How to create an encrypted startup, you need to avoid the minefield

I am an encrypted VC. This means that I talk to encrypted entrepreneurs every day, listen to them selling and evaluate products.

Working in this industry, you first realize that almost everyone is improvising. (This applies to me, but especially for entrepreneurs)

Compared with most industries, encryption technology is developing very fast, but in fact, at present, there is no good blueprint for this industry. We don't know how big the market will be, don't know how to evaluate the company, don't know which indicators to focus on, and don't know if these products are valuable. Except for Bitcoin itself, there are no ipo or fully validated success stories. This is left to the founders and investors to explore. The inevitable result of this is that there are many strange companies in the encryption system.

So I decided to write a guide on encrypting startups. I worked at an encryption startup and co-founded an encryption startup, but most of my advice was obtained by observing many entrepreneurs who were more successful than me in this field. While this won't be a detailed guide – no document can be the final conclusion of a company – it helps us to observe the development track of a startup and the generalization of the investor's ideas.

- Investment management company VanEck: Bitcoin is a great tool for diversifying your portfolio

- CFTC Chairman: ETH is not a security, it is a commodity; the forked asset should be classified into the same category as the original asset.

- The United Nations has set up a cryptocurrency fund to accept bitcoin and Ethereum donations.

When you want to create an encrypted startup

Before you continue, ask yourself: Is your understanding of encryption enough to create an encryption company?

When I wanted to try to create my first encryption company, my understanding of the blockchain ecosystem was awkward. It took me a while to realize how little I actually knew – how bad my initial thoughts were.

If you are not familiar with the history of encryption, encryption culture, encryption, and encryption, you should take the time to learn. The fastest way to learn is to join another encryption company. In any industry, spending time in the trenches is the best education. This is exactly what I did when I was 21 years old.

Read eagerly, attend parties, read newsletters, play with technology, and immerse yourself in the community.

Suppose you are very familiar with the industry right now – you know what it is. There is a second consideration before you start: Are you a technician?

If you are not a technician, you almost always need a technology partner if you want to build anything of value. Cracking passwords requires a deep technical foundation, and an independent non-technical founder rarely gets funding. Of course, the best way to find a partner is to work at another startup, and you have already done so.

As for forming a team, the best team is made up of friends or people who have worked together before. Remember, the primary reason for a company's failure is the break of the partner. If you and your partners don't build enough trust, you are unlikely to get together and eventually build a great business.

There is no need to start a company directly. Do not merge until you are ready to make a commitment. Starting with a small project or consulting job, it is perfectly reasonable to work with your partner first. Before pursuing a bigger goal, this will help you figure out how you are working together and whether you are suitable for the job.

The last question you should ask yourself is, why did you start this startup? Is it for money? Fame? Or is it because the world needs what you want to build, and you are the only one who can build it?

Give smart people a piece of advice: startups that make money as the main driver rarely do so. I don't know why – this doesn't seem to provoke the best of people. On the other hand, startups driven by the strong desire to change the world are often those that survived the difficulties.

Remember this.

(So far, this is the most standard entrepreneurial advice)

Suppose you are convinced that you are ready to build an encrypted startup. Then it is time to enter the concept stage.

You need to discuss a lot of ideas because your first thoughts may be bad. In fact, it is almost certainly bad. It takes a long time to find good ideas in this industry.

Blockchains are complex and confusing. In addition, the blockchain is a completely open platform – meaning that almost anyone in the world can launch a competing encryption product. This means that most straightforward good ideas have already been tried. If you have an idea, it may have been tried, or it is a very bad idea, not even worth trying.

There are very few really good ideas. Getting a diamond requires a long period of purification and distillation.

Thoughts and actions

There is an old saying in Silicon Valley: "Ideas are not important, execution is everything." Like most entrepreneurial advice, this is a good suggestion, not because it is true, but because it is useful.

In reality, the idea is obviously very important. But a bad idea, no matter how good it is, will only waste your time.

