How is Terra’s ecological disaster reconstruction? Learn about the development status of LUNA 2.0 in this article.

Learn about the development status of LUNA 2.0 in this article about Terra's ecological disaster reconstruction.Written by: Kadeem Clarke

Compiled by: DeepTechFlow

Introduction

The crashes of Luna and UST last year, Do Kwon’s legal issues, and the declining trend of the Terra ecosystem are still fresh in people’s memory.

However, many things did not completely disappear after negative events. The voices of reconstruction and speculation are intertwined, so we can see the activity of LUNA Classic or LUNA 2.0 again.

- Stablecoin Dashboard: Classifies nine stablecoins based on volatility risk

- Conversation with Scroll and Cysic Co-founders: Proof-of-Stake Network and ZK Hardware Acceleration

- How to break the interoperability trust problem by in-depth analysis of any message passing protocol?

What is the current state of the Terra ecosystem? Are there still things worth paying attention to?

With these questions in mind, M6 Labs sorted out the current situation of Luna 2.0, Terra ecosystem, partnership relations and technological progress, and presented them to us.

The last UST crash caused a blockchain split, also known as a hard fork, creating a new blockchain and token, which now runs independently.

LUNA or LUNA 2.0 represents the new LUNA token generated due to the fork, and the original LUNA token is now called LUNA Classic or LUNC. Over 65% of holders support the revival of the Terra platform after the fork.

Terra is a blockchain project created by Terraform Labs and is the foundation of many stable coins and decentralized applications. TerraUSD, or Terra $UST, uses an algorithm to peg it to the US dollar.

Terra UST is an algorithmic stable coin designed to reduce the inherent volatility of cryptocurrencies such as Bitcoin. The previous version of the Terra protocol has been extended to allow stablecoin developers to create Terra DeFi projects.

Terra and LUNA are two cryptocurrencies used in the project. Terra is a stable coin standard associated with fiat and other currencies. For example, TerraUSD (UST) is pegged to the US dollar, while TerraKRW (KRT) is pegged to the South Korean won.

The staking and governance assets of the network are the native token LUNA. Users stake LUNA to gain governance rights, become validators and receive rewards. Users can also use LUNA to create UST tokens for Terra or tokens pegged to their native currency.

However, it should be noted that although these stablecoins are associated with fiat currencies, they are not backed by fiat currencies. The LUNA token is considered an algorithmic stable coin.

Algorithmic stablecoins are digital assets whose value comes from a set of rules rather than being linked to tangible assets. This approach allows Terra users to invest in the prices of these pegged tokens without holding them in their physical form.

