Facebook is putting pressure on the currency, and central banks are issuing digital currencies.

“This payment system is beneficial to European financial centers and integration with the world financial system. We should not leave this area to China, Russia, the United States or any private sector,” Olaf Scholz said in an interview.

Facebook releases Libra, impacting the global monetary system

What is causing German concern is undoubtedly the Facebook issue. Olaf Scholz believes that currency issuance is a key component of national sovereignty and should be under government authority, not private companies. The biggest threat Libra brings is that once its impact is too large, it will shake the central bank's monetary and exchange rate policy dominance. In this regard, the author has roughly summarized three effects:

- Libra's inclusive financial nature makes local countries such as Zimbabwe and Argentina tend to use local currency to convert to Libra in order to avoid the depreciation of the local currency, but this will lead to further depreciation of the domestic currency, causing exchange rate risk and eventually shocking. The currency system is safe. For countries with stable currency values, when the proportion of domestic fiat money purchased by Libra is large, there will also be depreciation.

- Libra will use all real asset reserves as a guarantee, and the US dollar will become the main currency supporting the digital currency Libra, accounting for 50%. Compared with the US dollar, the euro accounted for only 18%, while the yen accounted for 14%, the pound accounted for 11%, and the Singapore dollar accounted for 7%. If you buy Libra in the most US dollars, Libra's exchange rate will basically fluctuate with the US dollar. If you want to ensure that the exchange rate is stable, you need to control the proportion and exchange rate relationship between different currencies. This will have an impact on the current exchange rate policy.

- The Libra Association manages Libra reserves and coordinates various stakeholders. The Libra Association will play the role of Libra's central bank in the Libra digital currency system and may also evolve into a private sector IMF. By then, Facebook's influence in the private sector will far exceed that of formal international organizations, which is a great challenge to national sovereignty.

- Is the Ethereum TPS 2000 enough? The capacity expansion is not as good as the Optimistic Rollup of Plasma.

- After a lapse of five years, the United States updated the cryptocurrency tax rules, still did not figure out the airdrops and forks?

- Jia Nan Zhi Zhi went to Nasdaq, and the mining giant's listing road ushered in the final

In the current monetary system, the top three currencies, the euro and the pound, the international status of the renminbi and the yen are also rising. It is not difficult to understand why Germany is issuing a central bank-based digital currency, because the currency status of the euro may be overtaken by latecomers. On the other hand, the European Commission has already intervened in the Libra project, asking Facebook to answer a series of questions about Libra, including the risks to financial stability and privacy of the public data, the company's subsequent compliance with counter-terrorism financing regulations and the prevention of money laundering by criminal organizations. Ability, etc.

The UK has responded a lot, mainly because Facebook has met with the UK Treasury, central banks and regulators three times in the weeks before the announcement of the digital currency plan, striving for British support. So, when Facebook announced its encryption plan, Bank of England Governor Mark Carney once said that the Bank of England plans to allow more companies to hold reserves in the central bank to negotiate, which may "encourage a series of new innovation capabilities."

But then the British attitude changed. In mid-July, Mark said that Facebook's cryptocurrency must be “rock-solid” from the start, otherwise it should not start. By early October, Christopher Woolard, executive director of strategy and competition for the Financial Conduct Authority, said Libra could disrupt existing financial ecosystems and make traditional payment institutions redundant.

In order to maintain monetary sovereignty, countries are making efforts to central bank digital currency.

In the face of the “threat” brought by Facebook, Mark Cliffe, chief economist at ING, said that the central bank will develop a “fully mature” digital currency in just two to three years, and the central bank’s digital currency era may soon Will come.

Globally, other central banks and institutions, including the Bank for International Settlements, have begun to consider more of the possible spread of central bank digital currencies. Although no official central bank digital currency has been released, countries are already gearing up.

China has released a very clear signal. China has been studying the central bank's digital currency since 2014. Mu Changchun, the former deputy director of the Central Bank's Payment and Settlement Division, even revealed some of the operating mechanisms: a two-tier operating system, the upper layer is the People's Bank of China for commercial banks, and the lower layer is for commercial banks or commercial organizations for M0 replacement, ie The alternative to banknotes cannot be M1 and M2.

In an interview with The Independent, French Minister of Economy and Finance Bruno Le Maire has made it clear that he will not open Libra in Europe, and he has already joined the outgoing ECB President Mario De. Mario Draghi discusses the issue of creating a “public digital currency”. The EU will hold the group, and Germany has already taken the lead.

The Swiss National Bank (SNB) and the Bank for International Settlements (BIS) have signed an agreement to cooperate at the BIS Innovation Center in Switzerland. The Swiss Centre will initially focus on two research projects: 1. Integrating Central Bank Digital Currency (CBDC) into a distributed ledger technology infrastructure; 2. And analyzing how central banks are responding to the growing demand for digital markets.

