Comprehensive Review of the Polygon zkEVM Ecosystem: Slow but Steady

Review of Polygon's zkEVM Ecosystem: Steady ProgressAuthor: 100 y; Compiled by: Deep Tide TechFlow

1. Introduction

In 2022, many ZK rollup networks are in fierce competition. Many of these networks have launched their mainnets and are actively developing their ecosystems. On March 23, 2023, the airdrop of Arbitrum was successful, which led to users migrating to ZK rollup, hoping to benefit from the subsequent airdrops. This transition is particularly evident in ZK rollup networks such as zkSync Era, StarkNet, and others that have not yet released their own tokens.

Unlike other emerging ZK rollup networks that do not have tokens yet, there is a ZK rollup network that has received less attention but has very stable technology and a developer-friendly environment, and that is Polygon zkEVM. Polygon zkEVM is one of the ZK rollup networks developed by Polygon Foundation, formerly known as Polygon Hermez. The main technical difference between Polygon zkEVM and other ZK rollup networks is its high EVM compatibility.

- Exploring the Effectiveness of Layer2 Airdrops: A Case Study of Optimism and Arbitrum

- Cracking the interoperability trust problem: how will Web3 and cross-chain bridges ultimately evolve?

- Analyze the three main characteristics of the Cosmos LSM module: what are the positive implications?

Unlike other ZK rollup projects (such as StarkNet and zkSync Era) that build their own virtual machines, transpile Solidity into zero-knowledge-friendly languages, and compile them into bytecode, Polygon zkEVM supports Ethereum opcodes. Therefore, Polygon zkEVM may not be as scalable as other ZK rollup networks, but it has an advantage in providing developers with a more user-friendly environment to build dApps using existing Solidity code.

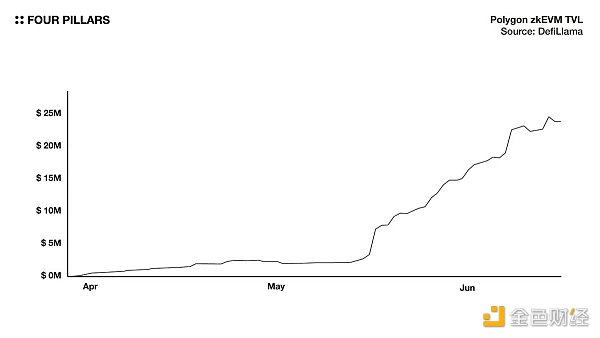

In Polygon zkEVM, ETH tokens are used as gas fees, while MATIC tokens are used as tokens to incentivize Sequencers and Aggregators, which respectively determine the order of transactions on the network to create batches, and generate ZKPs for these batches. Since both of these tokens have been issued, many users believe that Polygon zkEVM will not conduct airdrops, which is why it initially performed less well in terms of network activity than other networks. However, if you look at the recent trends of the Polygon zkEVM network, you will find that users and TVL are growing rapidly, and there are several reasons for this.

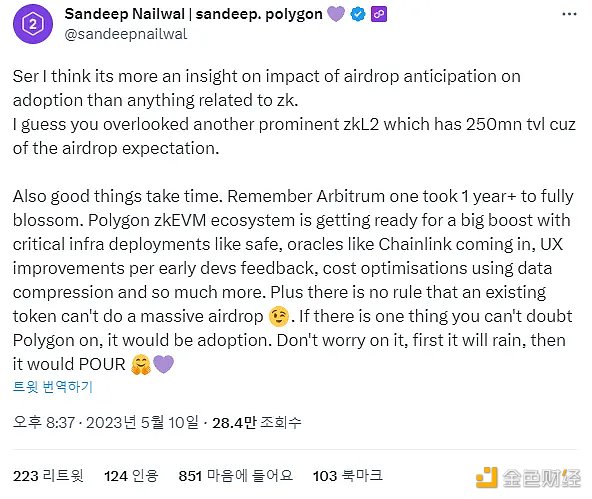

The first and most convincing reason is a tweet from Sandeep Nailwal, co-founder of Polygon. In response to a tweet mocking the low TVL of Polygon zkEVM, Sandeep posted the above tweet, which includes the phrase “there are no rules that existing tokens cannot have large-scale airdrops.” After this tweet, many users started using Polygon zkEVM in anticipation of the arrival of airdrops.