Luna 2.0

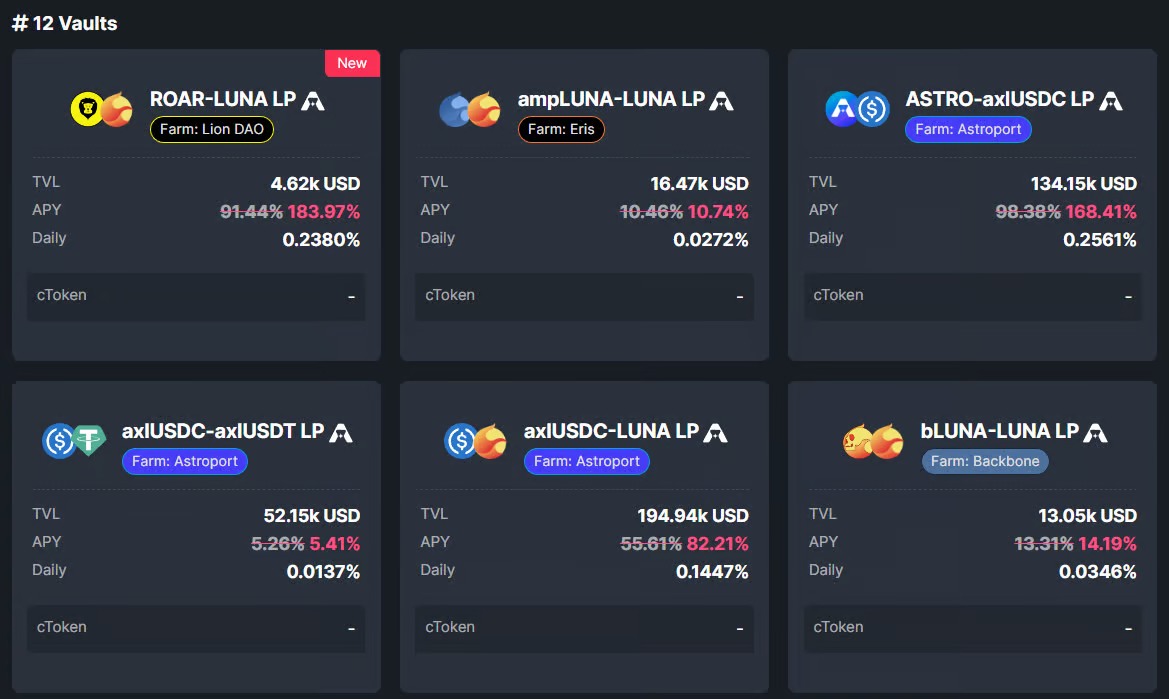

Luna 2.0 is the latest version of Terra (LUNA) and aims to propose a fork and airdrop of the Terra blockchain. The main goal of new projects in the Terra ecosystem is to restore trust in the stablecoin.

History

Terra Luna launched on the Cosmos blockchain in April 2019. Its initial price was $0.19, with fluctuations in the first few months between $0.19 and $0.30. Do Kwon is the founder and CEO of its parent company, TerraformLabs, and has been working with co-founder Daniel Shin on the ecosystem’s development since January 2018.

In 2019, Kwon discussed the origins of his blockchain on CNBC, with the central idea being that digital assets only increase in value when they innovate and create value for users.

How does Terra 2.0 work?

Terra 2.0 is an update to Terra Classic.

Although Terraform Labs and Do Kwon will not be part of Terra 2.0, the company behind Luna and Terra has developed a “strong revival plan” by creating a new Terra to effectively save the entire Terra Classic ecosystem. This is the first plan to be given the Terra 2.0 label.

Although there are strong indications that Terra 2.0 will not suffer the same fate as its predecessor, there is disagreement among cryptocurrency exchanges and tech entrepreneurs about the feasibility of supporting the Terra 2.0 blockchain.

Do Kwon and Terraform Labs’ original plan focused on validating each invalid block and blockchain network transaction, allowing the new LUNA token and Terra 2.0 to flourish? This plan will be implemented through a hard fork, which means that Terra 2.0 will not be directly associated with LUNA Classic, but will still be maintained on the same blockchain.

Do Kwon’s proposal is being considered, but more support is needed. Terra 2.0 is not based on the original Terra blockchain, but on a brand-new blockchain, the new Terra. LUNA Classic has replaced the original LUNA token.

What is the consensus mechanism of Terra 2.0 (LUNA 2.0)?

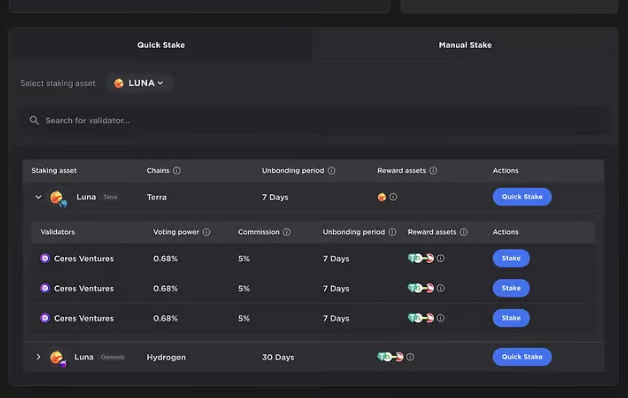

The Terra 2.0 cryptocurrency blockchain uses a standard proof-of-stake consensus algorithm to validate transactions. At any given time, there are 130 validators participating in network consensus, with their voting power determined by the amount of LUNA 2.0 bound to the node. Gas fees and a 7% fixed annual LUNA 2.0 inflation rate reward grant.

