The king of the public chain was surrounded by the chain, can the Ethereum return to the king?

As one of the earliest public chains, Ethereum (ETH) was once known as the "King of the Public Chain".

After the ICO (first coin issue) frenzy retreat, the project side began to sell ETH, which also caused ETH prices to plung 80% from historical highs (more than $1400). In the early round of the morning crash, Ethereum fell below the pressure of 200 US dollars, and then broke the 190 US dollar mark, hovering at 188 US dollars.

After the admission of many new leeks, they became the pick-up man, and the Ethereum was the sickle of cutting the leeks. Even the bull market that started in April this year did not drive a sharp rebound in Ethereum prices. Looking at the K-line of the Ethereum, the barley of the bargaining ones would like to ask: Is there any rescue in the Ethereum?

In addition to the unsatisfactory price of the currency, Ethereum has been criticized on issues such as technology and community governance, and many developers have turned to the new public chain for development.

- "Reverse refers to the king" Goldman Sachs milk was once again fulfilled, counting those "goos"

- Twitter Featured | Gold vs Bitcoin big debate, betting on the best assets in the next 10 years

- 2.8% bitcoin wallet address control 95% supply? The five reasons tell you that this conclusion is right.

Someone left, and some insisted. Some developers believe that Ethereum is still the best public chain, whether it is user base or infrastructure.

“Thanks to the destruction of ICO, many people think that Ethereum can only be used for financing.” Developers said that the destruction of ICO is an opportunity for Ethereum to turn from reality.

Today, developers and investors alike are hoping for ETH 2.0.

Is there any future in Ethereum? Can ETH 2.0 become an opportunity for Ethereum to regenerate?

Project party sells, leek stud

Project party sells, leek stud

"I have studed ETH, and as a result, it has been squatting and can't go up." The retailer Bai Sheng has some helplessness. "Then she lost some money and all of them changed to Bitcoin. I dare not take ETH again."

After the year, the cryptocurrency ushered in a recovery, Bitcoin repeatedly hit the hot search, attracting a large number of investors, Bai Sheng is one of them.

At that time, Bitcoin stood out, but Bai Sheng, who was the new leek, chose Ethereum as his investment target and got on the train for $300.

“The teacher in the group said that Ethereum used to be the mainstream currency after Bitcoin, and did not rise up, and had the opportunity to make up, so I bought Ethereum.” Bai Sheng explained.

However, there is always a gap between reality and ideals. After the Ethereum hit a maximum of 360 US dollars, it began to fall, and did not welcome the increase.

From the trend of Ethereum this year, it is obviously weaker than the trend of Bitcoin: Bitcoin’s highest increase is over 270%, and Ethereum’s highest increase is only 170%. As of press time, Bitcoin’s growth rate has remained above 150% this year, and Ethereum This year's increase was less than 40%.

In addition, Ethereum's gains this year are also significantly weaker than other mainstream currencies: EOS (+45%), LTC (+145%), and BCH (+95%).

"There are so many mainstream currencies, but they have chosen the worst. They just got a leek when they entered the market. "The price of Ethereum made Baisheng quite dissatisfied, but he also had a doubt: Why is the price of Ethereum this year? Is the trend so bad?

Encryption analyst Zelda believes that the main reason is the reduction of the use of Ethereum and the sale of Ethereum by the project side, resulting in selling pressure, which makes it difficult to increase prices.

1. Changes in financing channels and reduction in buying

In 2017, the rise of the ICO wave, Ethereum is an important means of fundraising, and the project party only receives ETH when raising funds.

“The reason why only ETH is received is because almost all tokens were issued based on the Ethereum blockchain, and ETH can also act as GAS,” explains an anonymous project party.

At that time, many projects including EOS were funded through ETH. The strong demand for fundraising has prompted the increase in Ethereum's buying, pushing the price of Ethereum to continue to rise, reaching a maximum of more than 1,400 US dollars, and becoming the second-largest cryptocurrency.

Today, the ICO boom has retreated and project funding has stopped accepting ETH. For example, the recently publicly funded project Nervos only accepts the stable currency USDT as a fundraising method.

A project party and Odaily Planet Daily explained: "Now the fundamentals of Ethereum are not optimistic, the price may fall again. If you want to sell (realize), there will be selling pressure, and the fall will be even worse. Simply use stable or legal currency. Fundraising is available."

“ICO is an important use scenario for ETH, ICO is shattered, and the purchase of ETH is reduced,” Zelda explained.

