Review of the plate rotation in the first half of 2019: IEO ignited the first fire, mode coin madness

At the beginning of this year, the bear market was enveloped by investors in each block. The overall market value of cryptocurrencies shrank to a level of 100 billion US dollars. Most investors chose to lose money and leave the market. The entire industry has entered the "Ice Age" of the currency version. At the most desperate time of everyone, IEO brought a glimmer of hope to the entire industry, but also brought fresh traffic and capital to the industry. ▎ IEO ignited the first fire ▎ halved the expected relay IEO ▎ crazy mode coin ▎ Facebook Libra triggered cryptocurrency regulation ▎ anonymous coin mines return to focus again

The first fire that IEO ignited

IEO may have been heard by everyone, the full name is Initial Exchange Offering , which means the first exchange is publicly released . In January 2019, Binance restarted Launchpad. The first project to be launched was BitTorrent, which was acquired by Sun Yuchen. The scene was very hot and the crowdfunding was completed in just 14 minutes. Since then, major exchanges have followed suit, from Huobi's Prime to OKex's Jumpastart, IEO has become the enthusiasm for capital.

- The plunging is very flustered, does the Bitcoin hedging property really disappear?

- Market analysis on August 15th: the market is on the left, the decision is right again

- Opinion: Is the long tail market the future of DEX?

