies at a rate of 1:1. Digital currency can only be created while destroying equivalent reserves or banknotes, and vice versa, national digital currency can only be destroyed when new banknotes or reserves are created to maintain price stability. If there is any difference in price, the user will use this arbitrage behavior to convert the digital currency currency into US dollars or US dollars into US dollars.

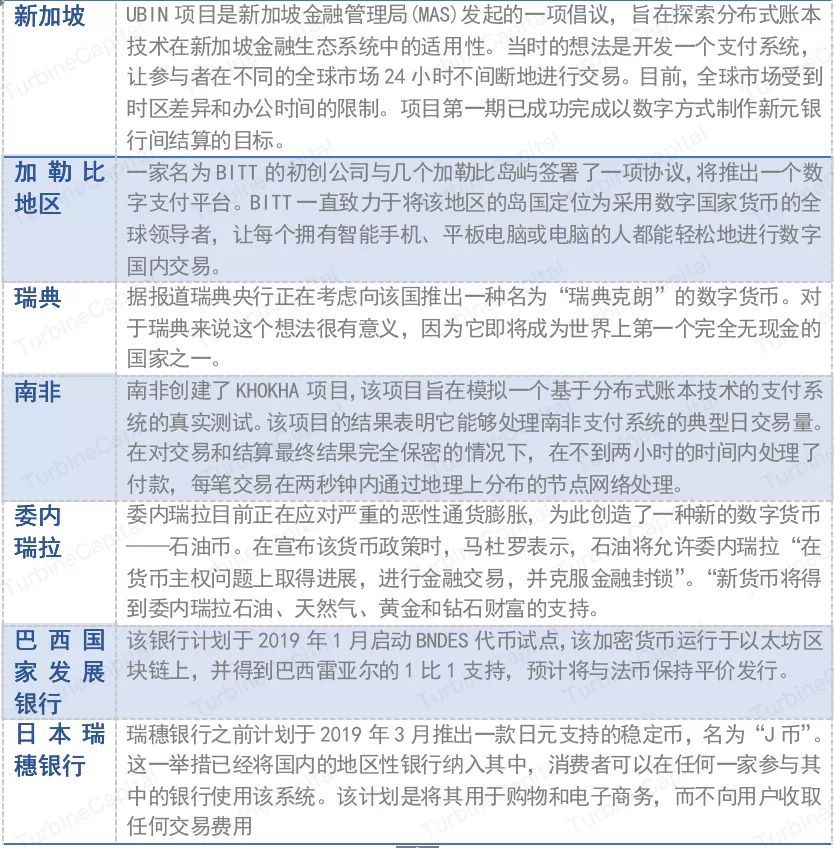

Many countries have begun to explore the idea of using federal coins or electronic money issued by the central bank, and many countries plan to follow suit. Here are some notable examples:

In order not to repeat the history of failure, the stable currency must guarantee three things: the issuer's good internal governance structure, the stability of the value of the collateral, and the social trust in its governance algorithms and social acceptance. Stabilizing coins such as Gemini Dollar and Paxos Standard, regulated by NYDFS (New York Financial Services), represent the beginning of the issuer's governance structure improvement standards. The stability of the value of the collateral brings an anchor point to the stable currency linked to the cryptocurrency, which requires an additional system safety net to mitigate and hedge this risk. Ensuring social trust requires more complex discussions. The degree of trust in the algorithmic stable currency and social acceptance of the cryptocurrency users and the general public is different. Establishing social trust in the public means that cryptocurrencies are widely used in everyday life. This is a challenge. However, this is the ultimate goal that the entire industry is currently pursuing, and it is hoped that it will be achieved one day.

Despite the controversy, stable currency may be the cornerstone of the steady growth of the encryption industry. It is worth noting that the failure of the stable currency will only lead to more confusion. The value of a truly sustainable stable currency is much higher than the value of just one dollar.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How does Ethereum fall into a technical dead end?

- Parity implements EIP delay, Ethereum Istanbul upgrade or postponed until November

- Market Analysis: Falling as expected, risk control is the number one priority

- Mysterious predictions hit one after another, is BTC rushing to $56,000 according to the script?

- Four forces compete for blockchain + supply chain finance. What can a pure technology company rely on to obtain a market?

- RightBTC (R network) won the huge investment of angel investor Bao Erye, completed the 3.0 version upgrade

- How far is it from the era of “People Bitcoin Payments”? As early as 2011, there were encrypted payment applications.