Shocking: Bitcoin consumes more energy than Austria!

Author: Digiconomist

Translation: Nuclear Cola

Source: blockchain outpost

Lead:

According to the Bitcoin Power Consumption Index on January 22, 2019, miners have invested all their income ($2.3 billion) in electricity costs.

Summary of annual statistical results

Single transaction statistics

Key data network statistics

For the estimated premise of this energy consumption, please click: https://digiconomist.net/bitcoin-energy-consumption0. This article discusses the opinions and potential verification ideas for this estimation.

For the estimated premise of this energy consumption, please click: https://digiconomist.net/bitcoin-energy-consumption0. This article discusses the opinions and potential verification ideas for this estimation.

Assume that the computers used in the network are all Bitmain Antminer S (single power consumption is 1500 watts) and are calculated based on the total network hash rate. On February 13, 2019, the minimum baseline was changed to Bitmain Antminer S15 (the update cycle averaged 180 days).

Since the launch, the trust mechanism of Bitcoin has been realized by its proof of workload. These “work” computers are consuming a lot of energy, and the purpose of establishing this bitcoin power consumption index is to help people understand the huge amount of consumption and raise awareness of the unsustainable workload.

Please note that this index report covers the sum of Bitcoin and Bitcoin cash, but does not include other binning currencies in the BitNet. The latter was deleted on October 1, 2019.

We also compiled an Ethereum statistical index, and interested friends can click: https://digiconomist.net/ethereum-energy-consumption.

The so-called miners add new blocks to the bitcoin blockchain about every 10 minutes. When collaborating on blockchains, miners don't need to trust each other, the only thing that needs to be trusted is the code that runs the Bitcoin project. This code contains a set of rules for validating new transactions. For example, a transaction can only take effect if the sender actually owns the amount sent. Each miner will independently confirm that the transaction complies with these rules, so that transaction verification can be completed without trusting other miners.

The trick is to get all miners to agree on the same trading history. Every miner in the network will continue to prepare for a transaction in the blockchain, but only one of the calculated blocks will be randomly selected as the latest block in the chain. But random selection in a distributed network is no easy task, so work proof is needed to provide support. In the proof of workload, the next block comes from the first miner who produced an effective blockchain. However, it is easier said than done. The design of the Bitcoin protocol makes it difficult for miners to grab this quota. In fact, the agreement periodically adjusts the difficulty to ensure that all miners in the network can only generate one valid block every 10 minutes. Once a miner has generated a valid block, it will send a broadcast to the rest of the network. After confirming that the block meets the requirements of the rule, other miners will receive the block and discard the same block that they are calculating. Lucky miners will receive a fixed amount of tokens to calculate the transaction fee rewards paid for each processed exchange within the new blockchain. After this, the entire cycle will start again.

The process of generating an effective block is basically a repeated attempt. Each miner is making a lot of attempts every second, trying to find the correct value for the so-called "nonce" block component, and hopes that the resulting complete block will meet its requirements (the results cannot be predicted in advance). Therefore, the mining is actually very similar to the lottery, and the participants are equivalent to choosing a lottery number. The number of attempts per second (hash) is determined by the hash rate of your mining equipment, usually expressed as Gigahash per second (that is, 1 billion hashes per second), abbreviated as GH/s.