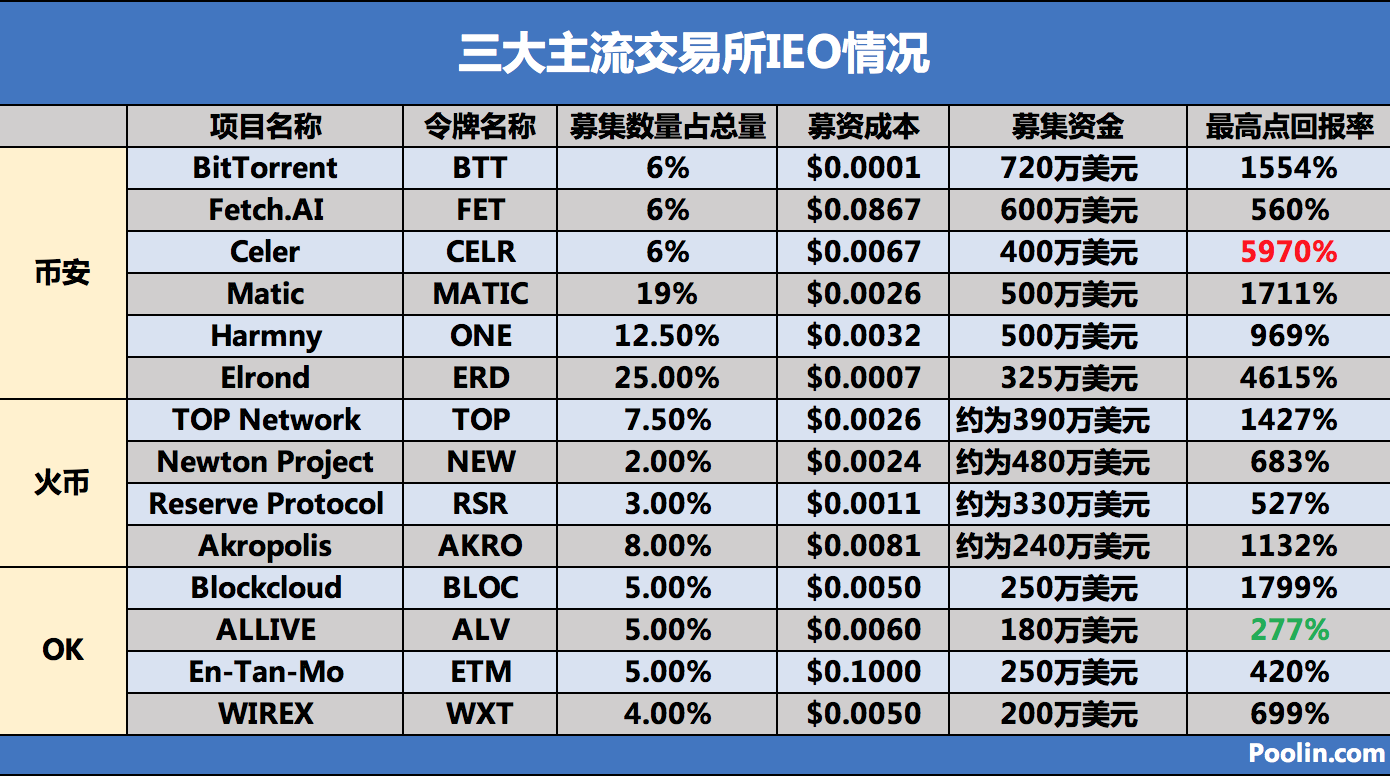

Through the IEO data of the three major exchanges, it can be seen that since the opening of the IEO in February, the three major exchanges have launched a total of 15 IEO projects, the total amount of funds raised is less than 10 million US dollars, the total raised funds are about 50 million US dollars, worth 350 million yuan. Among them, Binance's Celer has the highest return rate of 5970%, OKex's ALLIVE is relatively low, and the highest point return rate is 277%.

Unlike Huobi Pro and OKex's conservative cautiousness, Binance has absolute confidence in the assets issued by Launchpad. By counting the supply of tokens raised by IEO, Huobi Pro and OKex are between 4% and 8%. Binance is 6%-25%, and there is a gradual increase. The higher the proportion of the amount of tokens raised, the greater the impact on the price of the project after the launch.

In general, as long as the three major exchanges grab the IEO project, the logic of selling according to the online line will not lose money, but for most of the time, the project is in a down state, and the late entry funds are weak. The large amount of capital is limited to the early stage, and the long-term income situation is not clear, of course, it depends on the quality of the project itself and the team.

LTC halved the expected relay IEO

The LTC halving in the market is expected to quickly ignite the IEO's residual temperature, and all kinds of slogans will resound in the major communities of the currency circle. "Bit Gold, Wright Silver" has become the belief of everyone in the community.

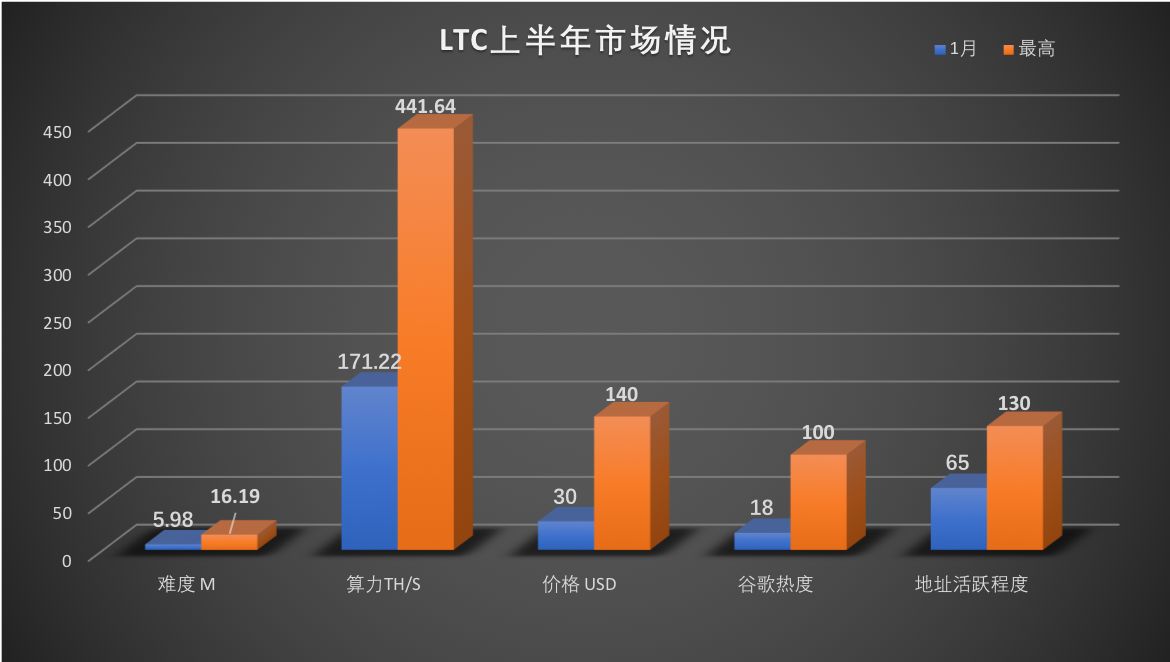

From the data level, the overall LTC difficulty is 270% at the beginning of the year, and the computing power has increased by 257%, which is equivalent to an average of 90,000 L3+ deployed in the mine every month. The number of active addresses is twice that of the beginning of the year. More, overall, the situation on the chain has been greatly improved compared to the beginning of the year. The price of LTC has basically continued the last half of the increase, 4.6 times the beginning of the year, and nearly 5 times in the trend of Google search. . This part is also attributed to the overall upward trend of the market, and on the other hand, the investment choices made by everyone to reduce the expectation.

