The absurdity in the Meme season: me, Ben.eth, sending money

The absurdity of sending money during the Meme season, as experienced by me, Ben.eth.Give money to $PSYOP, got blocked by $LADYS, buried by $LOTUS, the end of “Meme Season” is still wild…

By Cookie

“Meme Season” is gradually coming to an end. In the past month, meme tokens have been praised by players who have earned a lot, and have also been controversial in the market. Now, the most FOMO period has passed, just like the highest climax of a song has been played, and it is entering the end. But at the end of “Meme Season”, there are still many “ingenious” new projects. Are they opportunities or crises?

ben.eth’s $BEN and $PSYOP

$PSYOP may be the craziest “gamble” in this year’s “Meme Season”.

- NFT as a wallet: What innovations will the new standard ERC-6551 bring to NFTs?

- Where’s the next opportunity? A review of the potential projects that will issue tokens on the Sui blockchain.

- Overview of Bitcoin DeFi ecosystem projects

Send ETH to the ben.eth address and bet that ben.eth will send $PSYOP tokens to your address. Yes, you read that right, you’re not even betting on how much $PSYOP will rise, but you’re betting on whether you’ll get the $PSYOP token in the first place!

ben.eth raised about 3,800 ETH (about $7 million) through “direct money transfer” pre-sale in just a few days. (Note: The pre-sale has ended, please do not send any assets to the ben.eth address!) Before the launch of $PSYOP, ben.eth also launched another meme token $BEN on May 5th. Ben.eth obtained about 55 ETH through $BEN, and the market performance of $BEN was also very average at the beginning. But on May 8th, Bitboy Armstrong (@Bitboy_Crypto), a million-dollar influencer, suddenly shouted out for $BEN, and $BEN took off. (Related reading: “Standing at the peak of Meme, how did Ben become a legend in crypto from an unknown junior?” )

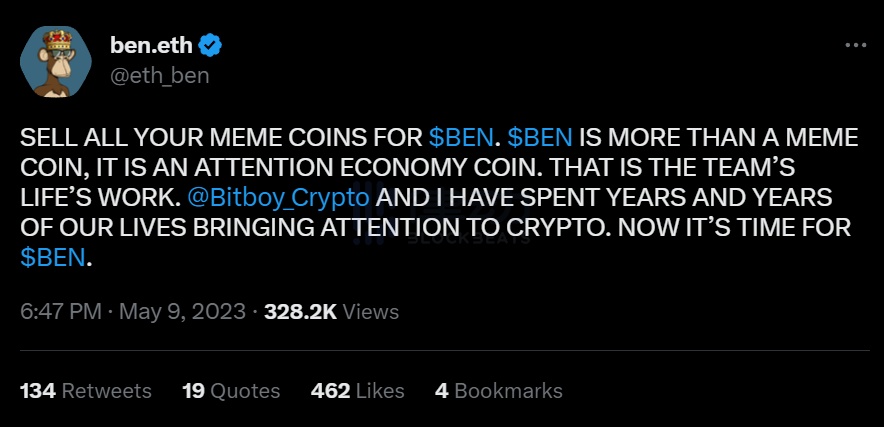

The next day, ben.eth tweeted that $BEN is a “attention economy” token, the result of him and Ben “Bitboy” Armstrong injecting traffic into the crypto world year after year, and he “deeply” shouted out for $BEN again.

Ben.eth went crazy on his Twitter, chanting “$BEN, $BEN, $BEN”. According to socialblade data, the number of tweets from ben.eth increased by 1965 during the week of May 5th to May 11th. His fanatical call to action drove the price of $BEN up to 200 times its original value. However, don’t cry just yet, because ben.eth turned around and sold the $BEN project.

On May 12th, Bitboy Armstrong tweeted that he had reached an agreement with ben.eth to fully take over $BEN, and ben.eth would step back as an advisor.

A 15-minute chart of $BEN. The feeling of "bad news is out" seems to have dissipated after ben.eth's exit, and $BEN's price has rebounded after stabilizing.