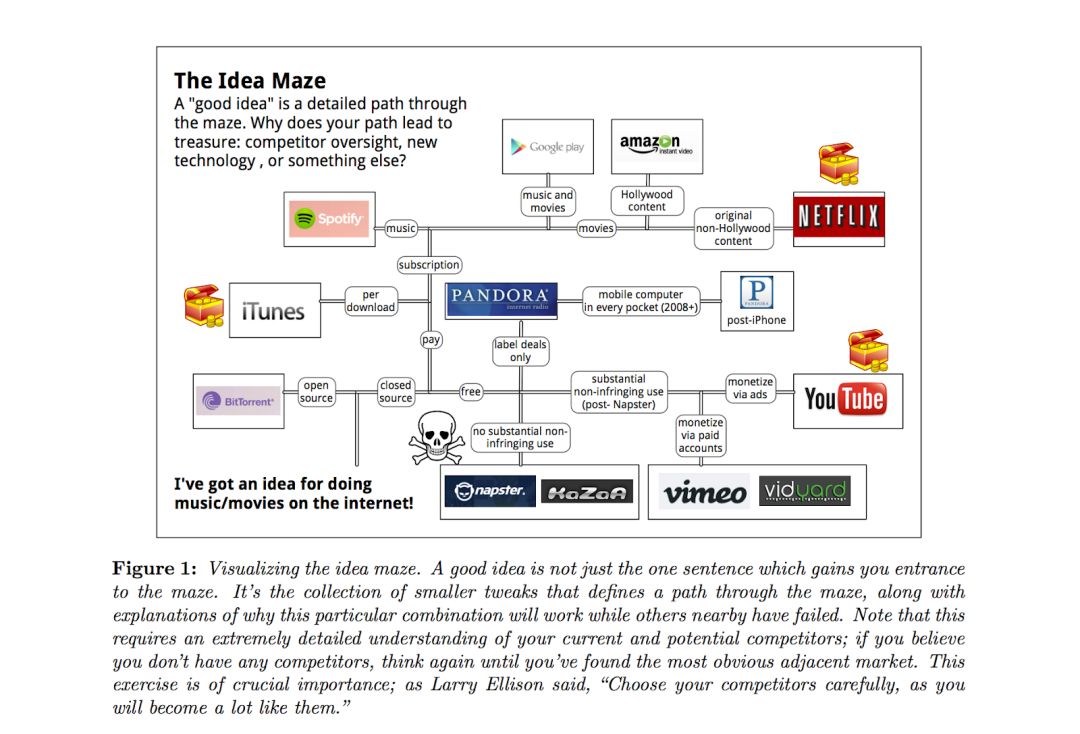

So how can you find a good idea? The best way is to delve into the areas you want to attack. Balaji Srinivasan (former CTO of Coinbase) described it as a "maze of thought."

First become an expert in some areas. Interested in building a DEX? Loan business? Market maker? A new second-tier mechanism? Before you have a rich history, you should study other players in the maze, continue to live and have died, to understand How the maze is laid out. How do these companies make money? Who are their customers? How are they differentiated? What are the reasons for their success?

Credit: Balaji Srinivasan

If you don't even know what to explore the maze, I suggest you do this exercise: How do you believe that the encryption world will change after two years from now? Don't build a Layer 2 mechanism or another smart contract platform – people I realized this was a problem a few years ago, and now they have gone very far. You are late in this game. What you need to consider is what will become more valuable when your product is finally mature. This requires vision and some belief about how the future of encryption will evolve.

By then, what will the world be different to drive demand for new products? Perhaps we will have high-throughput L1s, perhaps more real-world assets will be tagged, perhaps mature interoperability – No matter what it is, you must look to the future and predict what the market needs.

On the other hand, some concept labyrinths are certain to contain only dead ends, and any entrepreneur who enters these fields may be doomed to failure.

Here are some ideas for getting funding in the ICO boom, but most of them are currently not funded. For whatever reason, they still float around as the idea of caching. Here are some of my personal points of view (if your point is here, I would be happy to prove it is wrong):

A new stable currency with a legal currency background . Unless you are Facebook or JP Morgan, there are too many partners at this point, and it is impossible to be competitive or differentiated. Even if Tether goes bankrupt, there will be a large number of stable coins that are supported by the French currency and widely distributed.

A scattered stable currency. A little different from another major design. (Cryptographic guarantees, algorithms, etc.) It's too late to start from scratch, and the existing scattered stable assets don't have enough demand to guarantee competitors. Retail investors have shown that they are reluctant to distinguish between stable asset designs (for obvious reasons – their prices should be the same).

