Sei Network: The fastest Layer1 public chain on Cosmos designed for trading?

Sei Network: The fastest Cosmos Layer1 for trading?Author: Daniel Li

The SEC’s lawsuit against Binance has been the biggest event in the crypto industry over the past month. As a result of this event, the prices of the vast majority of crypto assets have been cut in half over the past few weeks, and the crypto market, which had just entered a small spring, has once again been plunged into the gloom of a bear market. This event has also caused crypto users to begin to lose trust in centralized exchanges (CEXs), further strengthening the need for the development of decentralized exchanges (DEXs). Sei Network, a Layer 1 public chain built using Cosmos SDK, aims to become the preferred chain for DEXs in DeFi, NFT, and GameFi. Sei’s built-in order book infrastructure, ultra-fast execution speed, deep liquidity, and fully decentralized matching service provide DEXs with a more secure, transparent, efficient, and trustworthy network, as well as new opportunities for innovation and development in the crypto market.

Sei is built for trading and aims to be the fastest layer1 public chain

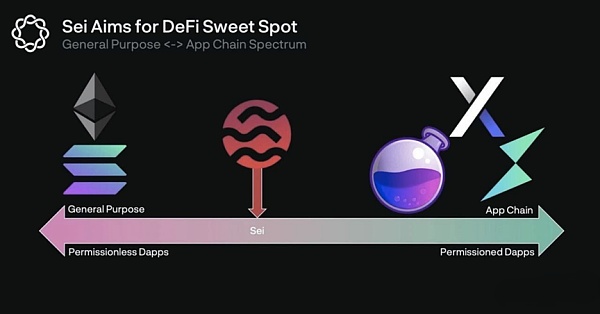

Traditional Layer 1 public chains can be roughly divided into two categories: general-purpose chains such as Ethereum and Solana, and chains specific to applications, such as dYdX and Osmosis. These public chains have their unique advantages and characteristics in technology implementation, but there are certain limitations in terms of transaction scalability.

- Encrypted Twitter’s FOMO trap and the quiet arrival of ROMO art

- Final Battle between DEX and CEX? Uniswap V4 Remakes Liquidity Growth Flywheel

- Summary of the 111th Ethereum Core Developer Consensus Meeting: Deneb Upgrade, Aggregation Deadline, Increased Maximum Effective Validator Balance…

Sei, as a new Layer 1 public chain, does not choose sides between general-purpose chains and chains specific to applications. Instead, Sei has found a middle ground between the two, becoming a public chain built specifically for trading. Compared to general-purpose chains, Sei has optimized every aspect of its technology stack to provide the best trading infrastructure. Compared to chains specific to applications, Sei is a relatively general-purpose public chain that can support various trading applications, rather than targeting a specific application. This makes Sei a more flexible and customizable trading infrastructure that can meet the needs of different types of trading applications.

As a public chain focused on trading, Sei aims to solve the scalability problems faced by current on-chain exchanges and become the fastest Layer 1 public chain. To achieve this, Sei has implemented several important improvements to its underlying network architecture, including the Twin Turbo consensus mechanism, which achieves industry-leading performance levels. The success of Sei’s technology largely comes from the Twin Turbo consensus, which can help Sei achieve a lower limit of 300 milliseconds for final confirmation time, 10 times faster than Solana. In addition, Sei has implemented a composable architecture for its order matching module, which means that dApps on Sei have synchronous composability. Through Sei’s numerous bridging partners, the IBC, EVM, and SVM ecosystems will all have asynchronous composability, allowing seamless connections and interoperability between different blockchain ecosystems, and developers can choose the technology stack that best suits their needs.

Sei has also increased throughput by 5-10x using market-based parallelization techniques and supports batch processing of orders, simplifying the process of updating multiple orders across different exchanges. These are innovative features Sei has implemented in optimizing trading application performance. Additionally, Sei’s liquidity center and its underlying technology are highly advantageous for running various dApps. Sei’s liquidity management system can help DeFi, GameFi, and NFT applications provide users with a deeper liquidity system and cost-effective trading processes while taking advantage of Sei blockchain’s agility and efficiency.

