When bitcoin "rules" the cryptocurrency market, will everything get better?

Recently, there have been some voices in the industry that "bitcoin has to dominate the cryptocurrency market." If we use the market value of Bitcoin to account for the weight of the encrypted world in terms of the total market capitalization of the crypto assets, yes, Bitcoin won.

But is this "market power dominance" really a good thing?

As the market value of Bitcoin continues to rise, prices have begun to sing against it. At the time of this writing, CMC data shows that bitcoin prices have fallen below the $10,000 mark, which is about $9956.06, a 24-hour drop of 5.65%.

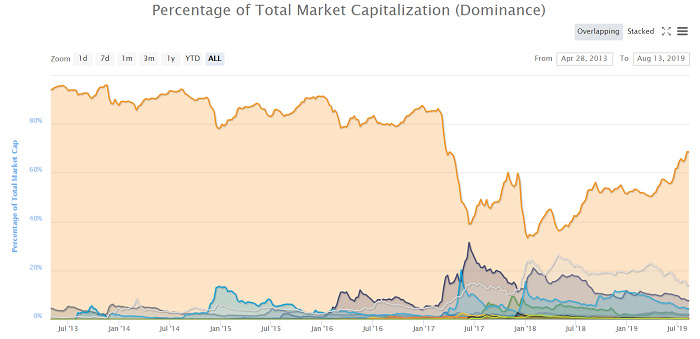

In fact, the market share ratio is indeed a market preference indicator that traders and investors pay close attention to. If we don't consider the “catch period” before the bull market in 2017, you will find that Bitcoin's recent market capitalization ratio has been hovering around 70%, and it has never been the level since April 2017.

- Bitcoin bottomed out, and the bottom-up funds appeared. Where will the market go?

- QKL123 market analysis | Bitcoin fell below 10,000 US dollars, is it really bad? (0815)

- Limited offer, up to 10,000 yuan, the second world blockchain conference · Wuzhen opened early bird ticketing

Above: Bitcoin's total market capitalization ratio in the cryptocurrency market since 2013 (Source: CoinMarketCap.com)

As the market value of Bitcoin continues to rise, some people think that this may indicate that another bull market is coming, and may even push the dominant position of Bitcoin to over 90%. Other alternative encryption assets (such as altcoin) It will become more and more difficult to gain more market share; but others feel that as more and more investors want to get a higher return on investment, they will also prefer to choose more speculative alternative encryption assets. , which in turn prompted the recovery of the altcoin market.

It is undeniable that any market indicator has a variety of different interpretations, but analyzing a single indicator in isolation may not yield accurate results. Therefore, in order to understand what “market dominance” represents, we need to analyze it more deeply. Maybe for Bitcoin and the entire cryptocurrency market, the rise in this indicator is not good news.

First, do you know that everyone knows that Bitcoin is the leader in the cryptocurrency market? Of course not, so this may be one reason why Bitcoin market capitalization ratio indicators are still being watched.

In fact, Bitcoin market capitalization ratio is a relative measure that reflects market preferences, market beliefs, and market trends.

Price is usually an indicator that directly reflects the popularity of Bitcoin, while the “dominant” indicator is used to assess the popularity of Bitcoin relative to other crypto assets. In theory, this could mean “quality leap” because investors are affected by market risks and convert some of the less secure assets into “safer” assets. In addition, this indicator may also represent a growing interest in the entire encryption industry, and believe that Bitcoin has the most powerful fundamentals.

Either way, from an investor's perspective, Bitcoin is the most attractive of all crypto assets. (It is important to note that as prices fall, market dominance may increase, and as prices rise, dominance may also decline – this is a relative rather than an absolute indicator.)

The market capitalization ratio also reflects people's market sentiment. Because of the relative liquidity, history and network size, people often think that Bitcoin's speculativeness is relatively small, and its growing market dominance also reflects the fundamentals. Relatively "safe."

Although not necessarily predictive, emotional indicators are often recursive—you can't be sure if the trend will continue, let alone have energy, but positive emotions usually have inherent inertia. If the trader chooses to buy based on certain market indicators, then the relevant indicators will increase, and then stimulate more traders to buy according to their trend, forming a cycle.

At present, there are not many institutional investors entering the cryptocurrency market. The role of Bitcoin's protagonist may increase the confidence of traditional investors in the whole industry, and enhancing their reputation may make it easier for institutional investors to make entry decisions. In general, large traditional funds do not pay special attention to the relative advantages of one token and another, and they are more willing to assess whether investing in a crypto asset can be part of their portfolio diversification.