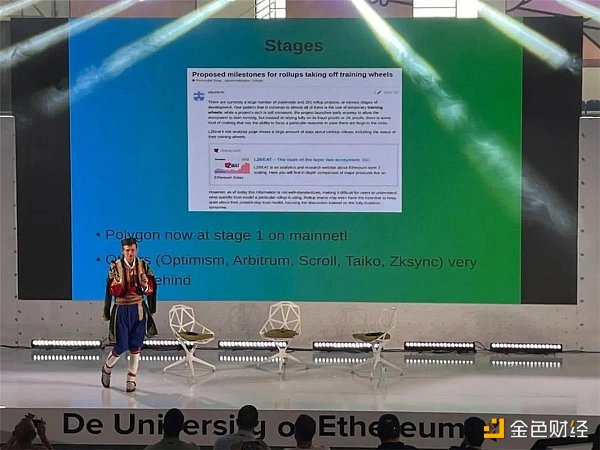

The second reason is that Vitalik Buterin mentioned Polygon zkEVM at the EDCON 2023 workshop. Previously, Vitalik had published an article on the Ethereum community Ethereum Magicians, introducing the milestones that the Rollup network needs to achieve, which are divided into three stages: 0, 1, and 2. At a workshop, Vitalik made a statement that Polygon zkEVM had reached the first stage, while other competing networks had not. This achievement attracted attention to Polygon zkEVM. It should be noted that to reach the first stage, unlike the zero stage, there must be a proof-of-work system (such as fraud proof or validity proof), and measures must be taken to protect the upgrade mechanism of Rollup smart contracts.

Polygon zkEVM has recently attracted more and more attention, and has soared from about $2 million to $25 million in TVL in less than a month, an increase of 10 times. Although the ecosystem is developing rapidly, the network is still in its infancy. In this article, we outline the dApps that exist in the Polygon zkEVM ecosystem. Although the ecosystem is still in its infancy, it has sufficient momentum for development.

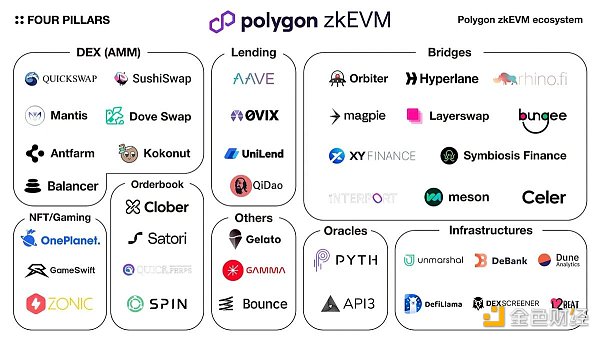

2.Polygon zkEVM Ecosystem

2.1 DeFi (AMM DEX)

2.1.1 Quickswap

Quickswap is the leading AMM DEX in the Polygon ecosystem, supporting Polygon, Dogechain, and Polygon zkEVM networks. Quickswap provides AMM DEX services based on CPMM (x*y=k) and provides a liquidity system similar to Uniswap V3. In addition, Quickswap has launched a new service on Polygon zkEVM, which is a perpetual futures trading service. Due to the high scalability of Polygon zkEVM, the Quickswap team seems to have deployed it on the Polygon zkEVM network rather than on Polygon PoS. The basic system is similar to GMX, but its advantage is that the price is obtained through an Oracle, allowing users to trade without price impact. Liquidity in the market comes from QLP tokens, and liquidity providers can deposit QLP tokens to earn transaction fees and incentives.

2.1.2 Mantis Swap

Mantis Swap is a stablecoin exchange in the Polygon ecosystem that facilitates trading of assets tied to stablecoins and the like. What sets Mantis Swap apart from other stablecoin exchanges is that it aggregates multiple assets into a single liquidity pool and allows for single-asset liquidity provision. For instance, the current Mantis Swap liquidity pool on Polygon zkEVM includes USDT, USDC, and DAI, and its advantage is that liquidity providers only need to provide one token rather than two or more.

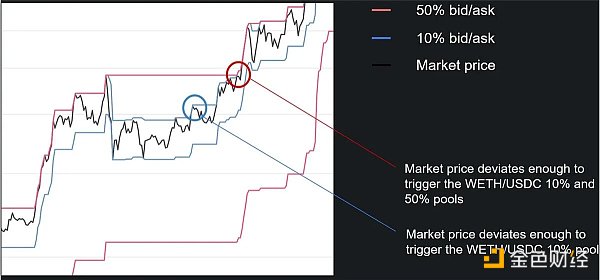

2.1.3 Antfarm Finance

Antfarm Finance is a DEX running on Ethereum, Arbitrum, and Polygon zkEVM that uses a new strategy called Band Rebalancing AMM. Using the ETH/USDC liquidity pool as an example, liquidity providers can choose to provide liquidity at a fee of 1%, 10%, 25%, or 50%. But who would want to trade in a high-fee liquidity pool at 10%? This might happen during periods of extreme volatility, if the price of 1 ETH is 1,000 USDC, but exceeds 1,100 USDC on another market, for instance. Therefore, users providing liquidity to Antfarm Finance’s high-fee liquidity pools have the advantage of betting on volatility.

