Research Report|Can blockchain technology effectively solve the high-risk problem of inclusive finance?

Following the second chapter, "The Blockchain in Development – How to Affect Emerging Markets," this article focuses on whether financial institutions can apply blockchains to mitigate risks. This issue has an impact on remittance recipients, businesses that need to apply agency business, and charities in the country.

Blockchain is an evolving technology, and understanding its scope and limitations is critical to applying it to solve these and even related problems.

Simply put, a blockchain is an online database that can be used to exchange information over a digital network to form a secure, transparent, and easy-to-use platform. This technology can be used for remittances between countries, verification of land ownership, power sharing between system networks, and reducing the cost of banks verifying customers and transactions.

The blockchain allows secure storage of data and can be accessed by multiple users without the need for a trusted third party, such as a bank.

- An article to understand edge computing and blockchain

- Mining from entry to proficiency (eight) mining industry ecology – peripheral services

- Hard core! 360 senior security expert Peng Brewing takes Zcash as an example to talk about the security and privacy issues of zero-knowledge proof

1. What is a blockchain or distributed ledger technology?

The term "blockchain" refers to the way data is stored. The transaction is recorded in a time-stamped "block", and each block is connected to the previous block, forming a transaction chain. This transaction chain is stored by all users on the network; each time the new block is verified and added, the entire transaction chain is updated between users.

Image source: Network

Currently, when buying, selling, or verifying ownership of an asset, individuals must rely on institutions such as banks, credit card companies, or governments. Blockchain technology has obtained an alternative approach by using encryption techniques and computer code to generate what is supposed to be prescribed by the organization.

2. Blockchain is a shared digital ledger

Let us now delve into the more technical definition of the books. A ledger is a book or computer file that records transactions. Blockchain technology is a shared digital book in which transactions can be recorded and verified without the need for central agencies to oversee transactions.

Sharing: Traditionally, computing services are run on a centralized network where the central server distributes the information on network computers (clients). Unlike digital books, which are replicated and distributed across nodes, they are used to verify transactions in a blockchain network where parties involved in the transaction share information.

Unlike a centralized network with only one hub or server and all other nodes being clients, the blockchain has a smaller small hub that contains a blockchain network of the same blockchain nodes, which can Acting as a client and acting as a server. Each blockchain node on the blockchain can provide power and store a replicated version of the ledger to build consensus and share governance responsibilities.

Recording and Verification: Transactions on the blockchain are confirmed by all participants in the network and, once recorded, cannot be tampered with. Unlike banks that need to spend a lot of resources to check with counterparty records, blockchain technology can update and store information in real time, and can greatly reduce reconciliation costs.

3. Financial sector management risk issues

Managing risk is a common response to anti-money laundering or counter-terrorism financing (AML / CFT) regulations. While financial crimes such as money laundering, terrorist financing, and tax evasion are serious crimes, anti-money laundering laws designed to combat such financial crimes can sometimes hinder capital flows, especially for individuals in poorer countries. These regulations may also reduce the transparency of financial flows.

Strict banking regulations require banks to assess the risks of doing business in countries where the anti-money laundering system is weak, or where they may engage in illegal activities. Otherwise, the bank may be subject to heavy penalties. However, regulatory guidance on how to manage these risks is often vague and contradictory. Therefore, in order to reduce its own risk, banks are becoming more conservative in assessing customers and less and less discretionary.

Available evidence suggests that some banks refuse to provide services to companies that appear to be more risky, have lower profits, and may face fines or legal issues in the future, as well as the entire country. In short, banks are busy reducing the risk of the entire customer base, rather than discretion to determine the customer's risk level based on discretion.

4. Who will lose because of the risk reduction?

Poverty and economically vulnerable people, as well as organizations that serve them, will suffer significant losses due to the management risks of banks. These people who suffered losses include:

1. Immigrants who send money to their families across borders, so they need a sound remittance department.

2. Remittance organizations that banks refuse to provide services, they are often forced to use services with higher transaction costs or less transparency in jurisdictions.

3. Non-governmental organizations (NGOs) that provide humanitarian assistance to vulnerable individuals in post-disaster or conflict situations. These organizations are affected by the risk because they may be outside the narrow risk appetite of the bank.

