Stable currency monthly report | USDC, DAI and other emerging stable currencies challenge USDT with DeFi scene?

According to the DAppTotal.com stable currency feature page data display:

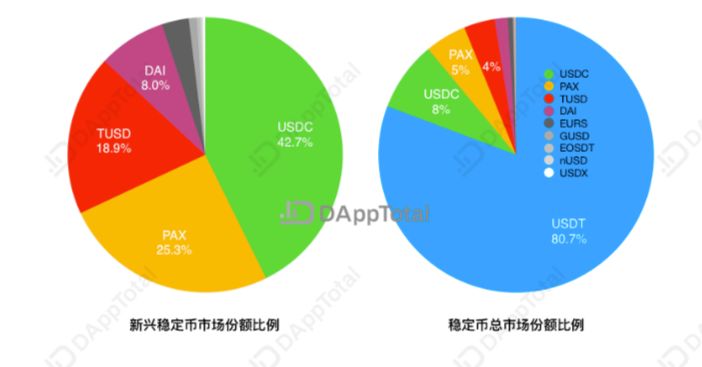

(Figure 1: Stabilization currency overall market share ratio chart)

- South Korea's blockchain company Iconloop receives $8 million in financing to build digital identity authentication services

- Decentralized communications startup New Vector received $8.5 million in financing, intended to replace WhatsApp, etc.

- Overview of blockchain application cases: health care and energy industry

I. The total liquidity of ERC20-USDT is approaching OMNI-USDT

The release and use of the USDT has been dominated by the OMNI network, but the situation reversed in August, and the daily trading volume and daily trading volume of the ERC20-USDT exceeded the OMNI-USDT. In addition to the technical advantages of the Ethereum network itself, the main reason is that the DeFi financial application on Ethereum is becoming more active and the demand for stable coins is growing.

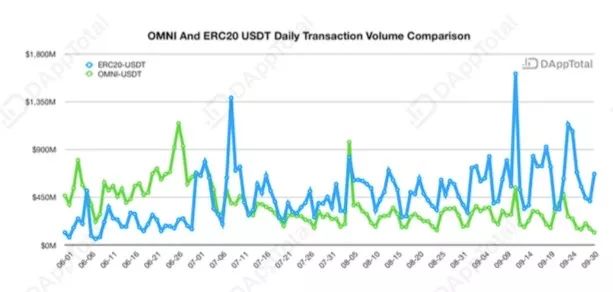

(Figure 2: Comparison of ERC20-USDT and OMNI-USDT daily transactions)

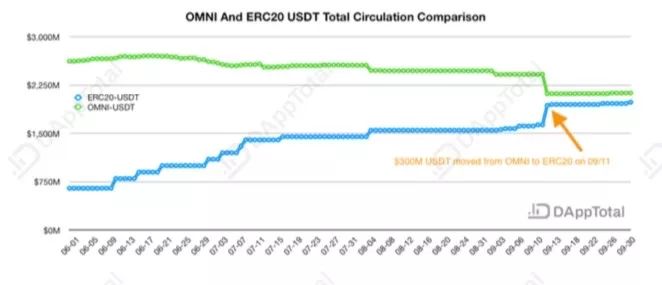

(Figure 3: ERC20-USDT and OMNI-USDT daily transaction amount comparison)

In September, ERC20-USDT's chain daily trading volume and trading volume continued to lead OMNI-USDT, especially the number of transactions has far exceeded OMNI-USDT, as shown in Figure 2 and Figure 3. On September 11, Tether transferred the $300 million USDT from OMNI to ERC20 at one time. As a result, the total liquidity of ERC20-USDT is very close to OMNI-USDT, as shown in Figure 4.

(Figure 4: ERC20-USDT and OMNI-USDT daily total liquidity comparison)

Second, the DeFi application boosted, the emerging stable currency grew steadily

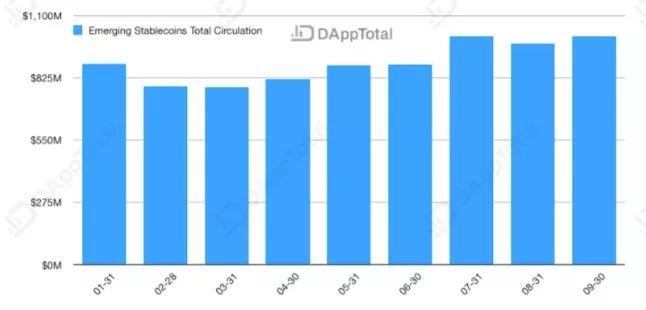

In the overall stable currency market, USDT still dominates, with a market share of around 80%. However, we can see from Figure 5 that the total liquidity of the emerging stable currency has continued to grow steadily this year, and for the first time at the end of July, it exceeded $1 billion, reaching $1.008 billion. The three emerging stable currencies with the highest circulation are USDC, PAX, and TUSD.

(Figure 5: Monthly change in the total liquidity of emerging stable currencies)

Through further data analysis, we found that although USDT has an unassailable and stable position in mainstream trading, with the rapid growth of DeFi financial market, some emerging stable currencies are also particularly active. From the data point of view, in the DeFi lending market, DAI and USDC have considerable activity.

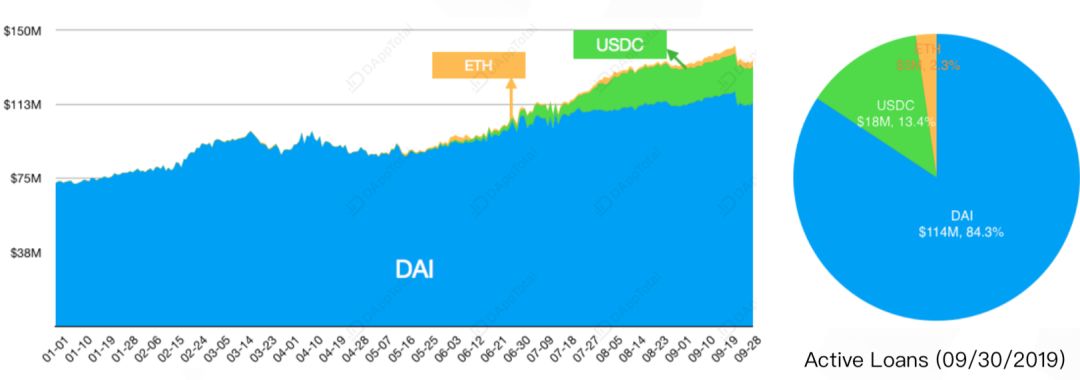

(Figure 6: DeFi loan platform outstanding loan asset distribution map)

From the point of view of the loaned assets of the DeFi lending platform, DAI ranked first in September with a total value of US$47 million, ETH second, US$14 million, and USDC third and US$7 million. In addition, from the total value of the DeFi lending platform, DAI and USDC are both $18 million, which also has a certain market share. It is not difficult to see that the development of DeFi application scenarios will gradually expand the use of emerging stable currencies. Compared to USDT's single exchange usage scenarios and potential risks, the market base of these emerging stable currencies will be stronger.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Internal and external, Libra can seek hope in the crack

- A text saying that IPFS: What is the expectation of Filecoin?

- The judge made a favorable Bitfinex ruling and rejected the file request filed by NYAG

- Monthly Report | September Domestic and Foreign Blockchain Policy: Virtual Currency Mining Supervision Strengthens Legal Digital Currency Multi-Country Support

- Zuckerberg "Second Palace" attends the hearing Libra can break through the blockade

- September public chain observation: How to treat Bitcoin mining after the market?

- How to create an encrypted startup, you need to avoid the minefield