How far is it from the era of “People Bitcoin Payments”? As early as 2011, there were encrypted payment applications.

In the cryptocurrency, the coin king bitcoin has been in existence for more than ten years. Many people regard it as a tool for value storage, which is called “digital gold”. It plays a risk hedging function when the international situation is turbulent. Some people just use bitcoin as a speculative tool, in an attempt to find a chance to get rich overnight in the huge fluctuations in the currency price.

However, we must not forget that Bitcoin was originally set up as an electronic currency for circulation and payment at the beginning of its invention. The opening page of the white paper is written with " bitcoin: A peer-to-peer electronic cash system ."

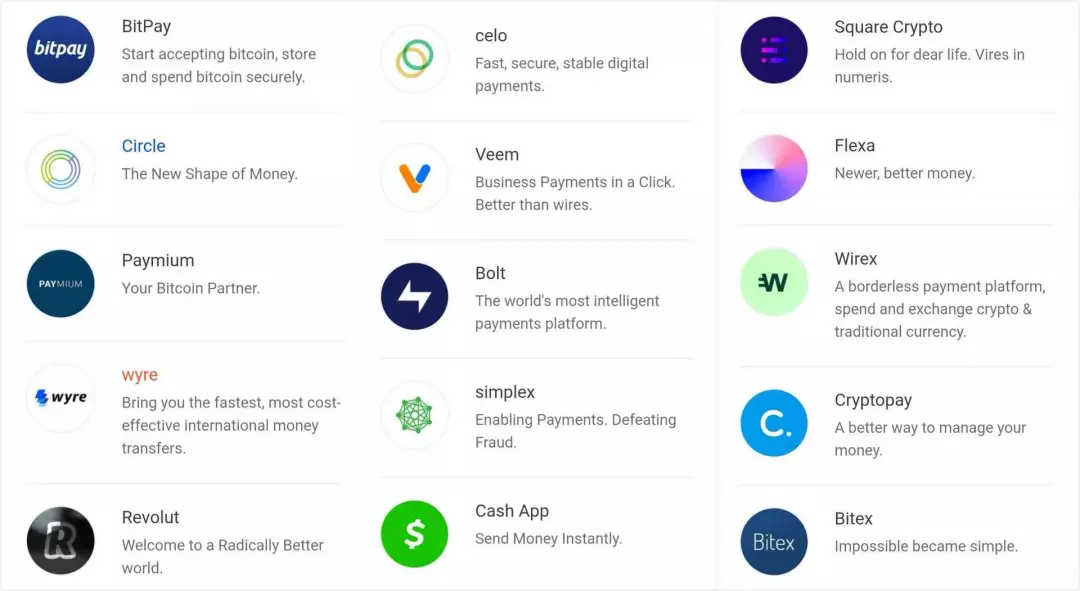

Along with the ten-year milestones of Bitcoin and the ups and downs of the currency, the payment of the cryptocurrency represented by it has been spread in all corners of the world. The payment bridge between the merchant and the consumer is the cryptocurrency payment service provider, and their role is like the UnionPay in the legal currency world . The following are some of the cryptocurrency payment service provider brands:

01

Why pay with cryptocurrency?

Before we understand the principles behind cryptocurrency payments, let's take a look at the current problems of traditional finance.

- Xiao Lei: The rumor is very subtle, Tencent and Ali will participate in the central bank's digital currency issuance.

- Dig bitcoin to send altcoin, and jointly mine PoW rivers and lakes

- "Slow" public chain became a new favorite, IPC knows the production chain announced the launch of IP BANK and blockchain navigation system

The cross-border process between traditional financial institutions is long and complicated, and it requires a series of intermediaries to bring inconvenience to trade and payment between countries, especially in less developed countries where financial facilities are not yet sound, due to lack of strong credit. Endorsed financial institutions, cross-border payments require cumbersome procedures and high costs.

In countries and regions with more developed financial infrastructure, banks have achieved inter-system interconnection through the UnionPay interbank transaction clearing system, which enables bank cards to be used across banks, regions and cross-border . In this process, UnionPay, Visa and other bank card joint organizations provide efficient inter-bank information exchange, clearing data processing, risk prevention and other basic services. However, because there are several banks under it, if a company wants to accept international credit card payments, it needs to establish a corresponding credit card service provider for each country and region that accepts payment.