4. Small and medium-sized companies in poor countries. Their ability to apply for credit usually depends on the rating of the local bank. Bank reports from wealthy countries indicate that they have withdrawn from the banking services of banks in high-risk jurisdictions, including poor countries.

5. How can the blockchain help?

Blockchain technology can help manage risk by reducing regulatory compliance costs while increasing transaction transparency. In particular, the blockchain has the potential to reduce the compliance costs associated with the “know your customer” requirements.

Image source: Network

Lower customer verification costs and greater transparency can alleviate the financial risk burden of financial institutions, as well as the beneficial effects of senders and recipients of remittances, companies that need trade finance, and charities operating in conflict zones.

Financial institutions will invest a lot of resources to meet the "know your customer" requirements. When recruiting new customers, they must meet these requirements, even if the customer's identity and credentials have been verified by another financial institution.

A Thompson Reuters survey found that the average cost per year a financial institution spends "knowing your customers" is $60 million. Some organizations spend up to $500 million a year to develop customer verification procedures.

The use of blockchains may improve this situation. As mentioned above, each block contains a valid transaction record with a timestamp and carries a history of all transactions on the network by including a reference to the previous block. Moreover, while a blockchain can replace a centralized authority or a trusted third party, it can ensure that any data stored by the user is not easily tampering. This feature, combined with biometric or “know your customer” utility, can be an effective and inexpensive way to verify customers and conduct transactions.

Blockchain is neither a perfect technology nor a technology that is not subject to hacking. Although it protects confidential information, its anonymity may cause problems, allowing bad actors to hide their identity and make their payments difficult to track.

According to the "two-party policy center", the blockchain can even play a role in anti-money laundering work. “The blockchain allows banks and regulators to access more detailed transactions and cross-institutional data than is currently available, allowing them to explore financial networks more deeply to identify bad actors. In addition, blockchain technology The distributed nature makes it difficult for criminals to falsify transaction data to cover their tracks.

All of this can be done in real time, giving law enforcement officers valuable time to identify terrorist tricks before they happen. However, the speed with which this technology is added needs to be balanced against privacy issues, and the privacy issues it generates may depend on how the system is implemented. ”

The huge regulatory potential of this technology should be highly valued by regulators to explore how the blockchain can improve current anti-money laundering systems and conduct practical experiments. For example, the “Innovation Project” of the UK Financial Conduct Authority has created a “regulatory sandbox” that allows institutions to test new products and their services. A new report from the UN Economic Commission for Latin America and the Caribbean suggests that some blockchain-based solutions can be used to address management risk issues in Caribbean countries in a enabling enabling environment.

6. Use of blockchain remittance

Blockchains can also be used to trade between two legal tenders. Local currency can be converted to bitcoin and then transferred between customers in each country in a cheaper and safer way than traditional methods of sending and receiving money.

Seamus Cantillon of Marino Software Insights insists that combining the blockchain of ID biometrics can reduce the cost of “know your customers”. He outlined six steps for financial institutions to identify customers and conduct transactions:

1. The customer joins the blockchain;

2. Add customer personal information, “know your customer” documents and biometric data to the blockchain using appropriate encryption methods;

3. The customer's biometric data, along with the PIN identification code, can be used as a key to the transaction;

4. Record and verify customer transactions through a consensus algorithm on the blockchain network;

5. Upon authorization by the customer, the financial institution can access the customer record to verify it;

6. Further changes to the record will be verified by the network.

Cantillon paints an optimistic picture, but there are also concerns about storing personal identity information on the blockchain. Despite this, blockchain-based services continue to emerge, including Kenya's BitPesa, a remittance service that allows its customers to use a cryptographic asset, Bitcoin, to remit money between countries.

Image source: Network

Customers can transfer legal tenders (such as Kenyan shillings) to BitPesa, which converts them into Bitcoin and transfers them to a designated mobile currency account, which is then converted back to another legal currency. BitPesa will charge a 3% remittance fee for this service. The BitPesa website said it can now transfer funds from Nigeria, Tanzania and Uganda to any bank in China.

