Staking: New wave of mining under the PoS era | PoS series (1)

The PoS era has arrived ?

On March 1, 2019, according to Etherscan, the height of the Ethereum block exceeded 7280000. The upgrade of Constantinople has been fully started. The hard fork upgrade that was tested in July last year has been a long way to go. Several times of jump tickets, after experiencing development obstacles, security loopholes, and other Ethereum core developers announced the delay four times, they finally got online. This also means that after five years of development, Ethereum has come to the final stage of its third phase of “Metropolis” and is about to move towards the final stage of its white paper project “Quiet”, which means that this is the second largest in the world. The cryptocurrency network and the public blockchain platform will be switched from the PoW consensus mechanism to the PoS consensus mechanism. This transformation will be the most important issue for Ethereum this year.

The end of the "Metropolis" and the beginning of "Quiet" will be a very historic moment. From this point of view, from the "frontier" to the "homeland" to the "Metropolis", the miners of Ethereum are Bookkeeping can reach a consensus, day and night will be used to guess the game, the "mine hammer" in the hands of the upgrade, from the CPU to the GPU to the ASIC, to the development of the power of the mining pool such a huge. However, with the launch and improvement of the Casper agreement, the original Ethereum mining machine will eventually be dusty. Under the new mechanism, the holder of the coin is the verifier of the transaction. Everyone has completed the book in a friendly manner during the process of pledge, voting and verification. Unification: not requiring excessive energy consumption, but relying on random methods, pledge of rights and punishment mechanisms. This is the charm of PoS.

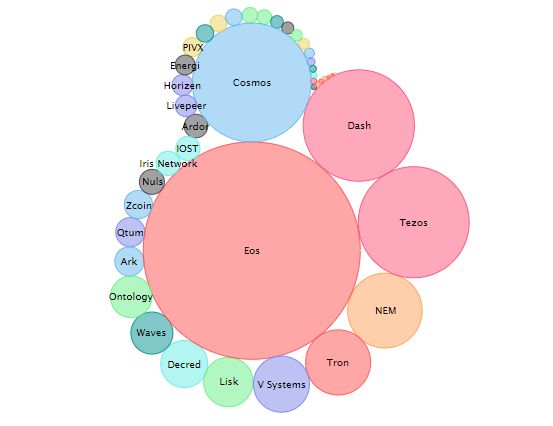

The transfer of Ethereum's consensus mechanism is not the beginning of the PoS consensus mechanism. As early as 2012, the first PoS-based project-based point coin (PPcoin) was born, and during the development phase of mixed consensus, pure PoS, BFT+PoS, etc. And derived from DPoS, LPoS and other variants, the development history and evolution trend here is very interesting, we will elaborate again next time. In the past 7 years, we have reviewed the top 50 currencies in the current market capitalization. The number of coins using PoS or PoS mixed consensus accounts for 16%, accounting for 32%, including EOS, Cardano, Tron, etc. Ten big coins, DASH, Bitshares, NEO, QTUM and other old public chains, as well as popular newcomers such as Tezos, Cosmos, and then look around, Polkadot, Algorand, IoTeX, V system, IRISnet and other new projects of great interest The PoS consensus has also been adopted without exception.

- Babbitt column 丨 G20 began to implement a unified encryption asset standard

- Dismantle MimbleWimble's privacy magic (part I)

- Lightning Network (on)|How to break through the ternary impossible: Re-implement the principle of lightning network technology with Solidity language

Source: https://coinmarketcap.com/ as of June 11, 2019

The PoS consensus technology is more and more perfect, and the derivative types are all in full bloom. The performance in terms of throughput, delay, speed, energy consumption, etc. is excellent. The public chain of PoS is surpassing the PoW in quantity and quality, and Ethereum is in the process. The key point in transforming PoS. This convinced us that we are fortunate to witness the opening of a new era of consensus.

What is PoS ?