But now, if trading through cryptocurrencies, companies can use the services provided by a cryptocurrency provider directly, without the need for credit card payment providers elsewhere in the world. And companies that accept cryptocurrency payments only need to pay a small fee to the service provider, even if they don't charge like Coinbase, and use a credit card for a fee of 2.7%~3%.

Image source: www.hellobtc.com

At the same time, Bitcoin's use of blockchain's ledger technology itself can simplify cross-border payment settlement and provide undifferentiated services to the world , regardless of poverty or wealth, regardless of political position, cryptocurrency can be unimpeded The circulation of the bitcoin that you can get in India is the same thing as the bitcoin accepted by American businessmen.

The first sentence of the Bitcoin white paper is "This article proposes an electronic cash system that is completely implemented through peer-to-peer technology, which enables online payments to be initiated directly by one party and paid to the other, without any financial need to pass through. mechanism."

With cryptocurrencies, merchants can win customers around the world who lost money because they didn't have a credit card. In addition, the absence of a credit card also reduces the risk associated with the transaction . For example, people from Nigeria can now visit the merchant's website, spend bitcoin on it, and the cryptocurrency payment service provider will process the transaction.

At present, the market value of Bitcoin is 100 billion US dollars (the highest is 300 billion US dollars). Such a large market size can bring many new users to the merchants, and the cryptocurrency payment opens the whole world for the merchants.

02

Perfect payment mechanism, free to cope with currency fluctuations

Seeing this, you may have to ask, bitcoin volatility is so big, maybe it will be $10,000 when the customer pays in the last second, and the next second merchant will receive $9,000, which is worth the loss. How to solve such problems?

From the point of view of the currency standard, there is really no problem in using Bitcoin transactions directly. As long as all services and goods can be denominated in bitcoin, then we can not care about the value fluctuation of Bitcoin itself . At present, there are indeed many merchants who use Bitcoin to calculate directly, and accept the payment of Bitcoin by consumers through the cryptocurrency payment instrument.

But in reality, many Bitcoin believers will still care about the price of Bitcoin against the standard currency, not to mention that for many traditional merchants and companies, they just want to leverage the powerful settlement function of Bitcoin to expand and Maintaining customers who pay with cryptocurrencies, and the volatility of cryptocurrencies can prevent them from getting involved in this ecosystem .

In response to this problem, cryptocurrency payment service providers naturally have a solution to alleviate the problems caused by fluctuations in currency prices, enabling reliable bank settlement through legal currency and storing it directly in the merchant's account, so the merchant The money received is the local currency (such as the US dollar, the euro, etc.).

The general specific process is:

1. Consumers choose to use Bitcoin to pay when they check out. 2. The payment service provider locks in the exchange rate of the transaction, and no price increase or other changes will occur. The consumer pays at the locked exchange rate. 3. The payment service provider will immediately convert the bitcoin into French currency to avoid the risk of currency fluctuations. 4. The merchant's bank account will directly receive the legal currency income, how much the merchant's fee will be paid, and how much the user will pay if the price is seen. 5. On the follow-up workday, the payment service provider will initiate inter-bank settlement, which is somewhat similar to the settlement of credit cards.

The entire process user can complete the payment with just a few clicks, and the funds are safe throughout. Customers do not need to wait for the long confirmation time of six blocks as with manual transfer.

03

Rich commercial landing scene

Because encryption or payment service providers have created a seamless and secure payment experience, more and more merchants are beginning to try, accept, and fall in love with this payment method.