LUNA 2.0 token holders contribute to consensus by delegating their tokens to validators. Validators typically stake their own money along with the representation. In the system, validator nodes retain commissions, then distribute rewards to delegators.

What makes LUNA unique?

The following factors make LUNA an attractive crypto asset:

Fast Cross-Border Payments:

Terra stablecoins enable seamless, low-cost cross-border exchange worldwide. Terra averages a block time of six seconds, allowing for fast transactions globally.

Low Transaction Fees:

Transaction fees on the Terra blockchain are some of the lowest in cryptocurrency.

Interoperability:

Terra runs on Terra Bridge, a cross-chain system that allows Terra tokens to be interoperable. Terra tokens can be transferred between Binance Smart Chain and Ethereum, and efforts are underway to support cross-Solana transactions. Terra also runs CHAI, a payment software that allows Terra users to seamlessly complete payments on its blockchain.

Automated Liquidity Pool:

After depositing, tokens are automatically staked on its protocol, saving users time and effort in finding liquidity pools. Terra tokens can be used in many applications easily built on its protocol.

What’s the difference between LUNA 2.0 and LUNA Classic?

Although they have significant similarities, LUNA Classic and LUNA 2.0 are different. According to the new governance plan, the Terra network has been split into two chains. The old chain will be Terra Classic with the Luna Classic token (LUNC), while Terra with the LUNA token will become the new chain called LUNA 2.0.

Rather than being completely replaced, the old LUNA will coexist with LUNA 2.0. Any Terra Luna DApps will prioritize LUNA 2.0, and the developer community will begin building DApps and providing utility to the new token. However, it does not include algorithmic stablecoins.

Terra Classic will retain its community, as many investors and traders oppose Do Kwon’s recovery plan and new chain. Terra Classic still has a large fan base. The Classic community has agreed to burn as many LUNC tokens as possible to reduce currency supply and increase individual token prices.

What will happen to the old Terra blockchain?

TerraUSD and LUNA Classic are both native tokens of the old Terra network. The blockchain platform’s goal is to provide a peer-to-peer electronic cash system. UST and LUNA are the two tokens available on this blockchain.

Since UST is a stablecoin, it can be directly pegged to the US dollar. This means that UST is expected to maintain a value close to $1. The LUNA token is crucial in ensuring that UST maintains its peg. A standard contract-based algorithm is used to maintain the peg. By burning LUNA tokens, the UST is kept at or near $1. This allows for the creation of new tokens.

Users on the original Terra platform had to exchange LUNA tokens for UST and then exchange UST back to LUNA. Even if the market price of one token was different from the other, these transactions were carried out at the guaranteed $1 price. Eventually, TerraUSD was unable to maintain its peg to the US dollar, causing its value to plummet. However, the exact reason for this stablecoin’s devaluation has not been identified.

When this happened, the algorithm powering the entire platform attempted to correct the issue by issuing significantly more LUNA tokens than usual. In fact, the total supply of LUNA increased from over 700 million tokens around May 5, 2022, to 70 trillion tokens just eight days later. As a result, LUNA lost 99.9% of its total value. By introducing trillions of new coins into the market, the value of a single coin eventually dropped to a few hundredths of a US penny.

The old LUNA tokens were renamed LUNA Classic and listed under the code LUNC since they were essentially worthless. On the other hand, the old Terra blockchain will effectively cease to exist. The UST stablecoin is the only aspect of the Terra blockchain that will be completely removed. Even though new LUNA coins will be issued, stablecoins will not be issued.

Terra Ecosystem

The Terra ecosystem is heavily focused on DeFi applications, which has led to the emergence of Terra Finance (TeFi). The sheer number of native projects built on Terra and the ability to attract significant capital in the early stages demonstrates the quality of this ecosystem.

