Sei’s Ultimate Marketing Rule The King of Rolls in the Post-Airdrop Era

Sei's Ultimate Marketing Rule in the Post-Airdrop EraAuthor: Xiaofei

Despite the intense competition in the environment of numerous old L1 chains, emerging new L1 chains, multiple L2 solutions, and the bear market’s liquidity game, Sei Network has never lacked traffic.

To be honest, when it comes to technological innovation, ecosystem projects, on-chain data, and financing scale, Sei may not be considered outstanding at present. However, when it comes to “marketing self-heat” and “managing airdrop expectations,” Sei can be said to be commendable. A series of combinations has made the community both love and hate it.

In the past year, how did Sei frequently “make headlines” and how did it once again come to the forefront of the wave and sweep the cryptocurrency community with a belated “sunshine airdrop” when it went live on Binance Launchpool?

- Insights on the future development of Ethereum How to unlock statelessness?

- MEV Track Overview Have we underestimated its importance?

- SEC is expected to give the green light to Ethereum futures ETF expected to be listed as early as October, with a total of 16 applications pending approval.

Controversy and Hype Before Going Live

In August 2022, Sei launched an incentivized testnet and announced that 1% of the total supply of SEI would be used to reward participants in the testnet. At that time, the step-by-step tutorial for interacting with Sei’s testnet was already widespread in the community. Everyone couldn’t help but feel that the interaction steps of the testnet were quite cumbersome. Not only did they require multiple interactions, but after completing the five major tasks, they also needed to fill out multiple forms and go through KYC to claim the rewards. However, the “Lumaomao Studio” adhering to the principle of “the more troublesome, the more it should be done” still actively participated in the interaction.

On May 27, 2023, Sei’s official Twitter account announced that the project’s Discord upgrade had been completed, and users could now obtain the “Verified Seilor” role through Humanode’s face recognition verification. It is reported that “Verified Seilor” is a badge of authenticity for users, proving that they are real people on the Internet.

As soon as this news came out, the community exploded with criticism, accusing Sei of violating the spirit of Web3 by requiring face recognition to claim the airdrop.

However, on June 15, Sei Foundation clarified in a tweet that the claim that “Sei’s testnet incentives or airdrops require face recognition” was a misunderstanding. Participation in Sei’s testnet incentives or airdrops does not require face recognition or KYC. It was only after receiving feedback about a large number of robot attacks on Sei’s Discord that a third-party face recognition tool was added to Discord. Sei will not adopt any form of face recognition or KYC. Sei is an open-source, permissionless Layer 1.

Although there was no actual change in the situation, Sei gained a lot of attention and hype in the discussions on media and social media.

Schrodinger’s Airdrop and the Anxious Community

Afterwards, rumors circulated in the community that Sei would soon go live on Binance. It wasn’t until August 1st that Binance announced that Sei would go live on Binance Launchpool and be listed on August 15th at 20:00 (UTC+8). The token details are as follows: Total token supply: 10,000,000,000 SEI; Initial circulating supply: 1,800,000,000 SEI (18% of the total token supply); Mining total supply: 300,000,000 SEI (3% of the total token supply).

However, what the community is unhappy about is that even though the launch of Launchpool has been made clear, Sei has not announced the airdrop details and quantity, only providing a brief economic model. When community members asked about it, Mod only replied that there is an airdrop plan and official announcements should be followed.

On August 11th, the Sei Foundation stated that the mission of the Sei Foundation is to support the decentralization of the Sei blockchain from the very beginning. The main network includes the Sei airdrop and incentivized testnet rewards. The initial major token distribution aims to identify loyalty and enhance the global impact of the Sei blockchain as the best place to build Web3 applications.

At this time, many people in the community have noticed that in Sei’s official statement, the terms airdrop and testnet incentives have always been separated and seem to be different.

It was not until the night before the launch that Sei finally announced the detailed token economics: 48% of the tokens are allocated to the ecosystem; 20% of the tokens are allocated to the team; 20% of the tokens are allocated to investors; 9% of the tokens are allocated to the foundation; 3% of the tokens are allocated to Launchpool. Among them, the tokens allocated to the ecosystem for mortgage rewards, ecosystem initiatives, and Sei airdrops and incentives account for 48% of the token distribution. Season 1 airdrop will distribute 3% of the SEI token supply as rewards to the community users.