2.1.4 Balancer

Balancer is a representative AMM DEX protocol in the Ethereum ecosystem that provides a variety of liquidity pools, including pools for two different assets in different ratios and stablecoin trading pools, in addition to the basic CPMM (x*y=k). Through BIP-224, Balancer proposed deployment on zkEVM and recently announced it officially.

2.1.5 Others

Aside from the aforementioned DEXs, there are many other protocols, including:

-

DoveSwap is a native zkEVM DEX that supports liquidity features similar to Uniswap V3, where liquidity can only be provided within specific price ranges.

-

Kokonut Swap is a Klaytn-based AMM DEX that has also begun supporting the Polygon zkEVM network. Kokonut Swap uses Curve’s stablecoin exchange AMM to handle assets of equal value and uses dynamic PEG to handle assets of different values, providing more focused liquidity than ordinary CPMM.

-

Sushiswap is a leading AMM DEX in the Ethereum ecosystem that now also supports the Polygon zkEVM network through a community proposal.

2.2 DeFi (Lending)

2.2.1 0 vix

0 vix is a lending protocol in the Polygon ecosystem that supports both the Polygon PoS and Polygon zkEVM networks. Users can deposit collateral to earn interest, or borrow using overcollateralization. 0 vix supports major tokens such as WBTC and WETH, as well as liquidity tokens such as wstETH and stMATIC, and various tokens such as vGHST, jEUR, and gDAI.

2.2.2 Aave

Aave is a leading lending protocol in the Ethereum ecosystem that supports various EVM networks. Like other lending protocols, it allows users to borrow using overcollateralization. Since 2022, Aave V3 has been deployed and tested on the Polygon zkEVM testnet, and is expected to be deployed on the mainnet in the near future, as it received overwhelming approval to deploy to the Polygon zkEVM mainnet in the March vote on the Snapshot governance platform.

2.2.3 Qi Dao

Qi Dao is a stablecoin issuance protocol. Users can deposit collateral using overcollateralization and issue the MAI stablecoin. The unique feature of Qi Dao is that the stablecoins issued by users do not have to pay any interest, and the stablecoins borrowed do not have a due date for repayment. Of course, there is a liquidation process with penalties when the value of the collateral decreases.

2.2.4 Others

UniLend Finance is a multi-chain decentralized money market protocol that supports overcollateralized loans.

2.3 DeFi (Order Book DEX)

2.3.1 Clober

Clober is an on-chain order book for EVM networks, currently supporting Ethereum, Polygon, Arbitrum, and Polygon zkEVM. Implementing an on-chain order book is challenging due to large trading volumes, and Clober solves this problem using its proprietary techniques called segmented segment trees and octopus heaps. By utilizing Clober, users can execute trades on-chain while enjoying an order book experience similar to centralized exchanges.

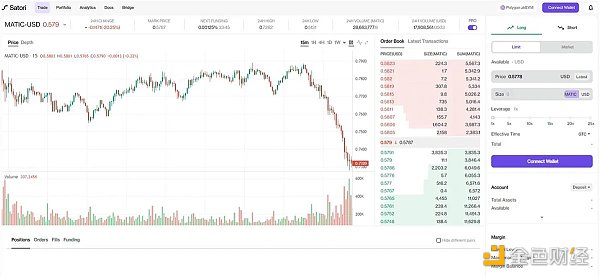

2.3.2 Satori

Satori is a perpetual futures order book trading protocol that has raised over $10 million in funding from institutions such as Polychain Capital, Jump Crypto, and Coinbase Ventures. Satori allows users to easily trade perpetual futures on-chain using a centralized exchange-like interface and user experience.

2.3.3 Others

SpinFi is an all-in-one DeFi platform originally built on Near Protocol, offering spot and futures order book trading, decentralized options vault (DOV), and more.

