[Stability Currency Analysis and Analysis] Market Performance, Transparency and Regulatory Analysis of USDT, PAX, USDC and TUSD

As the main standard bridge, Stabilizing Coin has received the attention and concern of the majority of currency traders. Whether it is USDT, PAX, USDC, TUSD, etc., we have a very important role. Today we will analyze the recent stable currency. Happening.

The recent price of USDT fell 4% for a short time, and the price of RMB otc fell from 6.85 to below 6.4 rmb/usdt. As the bridge between the world of legal currency and the world of digital currency, it is also the largest stable currency in circulation. Every large fluctuation of USDT is in fact challenging everyone's trust in encrypted digital currency.

So what is the reason for this large fluctuation? Let's analyze it objectively together:

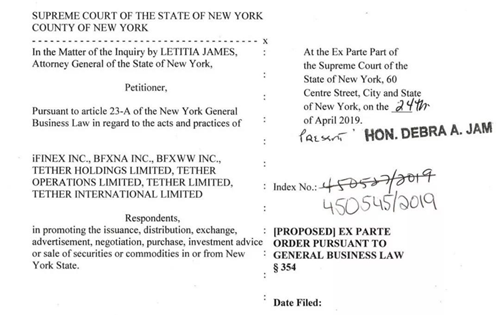

The outbreak of this trust crisis was caused by the New York State Attorney General's announcement of the parent company iFinex (also the parent company of Bitfinex) that sued USDT.

- Towards programmability, these five agreements should be part of the securities clearing platform

- The President of Finland approves the Cryptographic Service Provider Act, and all cryptographic service providers must register to operate

- Moody's Report: Blockchain technology can improve the efficiency of securitization transactions, but developer centralization may bring systemic risks

Invoking relevant media reports – "There is solid evidence that Tether has misappropriated the user's USDT reserve. It has seriously hurt the confidence of the USDT in the cryptocurrency market." The USDT price subsequently fell, not to mention this. Whether the media reports are completely correct, but indirectly explains the market's dependence and trust on the stable currency. When the issue of regulatory currency and regulatory issues is even suspected, it is easy to cause price fluctuations.

As we all know, the digital currency market is inherently a high-risk investment, but as an encrypted digital currency investor, when we face the mainstream stability currency risk, we should also learn to use the alternative stable currency selection as our hedging tool.

Stabilizing coins is no stranger to all of our ordinary users. Starting from a small currency, Bitcoin and Stabilizing Coins are the first step in our investment in the cryptocurrency market; in the long-term bear market, we hold stable coins. It is also one of the strategies to spend a bear market. Since the second half of last year, along with the public's doubts about the USDT, a large number of stable currency projects have emerged. After the USDT crash last year, other stable currencies such as PAX (Paxos), TUSD, and USDC (Circle) have become everyone's choices. I personally hold some stable coins other than USDT. At the beginning of the year, Bin Anin listed PAX as the first basic transaction pair other than USDT. I paid attention to PAX. I think PAX provides us with a new stable currency choice, and also has a certain amount of USDC, of course, there will be USDT. .

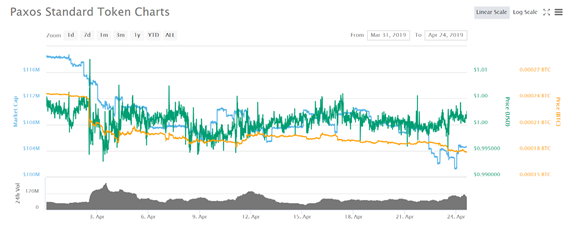

Under the current conditions of the New York State Forkman supervision, we can also analyze and analyze other stable currencies. We can first analyze the PAX monthly USDT comparison:

[The above picture shows that USDT, Tether's price trend in the past month – fluctuation range 0.9784-1.03; the following chart shows PAX price trend in the past month – fluctuation range 0.9948-1.013]

As shown in the above figure, although the current USDT is still the foundation of the mainstream exchanges, it is indeed stable in terms of stability, especially on the OTC. The 4% fluctuation is indeed a bit large, I remember most. At that time, RMB: USD was 6.7, but USDT was 6.93. If it was bought by 6.7, it would be very happy to rise to 6.93. However, it is quite painful to fall to 6.5 in these two days of 6.93. Indeed, it is empty. Holding the overall decline of 4% is more unstable than the recent BTC.

So it made us have to question the word "stable", but the USDT has recently been decoupled from the US dollar, so we can't ask it to fully 1:1 with the US dollar.

Recently, with the USDT not having a regular audit plan, the centralization is serious, and the current situation of arbitrarily increasing issuance, and the dollar reserve of bank accounts is not transparent enough. This is indeed a bad news for the USDT.

The registration of USDT in the United States is MSB (Money Service Business). TUSD is the same as USDC. The objective analysis is that they are not very compliant. Circle has a good reputation, but objectively it also has regulatory aspects. Risk with assets. The biggest difference between PAX Stabilizer and other Stabilized Coins is that it has been audited and regulated and approved by the New York State Department of Financial Services (NYDFS).