Trading is the most basic application scenario and use case of blockchain technology, as well as an important driving force for the development of blockchain and Web3. By creating a specialized trading public chain, Sei provides an attractive product for developers who want to build applications on the general Layer 1. Sei’s appearance fills the gap in the current trading-exclusive public chain, bringing new opportunities and challenges to the development of blockchain technology and Web3, and providing more possibilities for the circulation and trading of digital assets.

Sei’s technological advantages are disrupting the traditional DEX network environment

With the rapid development of Web3, exchanges, as centers of asset trading, are becoming increasingly important. Currently, exchanges are mainly divided into centralized and decentralized exchanges. In the past, centralized exchanges have always dominated. However, with the leading centralized exchange Binance being prosecuted by regulatory agencies, higher regulatory pressures on centralized exchanges will push the market towards decentralized exchanges. This requires DEX to expand and adapt to the huge adoption wave.

Given that DEX has unique requirements for speed, throughput, reliability, and front-running, specialized infrastructure needs to be built to address these issues. Sei was born for this purpose. It provides a solution to the scalability problem of DEX and enables exchange applications to scale effectively while maintaining decentralization and capital efficiency. Sei’s technological advantages mainly include the following aspects:

Order Matching Engine

Sei is a Layer 1 public chain based on the Cosmos ecosystem. Like Ethereum, Sei also allows users to transfer assets and deploy smart contracts. However, Sei’s feature is that it also creates an order submission and matching engine at the chain level. This order matching engine is one of Sei’s core features because it allows anyone who wants to build an exchange to easily use this engine to create an order book-based exchange. This means that builders can skip the step of building an order book from scratch, making it more efficient in terms of technology and cost.

In addition, Sei’s order matching engine provides a limit order design space similar to conventional centralized exchanges such as Binance and Coinbase. It creates a set of orders at different prices and allows for the update of asset values based on executed orders. The benefits of using an order book exchange are that it can provide higher liquidity and better price discovery mechanisms. Although technically more challenging to launch an order book-based exchange and provide it with liquidity than an AMM DEX, Sei aims to provide a cost-effective system for developers and users building decentralized applications on the network. This way, they can build order book-based exchanges more efficiently without sacrificing security and reliability.

Parallel Order Execution

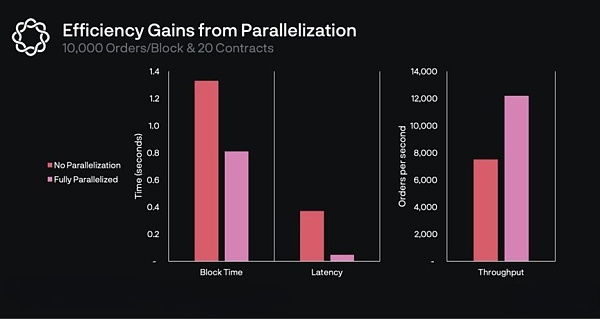

Sei’s parallel order execution is a significant improvement. It can process orders in the same market sequentially and orders from different markets simultaneously. This approach significantly improves Sei’s throughput while ensuring deterministic behavior among validators. In traditional blockchains, order processing order matters, meaning that each order must be processed in the exact order received, regardless of the asset or market it interacts with. Sei’s approach is different, allowing orders from independent markets to be processed simultaneously, resulting in faster block times, lower latency, and higher throughput for Sei at all load levels. This marginal improvement is particularly significant under high loads.

According to Sei’s internal testing data, in the case of 10,000 orders/block and 20 different contracts (markets), parallelism can reduce block time from 1.33 seconds to 0.81 seconds, latency from 371 milliseconds to 48 milliseconds, and throughput from 7,500 orders/second to 12,200 orders/second. As the load increases, the marginal optimization becomes more significant.