PoS is an abbreviation of Proof of Stake, which is also a consensus proof mechanism. To understand the concept of proof of equity, we may wish to review the role of consensus mechanisms in the blockchain. It is well known that the essence of the blockchain is a decentralized ledger. How to achieve the accounting of all the accounting nodes without the central manager, this requires a consensus mechanism. In the existing blockchain system, the basic idea of randomly selecting a node to generate blocks is generally used to solve this problem. In the previous PoW consensus, a hash function based on unpredictable output is used to achieve this randomness. Only by constantly calculating the target result through a large number of calculations can we have the right to block. The randomness caused by such a small probability makes it impossible for the perpetrator to generate a long chain multiple times in succession, thus ensuring the uniqueness and non-tampering of the book consensus. Sex. The well-known Bitcoin, Litecoin, and now Ethereum all use this mechanism to maintain the consistency of the books, so that the mining machine industry has developed rapidly, and the mining machine is inevitable for the mathematical game of calculating the hash function. A lot of power is needed, and a lot of power is wasted, as well as CPU, graphics, and memory consumption. This is also a point that the PoW mechanism has always been criticized.

In the world of PoW, all miners are out of the box, and random choices are made by playing an unpredictable puzzle like a hash function. In the world of PoS, if such a corresponding summary is made, the random selection is done by the same unpredictable human behavior! Under the PoS mechanism, all nodes are also in the block, and the holders select the block by verifying the voting. The number of votes is linked to the holder's currency. The more the currency, the more the equity, the more the voice is. Big, this is the origin of the PoS name. Of course, after years of development, the PoS random selection method has produced many variants. Cardano proposed the Uroporos algorithm to randomly select the block nodes by directly generating random numbers, and the EOS DPoS mechanism is controlled by the holders. The method of voting for the super node instead of each block reduces the difficulty of the voter's vote verification and increases the participation rate of the vote. The LPOS used by Tezos and the Tendermint used by Cosmos are also innovations on existing PoS mechanisms, developing an incentive mechanism, a mortgage mechanism, and a slash mechanism to deal with the “Nothing at Stake” and long-range discovery that PoS just discovered. Attack and other issues. For the current PoS public chain, the process of voting holders participating in voting, verification, and reward distribution is more complete and standardized, and the ratio of participation in voting verification by each public chain has been greatly improved. The stability of the main network based on the PoS mechanism is obtained. Verification.

The significance of S taking in PoS consensus algorithm

The word Staking is derived from the stake in the Proof of stake, which means that the holder of the money pledges the digital currency to vote during the PoS consensus generation process. Since verifying the content of each block and voting is a certain threshold, not only requires a better computer configuration, but also 24h online full connection, which is not a simple and sustainable thing for the public money holder. Therefore, the current mainstream PoS public chain has considered verifying the roles of the whole node and the holder of the coin, setting a high threshold for the node, and the holder can participate in the verification by voting for the node, and obtain the dividend of the verification reward. For example, EOS and Tron set a fixed number of super nodes/representatives to vote for rankings; Tezos, Cosmos, etc. have requirements for depositing mortgages for nodes, without limiting the number of nodes.

The holder of the coin pledges the money, votes to the node, and shares the reward with the node or the verification block. This process is called staking . Due to the different processes of different projects, the country may also translate into voting, pledge, verification, etc., but the essence is to exercise voting rights and gains according to the amount of money held. Staking is an indispensable part of the PoS mechanism, which plays an important role in both the public chain and the holders:

1. For the public chain, the more staking the higher the value. The more people participate in staking, it means that the consensus consistency of each block is more guaranteed. The amount of staking is basically equal to the size of the computing power in the PoW public chain. The more the staking amount, the more stable the chain. The more assured the sex, the greater the value of this public chain.

2. For the holder of the currency, staking is the best means of maintaining and increasing the value of the equity. In order to encourage the holders to participate in staking, the public chain will generally issue tokens as a reward for block generation. The staking holders can get rewards, and the holders who do not participate in staking are wasted their profits. Inflation losses caused by the issuance of coins. The annual growth rate of the existing mainstream PoS public chain is on average more than 5%. Cosmos's additional issuance mechanism is particularly unique. When the staking ratio of the whole network is less than 2/3, it will increase by 22%, and when it is higher than 2/3, it will increase by 7%. Forcing the holders who are not staking to see the high expansion rate, keep the staking ratio of the whole network higher than 2/3 to maintain stability.

List of pledge cryptocurrency market values for each network

Chart source: https://stakingrewards.com/global-charts as of June 11, 2019

S taking: a new wave of mining under the PoS era

The mechanism for the public chain to issue tokens to reward Staking is just like Bitcoin rewarding its miners with a block of 25 bitcoins, which has developed a huge mining industry in the past 10 years, which has spawned AntPool and F2Pool. Such a mining giant and a large unicorn whose valuation is over $10 billion. In the era of PoS, staking will surely create a new economic ecology that will not be lost to the mining industry.