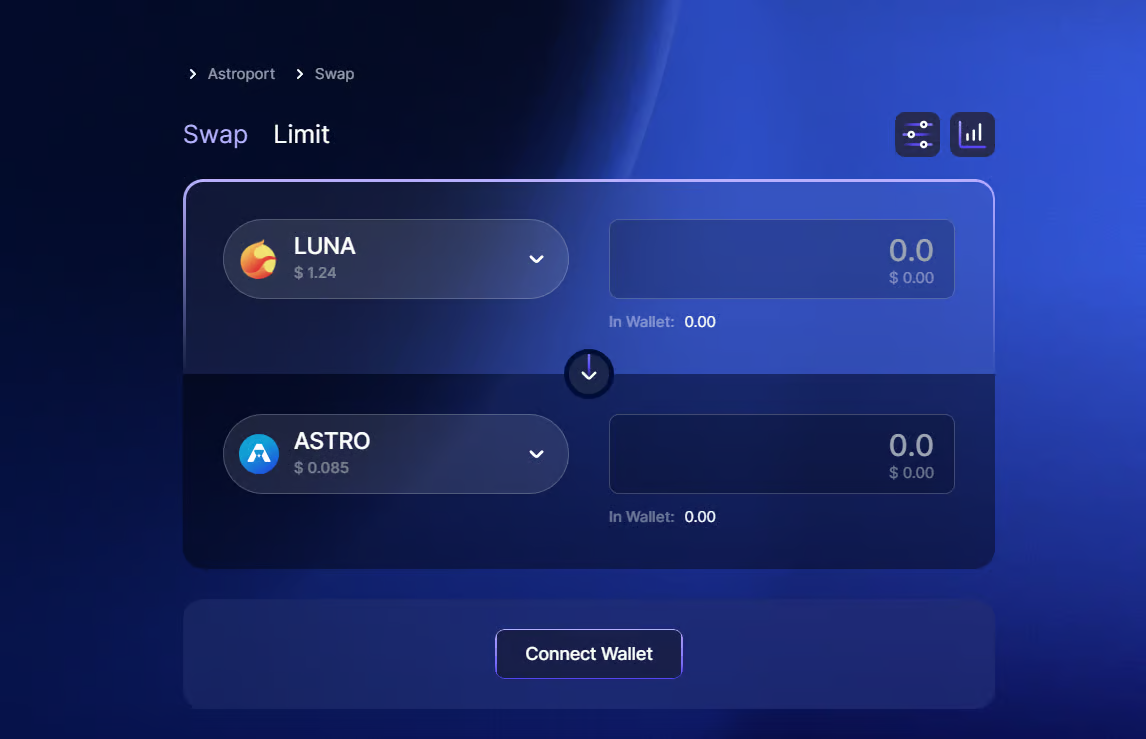

Astroport Protocol

Similar to the relationship between Uniswap and Curve, the Astroport protocol aims to be the core DEX or automated market maker of the Terra ecosystem, facilitating the exchange of all assets on Terra. Within 7 days of its launch, 23,379 independent wallet addresses had deposited over $1.2 billion into the protocol. In addition, Astroport’s unique token distribution and long-term staking design will protect the protocol from any rapid outflows in the short term.

It is one of the most important dApps for LUNA, with a total locked value (TVL) of $13.93 million.

1.TerraSwap

TerraSwap is the first AMM protocol on Terra, similar to Uniswap. The main difference is that TerraSwap does not allow users to freely list tokens or create pools.

In short, TerraSwap allows users to exchange tokens on the Terra blockchain and create liquidity pairs. These liquidity pairs, called pools, provide users with liquidity to exchange blockchain tokens. The pool tracks the balance of two assets to ensure that there is always a certain amount of tokens available for trading. Users who provide liquidity will receive LP tokens as a reward.

TerraSwap is the original TerraSwap protocol.

2.Prism Protocol

Prism Protocol is one of the most unique protocols on Terra. It allows users to split revenue-generating assets into two separate parts: a revenue part and a principal part, creating a new asset class. Users can maximize their price or yield exposure while avoiding liquidation risk.

As the PRISM token is the underlying asset in all liquidity pools, users must hold PRISM as well as other assets to provide liquidity. Users who wish to participate in governance can stake their PRISM to receive xPRISM and a portion of the protocol fees.