In addition, Russia, Sweden, Thailand, Lithuania, the Bahamas and other countries are all planning to introduce the central bank digital currency list. However, the United States and Japan, as economic powers, have no plans at present.

Most Fed officials said that the technology is not yet mature, the US dollar is still the world's reserve currency, and it is not clear what benefits the central bank will bring to the digital currency. However, Fed official Patrick Harker said at a community bank meeting in St. Louis that the United States should not be the first big country to issue central bank digital currency, but "this is inevitable." He expressed his readiness to organize scholars to conduct research conferences early next year.

Although Japan did not plan to release the central bank's digital currency, in February of this year, it published a research report on the role of the central bank's digital currency in the current digital currency system. The report states that distributed ledger technology (DLT) and blockchain are available for token-based CBDC.

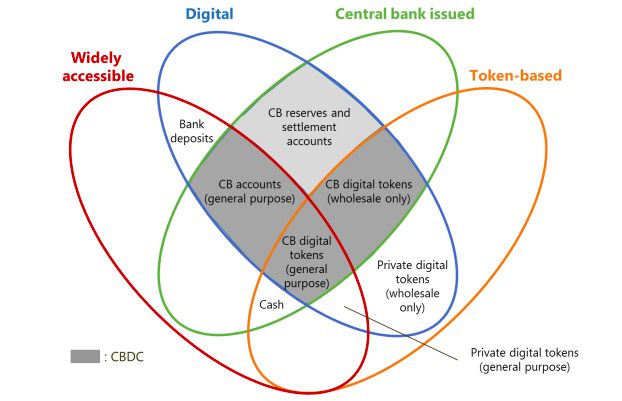

The BIS uses the above chart to illustrate the four key attributes of the currency in the Central Bank Digital Currency report: issuer (central or non-central bank), form (digital or physical), accessibility (wide or restricted) ) and technology (based on account or token).

From the picture, we can see that the Bank of International Settlements defines the central bank's digital currency within the scope of “digitalization” and “central bank jurisdiction”, which is completely different from cryptocurrencies such as Bitcoin and Ethereum. Mu Changchun, former deputy director of China's central bank payment and settlement division, also said that China's CBDC is actually a digital replacement for banknotes. It is clear that the current central bank digital currency (CBDC) is by no means a central bank cryptocurrency (CBCC). Readers who have “decentralized” shackles on the central bank’s digital currency may be disappointed.

The design of the central bank's digital currency needs to be considered in terms of access (wide or limited), degree of anonymity (from complete to no), operational availability (from current open time to 24 hours a week), interest-bearing, etc., and possibly Different categories of CBDCs appear to perform different duties, such as CBDCs that are open to the public in the form of banknotes and CBDCs that are limited to large settlements. Therefore, different countries have different starting points for consideration, and there will be differences in the issued digital currency.

Of the top 10 countries in the 2018 GDP released by the International Monetary Fund, only China and Germany have clearly stated that they will issue central bank digital currencies, but almost all of the ten countries have already begun to study the central bank's digital currency. In addition to monetary sovereign protection, many countries choose the central bank's digital currency because of its convenient and efficient performance, which promotes the effective circulation of its economy.

However, it cannot be ignored that the establishment of central bank digital currency may have a certain impact on commercial bank deposit funds, which may make the central bank occupy a more important position in the financial system. This may have a chain reaction in some countries. At present, countries are cautious about the introduction of the central bank's digital currency, but looking at the future digital battlefield, no country will give up research and exploration of the central bank's digital currency.

We are not sure if Libra can succeed, but its driving role in finance and banking is undoubtedly huge. The “digital currency promotion war” brought by Facebook’s Libra digital currency plan has gradually evolved into a battle for the monetary sovereignty of central banks, and may even be an important battle for the future economic battlefield. The central bank’s digital currency is in the hands of countries. The first weapon.

Author | Joyce

Source | blockchain outpost

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Vitalik Devon Lecture: How PoS Makes Ethereum Network Safer

- DEX Monthly | Ethereum DEX Shuangxiong: IDEX and Eth2dai

- The combination of stable currency and DeFi will create the next big event, said former Jetcoin Core developer Jeff Garzik.

- Established for 6 years, with a valuation of 15 billion, mining machine giant Jia Nan Zhizhi will be listed in the US

- Blockchain for 15 months, Microsoft Azure, Office, DID evolution

- Cornell University professor Emin Gün Sirer confirmed attending the World Blockchain Conference in Wuzhen, where he had published PoW digital currency for 6 years.

- QKL123 market analysis | Bitcoin ETF was rejected in line with expectations, Syria warfare helped to rebound (1010)