Still taking Etheruem as an example, with the coming of the "quiet" phase of Ethereum. The transition from PoW consensus to PoS consensus will inevitably lead to the disappearance of the current use of mining machines to dig ETH. Instead, the existing holders of ETH are mining through “staking”. In fact, the upgrade of Constantinople will be The 3 ETH rewards for the block were reduced to 2, and everything is preparing for the PoS transformation.

There are two most important roles in the staking economy: nodes and money holders, which can foresee the emergence of giant mine pools at major mainstream public chain layout nodes, which will attract the miners to join the same force as the power mining pool. In the era of PoS, many currency holders are encouraged to place their voting rights in their own mining pools, competing for the right to block and share the proceeds. From a model point of view, this is closer to the traditional fund's use of funds to invest in income and then dividends. In fact, the major nodes of the current public chain have also launched products that indicate the expected annualized rate of return, similar or regular or current. .

At the same time, the two roles of nodes and holders will also develop an auxiliary service industry. For companies that provide operational services to institutional nodes or individual nodes, Staked.us, a startup that focused on the PoS sector in February this year, has completed $4.5 million in seed round financing, and the capital side expects PoS projects to reach all projects this year. 25%, and staking is expected to bring in $2.5 billion in revenue. For individual holders, a variety of principal-agent services will be developed to help the holders to conduct staking voting and asset management. The organizations that are now running include Firebase, HashQuark, Infinity Pool, Cobo Wallet, Wetez and so on.

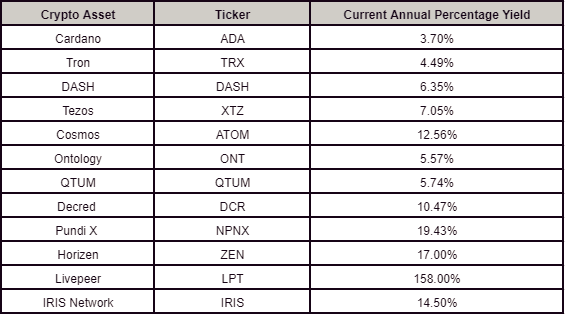

For individual investors, mining in the PoW era requires the purchase of a separate mining machine, and also requires special considerations for the site and electricity. The threshold is too high, and many investors who missed the CPU mining era regretted it. and. However, in the era of PoS, the role of the holder and the miner coincides with the construction of the functional role of the verification node, so that the holder of the mine does not need too high computer hardware requirements, so that everyone can mine. You can enter the market by buying coins. The mining process is like paying interest on the currency. The more coins you have, the longer the interest, the more interest you have. The model is simple and easy to understand. At present, the average staking yield (coin standard) of major mainstream PoS projects is around 10% or even higher. This kind of income is higher than the traditional investment financial return rate, and as the bull market gradually wakes up, the price increase will bring more High value gains.

Source: https://stakingrewards.com/global-charts

The public chain is an important infrastructure for the blockchain industry, and its performance upgrades and changes in consensus mechanisms will broadly affect the blockchain ecosystem. With the advent of the PoS era, Staking will replace the new system of birth of the original computing mining industry, and new opportunities for development will be derived from the two important roles of nodes and holders.

Reference material

Han Wei. Research on Consensus Mechanism in Blockchain Technology[A]. Chinese Computer Society. Proceedings of the 32nd National Computer Security Academic Exchange Conference [C]. Chinese Computer Society:, 2017:6.

Sunny King, Scott Nadal. PPCoin: Peer-to-Peer Crypto-Currency with Proof-of-Stake[EB/OL]//https://peercoin.net/assets/paper/peercoin-paper.pdf,2012

Source: Hash Future

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- V God personally wrote an article explaining the US Treasury’s Encrypted Assets Supervision Act

- Twitter Featured: Facebook Encryption Project Launched This Month; Wu Jihan will launch a new company Matrix by the end of July

- What is the recent popular Staking, is it worth investing?

- Listed company tracking | Zhongan Online: Pushing insurance products to pass

- The first launch of Cosmos exposed a high-risk vulnerability, will be hard fork upgrade at block height 482100

- US state insurance giant State Farm and USAA test blockchain insurance claims platform

- Ethereum Layer 2 Expansion Plan: Status Channel, Plasma, and Truebit