Prism only supports the reflection of Terra’s native token LUNA into pLUNA and yLUNA. PRISM plans to reflect more tokens from Layer 1s into high APY mining pools in the future and allow users to choose from multiple target yields to ensure their returns. Users can also place limit orders for token swaps using Telegram and receive alerts when the orders are filled.

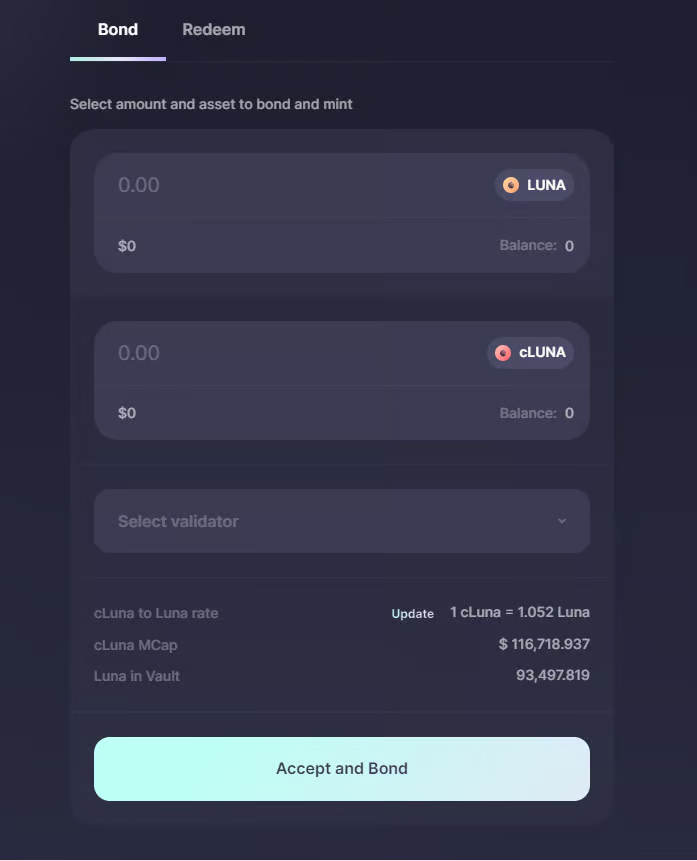

3.Risk Harbor

Risk Harbor is a DeFi risk management market that protects liquidity providers and stakers from smart contract hacks and attacks using automated, transparent, and fair claims processes.

The core belief of Risk Harbor is that every crypto asset should be protected without the need for trusted intermediaries, enabling a truly permissionless open financial system for everyone.

Different from other decentralized protection policies, Risk Harbor adopts parametric protection pedagogy. Its algorithmic, transparent, and fair solutions eliminate the need for oracles and third-party institutions while providing nearly instant payments.

Individual users can purchase the desired parametric protection through Risk Harbor. Underwriters use predefined parameters to create risk management pools, and buyers choose the pool they want to invest in. They prepay the total premium and proportionally add the amount to the corresponding underwriter’s pool.