"Bitcoin-killers " is sorry, but Bitcoin has killed all Bitcoin killers. The reason why Bitcoin is king is not related to technology, so it is not wise to compete with Bitcoin on the basis of technology.

The window of "Ether Killer" is closing quickly. In general, I think they have no money. In the next two years, there are already about 10 projects in preparation. Unless you have a deep distribution advantage, your competition may be too late.

Blockchain for X. X can be advertising, oil, natural gas, bananas, and the like. This is the same as the "X Social Network" or "X's Uber" mode – almost all of which are unnecessary and cannot successfully solve the problem they want to solve. Especially if you are trying to monetize this micro economy by adding a payment token.

Let me develop this intuition, because many people who want to start a business are like this.

The blockchain was originally invented to solve the problem of diversification of funds. Many people, including myself, initially believed that blockchain technology could be promoted to solve many different coordination problems.

So far, this argument is negative. We have not seen the blockchain function in any area other than money and property rights.

I don't think this is an accident, nor do I think it is just too early. Rather, it seems that few coordination issues have specific forms that enable technology to solve them separately.

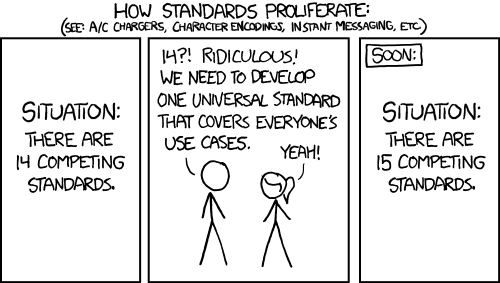

Seeing a fragmented ecosystem, the players are not cooperating and thinking, "Hey, I bet the blockchain can solve this problem." "I have seen hundreds of startups, they are offering such The solution. After a thorough and in-depth study of them, the usual pattern is that using only blockchains does not solve the problem. These startups often fail to fully understand why participants in their field are not cooperating (usually, this is because The dominant market participants are encouraged not to cooperate).

In addition, many "Blockchain for X" games actually only let everyone use a common data standard. Unfortunately, this is actually not much related to the unique properties of the blockchain, and it is difficult to do for other reasons.

Global, unlicensed, programmable currency and property are actually new. They are the first thing we have created to create a blockchain, and so far they seem to be the only thing we can do with this technology that is fundamentally novel. I encourage you to look in this direction because I believe that most of the innovation in this industry will be built in this direction.

Build for customers that don't exist yet. I can see everywhere, it’s really hard to develop products for people who haven’t come yet. It's like trying to develop an iOS app before the iPhone was invented.

This also extends to Fortune 100 companies, who do not use blockchain. Although they said they were. But in fact, their innovation department is only responsible for proof of concept. This is similar to cloud computing in 2004: it's a buzzword that is exciting for business innovators, but it's too early for policymakers to really transform their infrastructure.

You might say: But encryption is so new! It will change the world! This will lead to a whole new world, and the standard of money will change completely! That is the source of my customers!

well. But today all great encryption companies have built what at least someone wants. These people may be a small group: password punk, racist, encrypted traders, and so on. But don't fall into the trap of building relationships for groups that don't exist.

The best way to bet on future trends is to build a small customer base that you think will grow . Don't assume a customer base that doesn't exist yet, and try to imagine their future preferences. You haven't built it for anyone, don't have feedback, and don't know if you've made any progress. For a startup, this is simply purgatory.