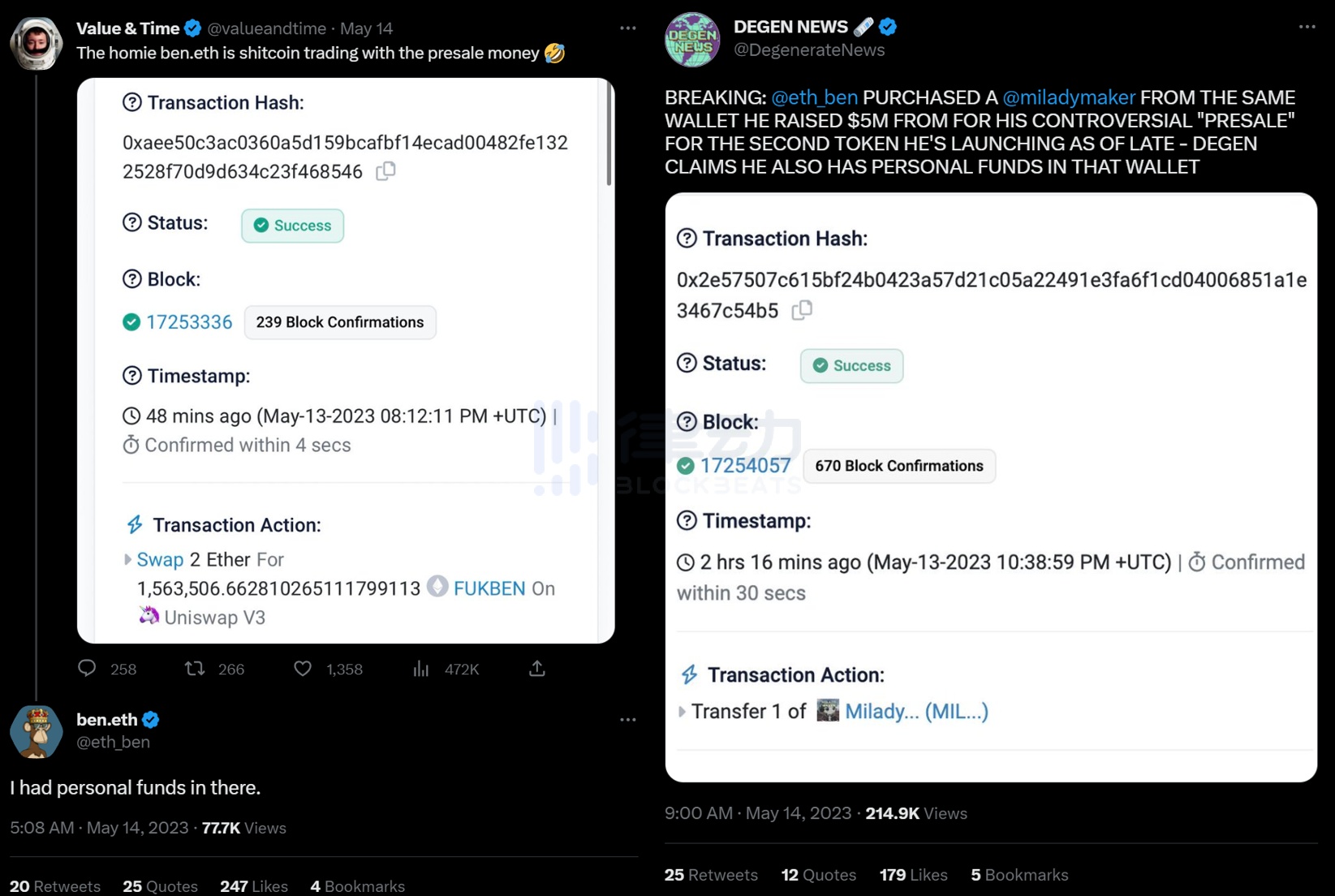

One day later, ben.eth brought the traffic accumulated from $BEN to his new project – $PSYOP. As of today, the $PSYOP Token contract has still not been deployed, with two small controversies of “dev running away” and “misappropriation of public funds for personal use” in between.