2.4 DeFi (Others)

2.4.1 Gamma

Gamma is not an AMM DEX, but a protocol that provides automatic liquidity provision services for DEXs such as Uniswap V3, allowing centralized liquidity provision by setting specific prices. The disadvantage of centralized liquidity is that if the market price goes beyond the set price range, liquidity will be excluded from liquidity supply, not earning interest, and resulting in significant losses. However, Gamma can solve the above problem by automatically rebalancing the price range based on market prices. Gamma is currently working with Quickswap to provide this service on the Polygon zkEVM network.

2.4.2 Gelato

Gelato is a protocol that helps automate smart contracts, and many DeFi protocols use Gelato. The protocol can use Gelato to implement limit orders on AMM DEXs, manage liquidation risk in lending protocols, or introduce the ability to rebalance price ranges on protocols that support concentrated liquidity, such as Uniswap V3. Gelato will deploy a relay network on the Polygon zkEVM network to help various dApps in the ecosystem automate their smart contracts.

2.4.3 Others

Bounce Finance is an auction-as-a-service protocol that allows for various auction methods to be easily implemented on-chain, including fixed-price auctions, Dutch auctions, and sealed-bid auctions.

2.5 NFTs and Gaming

2.5.1 OnePlanet

OnePlanet is a leading NFT marketplace in the Polygon ecosystem that recently announced it has been deployed to the Polygon zkEVM network. Unlike other NFT marketplaces, OnePlanet curates its NFT collections. Not any project can be listed on OnePlanet, only NFT collections that have been verified by the team can be listed, so users can buy high-quality NFTs safely and reliably. Various projects in the Polygon ecosystem have partnered with OnePlanet to hold various activities.

2.5.2 Other

-

Gameswift (previously called StarTerra on the Terra blockchain) is a comprehensive gaming platform that offers IGO, INO, and gaming services.

-

Zonic is an NFT marketplace specifically for second-layer networks such as Optimism, Arbitrum, Nova, zkSync Era, and Polygon zkEVM.

2.6 Cross-chain Bridges

2.6.1 Orbiter Finance

Orbiter Finance is a cross-Rollup protocol specifically for Rollups and supports various L2 networks outside of Ethereum. In Orbiter Finance, there is an entity called Maker that has liquidity on every network, and the bridging process is that the user sends funds to Maker on the source chain and receives funds from Maker on the target chain. The disadvantage is that there is a limit to the amount of ETH that can be sent at one time, but the advantage is that the bridging process is very fast.

2.6.2 Hyperlane

Hyperlane is a protocol that modularly implements cross-chain communication, allowing anyone to adopt Hyperlane, whether it’s an L1, L2, or application chain. Currently, Hyperlane only applies to EVM chains, but support for non-EVM networks will be provided in the future. The verification method uses external validators. Introducing Hyperlane will improve the composability with other networks that enable Hyperlane on Polygon zkEVM.

Hyperlane is a protocol that modularly implements cross-chain communication, allowing anyone to adopt Hyperlane, whether it’s an L1, L2, or application chain. Currently, Hyperlane only applies to EVM chains, but support for non-EVM networks will be provided in the future. The verification method uses external validators. Introducing Hyperlane will improve the composability with other networks that enable Hyperlane on Polygon zkEVM.

2.6.3 Rhino Fi

Rhino Fi is a one-stop DeFi platform specifically for the Ethereum ecosystem and supports multiple Rollup networks, including Optimism, Arbitrum One, Polygon zkEVM, and zkSync Era. In addition to supporting exchanges, liquidity pools, and various insurance vaults, users can also bridge to the Polygon zkEVM network.

2.6.4 Magpie Protocol

Magpie Protocol is a cross-chain DEX that allows users to trade assets directly from multiple networks. To trade assets from different networks, users typically need to bridge their assets from one chain to another and then execute the trade, but with Magpie, users can complete all of these steps in one go. There is no mechanism for locking/burning tokens during cross-chain exchanges, and token trades are conducted using Wormhole’s universal message protocol. The process of token exchange is as follows: 1) The user’s trade is submitted on the source chain. 2) The user’s assets are converted into stablecoins. 3) The stablecoins are deposited through existing cross-chain bridges like Wormhole and Stargate. 4) The user’s exchange and deposit information is sent to the target chain via Wormhole. 5) Once verified, the stablecoins are used to purchase the tokens on the target chain and sent to the user.

2.6.5 Others

-

Layerswap is a cross-chain bridge protocol that supports 17 exchanges and 20 blockchains. Unlike other bridges, it also supports bridging with CEX.

-

XY Finance is a cross-chain exchange protocol where liquidity providers provide liquidity to Y pools on each network, and traders can swap it for any asset they want using the X swap feature and the liquidity on each network.