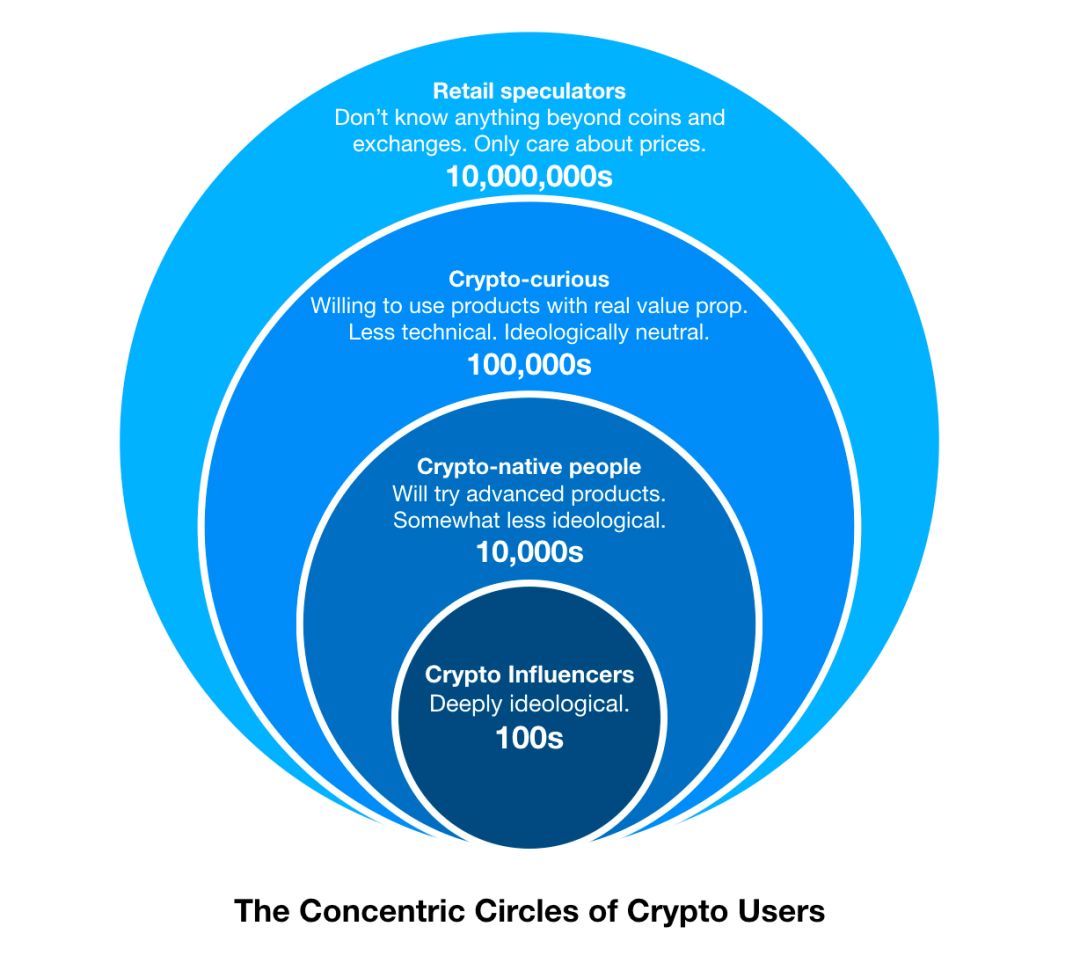

Built for encryption influencers. This is another common password startup trap. In most industries, if you develop a product that influential people will like, there will be millions of other customers to follow. But the field of encryption is a strange space – the encryption influencer's preference is a very unrepresentative encryption client.

These numbers are very rough approximations

If you leave the encryption influencer, you will think that most encrypted consumers are paranoid password punks who run their own full nodes and never hide their cryptocurrencies in the exchange. In fact, this only describes a small number of encrypted users. Most encrypted users put their tokens on the exchange, don't know how to operate the command line, and have never even heard of Austrian economics. They are more concerned with making money and a good user experience than about being scattered.

Built in unfriendly regulatory jurisdictions. If you are building anything that interacts with tricky rules (almost everything is encrypted at this point), it's important that you establish the jurisdiction of the company. If you are building a global product, this means that Hong Kong, Singapore and Switzerland are great places to locate your encryption company. On the other hand, if you set up an encryption company in New York, you pay too much wages and rents just to get the regulator to continually poke your eyes.

This does not mean that there are no successful companies in New York, but you should weigh the pros and cons. If you are doing anything in the exchange space, DeFi, or trying to build a global company (like many encryptions), think carefully about your regulatory strategy. Most entrepreneurs tend to cover up this, but choosing a jurisdiction from the start is one of the company's most critical decisions in the future.

In other words, don't be afraid of rules. Regulatory is an obstacle at first, but it can also be a powerful moat after you build your own business. On the other hand, you can't spend all your money talking to a lawyer before you have a business to talk about.

Once you feel that your idea has been well processed, you should enrich it into a broader plan.