Twin-Turbo Consensus Mechanism

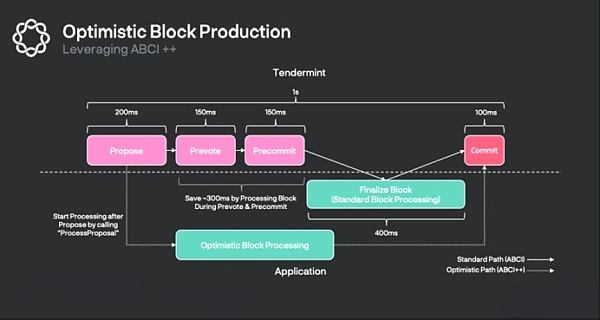

Sei’s Twin-Turbo consensus mechanism optimizes and upgrades ABCI of Cosmos, enabling every step of the consensus to be programmable. This consensus mechanism consists of two parts: intelligent block propagation and optimistic block processing.

Intelligent block propagation aims to improve block processing speed and efficiency. On the Sei Network, block proposers can send compressed block proposals that only contain transaction hashes rather than detailed block contents. During the block broadcast phase, if a validator has all the transactions in the proposal in its local mempool, it will rebuild the entire block from its mempool, without waiting for all block parts to arrive. This process significantly reduces the total time validators wait to receive blocks. If a validator’s mempool does not contain any transactions, it can simply fall back to waiting for the uncompressed detailed proposal. According to Sei’s testing, in over 99.9% of cases, each validator already has the transactions in its local mempool due to the gossip mechanism of the network. Therefore, this intelligent block propagation method can greatly increase Sei’s throughput while still ensuring the validity of transactions.

Optimistic rollup is a blockchain validation method that enables faster and more efficient validation processes. Unlike traditional non-optimistic blockchains, optimistic rollup skips the pre-vote and pre-commit phases, allowing validators to directly call the block finality function, thereby speeding up block validation and voting. On Sei Network, validators can also optimistically process the first block proposal they receive at any height by initiating a parallel processing process and writing state candidates to the cache. This greatly reduces the waiting time caused by delays in block production, thereby improving Sei’s throughput.

Through the Twin-Turbo consensus mechanism, Sei has reduced block confirmation time from 6 seconds on the Cosmos chain to 500 milliseconds, achieving the fastest final block confirmation time in the entire network and processing a throughput of 20,000 transactions per second. This efficient consensus mechanism also makes Sei a high-performance, scalable, and programmable blockchain system, providing faster and more efficient services for DEXs.

In addition to the three main improvements mentioned above, Sei has also added other features at the base layer. These include:

1. Single-block order execution: In Sei, it is allowed to place and execute orders in a single block, while in Serum it takes multiple blocks to complete.

2. Order bundling: Market makers can update the prices of multiple markets in a single trade, thereby increasing efficiency.

3. Frequent batch auctions: Market orders can be aggregated at the end of a block and settled at a single price. This approach is intended to attempt and minimize frontrunning.

4. Native price oracle: A native price oracle is integrated into Sei’s base layer to ensure reliable price information from on-chain markets.

The introduction of these features can further improve Sei’s efficiency and scalability, making it a more comprehensive blockchain network that provides better services for DEXs.