-

Bungee is a cross-chain exchange protocol based on a cross-chain protocol called Socket and supports various EVM networks. Fund transfer is done through a liquidity layer.

-

Meson Fi is a cross-chain stablecoin exchange protocol that allows users to exchange stablecoins across multiple networks by utilizing the liquidity provided by liquidity providers on each network. It uses HTLC atomic swaps as the bridging method.

-

Interport Finance is also a cross-chain DEX protocol that allows users to execute cross-chain exchanges simultaneously, utilizing liquidity provided by liquidity providers.

-

Symbiosis finance is another cross-chain DEX protocol that supports multiple EVM networks. To bridge securely, it relies on validators maintained through an incentive mechanism called the Symbiosis Relayer.

-

Celer is a cross-chain bridge that optimizes EVM chains, where transactions are verified by an entity called the State Guardian Network, which is driven by economic incentives. Bridging is achieved through liquidity provided by liquidity providers on each network.

2.7 Oracle

2.7.1 Pyth

Pyth is an oracle that provides price data for cryptocurrencies, stocks, forex, commodities, and more, running on over 13 different blockchains. Pyth directly sources data from first-party resources, including Cboe, Jane Street, Binance, and many other large organizations. Pyth’s price information is currently available for the 0 vix protocol on Polygon zkEVM and will be supported on various other Polygon zkEVM protocols in the future.

2.7.2 API 3

API 3 is an oracle like Pyth that can directly source data from first-party resources. API 3’s product Airnode has the advantage of sourcing data directly from third-party resources and is very easy to use and maintain, with low costs. API 3 is currently being used to provide price information for the Dovish perpetual protocol on Polygon zkEVM.

2.8 Infrastructure

2.8.1 Unmarshal

Unmarshal provides various data infrastructure services and APIs across multiple networks. Services include a block explorer with a convenient UI called Xscan and a no-code smart contract indexer called Blockingrser. Unmarshal will be used as the indexing and querying layer for Polygon’s zkEVM network.

2.8.2 Others

-

Defillama is one of the most well-known DeFi analytics websites that aggregates on-chain data related to DeFi across multiple networks.

-

DeBank is an asset dashboard service specifically for EVM networks that displays the assets of a particular wallet in a convenient UI. Additionally, it provides messenger services and other features.

-

Dexscreener is a service that analyzes and provides data for DEXs that are harder to access than CEXs, allowing users to view price charts for tokens listed only on DEXs or access data for various liquidity pools.

-

L2beat displays information about various Ethereum Layer 2 networks, allowing users to view quantitative data such as TVL and Tx count as well as qualitative analysis of risk.

-

Dune is an on-chain data analytics platform that allows users to query and visualize data from various networks.

3. Conclusion

Recently, Polygon outlined its vision for building a Layer 2 chain network based on ZK technology and proposed a roadmap called Polygon 2.0. While more details will be disclosed later, we can expect the Polygon ecosystem to expand around Polygon zkEVM and related technologies. For such a future roadmap, the initial Polygon zkEVM ecosystem will play a very important role. As someone recently proposed extending Rocket Pool’s rETH to Polygon zkEVM, we expect more Dapps and users to join Polygon zkEVM in the future.

Disclaimer: This article was sponsored by the Polygon Foundation. This article is for general informational purposes only and does not constitute legal, commercial, investment, or tax advice. It should not be relied upon as a basis for making any investment decisions, nor should it be relied upon for accounting, legal, or tax guidance. References to specific assets or securities are for illustrative purposes only and do not constitute a recommendation or endorsement. The views expressed in this article are solely those of the author and do not represent the views of any affiliated organization, entity, or individual. The opinions expressed here are subject to change without notice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain detective ZachXBT sued by “Big Brother Ma Ji”: Received donations of over one million US dollars, supported by CZ and Justin Sun

- Sei Network: The fastest Layer1 public chain on Cosmos designed for trading?

- Encrypted Twitter’s FOMO trap and the quiet arrival of ROMO art

- Final Battle between DEX and CEX? Uniswap V4 Remakes Liquidity Growth Flywheel

- Summary of the 111th Ethereum Core Developer Consensus Meeting: Deneb Upgrade, Aggregation Deadline, Increased Maximum Effective Validator Balance…

- Is “The Empress’s Seal” infringing on copyright? The issue is not that simple.

- Vitalik Buterin proposes that Ethereum will fail without L2. What new opportunities can the Cancun upgrade bring to L2?