Verify your thoughts

Now that you have a general idea of what you are doing. It's time to verify it. Participate in local gatherings and events. Communicate with other entrepreneurs. Tell each and every smart person your thoughts and get their feedback.

Establish a proof of concept. Show it online or in a hackathon. Let people be excited about your work. Many of the greatest encryption projects were built this way – InstaDapp was originally built on a hackathon (it was originally named CryptoPay), and BitMEX launched their janky "alpha" before it could raise external funds.

Spend as much time as possible with your users to find out their pain points, the products they are using and the deficiencies of those products. Now you should know who your actual customers are. Are they speculators? Traders? DeFi users? Exchanges?

If your job is more like basic science (think of esoteric technology, a new blockchain, etc.), then getting user authentication becomes more difficult. If this is the case, you should talk to many technicians and projects that you might want to build on top of you. At this stage, design feedback is priceless. But the most important thing is that you have your own architecture and build capabilities.

To raise funds

Let us assume that you have verified your idea and now you have the confidence to turn it into a business.

The next question is: Do I need to raise funds? Usually, the answer is: No! If your business is not capital intensive, or the cost is not high, then you may not need to raise funds at all. CoinMarketCap is the largest cryptocurrency price statistics site, but it was originally an amateur project for an engineer who worked full time at an enterprise software company in New York – without traditional venture capital. And now it has become one of the largest ad-driven encryption businesses.

But many companies are capital-intensive (or just need to accelerate their pace to beat their competitors) and need to raise venture capital. If you are such a person, let us see what you need to do to raise money.

First, you need to prepare a deck of cards. If you are doing some technical work, you still need a white paper. (Why is it a white paper? It's mainly because the encryption industry has a passion for Bitcoin and Ethereum. It's stupid, but it's best to follow industry norms.

Your deck is important. It needs to convey what your project actually does (you will be surprised to find that few people can do this clearly) and it also needs to convey how your project works. If as an investor, I can point out any obvious weaknesses, attacks or omissions that you didn't mention, then you can't believe that you have fully considered your system.

Your deck should also describe your financial situation and why your tokens/stocks can be valued. Considering that it is now 2019, you need at least a viable listing strategy. "Build it, they will come" is no longer convincing because you will compete with thousands of encryption projects.

You should also start thinking about valuation . This does not need to appear on your card, but you should consider how you will price your company when the conversation begins. In early trading, this is usually done by comparison. Looking at projects that are similar in the same field, similar in quality, and launched in the same market cycle, what is their value? (Comparing with the project to raise funds in 2017 does not benefit you, it is a completely different market, no People will give you the same price.

Now you need to cast a real VC.

How do you lead in the wind? The answer is usually through their network, which means you need an introduction. This can be done through another venture capital firm, or, ideally, an entrepreneur who has worked with them. (This is why it is a good thing that you have done so much social.)

Don't expect to encounter a cold VC at the conference, and don't use LinkedIn. Honestly, I don't know which VC is investing in this field by email unless he is already familiar with the project. Because encryption is a global industry, we have received a lot of spam from around the world, many of which are downright scams. Almost every VC company in Silicon Valley will tell you: get a passionate introduction, especially for encrypted VCs.

But if you are recommended, you usually avoid the noise.

Finally, once you start financing, you need to set a clear deadline for your financing – both to establish a sense of urgency and to show your seriousness (and because the VCs are busy, if you allow it) They often take a nap when you finance.) You should also set a deadline because fundraising is really a waste of your time as a founder. You want to complete the fundraising and start building your career again.

So who should you raise funds for?

First of all, you have to consider what stage you are going to rise to. You want to make sure that the money you are raising is consistent with the fund you are talking about. A16z Crypto and Paradigm are both amazing encryption funds, but they are large post-funds, usually only large checks can be issued – the $500,000 seed pre-transaction is not worth the time, because such checks only Less than 0.2% of its portfolio. But smaller funds like ours are more than happy to issue checks between $250,000 and $500,000. There are also active angel investors and family finances who are happy to invest at an earlier stage.

Chatting with entrepreneurs who have worked with your investors is always worth investigating. Especially in encryption technology, it is not a good idea to take money from anyone who is willing to throw money at you. In the opaque industry of encryption, the gap between "smart money" and "stupid money" is particularly large. There are many scary stories about investors expelling founders, prosecuting companies, or preventing follow-up financing. You want investors to really understand what you are doing and to be consistent with you for a long time.