2. The project side sells and forms a selling disk

Since operations, development, etc. require funds, the project side will also choose to sell the ETH in exchange for the legal currency.

A project based on Ethereum told Odaily Planet Daily that its company had sold a total of 30,000 ETHs in batches in May and September last year, emptying the stock tokens in their hands.

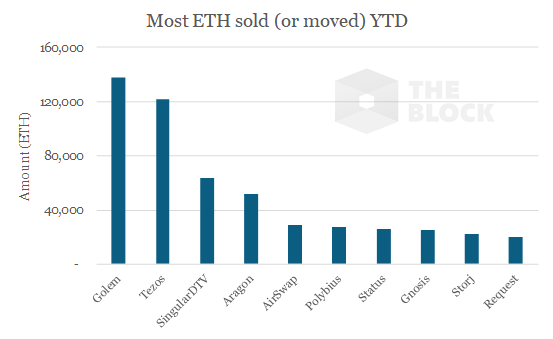

According to The Block, the number of ETHs held by ICO fundraising projects has been steadily declining over the past year.

The data shows that in the past 12 months, 57 token financing projects, each project averaged or transferred 2,500 ETHs per month (approximately $530,000). A total of 8.2 million ETHs were raised in these projects, of which 5.9 million ETHs (72%) have been transferred or liquidated since the financing of the tokens.

A large number of throwing pressure plates not only make it difficult for ETH prices to rise, but also suppress prices to the bottom.

According to Santiment data, the ICO project side concentrated on selling ETH in December last year, with a record sales of 45,000 on December 14. At that time, ETH prices hit a new low of $82 in nearly a year.

"If you want ETH prices to rise, first, there are new hype hotspots that can stimulate buying; second, wait for the selling discs to sell out and eliminate the resistance above," Zelda explained.

Project development, questioning constantly

Project development, questioning constantly

In addition to the poor performance of the price trend, Ethereum has also been questioned by the emerging public chain. The technology bottleneck, the loss of developers, the chaos of governance and the centralization of V God.

Technical bottleneck

As the earliest distributed general-purpose computing platform, the processing speed of Ethereum is now slightly insufficient, that is, TPS (Transaction Per Secound) is not high.

The Etherchain.org data shows that the current TPS of Ethereum is only 8.4 and has been constant around this value. In the past week, the unconfirmed transactions of the Ethereum network have been maintained at more than 30,000.

In contrast, Ethereum's competitors are far ahead: EOS and TRON (wave field) can generally reach more than 50, and sometimes even hundreds.

“The slow speed of TPS does have a big impact,” said Yang Zhen, a translator of the Ethereum Yellow Book. “For example, in the game, you hit each other and you can’t wait 15 seconds for this data to be packaged. It’s definitely not fun. It is."

Congested Ethereum can only increase GAS fees in order to package transactions. Data from coinmetrics.io shows that the current Ethereum GAS fee is $0.04, showing an upward trend. Last year's peak reached $2.1.

2. Developer churn

Since last year, some developers have turned to other public chains, in part because of the TPS mentioned above and the technical bottlenecks that are pending.

But developer Chen Jing told Odaily Planet Daily that developers are turning to other public chains, and the more important reason is the policy support of the public chain.

"Although the user base of some public chains is not as deep as Ethereum. But for us, survival is the first. Where is the support for it, where to go." Chen Jing explained that his public chain will give DAPP The project developers will support the funds from 100,000 to 500,000 yuan and issue their rights to the media.

Previously, Tron gave project developers a $100,000 grant in order to encourage developers to use their blockchain. The wave farmer who was on the fire in Tron last December was affected by this, moving from Ethereum to the wave block blockchain.

In contrast, Ethereum can be said to be more demanding for developers, and no specific incentive policy has been introduced.

“The Ethereum Foundation will also fund some projects, but the support standards are not open, and ordinary developers are hard to obtain, and they can't be hydrolyzed.” Developer Zeng Zhuang wrote to the Ethereum Foundation to seek funding, but Did not get a reply.

3. Governance confusion

Lane Rettig, a core technology member of Ethereum, once said that the governance of Ethereum has failed.

“We are actually technocracy: a small group of technologists (core developers) have the final say on protocol updates.” Lane Rettig explains that Ethereum is now facing more and more non-technical challenges. But no one can stand up and represent Ethereum to make a decision.

“Core developers don’t want to make these decisions because they don’t recognize enough, they are afraid of taking legal risks, or they are used to avoiding conflicts and just like to write code. The Ethereum Foundation will not make decisions because they are afraid, go to good Saying that you are worried about favoring one side, you are afraid to stand on the side (expressing opinions)," Lane Rettig said.