However, the specific rules for the airdrop have not yet been announced.

Cross-chain blind box airdrop ignites the community again

It was not until the day SEI was listed on Binance for trading that the airdrop rules were announced, which surprised everyone and once again ignited discussions within the community.

Sei announced that it will conduct a “cross-chain” airdrop to active users of the six major ecosystems when the LianGuaicific-1 mainnet is launched. The specific rules are as follows: active users on Solana, Ethereum, Arbitrum, Polygon, BNB Chain, Osmosis, and other chains all have the opportunity to be selected for the whitelist for the airdrop. To claim the airdrop, users need to create a Sei wallet and bridge designated assets to the Sei network after the mainnet is launched.

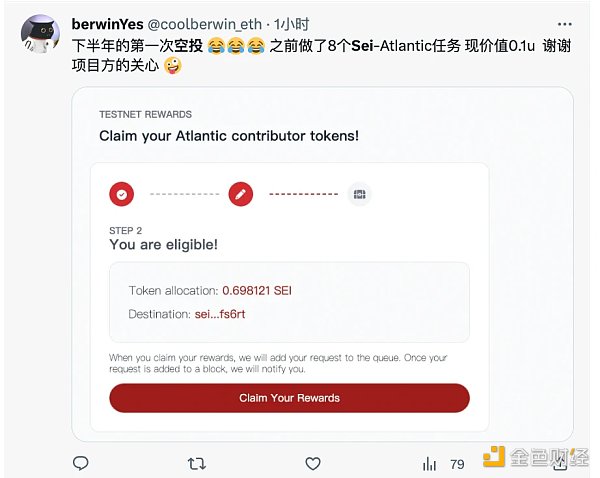

For those who have participated in the Sei Atlantic 2 testnet and/or ambassador program, there are separate reward rules, which are not referred to as “airdrops”.

This seemingly “sunshine” airdrop rule has caused a stir in the community. However, some users have also expressed that this set of rules is similar to Cosmos’ cross-chain operations, similar to the evmos airdrop in the past, but airdrop rules are not commonly seen on public chains, which is not surprising considering that the Sei team itself comes from Cosmos.

Community testing has found that when claiming the SEI airdrop, users can choose to claim from either the “airdrop treasure chest” or the “cross-chain treasure chest”. Choosing the “cross-chain treasure chest” will enable users to bridge at least $500 worth of assets such as ETH or USDC to Sei, and they will receive a certain amount of SEI based on the value of the bridged assets.

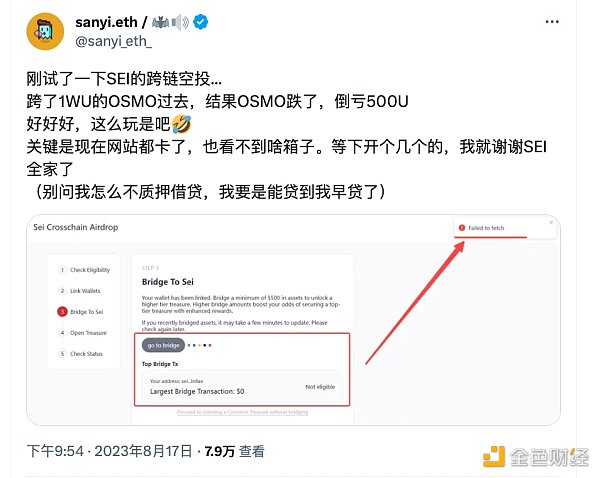

This whitelist for multi-chain active addresses adopts a gameplay of random airdrop quantities, sparking a frenzy of community discussions on how to obtain more airdrops. In the end, it was concluded: Basically, the more the whitelisted addresses participate in cross-chain transactions, the more airdrops they receive. Some people even shared screenshots of receiving over 10,000 SEI tokens, which prompted more people to join in, with many borrowing and lending for cross-chain transactions.

Subsequently, Sei announced that due to high demand, the Sei Foundation would increase the number of eligible wallets for cross-chain airdrops from 500,000 to 1.5 million, allowing more people to participate. Because many people chose the relatively niche Osmosis for cross-chain transactions, and one had to hold more than 500 U to qualify for the airdrop, the price of OSMO briefly spiked.