Sei Network’s Ecological Development

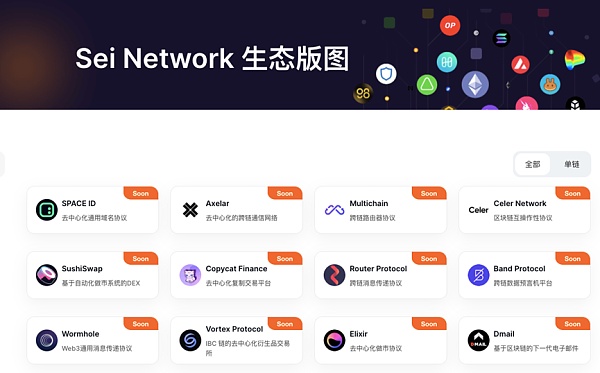

Ecological layout has always been a key focus of Sei’s development, especially after entering 2023. In January and April, Sei received two ecological investment funds. These include MEXC’s $20 million cryptocurrency ecological fund and Foresight Ventures and Bitget’s $50 million cryptocurrency ecological fund, as well as the $50 million investment from many investment institutions and market makers such as Multicoin Capital, DelphiDigital, and Hypersphere in September last year. As of now, the total size of Sei’s ecological fund has skyrocketed to $120 million.

These ecological investment funds provide Sei with more resources and support, helping Sei further expand its influence and market share in the blockchain field. The participation of numerous institutions also reflects the generally optimistic outlook for the exclusive trading public chain created by Sei.

Although Sei’s mainnet has not yet been launched, its ecosystem has already attracted many well-known projects. As of now, more than 150 teams have developed projects on the Sei Network, covering multiple areas including infrastructure, DEX, MEV, cross-chain, NFT, and mortgage lending. According to the latest financing report, there are already 120 cooperative projects in the Sei Network ecosystem. Currently, the official website discloses about 70 cooperative projects, focusing on decentralized exchanges, infrastructure, wallets, and cross-chain bridges. The addition of these cooperative projects injects new vitality and momentum into the construction and development of the Sei ecosystem, while also providing users with more choices and services.

Sei Network’s key projects

Decentralized Exchange (DEX):

-

Sushiswap: An AMM-based DEX that launched a decentralized perpetual futures exchange on Sei Network in January 2023.

-

Satori: A chain-based evolutionary product protocol built on Polkadot that provides evolutionary product protocols on Sei Network.

Infrastructure:

-

White Whale: A cross-chain liquidity protocol that provides tools for efficient markets through arbitrage, flash loans, and cross-chain liquidity pools, and will conduct airdrop activities on Sei Network to reward validators and token holders.

-

Kado: Supports basic settings and allows Sei users to use their non-custodial wallet transfer rules and digital assets.

Wallet:

-

Keplr: A wallet for cross-blockchain ecosystems that supports Sei Network’s tokens and applications.

-

Cosmoscan: A verification node operator and wallet provider that provides a block browser for Sei Network.

Cross-Chain Bridge:

-

Gravity Bridge: a cross-chain bridge that supports the transfer of assets and messages between Cosmos and Ethereum, providing an open access point for DeFi projects in the Sei Network ecosystem.

-

Axelar: provides various services, including multi-chain liquidity pools, to bring cross-chain liquidity into Cosmos, making it easier for Sei to acquire liquidity outside of the Cosmos.

Summary

Sei Network is known as the decentralized Nasdaq and aims to build a blockchain that focuses on DeFi infrastructure. To achieve this goal, Sei has introduced multiple technological applications to improve the trading experience, including modular order matching, Twin-Turbo consensus, and parallel order execution and on-chain price oracle, among other foundational layer functions. By combining these protocols, systems, and algorithms, Sei provides the best infrastructure for trading applications and exchanges. In the fast-paced world of trading and innovative technology, speed, scalability, and affordability are crucial factors. As a high-performance, general-purpose Layer1 public chain, Sei has become the preferred solution for traders, developers, and gaming communities alike.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is “The Empress’s Seal” infringing on copyright? The issue is not that simple.

- Vitalik Buterin proposes that Ethereum will fail without L2. What new opportunities can the Cancun upgrade bring to L2?

- What are Stacks? What challenges might the BTC Layer 2 network Stacks face?

- What are Intents? What are their use cases? What possibilities exist for the future?

- Founder of Synthetix: Evolution of SNX Staking and Future Development?

- How is Terra’s ecological disaster reconstruction? Learn about the development status of LUNA 2.0 in this article.

- Stablecoin Dashboard: Classifies nine stablecoins based on volatility risk