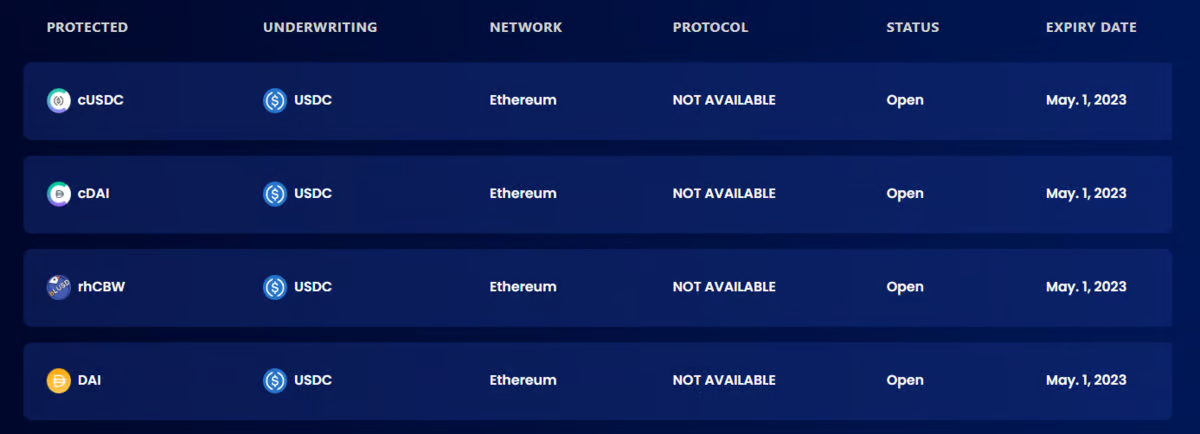

4.Spectrum Protocol

Spectrum Protocol is a decentralized yield optimization platform that enables users to compound their earnings on their liquidity mining.

Spectrum Protocol automatically maximizes the returns of various liquidity pools and other yield products in the Terra ecosystem by using smart contracts to protect and manage various investment strategies.

The primary product of Spectrum Protocol is Vaults, where users can provide liquidity or stake their crypto tokens (SPEC, MIR, ANC, mAssets, etc.). Users can choose an auto-compounding investment strategy where Vaults automatically increase the number of tokens deposited by compounding rewards back into the LP initially deposited, or an auto-staking strategy where Vaults automatically stake rewards into the corresponding governance equity to further increase rewards.

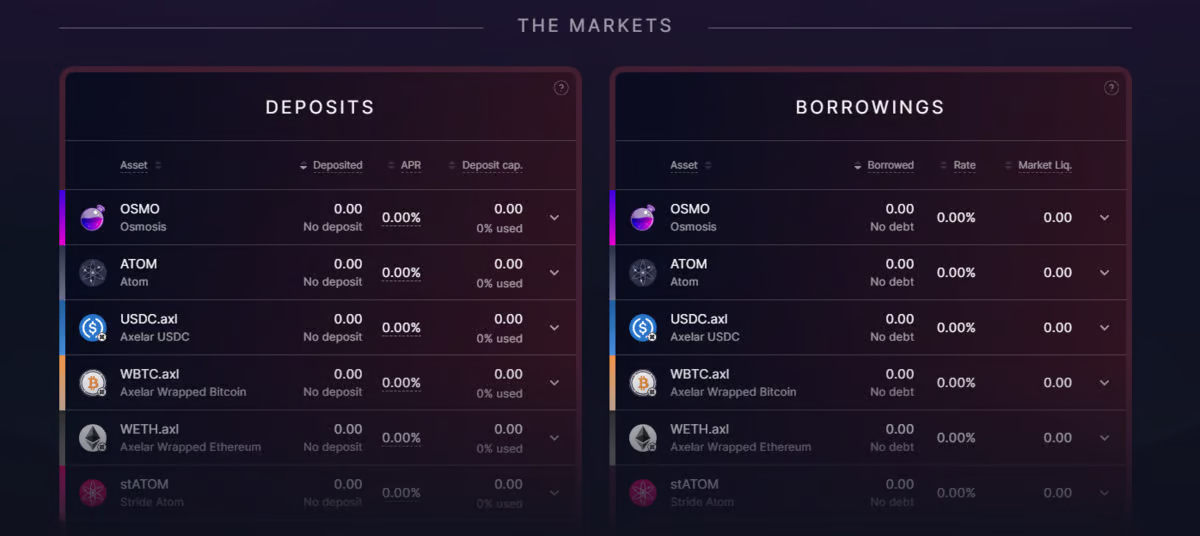

5.Mars Protocol

The collapse of Terra Luna caused the cryptocurrency market to lose $60 billion. Platforms like Mars Protocol resurface, while others like Pylon Protocol gradually disappear.

Mars is one of Terra Luna’s main borrowers. Mars Protocol’s new plan includes launching an independent Cosmos application chain on January 31. Its new features will make it easier for blockchains from other Cosmos ecosystems to borrow and lend.

Partnership

There are many partnerships in the past and present of this project. From a purely research perspective, these partnerships have strategic value. Allina Health, The McKnight Foundation, AmeriCorps, Omaha Public Schools, and Washington Nationals are just a few examples. The project has over 300,000 Twitter followers and a strong social media influence.