For most institutional investors, Bitcoin is the only viable option if you want to enter, for four reasons:

1. Bitcoin is the only cryptocurrency option that has sufficient liquidity and is capable of absorbing small and medium-sized funds.

2. Bitcoin is the only cryptocurrency with an active derivatives market;

3. Bitcoin can provide a wider range of admission channels;

4. Bitcoin will not be considered unregistered securities in most jurisdictions.

However, any trend will not last forever.

There is an underestimation at the peak, and the dominance of Bitcoin in the cryptocurrency market is no exception. As investors turn their attention to other new cryptocurrency alternatives, the rising market advantage of Bitcoin may be revised. Some "investors" may find other more attractive opportunities to make a profit. Take the above bull market as an example. At that time, the market value of Bitcoin fell from 85% to 40%.

Of course, this situation is unlikely to happen in the short term, and the market conditions are different this time.

why?

The last bull market was largely driven by the initial coin-issuing (ICO) hype, and many products promised to bring about a disruptive revolution. Many white papers are actually disguised marketing documents, and a large number of retail investors poured into the cryptocurrency market. – At this stage, some people even think that Ethereum will push Bitcoin from the "king" of market leaders.

However, the recent market activity has been more moderate, and there is absolutely no such madness in the 2017 bull market. Not only that, people’s “awakening” in bear markets, legislators and law enforcers are gradually gaining the potential and threat of cryptographic assets, and regulatory scrutiny is becoming more stringent and more stringent for token issuers, sponsors and investors. Standards make the market more calm. Many of the tokens issued in 2017 are now almost gone, and even with new projects, investors have become more cautious.

More importantly, institutional investors may play a more important role in the next round of bull market, because they regard Bitcoin as a representative encryption asset, which may further promote the market dominance of Bitcoin.

Bitcoin is now dominant, so what about?

All trends will eventually become a thing of the past, replaced by more dynamic trends, and Bitcoin is no exception.

Once institutional investment is no longer new or requires deeper liquidity to curb volatility, the market will change. When people start to focus on other assets, they may transfer funds from bitcoin to other neglected alternatives, in either case, the relative weight of other crypto assets will increase.

However, this situation is unlikely to happen soon, because institutional investors have just begun to enter the market, and there is still a long way to go in the future. Although the current volatility and macro uncertainty in the cryptocurrency market will accelerate the entry rate of institutional investors, most institutions tend to be relatively conservative, and they usually wait for the market to show signs of steady growth before they risk their reputation and Reward the risk of admission.

Risk that cannot be ignored

Although the market advantage of the Bitcoin market continues to grow, the possible risks should not be ignored. Bitcoin has become the preferred asset of many crypto investors and will also stifle interest in other crypto assets to some extent – if the encryption market Developing in this way may be detrimental to the entire industry. The main reasons are as follows:

1. Bitcoin will absorb funds from other areas of the market and kill the development of blockchain applications. The potential of blockchain technology far exceeds Bitcoin, which not only allows people to rethink how business models work, but also decentralizes The economy brings more opportunities for capital and income redistribution;

2. Centralization is a sign of the immature asset class. Imagine that in an emerging stock market, a company's market capitalization accounts for 80% of the market value of the entire stock market, which is clearly not a healthy market. Diversified asset classes can make the market more flexible and flexible.

The cryptocurrency market is entering a new phase in which people may be more concerned with market dominance indicators, which may last for a while. (After some analysts pointed out, if the false transaction volume and stable currency are excluded, the adjusted market value of bitcoin may account for up to 90%)

Frankly speaking, it is very difficult for people to shift their attention to Bitcoin now, but there will be a “turning point” in the market and they will eventually pass this “turning point”.

This article comes from Coindesk , the original author: Noelle Acheson

Odaily Planet Daily Translator | Moni

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Comparative Analysis of Internet Bubble and Encrypted Asset Bubble

- Ponzi Research Series: Analysis of Ponzi scheme from the model of Bell Chain

- Say good and dollar 1:1 anchor? This stable currency is priced at $34 in a short period of time.

- Good intentions for Bitcoin to celebrate, BitMEX is therefore a pot

- Preconceived? Tencent, Huawei and other big companies bet 5G and blockchain at the same time

- Bitcoin's risk-averse ability is unquestionable, but it is still young. Analysts say Bitcoin is the standard for all currencies.

- The savior of Ethereum? Enterprise Ethereum Alliance (EEA) main network plan is ready to go