A German company, BitBond, which uses a bitcoin blockchain to provide blockchain loans, announced that it will work with BitPesa to finance small businesses in Kenya, Nigeria, Uganda and Tanzania. New borrowers can pay their BitBond funds to their local currency mobile payment account or bank account in as little as 20 minutes.

7. Trade finance use of blockchain

Although many financial institutions are now willing to accept the blockchain, other institutions still have doubts about the blockchain. Some people are opposed to investing heavily in technologies that they think may not be profitable. Others have invested heavily in building a blockchain-based network.

An example of Hyperledger is the result of an open source collaboration that promotes the development of cross-industry blockchain technology. It is controlled by the Linux Foundation, including ABN-AMRO, ANZ Bank, Deutsche Borse Group (German Stock Exchange), BNP Paribas (BNP Paribas), BNY Mellon (New York Mellon Bank), State Street Bank (State Street Bank) Bank), Wells Fargo (Wells Fargo) and other financial institutions.

In October 2016, Commonwealth Bank of Australia, Wells Fargo and international cotton producer Brighann Cotton announced the first global trade deal between two independent banks, combining blockchain with smart contracts and the Internet of Things. The transaction involves the use of a distributed ledger algorithm called Skuchain's Brackets system to finance cotton transportation from Texas to Qingdao, China.

According to a press release from the Commonwealth Bank of Australia, the transaction “involves an account opening transaction, which reflects the letter of credit through a collaborative workflow at the seller (Broriann Cotton US, Brighann Cotton US), buyer (Bray, Australia) Cotton Co., Ltd., and its respective banks (the Bank of Australia and the Commonwealth Bank of Australia) execute on a privately distributed ledger." All parties involved in this transaction have introduced physical layer supply chain triggers. The purpose is to send a notice confirming the geographical location of the goods in transit before lending. This tracking feature provides greater certainty to the parties than traditional trading tools that open accounts and letters of credit that focus on documents and data.

According to the Federal Bank, blockchain technology is used to establish transparency between buyers and sellers, improve security, and track shipments in real time. From paper ledgers and manual processes to electronic tracking of distributed ledgers, errors have been reduced and transaction time has been reduced from days to minutes.

Table 1: Proof of concept of traditional process and blockchain

Source: Commonwealth Bank of Australia

Federal Bank and Wells Fargo said they will continue to work with trade finance clients, financial institutions, financial technology companies and consortia, as well as companies in the insurance and shipping industries to explore the potential of distributed ledger technology. Table 1 shows a comparison of traditional process costs/benefits and process cost/benefit using blockchain.

Barclays Bank offers another example. In 2016, the bank hired Israel's financial technology company Wave to develop a system based on the blockchain for settlement transactions. Food distributor Seychelles Trading Company and Irish agricultural cooperative Ornua generated a letter of credit through Wave's blockchain platform, which was settled using smart contracts, guaranteeing nearly $100,000 worth of dairy products. Seychelles is shipped to Ireland.

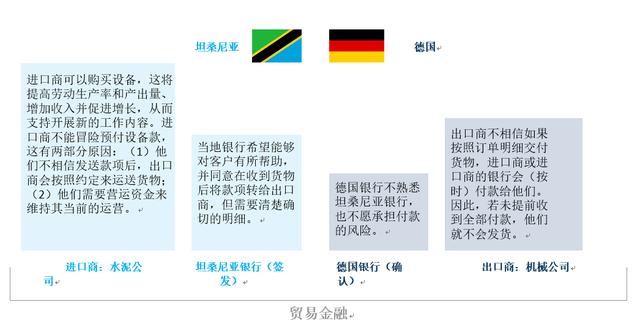

Traditional trade finance requires a lot of paperwork, including bills of lading, insurance certificates, certificates of origin, letters of credit, money orders and invoices, in order to transport goods on a global scale (an example of traditional transactions between institutions in Tanzania and Germany) See Figure 2 below).