For the PAX assessment, we can then analyze the rationality of the specific regulatory and issuance mechanisms:

[I. Issuer] As a compliant currency, PAX is issued by Paxos, a well-known US trust company. Paxos' predecessor was the well-known veteran exchange itBit. In May 18, Paxos raised 90 million US dollars in the traditional financial market, which was recognized by the traditional institutions and supported by funds.

[two, PAX release mechanism]

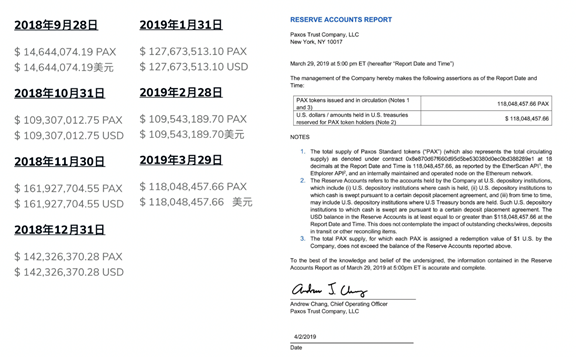

PAX is collateralized in US dollars, that is, for every PAX issued, Paxos will officially deposit $1 into the bank account, and all deposits and tokens will be placed under the supervision and monitoring of the New York Financial Bureau. As a cryptocurrency stable currency that becomes "no bubble". In other words, even if the Paxos company goes out of business, the holder can exchange US dollars at a 1:1 exchange rate.

At the same time, as the first blockchain financial trust company, Paxos has the same asset custody qualification as the bank, and only two stable currency issuers with such qualifications on the market, while receiving regular government supervision and external Audit, publicly issue financial audit reports every month, and give an objective bonus to it in the credit endorsement.

Investors can view the report at https://www.paxos.com/standard/attestations/ at any time to verify their disclosure.

[III. Analysis of liquidity and situation above:]

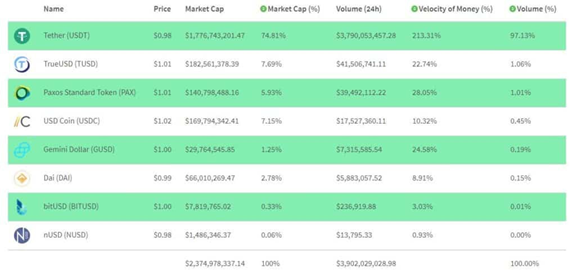

From the perspective of Coinmarketcap, PAX has been launched on more than 90 trading platforms and OTC platforms, indicating the recognition and confidence of the exchanges and the market for their compliance, and thus obtaining a certain amount of liquidity for the majority. Investors provide the liquidity and convenience of stable currency.

Secondly, from the statistics, the current trading volume of USDT, TUSD and PAX is the top three in stable currency, which represents its excellent liquidity.

In addition, as a user point of view, PAX's transfer speed is relatively fast compared to stable coins, and the experience experience adds a lot. This is quite true. USDT is indeed as slow as BTC when transferring money on the exchange. This hard injury has also experienced a few times in the future. It will miss some market conditions, or it will be anxious, and of course it will be moved by XRP temporary speed. Bricks, but transaction fees and market fluctuations must be borne by themselves.

Usually USDT transfers take half an hour or even hours, and PAX transfers can usually be completed in ten minutes; especially when the market is suddenly changing or there is a chance, the time window is often very short, but if you use BTC or USDT to transfer money, It is easy to miss market opportunities; while using other currency transfers, you must bear the price fluctuations of those currencies during the transfer process (ONT, OKEX premium 5%, in fact, switching the main network, OKEX does not suspend the coin to cause me hundreds of The ONT was stuck there, falling a lot after a month, and it was very painful to understand). The speed and convenience of transfer allows us to capture opportunities in the market in real time.

Recently, users have received emails about "one-click subscription/redemption". Personally, this will drive it to become a more meaningful stable currency product – PAX's launch of real-time redemption does demonstrate the ability to manage asset management and compliance, regulated promises, compared to the long wait for a stable currency withdrawal process. .

The significance of stabilizing coins is that on the one hand, it can generate huge profits in terms of payment, lower payment costs and higher payment speed. On the other hand, you can shine in the clearing and settlement scenarios. At present, in cross-border trade, the time between goods and payment is not matched, and we can solve a large number of similar problems with stable coins, such as reducing the risk of financial institutions, increasing the delivery speed and greatly saving costs. Regardless of the scene, compliance and legality are eternal themes, and unsteady and legal stable coins will eventually be abandoned by the times.

I hope this analysis can help my friends. PAX is indeed good. USDT is indeed the most stable currency now. TUSD and USDC do have their own characteristics. I hope that the whole market can bring us more surprises.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Did Bitfinex kill the bull market? The US SEC may not approve the Bitcoin ETF this time.

- Who can represent real bitcoin? Twitter account @Bitcoin controversy

- USDT is thundering, is DeFi spring coming soon?

- Bitcoin – the flower of the unexploded crisis

- Market analysis: the bears have not gone far, they will counterattack at any time.

- Introduction to Blockchain Technology | Distributed Hash Table (Part 1)

- Play with Plasma: Implementing Plasma's Substitutability