In other words, entrepreneurs generally think that financing is just a rating issue. As an entrepreneur, you will receive a rating based on your funded venture capital firm rankings. But this way of thinking is wrong. Raising funds is not only a matter of level but also a question of matching. VCs will match you based on their portfolio. If they already have a large number of deals, or if they don't have enough smart contract platforms to expose, this will often determine if you are better suited to one or the other venture capital. Or, if they already know you, they will invest better than other entrepreneurs who have a weak relationship with them (or they just don't want to work with them).

So talk to a lot of investors. It is wise not to over-optimize the valuation, especially at an early stage. I know this sounds like a selfishness from an investor, but you will hear it over and over again. In the early days, valuation is not important. It is important to choose the right partner to set a good growth track for the company and not to over-finance or over-commit to investors. If you succeed, you will earn most of the money in the future, not in your early fundraising.

This is counterintuitive. It is worth noting that raising too much money usually means the end of the company. We all know that ICO's large projects have raised too much money, but now they are waiting for opportunities. They don't know how to iterate their tens of millions of dollars and fall into a meaningless business plan. Of course, all the money you raise is not an exit – it won't enter your bank account. It sits in your company's safe and tries to build your business in some way. When there is no clear way forward, companies tend to stagnate and fall into politics and guilt. This is not the place you want to end.

If you are doing equity financing, your trading mechanism should look like standard startup financing. But for a symbolic raise, there is a completely different script.

Token transaction structure

Encrypted corporate structures have caused a lot of trouble when it comes to tokens. In general, security funds are now out of favor with equity with symbolic rights (ie, your company's shareholders will automatically receive any tokens created by the company). But most good password investors can trade equity or tokens. Discuss with your investors and legal counsel.

You need to think carefully about the token distribution. Some rough rules of thumb are that you should not give the team more than 15-20% of the symbolic supply, and investors should not exceed 30% of the supply. If the assets held by VCs exceed this number, your money may become "wind investment money." "You want it to spread more widely.

On the other hand, some symbolic founders sell too few tokens. By selling a small portion of the network at the highest possible valuation, they want to maximize their ownership and make a lot of money on the books. This is a huge mistake.

The point of token distribution is to distribute tokens as widely as possible. Why? Because tokens should be global, decentralized, and money-like. In other words, tokens are valuable because they are distributed. Having an 80% stake in a company will make you a savvy owner, but having 80% of a token will make the token worthless. You should be excited about distributing tokens, as this will make your bets on tokens more valuable.

Should you be a foundation? Where should you do it? How should the arrangement be between the foundation and the company?

Although I would like to answer these questions clearly, the truth is that no one is really sure, and there are no best practices. In short, we have seen that almost all models are going downhill. Although it is too early to say that all models are going downhill, we have seen almost everything. My guess is that this will continue to evolve in the near future. Your best bet may be to talk to your investors, entrepreneurs you trust, and develop a good way to bet on you.

market

Market, distribution… There are many terms for the same thing. This is the most overlooked part of the encryption world.

How will you attract your initial users? What distribution channels can you use? What kind of virus cycle or recommendation program will you use to attract new users? What is your customer acquisition cost (CAC)? What about your return? You should have a more specific plan than "boosting through influential people" or "doing the market." "To be successful in 2019, you need some creativity.

If you are making a token, you also need to consider how to distribute the token supply outside of the pre-issuance investor. Unfortunately, there is no simple answer here.

Ico used to be the standard, but now they are less and less common. CoinList allows you to reach out to approved investors, but many of them just want to convert your tokens, and there are a lot of things that cross the wind. Earn allows you to distribute tokens to Coinbase users while explaining them to your product, but it is not used as a turn-key. IEOs may be a bit dark because of the location, but it allows you to distribute money to a more global investor community (just make sure your investment is legal, especially when it comes to US customers). Airdrops are another option, but as far as I know, no non-fork tokens have been successfully adopted on the basis of airdrops. There are some very creative ways, such as dropping Handshake into a Github account, or dropping Stellar to Keybase users, but unfortunately, most of the airdrops are not applied.

