Quote analysis: insufficient rebound power, the market has entered a downward trend

Previous review

BTC: BTC has entered the $7,500 first-line support platform. On the platform, BTC will consolidate for a period of time, which is definitely a rebound demand; if it falls below the $7,500 support platform, it will further explore $5,000. The BTC rebounded to a maximum of $8,800 and then fell rapidly.

ETH: ETH is currently in the vicinity of the resistance platform, and must break through the resistance level. The ETH price will return to the shock zone and produce a certain rebound. ETH rebounded as high as $197 and then fell rapidly.

BCH: BCH has a certain rebound neckline demand, but the demand is not strong, and the price has entered a downward trend. BCH rose to a maximum of $240, and the rebound was weaker than other mainstream currencies.

- A week of review | Libra received 5 "good guys card", and Telegram wants to receive a certificate

- Joe Lubin's full presentation from Devcon 5: How do we implement a decentralized world wide web?

- Litecoin Foundation "funds exhausted", Li Qiwei: Most of the losses are attributed to the collapse of LTC and BTC prices

Highlights of this issue

Summary: According to the standard consensus sentiment index, the current market sentiment is good, the latest index is 1.02. After the rebound, the market will once again enter the stage of downward trend. In the short term, the overall trend of the market will be dominated, but the strength of the empty side is gradually increasing.

BTC: This week, BTC basically completed the rebound trend. In the short term, it entered the downside range. The power of many parties has not been completely lost. It will go out of a turbulent trend, but the overall trend of the market is still dominated by bearishness.

ETH: ETH's current support range is at $180. If the re-quantity falls below $180, the downtrend channel will open.

EOS: EOS investors have insufficient confidence. Once they fall, the volume will be enlarged to some extent. The current support range is around $3.00, but the support is not strong.

Current report

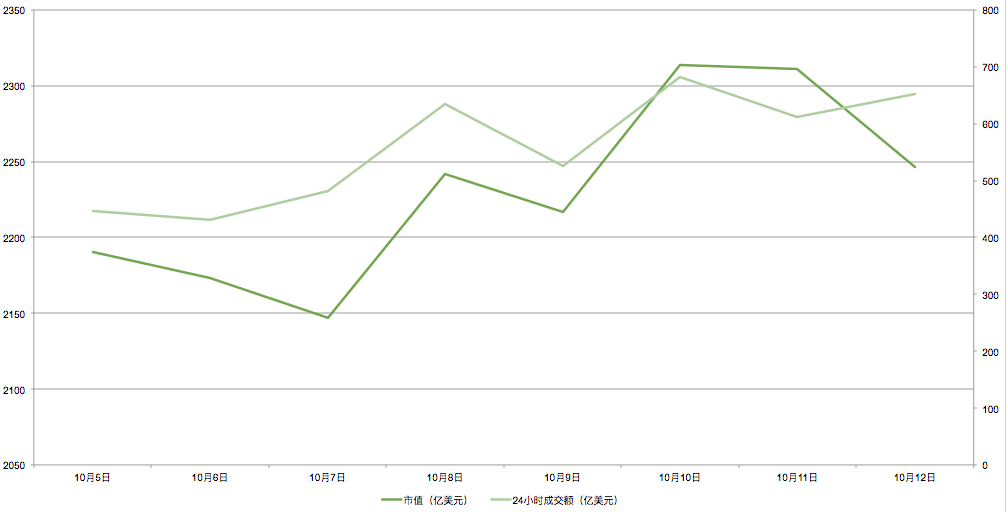

As of the release date of the report (October 12, 2019), the total market value of global digital currency assets this Friday was US$246.624 billion, up US$5.591 billion year-on-year, up 2.55%. The 24-hour market turnover was US$65.13 billion, up US$20.637 billion year-on-year, up 46.19%. Although the market value and 24-hour turnover have both increased year-on-year, the current callback has partially swallowed up before the partial rebound, while the volume of the decline during the decline has been significantly enlarged, and the market has once again returned to the falling range.