Figure 2: The traditional model of trade finance

Source: International Finance Corporation (IFC)

Jeremy Wilson, vice president of banking at Barclays Bank, believes that the least efficient step is the bill of lading. He points out that “the bill of lading may take several weeks to reach the other end of the globe.” There are more than 12 common types) including product description, quantity, weight, shipping details, loading and unloading port, final destination, shipper name, etc. If the issue is not correct, the freight forwarder may lose the goods.

The blockchain system allows individuals to conduct real-time and transparent global transactions and quickly correct document errors while avoiding delays in importing original bills of lading.

Many banks are considering exploring the potential of blockchain technology. Signed by Natixis, HSBC, KBC, Société Générale, UniCredit, Rabobank and Deutsche Bank A memorandum of understanding to develop the “Digital Trade Chain”, a new prototype-based product that allows small businesses using blockchains to conduct cross-border trade. Alfa Bank and S7 Airlines also tested blockchain technology by recording letters of credit on blockchain platforms and using smart contract settlement transactions.

Although there are not many examples of non-governmental organizations (NGOs) that use blockchain to transfer funds, it is not difficult to see the potential of platforms such as BitPesa. However, when crypto assets are converted to fiat money, there is still the question of whether transparency can be ensured.

However, during this period, there is still a business-to-business transaction space between the NGO departments. Currently, NGOs are testing blockchain-based applications for non-financial transactions.

8. Can the blockchain really transform?

Blockchain technology has great potential in every field. The power sector has many examples of blockchain technology, including a startup called Grid Singularity, which uses the financial transactions recorded in the blockchain to explore the “pay-as-you-go” solar business.

It is too early to say whether the blockchain will become a widely used technology. According to Marco Iansiti and Karim Lakhani of Harvard Business School, blockchain is a basic technology similar to the TCP/IP technology introduced in 1972 and powering the Internet we know today. They believe that "single-use" applications (which are less novel and complex, such as payments made using bitcoin or blockchain-based "know your customers" credentials) have emerged in the financial sector, and It may be gradually spread in certain parts of the field. And the use of this technology is constantly innovating, such as private distributed ledgers or blockchain networks. As mentioned above, some banks are testing blockchain technology as a new way of dealing with trade finance and cross-border settlements.

However, other applications (such as self-executing smart contracts) may take a while (and perhaps decades) to be widely used. Iansiti and Lakahni warned that with the increase in the size and impact of blockchain transactions, the adoption of this technology will require major institutional changes and will pose a very real challenge to governments, regulators and financial institutions.

IX. Conclusion

The blockchain is an exciting new technology that has the potential to reduce the cost of verification of customer transactions, thereby expanding the range of financial services in emerging markets. Major players in the financial sector may continue to invest in blockchain technology. It is not clear whether the blockchain will become a widely used technology. At the very least, the widespread use of technology takes time and involves major changes to the regulatory regimes and institutions that govern economic activity.

———— end ————

Legal Notices:

Intellectual property statement

All texts that indicate that the author is “Zhen Chain” and “Dazhi Think Tank” are copyrighted by the company. No organization, organization or individual may reprint, link or repost without the written authorization of the company. , interception and other ways to copy and publish.

Disclaimer

All the contents contained in this report are produced by the unique data and analytical resources of “Zhen Chain” and “Dayu Think Tank”, aiming to provide technical reference for practitioners in the blockchain industry.

The various reports produced by the company are for reference only and do not constitute investment advice. If the visitor suffers losses according to the report issued by the company for investment or trading, the company does not assume any liability for compensation. For other acts performed by visitors based on reports issued by the company, the company does not assume any form of responsibility unless there is a clear written commitment of the company.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Q3 cryptocurrency market value plummeted 100 billion US dollars, mainly due to investors' concerns about the blocked institutions entering the market

- The giant digital currency may be the most valuable asset left by this wave of blockchains.

- The new blockchain law will enter into force in Liechtenstein

- Where are the giants withdrawing, and where are the opportunities and challenges of Libra? | 2019 CCF Blockchain Technology Conference Heavy Round Table

- Jinshan Yun Zhujiang: Layout BaaS Occupy Distributed Financial 4.0 Era

- 5,200 tobacco stores in France started selling bitcoins again, but this may not be a good thing.

- You can buy Bitcoin in a cardboard box. You can do this simple DIY.