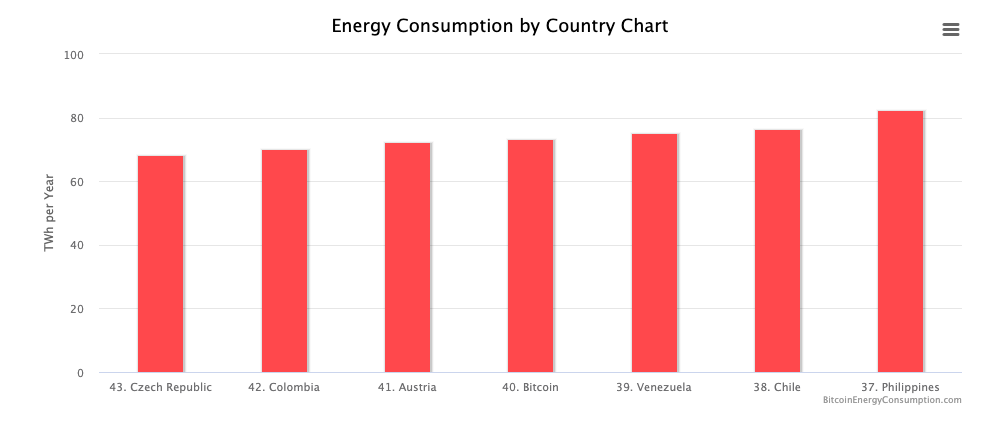

This cyclical block mining has inspired people all over the world to participate in Bitcoin mining. Because mining provides a stable source of income, people are very willing to run large amounts of electrical equipment to generate revenue. Over the years, as bitcoin prices have continued to break new highs, the total energy consumption of the Bitcoin network has continued to grow at an alarming rate. According to the latest report released by the International Energy Agency, the power consumption level of the entire Bitcoin network has surpassed many countries. If you consider a Bitcoin item as a country, its power consumption rankings are as follows:

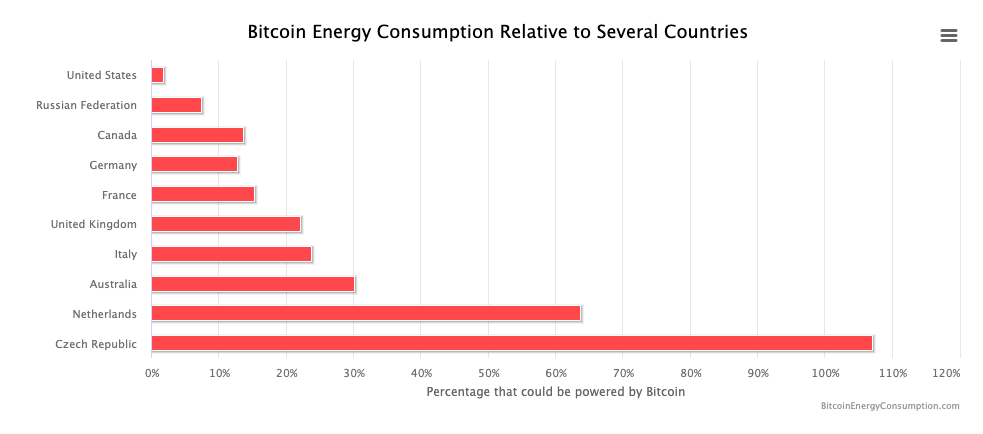

In addition to horizontal comparisons, we can compare the power consumption of Bitcoin networks with the countries with the highest global energy consumption. The results are as follows:

Carbon Footprint

The biggest problem with Bitcoin is not even its terrible power consumption, but most of the mining facilities in the Bitcoin network are located in areas that rely heavily on coal-fired power (directly using thermal power or using thermal power to balance power) (mainly is China). Simply put, “the Bitcoin project relies on coal to fuel it.”

Consideration should be given to controlling bitcoin spread to reduce carbon dioxide emissions.

Determining the carbon impact of Bitcoin networks has been a huge challenge for many years. Not only do we need to understand the overall power level of the Bitcoin network, but we also need to understand the exact geographical distribution of these energy sources. The location of the miners is a key factor in determining whether the electricity used is clean.

Just as judging how many active devices are included in a bitcoin network is a very difficult task, it is difficult to track where these devices are located. Initially, the only consensus associated with this was that most of the mining equipment was located in China. Since we are able to determine the average emission factor of China's power grid (the production of electricity per kWh is about 700 grams of carbon dioxide), we can roughly estimate the carbon footprint of Bitcoin mining. Assuming 70% of Bitcoin mining activities are carried out in China, and 30% of the mining activities are completely clean, the weighted average carbon intensity is about 490 grams of carbon dioxide per kWh. Using this number, we can further estimate the total power consumption and carbon footprint of the Bitcoin network.

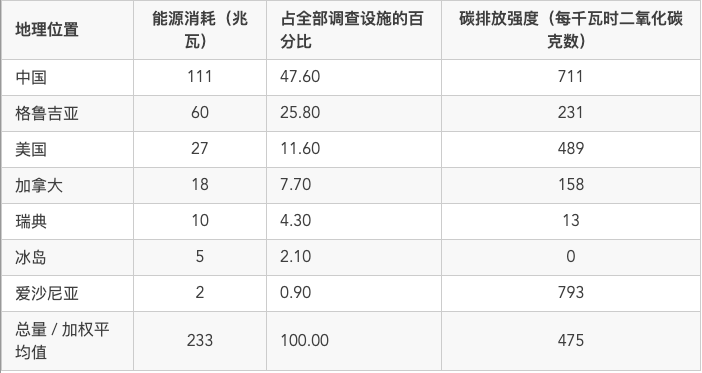

After that, Garrick Hileman and Michel Rauchs released a report on the Global Cryptographic Benchmark Study in 2017, which released more detailed information. In this study, they determined that about half of the current bitcoin hash rates for mining facilities have an overall power consumption (minimum estimate) of 232 MW. Among them, China's mining facilities account for about half, and the minimum electricity consumption is 111 MW. Using this information, we can more accurately calculate the carbon dioxide equivalent (grams of carbon dioxide per kWh) and carbon emission factor (grams) per kWh of electricity used for mining.