At present, LTC has been halved, but the price performance is not satisfactory. According to the trend of previous years, when LTC is reduced to a later period, LTC will make a good adjustment for its value. After the halving of this LTC, a large number of mining machines were shut down due to the decrease in revenue, and the calculation power fluctuated in a short period of time. The total network computing power dropped from 450T to 400T, a decrease of 11%. At the same time, the difficulty in the next difficulty cycle dropped by 4.37%, which is much higher than most people expected.

Crazy model currency

This model currency is mainly divided into two types, one is “resonance” and the other is “fission”. They attract a lot of speculation through a series of schemes such as dividends, locks, new rebates, and airdrops. By.

However, most of the chips in this project have been controlled by the bookmakers, and it is easy to control the market's rise and fall. Such projects are basically worthless. When the time is ripe, the dealer will harvest most of the retail investors in the market. The high returns that most participants want are not even recoverable in the end.

Facebook Libra triggers cryptocurrency regulation

In the first half of the heavy event, Facebook's Libra white paper is undoubtedly one. This is the first cryptocurrency project jointly led by the global Internet, finance, telecommunications and other multi-domain giants. Libra's mission is to create a simple, borderless currency and financial infrastructure that serves billions of people. As the most-owned Facebook on the global social networking site, its products have no unified solution for payment and purchase of products because of the users involved in various countries. This is the original intention of establishing Libra. Libra and the US Congress recently held a much-anticipated hearing on some cryptocurrency issues. If Libra can successfully pass the government and agency review, it is a matter of celebration for the industry, which is to apply the payment of cryptocurrency. Get it in front of the stage and get supervision. But contrary to expectations, the US Congress has not responded well to Libra's hearings. The main reason is the issue of national currency exchange and anti-fraud anti-money laundering, because it involves policies of most countries. The USDT can play this role long before Libra was released. The current stable currency market has been regarded as a hundred schools of thought, most of which have passed regulatory review, such as GUSD, TUSD and so on. However, the current stable currency market is still dominated by USDT, which accounts for the vast majority of liquidity, and USDT reduces its risk in a single network by issuing currency on different platforms.

Anonymous coin mine returns to focus again

In the first half of the year, with the launch of Facebook Libra, cryptocurrency once again appeared in the public's field of vision, and governments in other countries are also suffering from the regulatory issue of cryptocurrency. In the face of this "hard thorn" in the financial system, they have come up with different ways to deal with it. For example, like India, it has adopted a one-size-fits-all policy to put an end to all domestic cryptocurrency-related activities because the country’s domestic economy The regulation is weak, and there is no strong resilience in the face of such impactful financial products. For example, in some developed countries in Europe and Asia, the policy is relatively loose, which is also based on its relatively stable financial system, and it is difficult for cryptocurrency to move its roots. Despite this, the regulation of cryptocurrencies in various countries has been put on the agenda, and various proposals from overseas CRS to anti-money laundering are restricting cryptocurrencies.