The Odaily Planet Daily observed in the Ethereum core developer community that this is indeed the case. Some technical posts have a generally high response rate; however, there are very few follow-up posts for issues involving rewards and management. This may make it difficult for the development team to gather opinions in the community even if they want to improve governance.

The impact of this kind of anarchism is the community governance of Ethereum, which has always been chaotic. Behind the seemingly decentralization, but lack of forming mechanisms, resulting in inefficiency, is not conducive to project advancement.

The previous hard-fork of Constantinople was scheduled to take place in November 2018 according to the original plan. However, as the community has not reached a consistent opinion, it is postponed until the beginning of this year.

Even so, the system was leaked the day before the official hard fork. Later, the core developers on the issue of bug fixes, repeated research, the project was postponed for another two months, until the beginning of March this year, the fork was successfully completed.

“Ethereum is more like a group of geeks. The two ears don’t know what’s going on in the world, and they only do technology development.” Ethereum researcher Du Siyu said bluntly, “Is it possible to carry out the Istanbul fork this fall? An unknown number. According to the project plan, the Istanbul fork will be carried out on October 16 this year.

4. The centralization of V God

Unlike the "evaporation" of Nakamoto Satoshi, Vitalik Buterin (V God), the soul and core of Ethereum, has always played an active role in the Ethereum community.

In the Ethereum community, in theory everyone can initiate a proposal, but V God's proposal is more likely to be valued.

"The impact is great, because he is the founder, community users including fans, they may be deified, with some personal worship." Yang Zhen explained, "This is human nature, human nature is normal."

V God seems to realize that his influence is too big, from the stage to the behind-the-scenes research.

“He is slowly fading out and reducing the impact on the Ethereum community,” Yang Zhen said. “We can see that he is working on some Papers to explore some directions. He is out of Paper and finally by the community. Vote to decide."

Without V God, how will Ethereum develop? V God does not know the answer, he can only continue to move on now. We don't know, we can only wait for its development.

Sailing, there is still hope

Sailing, there is still hope

Although Ethereum currently faces many problems, some developers and investors still have hope for it.

On the one hand, developers still have nostalgia for the current Ethereum, which is considered to be the best public chain; on the other hand, everyone also has high hopes for ETH2.0. Many investors have also begun to actively raise coins, and they believe that ETH2.0 will become a new round of benefits for Ethereum.

a reluctant developer

“Thanks to the destruction of ICO, many people think that Ethereum can only be financed.” DDEX founder Bowen said that the value of Ethereum before was ICO, and the current value is the miner's computing power and the chain trading scene.

According to Etherchain.org data, since mid-February this year, the number of transactions on the Ethereum chain has continued to rise, with the highest increase of more than 130%, close to the all-time high.

Bowen explained that DAPP increased the usage of the Ethereum network and caused a sharp increase in the number of transactions. “At the same time, the exchanges are not active, indicating that these transactions are really in use. The fastest growing scenario is Defi's scenario (represented by MakerDao), the most basic financial needs of Staking, lending, etc.”

But Bowen also pointed out that the real users of ETH have not grown by orders of magnitude in the past year. “After the Ioto era’s overdraft valuation, it will take some time to restore natural growth.”

For the DDEX development team, Ethereum is also the object they have always loved. “Ethereum is not the best public chain. It is indeed. It has relatively mature developer facilities and total tradable assets.”

Bowen explained that for developers, development support tools like Truffle, Infura, and OpenZeppelin are relatively easy for developers to get started with. In addition, more than $1.5 billion in USDT, $400 million in USDC, $200 million in TUSD, and $80 million in DAI are now based on Ethereum. More assets have been ported to the Ethereum, with different stable currencies to choose from and different chain liquidity, which is unmatched by other new public chains.

Even the previous processing speed problem is not a big problem in his eyes.

"How high does TPS need to be? It depends on his usage scenarios, and many can be solved by chain-linking," Bowen said.

Yang Zhen agrees with this. He believes that some operations can be carried out under the chain without increasing the TPS, and only the results are packaged.

This expansion scheme has also become a layered structure (Layer 2), which separates unnecessary transactions from the lowest-level main chain to the subsidiary structure. The Bitcoin lightning network is also the idea.

To this day, Ethereum is still very attractive to developers, as can be seen from the data: Ethereum has 40 times more developers than competitors; ETH DAPP is twice as many as EOS and TRON .

2. ETH 2.0 brings new hope

"The current crisis facing Ethereum is also a turning point for rebirth. The opportunity is ETH 2.0." Du Siyu explained.