Of course, except for a few whales, most people only received a small amount of rewards, while Sei’s cross-chain data skyrocketed.

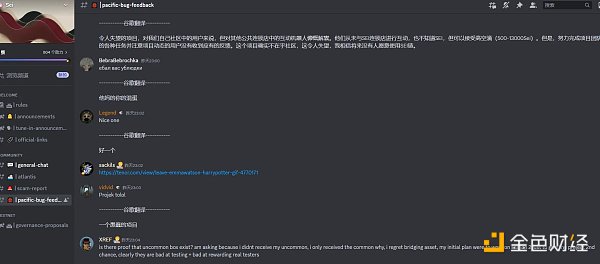

Many people praised Sei for being thoughtful and innovative in their rules, but this also caused dissatisfaction among some people. First, users who had previously completed complex incentive tasks on the testnet felt that their efforts were not valued as much as the whales who easily participated in cross-chain transactions, and they believed that the project team did not value the community. Second, some users complained that they participated in significant cross-chain transactions but received very few rewards. They criticized the blind box mechanism and expressed their dissatisfaction on Discord.

Last night, due to the overwhelming number of airdrop claims, the network became congested, and many community users reported that they got stuck on the LianGuaicific-1 webpage while trying to claim the cross-chain airdrop. The page remained on the third step for a long time, and they were unable to complete the claim process successfully.

What’s even worse is that early this morning, the long stagnant Bitcoin experienced a sharp drop, falling nearly $40,000 in a short period of time, and naturally, other tokens followed suit. Some users expressed on social media that they borrowed money for cross-chain transactions in the hope of getting Sei airdrops, but while they were stuck on one end, their positions were liquidated on the other end. Even for those who weren’t liquidated, the airdrops they received may not have covered the decline in token prices…

Final Thoughts

Regardless, Sei’s case seems to be a “success” in a certain dimension, with innovative mechanism design and full of discussions. However, in the long run, it may also be a form of consumption and overdraft in another dimension. Additionally, it requires continuous follow-up operations.

Whether a project should conduct airdrops and how to establish rules and standards has long been a topic of discussion in the cryptocurrency industry.

Originally, airdrops were intended to incentivize active users and achieve a cold start, but under the incentive of wealth creation myths, countless “lurkers” embarked on their dreams. They dreamed of freedom in an instant, and many studios emerged as a result, forcing project teams to be cautious and gradually falling into a dilemma of seduction, tug-of-war, and love-hate relationships. In the current market downturn and with project teams tightening their belts, “airdrop wealth creation” is becoming increasingly difficult. It has become a frenzy. Recently, according to media reports, many studios are struggling to make ends meet and are unable to sustain their operations, resulting in their closure.

Indeed, this is also the result of industry shuffling and iteration. DeFi OG Mindao once bluntly stated on Twitter: Nowadays, airdrop farmers have become industrialized, and now airdrop rules are so predictable that witch resistance is simply impossible, forgive me for being blunt, it is best to completely give up airdrops, or distribute more tokens to ordinary liquidity mining after TGE.

However, to date, there is no convincing conclusion to this discussion. Perhaps we can only hope for the market to recover and new traffic to enter again, forming a healthy ecological cycle in the industry.

Additional Reading

Sei Airdrop Comprehensive Guide: Cross-chain airdrops covering six mainstream public chain users

Delphi Digital: Why do we have high hopes for Sei Network?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Wood Sister’s Long Push Raising interest rates by the central bank is a more important goal than controlling inflation – bursting the Chinese bubble

- Full text of the speech by Hong Kong Chief Executive Carrie Lam at the 2023 Summit on Innovative Technology and Art Development

- The evolution of the order flow lifecycle What changes does intent-centric bring?

- Exploring the future of Web3 social Building social graphs to solve customer acquisition problem.

- Delphi Digital Researcher UniswapX is Changing the Landscape of DEX

- CME Group will launch BTC and ETH reference rates for Asian investors.

- Trump has nearly $5 million in Ethereum NFT licensing fees, with revenue of nearly $4.9 million.