Source: Standard Consensus, CoinMarketCap

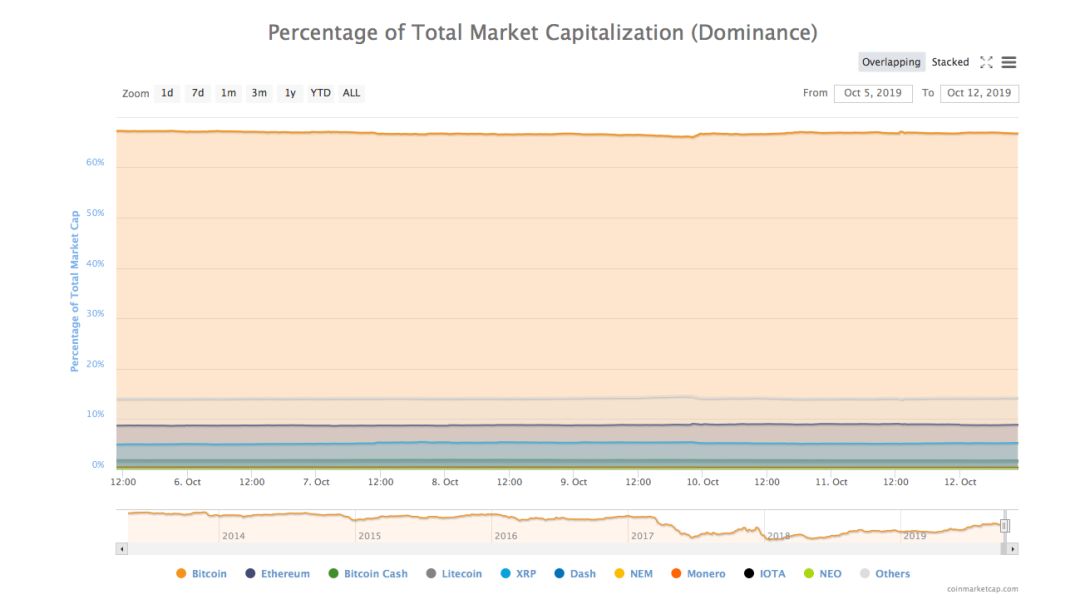

According to the standard consensus sentiment index, the current market sentiment is good, the latest index is 1.02. After the rebound, the market will once again enter the stage of downward trend. In the short term, the overall trend of the market will have been dominated, but the strength of the empty side is gradually increasing. At the same time, according to the ratio of bitcoin to total market capitalization, the market value of bitcoin declined, down 0.48% year-on-year. The market value of bitcoin accounted for less than 70%, but still more than 65% in market control; while other currencies accounted for market value. Compared with no significant change, it only increased by 0.19% year-on-year. BTC is still in the dominance of the market, and the rise and fall of BTC will continue to affect the market trend, and the market enters the downtrend channel.

Source: Standard Consensus, CoinMarketCap

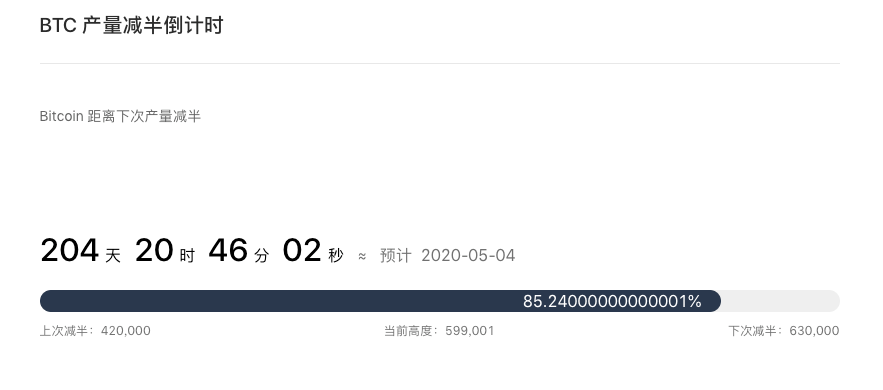

According to the standard consensus halving countdown index, the current block height of BTC is 599,001, and there are still 204 days from the next halving. It will take some time for BTC to achieve a halving of expectations. However, investors should pay attention to the halving of BTC. When the next halving approach, BTC prices will once again enter a fast-rising cycle.

Review and analysis of the trend of BTC, ETH and EOS

According to CoinMarketCap data, BTC's average daily turnover rate was 11.03% on the 7th, which was 1.47% higher than the average daily turnover rate in three months, and 1.46% higher than the average daily turnover rate in the previous week. The BTC price hit an impact of $8,800 at 12 o'clock on the 11th, but the volume of the volume failed to follow the enlargement, and then quickly fell, so the rebound of this round basically ended. This week, BTC basically completed the rebound trend, and entered the down range in the short term. The power of many parties has not been completely lost. It will go out of a turbulent trend, but the overall trend of the market is still dominated by bearishness.

According to CoinMarketCap data, ETH's average daily turnover rate was 38.59% on the 7th, which was 5.00% higher than the average daily turnover rate in three months, and 2.91% higher than the average daily turnover rate in the previous week. ETH has rebounded strongly this time. At present, the overall trend is still in the band, but the trend of the volatility of the heavy volume has destroyed the further imagination of the rebound. ETH's current support range is at $180, and if it falls below $180 again, it will open the downtrend channel.

According to CoinMarketCap data, EOS's average daily turnover rate was 51.01% on the 7th, which was 1.17% higher than the average daily turnover rate in three months, and 0.42% higher than the average daily turnover rate in the previous week. The overall upward trend of EOS is relatively flat, the transaction volume has not changed significantly, and the volume of transactions during the decline has been significantly enlarged, indicating that investors have insufficient confidence in the rise. EOS investors have insufficient confidence in holding. Once the decline occurs, the volume will be enlarged to a certain extent. The current support range is around $3.00, but the support is not strong.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Mind Reading: Extracting "Knowledge" from Zero Knowledge Proof

- Academician Zhou Zhongyi of the Chinese Academy of Engineering: Blockchain application must first distinguish user-centric classification

- Financial giant Fidelity executives: In order to protect investors, we have not yet provided cryptocurrency trading services on retail trading platforms.

- Will the quantitative fund industry break out? Global mainstream investors will participate in 5 years

- The curse of the Bitcoin ETF: Passing forever "Next Year"?

- Looking at the blockchain from the history of communication development: Where is the wealth opportunity of the blockchain industry now?

- Search index analysis: Bitcoin may be a "relative safe-haven asset"