The table below shows the breakdown of the energy consumption of mining facilities compiled by Hileman and Rauchs in the survey report. Corresponding to the national grid emission factor, we found that the weighted average carbon intensity of the Bitcoin network is 475 grams of carbon dioxide per kWh. (Currently this number is also widely used to determine the overall carbon footprint of the network based on the power consumption index of the Bitcoin network.)

Rauchs et al. released a similar second round of research results a year later. In the latest study, the total energy consumption of cryptocurrency mining facilities identified by Rauchs et al. was approximately 1.7 billion watts. Based on their inferences and estimates, all cryptocurrency mining facilities (currently the top six cryptocurrencies) operate at between 5.9 billion watts and 12.7 billion watts. This shows that the range of data they covered in the last round of surveys was very limited, and Bitcoin only accounted for a small fraction of total energy consumption . But the good news is that the geographical distribution of mining facilities from the latest research has barely changed from the previous round.

Some may say that the actual carbon intensity of electricity generated by the countries covered in the survey may not be as high. For example, in 2018, Bitcoin Coinshares mentioned that most of China's mining facilities are located in Sichuan Province, where people use cheap hydropower to mine bitcoin. Although there are many untenable arguments in this report, we can also assume that the conclusions are correct and then think about what it all means.

Many people may recognize the existence of hydropower, which means that the carbon footprint of the Bitcoin network is relatively low. But it turns out that the problem is not that simple. The main problem is that hydropower (or other forms of renewable energy) often suffer from unstable power generation. Especially in Sichuan Province, the average power generation in the rainy season can reach three times that of the dry season. In order to offset this fluctuation in electricity supply, the shortfall during the dry season often needs to be filled by other types, especially thermal power. In contrast, Sweden's grid emission factors are stable and low, because the power generation methods here are mainly nuclear and hydropower. The Swedish grid has a carbon emission factor of 13 grams of carbon dioxide per kWh.

In a recent report called “The Carbon Footprint of Bitcoin”, the researchers explained this regional difference (and introduced a new method for geographical distribution of miners based on IP addresses), and concluded that the entire bit The weighted average carbon emission intensity of the currency network is approximately 480 grams to 500 grams of carbon dioxide per kWh (substantially consistent with previous rough estimates).

It can be seen that renewable energy generally has a problem of insufficient supply, but the energy demand of Bitcoin miners is constant. Once Bitcoin mining is turned on, it will never close unless the system crashes or cannot continue to be profitable. Therefore, when the output of renewable electricity is low, the existence of Bitcoin miners naturally increases the basic demand for grid load and stimulates power generation facilities to use fossil fuels to fill this part of the power gap. In the most extreme cases, the existence of bitcoin miners may even spur power operators to build new combustion power plants or restart existing thermal power plants that have been shut down, and this impact is clearly difficult to quantify accurately.

Interested friends can also refer to the article “Renewable Energy Cannot Solve Bitcoin Sustainability” between Bitcoin and Renewable Energy in the top journal Joule Magazine.

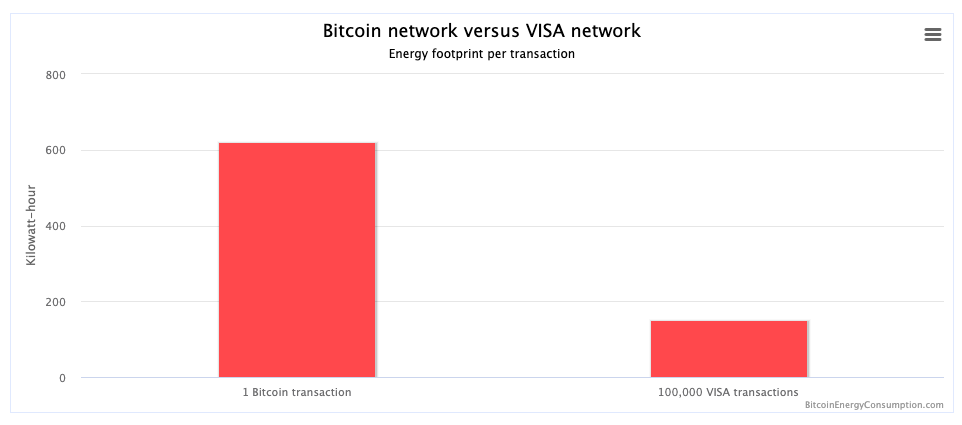

To further understand the power consumption level of the Bitcoin network, we might compare it to another type of payment system (such as VISA).