At the beginning of Ethereum, four stages were set: Frontier, Homestead, Metropolis and Serenity.

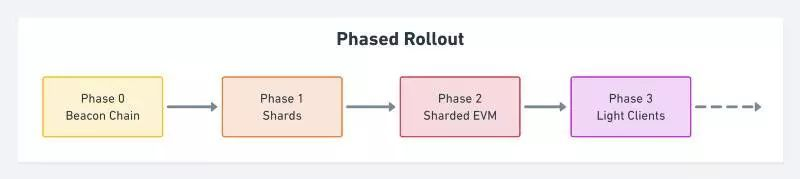

At present, Ethereum is in the metropolitan stage, and tranquility is ETH 2.0. Unlike the ETH 1.X phase, ETH 2.0 will have two major changes: one is the transition from PoW (workload proof) to PoS (the proof of equity); the second is the expansion of Ethereum performance.

Time stamp capital CEO Li Zongcheng said that ETH 2.0 will lead the development of public chain technology from three aspects.

- The first is Plasma, time to be determined. Plasma's main idea is to provide a model that can execute under-chain transactions while relying on the Ethereum backbone to ensure its security. Allowing the creation of a "sub" blockchain attached to the "main" Ethereum blockchain is equivalent to doing a technical exploration on a Layer 2 network.

- The second is Casper, which is expected to be implemented in early 2020 to move from PoW to a more efficient PoS.

- The third is Sharding. The shard roadmap lists seven phases, only phase 0 has a clear specification and is updated regularly. The rigor and accuracy of the Phase 1 specification is much lower. After Phase 1, the roadmap is transformed into a target list, no longer a technical document.

“At present, most public chain projects are innovative in these three directions. Ethereum has more manpower and capital in these three directions than other projects, and has the advantage of manpower and capital.” Li Zongcheng Say.

At the 4th Developer Conference of the Ethereum Community on October 31 last year, founder Vitalik Buterin once said, “The volume of transactions that Ethereum 2.0 can handle is 1000 times higher than the current version, which will make Ethereum become The real world computer."

It is worth noting that ETH 2.0 is not on paper, and there are currently 9 teams working on ETH 2.0 clients. Although core developers have been questioned before, the work is still being implemented.

According to the ETH 2.0 official research team, both the Nimbus client and the Prysm client test network are online. In addition, after a full year of centralized development, the ETH 2.0 beacon chain specification was frozen on June 30, and related research and design has been completed, but the final online time has not been determined.

On the surface, it is now the darkest moment of Ethereum, and the pre-dawn is often the darkest. There are indications that ETH 2.0 may become the next explosion point in Ethereum.

3. Old leeks and coins ETH

“At present, ETH accounts for 50% of all my encrypted assets, and the other half is bitcoin.” Bowen tells us about his asset ratio and is still optimistic about the future price trend of ETH. “Head effect, strong and strong.”

Bowen is by no means the only one who is optimistic about the future trend of ETH. Investor Liu is one of them.

Although not involved in the private placement of ETH, Da Liu is still one of the early investors of ETH. “In the early days, my buying cost was relatively low, only a few tens of dollars. Now there are tens of thousands of ETHs in hand, and some of them are bought at the December low.”

In the view of Da Liu, the future ETH2.0 will be the next hot spot in Ethereum, and the price of the coin will also make a big leap. Therefore, it is necessary to advance the coin.

"What is the next hot spot? I don't know, but I believe that only Ethereum can compete with Bitcoin, and the rest are virtual." Da Liu said.

Li Zongcheng believes that "If the market value of the public chain has exceeded the BTC in the future, then the most likely Ethereum. It can carry more people, can support the public chain of a larger number of transactions, and the market value will be larger."

(Note: Some respondents are pseudonyms.)

Text | Qin Xiaofeng

Produced | Odaily Planet Daily (ID: o-daily)

Original article; unauthorized reprinting is strictly prohibited, and violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BTC fell below the $10,000 mark for the first time in half a month, with a negative correlation signal with gold prices

- US Internal Revenue Service upgrades, sending credits to cryptocurrency users

- The data shows that the positive correlation between Bitcoin and gold is gradually strengthening.

- HOLder – the wife of the blockchain industry

- Opinion | Bitcoin is enough, why do you need other coins?

- Going back to the Wandao mark again, but the market is still not optimistic.

- In less than two years, the market value will be evaporated by $460 billion. How can the self-help of the collective misfiring of the altcoin?