As the total size of DeFi grows, the utility of DeFi stablecoins will increase. The overall utilization of LUNA is good, which keeps them stable.

Additionally, Terra focuses on decentralized finance and needs greater user adoption to pose a real challenge to dominant blockchains.

Alliance: Leveraging the Power of Incentive Coordination

After overwhelming voting in favor of proposal 4717, the LUNAtic community has successfully integrated the Alliance module into the Terra mainnet, opening up a range of possibilities for growth and cross-chain collaboration.

Alliance represents a paradigm shift in the extension of decentralized economies.

It is worth noting that chains such as Migaloo and Kujira have decided to integrate it.

The ability to achieve large-scale coordination among different participants through economic incentives is an exciting feature that emerged in the transition from Web2 to Web3. Alliance is an open-source Cosmos SDK module that strengthens and extends their ecosystem by allowing blockchains to coordinate incentives with adjacent chains, developers, and users.

The core goal of Alliance is to guide the monetary policy of decentralized economies (i.e., staking rewards) to the desired target as an economic tool. This function is achieved by allowing users to stake multiple tokens on a single chain to receive a portion of the native staking rewards, which was previously not possible in Web3.

Alliance is a tool that can dynamically adapt to changes in ecosystem demand. It can convert any token into Alliance assets and adjust their reward weight and yield through chain governance. Both users and decentralized economies can use Alliance to:

- Diversify and increase staking rewards — By increasing rewards to above 0%, new, low-liquidity chains can supplement their native staking rewards with unrelated, less volatile, and more liquid Alliance assets. Larger, more mature chains can diversify their native staking rewards by including external tokens as Alliance assets and setting rewards rates above 0%. Users can diversify and increase their rewards by staking on one chain, bridging their LSD to another chain, and staking there, earning a second reward in the form of the native token of that chain.

- Attract users, liquidity, and developers — By allocating lower rewards rates to Alliance assets, chains of any size can attract new users and liquidity from within their ecosystem to bridge and stake. Staking produces a positive feedback loop: higher usage leads to higher liquidity, which in turn encourages more developers to create dApps, further increasing usage and liquidity, and so on.

- Incentivize application developers — Alliance can provide L1 staking rewards to app token stakers within the ecosystem, allowing users of the most promising applications to earn rewards directly from L1 fees and inflation. The community can also use Alliance to fund the development of critical ecosystem applications (such as DEXs, money markets, NFT markets, etc.) or new DeFi primitives.

- Deepen liquidity for underlying token pairs — Chains can increase liquidity for necessary token pairs by including LP tokens as Alliance assets and designating reward weights greater than 0%.

Conclusion

Given the collapse of its UST stablecoin, the future of LUNA 2.0 is uncertain. Previously, LUNA was the home of some very popular DeFi projects, but now it is rarely mentioned.

With massive departures of investors, developers, and community members, Terra’s new blockchain is struggling to gain enough market share, many of whom were severely impacted by the collapse of the original Terra ecosystem in May of last year.

Even if the new blockchain does not include algorithmic stablecoins and will not lead to its collapse like the unlocking of the old ecosystem, trust in the Terra project seems irreversibly damaged, with many predicting that LUNA will eventually fall to zero. However, the future often cannot be predicted entirely based on past events. Whether Terra LUNA 2.0 can succeed depends on whether the new chain performs well enough to regain investor trust.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- EN: Binance has requested “Binance Nigeria Limited” to cease operations.

- Hayden Adams: Looking back at the history of Uniswap, there have been many unsettling moments.

- What are the principles and changes in Uniswap v4, an important piece of DeFi puzzle?

- Will the current chairman of the US SEC be replaced soon? Apparently, he has a close relationship with this woman.

- Waterdrip Capital: Exploring NFTFi Leasing for New Breakthroughs in NFT Liquidity

- DeFi protocol Concordia raises $4 million in funding, co-led by Tribe Capital and Kraken Ventures

- Tether responds to FUD rumors: no intention to engage in time-consuming and fruitless US litigation