According to data published by VISA, the company's total worldwide operations consume a total of 679,922 gigajoules of energy (covering multiple sources). This means that the total power consumption of VISA is equivalent to the energy needs of 17,000 ordinary American households. We also know that VISA handled a total of 111.2 billion transactions in 2017. Based on these figures, we can compare the two payment networks and find that bitcoin's single transaction power consumption is much higher than VISA (please note that the following chart shows a single bitcoin transaction with 100,000 VISA transactions) Comparison of power consumption).

Of course, these numbers are not completely accurate (for example, they do not count toward the power consumption of the VISA office system). But because of the huge difference in energy consumption between the two, even if the existence of this inaccuracy is acknowledged, the conclusion is still shocking. Compared to the average non-cash transaction energy consumption level in the conventional financial system, the average power consumption of bitcoin transactions can reach thousands of times. Some friends may argue that these costs are entirely from the transaction itself and do not involve any third-party trust institutions. But we will mention in the following that energy consumption should not be so high anyway.

Workload proof is the first self-certifying consensus algorithm, but it is not the only viable consensus algorithm. In recent years, more energy efficient algorithms such as proof of rights are rapidly evolving. In the proof of equity, the block creation work will be carried out by the token owner – not the miner – so that the device no longer needs to consume a huge amount of power in order to generate as many hashes as possible per second. In fact, compared to the work proof algorithm, the energy cost of the proof of equity is almost negligible. Bitcoin is likely to turn to this new consensus algorithm in the future, thereby significantly improving its sustainability.

But the only downside is that there are many different versions of the current proof of equity, and no single version can force the group to become an objective standard. Of course, it must be acknowledged that the existence of such an algorithm has brought important hopes for the development of cryptocurrency in the future.

Even if we can quickly calculate the overall hash rate of the network, we can't say what level of power consumption this indicator represents. After all, all active devices have been fighting each other – so it is impossible to calculate the exact energy consumption.

In the past, we often used the following assumptions in energy estimation: which devices are still active and how they are distributed, and then the specific wattage of electricity consumed per GH/s (Gigahash per second) is derived. After investigating the bitcoin mining in the real world, we realized that because this model ignores factors such as machine reliability, climate, and cooling costs, the resulting energy consumption results must be lower than the actual level. This arbitrary estimation method brings a variety of energy consumption estimates, and there are often large differences between the different estimates, even enough to change the economic conclusions thus drawn. Therefore, we have proposed new solutions in the Bitcoin Power Consumption Index and tried to examine its specific energy consumption from an economic perspective.