If you are building pure encryption, please open the source code. Once you release it, if you want anything that ultimately goes to decentralization, this is a prerequisite. You must incorporate the community into the project you are building. If they can't participate in the development, people won't trust it. If possible, you will gradually want to pull the company out of its core operational roles. Good models worth learning are Maker, Cosmos and Ethereum.

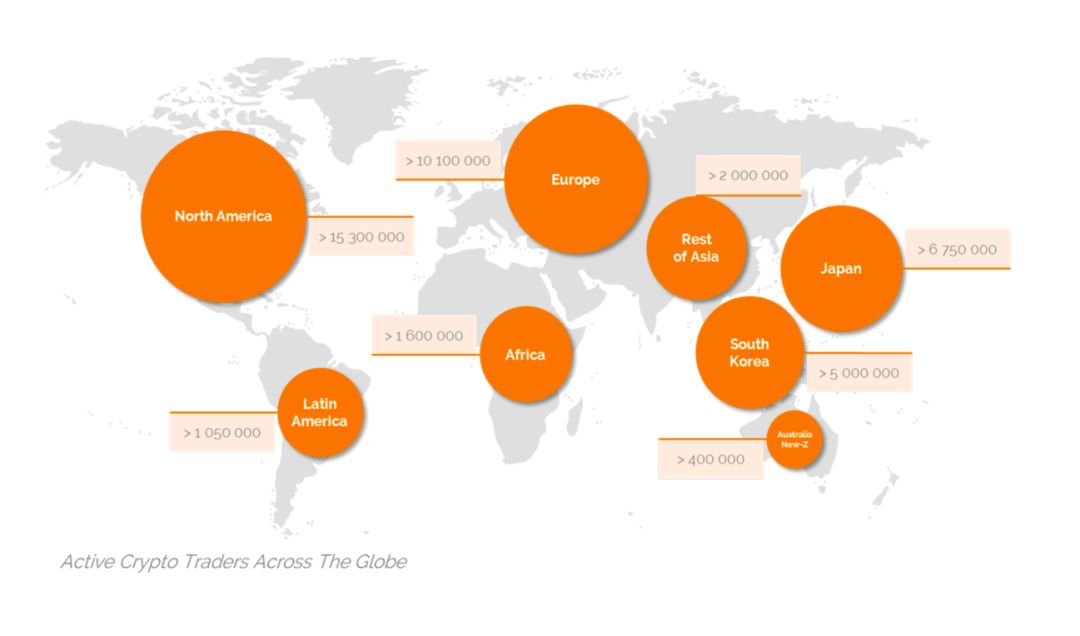

Unlike the Internet, encryption is global from the start. This means that no matter where your company is established, you will eventually have to build a global team with operations all over the world. Whether you are from the US, Europe or Asia, you want to have a place in these areas to raise awareness and meet the needs of different communities. Just focusing on the local location is not enough.

Source: Chappius Halder (Note: This data does not track China, China's password traders may be more than North America)

Finally, you must constantly iterate over UI/UX. This is probably the most important frontier for encryption, and I suspect that more and more companies will differentiate between user experience and not core technology.

Build physical objects, get users, hire talents, and iterate.

From now on, I don't think I can give you any general advice anymore. Your company will have its own unique needs and challenges, and you and your team need to find them.

No matter where you are in the process, I hope this guide will help you move in the right direction. I am looking forward to seeing your results!

Original link:

Https://medium.com/dragonfly-research/so-you-want-to-build-a-crypto-startup-8904ca300794

Author: Haseeb Qureshi

Compile: Sharing Finance Neo

Source: Sharing Finance

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Facebook is putting pressure on the currency, and central banks are issuing digital currencies.

- Is the Ethereum TPS 2000 enough? The capacity expansion is not as good as the Optimistic Rollup of Plasma.

- After a lapse of five years, the United States updated the cryptocurrency tax rules, still did not figure out the airdrops and forks?

- Jia Nan Zhi Zhi went to Nasdaq, and the mining giant's listing road ushered in the final

- Vitalik Devon Lecture: How PoS Makes Ethereum Network Safer

- DEX Monthly | Ethereum DEX Shuangxiong: IDEX and Eth2dai

- The combination of stable currency and DeFi will create the next big event, said former Jetcoin Core developer Jeff Garzik.