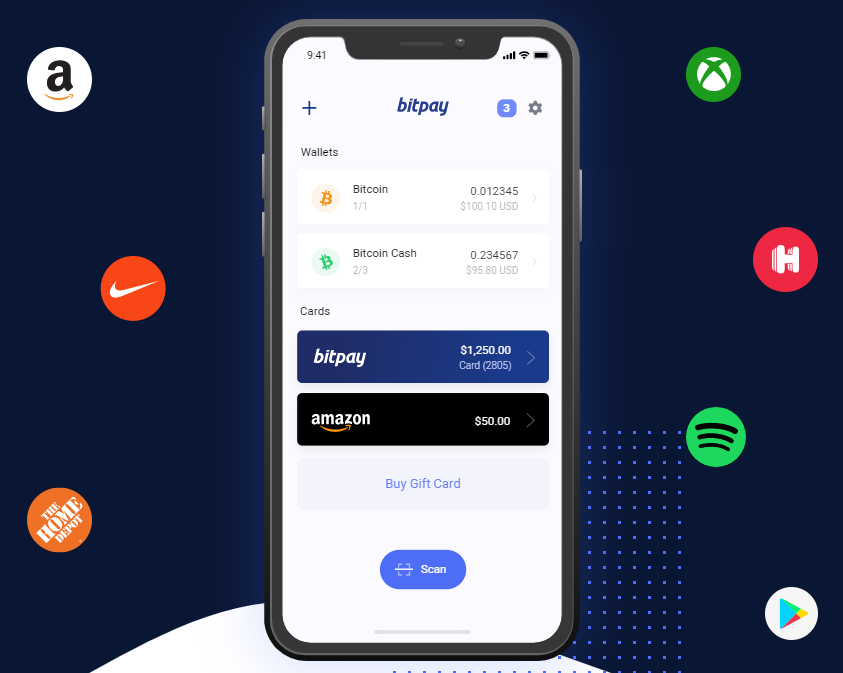

For commercial organizations, after accepting cryptocurrencies, they can indeed bring tangible benefits and benefits to the company. The most important of these is to help companies develop new customers. BitPay's CCO Singh said that 53% of merchants' cryptocurrency payments through the BitPay system come from new customers.

“It’s an amazing amount of data,” he said. “By accepting bitcoin payments, you get 53% of new customers that you couldn’t get before. This is the cheapest way to monetize and get new customers.”

Founded in 2011, BitPay, the global provider of bitcoin payment services, has become the largest provider of bitcoin payment services, with services on six continents.

Its customers' commercial maps cover various fields such as finance, technology, law and consumer goods. There are Fortune 500 companies, small and medium-sized enterprises, B2B models, B2C models, etc. It can be said that it is a very diversified customer portfolio. Such as Wikipedia's Wikimedia Foundation, Wall Street research agency Fundstrat, game platform Steam, Canadian luxury goods Birks and IT giant Microsoft .

BitPay has licensed Bitlicense, which operates in New York State, making its business easier in the government sector. So BitPay also has many clients from all continents of the United States, such as Ohio and Florida, which allow taxpayers to pay taxes in cryptocurrency.

In 2018, BitPay handled more than $1 billion in cryptocurrency payments.

04

Encrypted currency to pay for future imagination

There is still a huge imagination in the field of cryptocurrency payments. The scale of payment will definitely expand rapidly with the development of the blockchain industry and the increase in the total market value of cryptocurrencies. In the cryptocurrency payment market, there will certainly be a lot of payment giants. Although there are many powerful service providers in the market, the scale of traditional financial UnionPay and Visa is still negligible.

Second, small and medium-sized cryptocurrency payment service providers still have the opportunity to overtake. The key is nothing more than innovative product design, technical risk control, legal compliance, and user growth strategies.

In addition, although the current mainstream is still based on bitcoin payments, stable coins may come later . In the field of cryptocurrency, stable currency has the characteristics of low transaction cost, high settlement efficiency and stable value, and is naturally suitable for payment scenarios. In October 2018, BitPay announced the settlement of supporters' home GUSD and USDC, which set a precedent for stable currency payments.

It is foreseeable that cryptocurrency payment service providers will continue to be at the forefront of this technology, creating more innovative tools and services for everyone and every company. So, will cryptocurrency payments be infiltrated into every household like Alipay and WeChat payment in China? let us wait and see.

——End——

Original: Luo Zi

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | fried market continues, waiting for the right signal (0828)

- JP Morgan Chase Quorum blockchain platform restarts, JPM Coin is ready to go

- Facebook tired of fighting alone? Libra Association asks members to make public voices

- Report | Bitcoin market decline expected to increase, the lowest drop to $9500

- Bystack: Looking for killer "assets" (on)

- The macro economy basically faces the potential impact of bitcoin prices

- Trading Robot for Encrypted Assets: How to Understand? How to choose?