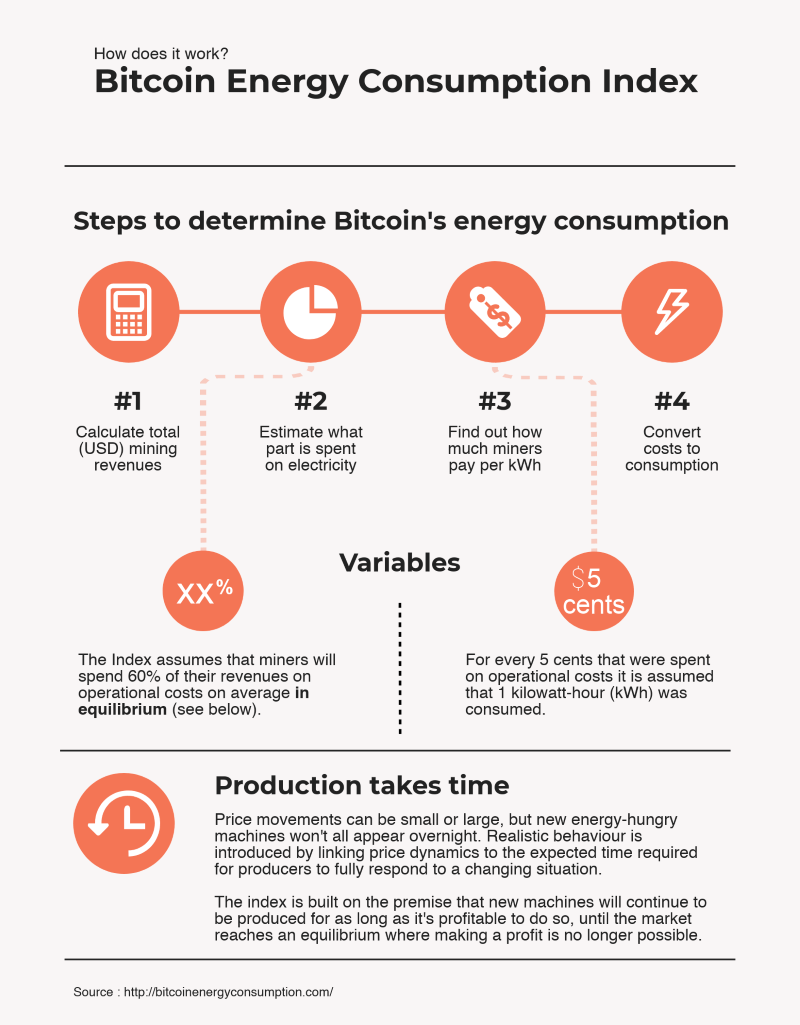

This index is based on the correlation between miners' income and cost. Since electricity costs account for a major proportion of the ongoing cost of mining, the total electricity consumption of the Bitcoin network is also necessarily directly related to mining revenue. In short, to achieve higher mining revenues, it is necessary to introduce more high energy consumption calculations. The chart below explains in detail how the Bitcoin Power Consumption Index uses miners' income to derive electricity consumption estimates:

It should be noted that different hypothetical premise may lead to different calculation results (click here to view a special calculator we developed to provide different calculation results according to different assumptions). In this estimate, we chose an intuitive and relatively conservative calculation based on actual mining operations information. It is important to emphasize that the goal of this index is not to produce accurate estimates, but to provide a routine assessment of reliability at the economic level to ensure that the accuracy and reliability of relevant conclusions is higher than conventional calculation methods based on mining equipment.