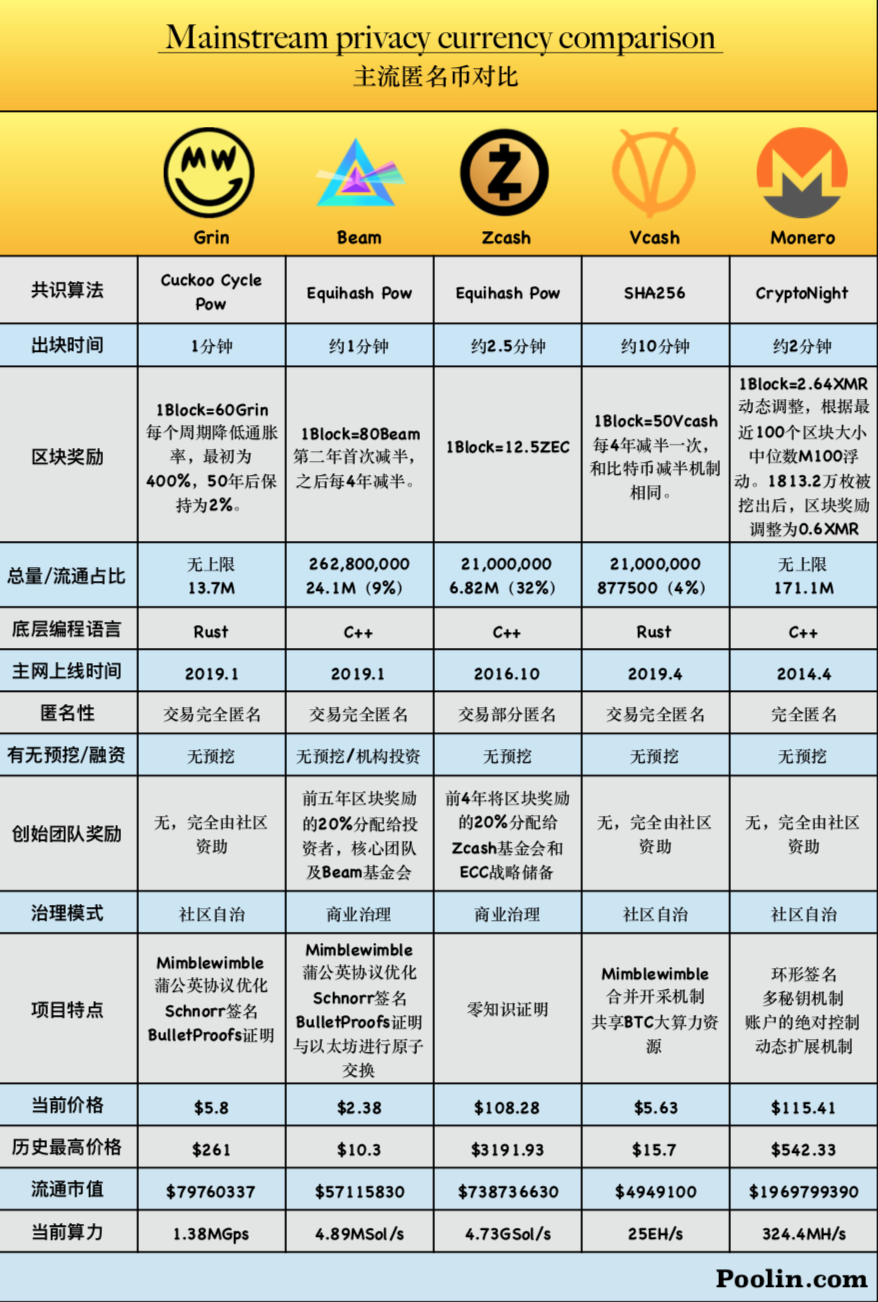

In such an environment, the anonymity in the cryptocurrency is particularly important, and the anonymous currency has become popular again. After the old anonymous coins ZEC, XMR, and DASH, new members like Beam, Grin, and VCash have emerged, not only emerging. The project attaches great importance to anonymity. On some long-term projects, the development of anonymity is also put on the agenda. For example, LTC hopes to add other anonymous measures such as confidential transactions in the development of the second half to further improve its functions.

At the same time as the anonymous storm, a large number of PoW mineral projects have followed. While focusing on anonymity, the security and stability of the network is particularly important, which is why most anonymous coins adopt the PoW consensus mechanism. In the wave of last year, the PoS mechanism was taken up by everyone, but in the end, look at the poor residual market value of these projects, the institutions that have been hyped up, and the remaining leeks. The cost of developing a PoS mechanism project is quite low. It only needs basic server operation and maintenance to support it. The PoW-based project needs to study the rationality of the consensus mechanism and choose the route of ASIC or GPU and CPU mining. Considering the economic model design of the project, but also paying attention to the fairness of the participants, which leads to a new level of design complexity.

In the first half of 2019, both IEO and Anonymous coins injected fresh blood into the industry. This is like the life cycle of a health industry. After going through a low valley, it must be the peak.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- When bitcoin "rules" the cryptocurrency market, will everything get better?

- Bitcoin bottomed out, and the bottom-up funds appeared. Where will the market go?

- QKL123 market analysis | Bitcoin fell below 10,000 US dollars, is it really bad? (0815)

- Limited offer, up to 10,000 yuan, the second world blockchain conference · Wuzhen opened early bird ticketing

- Comparative Analysis of Internet Bubble and Encrypted Asset Bubble

- Ponzi Research Series: Analysis of Ponzi scheme from the model of Bell Chain

- Say good and dollar 1:1 anchor? This stable currency is priced at $34 in a short period of time.