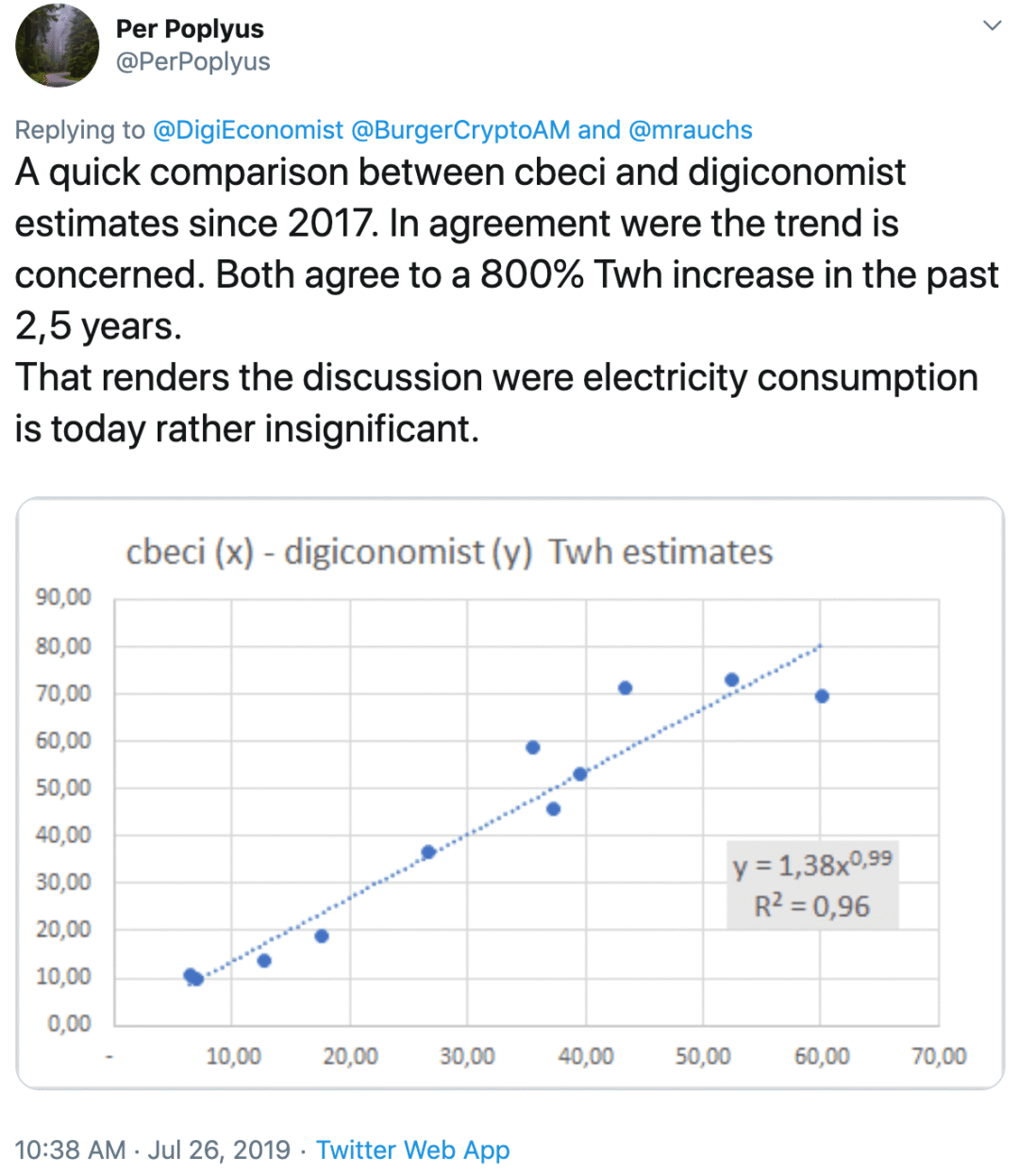

Critics such as Marc Bevand and Jonathan Koomey have long insisted that there are “serious flaws” in the estimation of the Bitcoin Power Consumption Index, but they have different opinions on the Cambridge Bitcoin Power Consumption Index (CBECI) issued in 2019. The Cambridge Index is based on an alternative estimation method strongly promoted by Koomey, but the results obtained are not different from ours. In fact, the Bitcoin Power Consumption Index is in line with the conclusions of the Cambridge Bitcoin Power Consumption Index.

In addition to power consumption estimates, the resulting environmental impact (expressed as a carbon footprint) is strongly opposed by critics such as Robert Sharratt and Coinshares. Among them, Sharratt also used Coinshares' mining survey report to demonstrate that the Bitcoin network did not have a significant impact on the environment. Interestingly, the Coinsahres mining report only implies that Bitcoin mining may not have significant environmental impact due to the use of large amounts of renewable energy, but there is no mention of the term “carbon footprint” at all. This omission is very serious because it ignores another data listed by Coinshares in the report, that is, as the center of China's bitcoin mining, the carbon intensity of power generation facilities in Sichuan Province is not as low as people think. The Technical University of Munich (TUM) took this reality into account and, after independent research, gave the conclusion that the Bitcoin project relies on coal to fuel it. In the university's study, they matched the overall weighted emission factor of the Bitcoin network to the carbon footprint weighted emission factor of the mining facility given by the Bitcoin Power Consumption Index, thus giving a completely different perspective.

Of course, the Bitcoin Power Consumption Index can also be used as a predictive model for future bitcoin power consumption (different from hash rate based prediction). Our model predicts that miners will eventually spend 60% of their revenue on electricity bills. As of January 2019, the miners' expenses on electricity bills were actually higher than 60%. According to the Bitcoin Power Consumption Index on January 22, 2019, the miners have invested all of their income ($2.3 billion) in the cost of electricity. In the case of a sharp drop in mining revenues or even no profit, people may give up using a lot of computing equipment to invest in the Bitcoin network. However, considering that this part of the machine purchase investment will be reduced to sunk costs, the miners will continue to maintain the equipment operation until the electricity cost exceeds the mining income (close to 100%).

At that time, since almost all of the income is used to pay for electricity, the predicted consumption of bitcoin power consumption given by the power consumption index will not change significantly.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interview with Ant Jin Li Lili: Blockchain is underway, and more and more assets can be digitized in the future.

- Bloomberg: The US Taxation Authority has identified dozens of encrypted tax evasion and cybercriminals

- Wuzhen·Bai Shuo: To compete with Libra, we need to establish a legal digital currency system.

- Image Chain Technology Releases "Blockchain + Artificial Intelligence + IoT" Integrated Solution

- Brokers enter the blockchain research and compete with the original investment research institutions for pricing power

- Tether said the USDT stable currency has been fully supported by its reserves

- Zhou Xiaochuan's latest speech: The internationalization of the renminbi is a "premature baby", and the central bank's digital currency is mainly focused on domestic