On May 13th, ben.eth announced that "dev has run away", and players continued to maintain their humor in anxiety: "dev has run away" or "dev is dead", a standard "Rug"!

On May 14th, someone discovered that ben.eth used assets under his address to “buy Dogecoin” and a Milady. Ben.eth explained that his address has not only the funds raised by $PSYOP, but also his personal assets.

Players are willing to participate in this “gamble” because they believe that ben.eth is a master of the “attention economy” and has accurately seized the “meme season” that was completely detonated by $PEPE, using exaggerated calls to action to attract more fans. During January to March of this year, he only gained 849 followers. In April, his number of followers increased by nearly 2500, laying the foundation for his $BEN and $PSYOP projects.

Example of ben.eth's short selling, "abandoning the dog and investing in frogs"

While the fundraising method of $PSYOP, which is to “directly pay money,” may seem absurd, this method itself is a great story that attracts “attention.” This is the madness of $PSYOP – in order to pursue profits brought by “attention,” it uses real money to support the promotion of “attention.” Profit and risk come from “attention”, will bold players win?

The “blacklist” of $PEPE and $LADYS

$PEPE and $LADYS are both stars of this year’s “meme season.” Their common point is that they both have a “blacklist” function in their contracts. Once an address is “blacklisted,” all $PEPE/$LADYS tokens under the address cannot be transferred.

The ownership of the $PEPE contract has been abandoned, which means that the “blacklist” of $PEPE cannot be changed again, neither added nor removed. This also means that the address 0xAf2358e98683265cBd3a48509123d390dDf54534 will always be alone on $PEPE’s “blacklist”. This address spent 0.013 ETH to buy about 25 trillion $PEPE within a few hours after the trading pair was launched on Uniswap, and was “blacklisted” 8 minutes after the purchase. At the time when $PEPE reached its all-time high, these $PEPE tokens were worth more than 9 million US dollars.

Compared with $mememe initiated by @mememe69696969, the “Milady lineage” of $LADYS is impure. The ownership of the $LADYS contract has not been abandoned, and the LP has not been locked. Even the person who deployed $LADYS is unknown.

The “blacklist” of $LADYS can still be added or deleted by the contract owner. This time, the address 0xAf2358e98683265cBd3a48509123d390dDf54534 was blacklisted again, but this time the address ran away with most of its position and cashed out 52 ETH in profit. The other two “blacklisted” addresses were unable to escape. They spent costs of 9.6 ETH and 7.2 ETH respectively to buy a large number of $LADYS, all of which were locked.

Players have a lot of controversies regarding “blacklist.” Some players believe that the “blacklist” itself is very centralized and should be condemned. Some players believe that, although they do not know the insider of the “blacklist” of $PEPE and $LADYS, they believe that this is a “just sniper” against “rat warehouses.” Some players combine the subsequent actions of DWF Labs continuously buying $LADYS and believe that “blacklisting” is just a “self-directed and self-acted” by the project party.

Transient “white lotus”

“White Lotus” $LOTUS attracted a lot of market attention on the day it was launched on May 9th. Not only because its team is Muse DAO, which has developed an NFT fragmentation platform NFT20, but also because of its “only rise not fall flywheel” combined with Trader Joe’s “flow box” mechanism.

Within the price range of 0.2-4.2 US dollars, a certain amount of $LOTUS is stored every 5 “flow boxes.” Whenever a player spends ETH to buy $LOTUS, the ETH reserve in the pool will increase correspondingly and be locked as liquidity in the pool. When a player sells $LOTUS, a 10% tax will be charged. 8% of this tax will be destroyed, and 2% will be used for staking rewards.

The price of $LOTUS will be rebalanced every time it fluctuates more than 5 “flow boxes,” and the bottom price protection mechanism will be rebalanced. When rebalancing, 10% of the ETH in the pool will be put into the “flow box” adjacent to the current dense trading price to provide direct liquidity, and the remaining 90% will be placed in the position with the latest bottom price based on the total circulation of ETH/$LOTUS. As ETH becomes more and more, and $LOTUS becomes less and less, $LOTUS theoretically achieves the “only rise not fall flywheel.”

With a good team background and a novel mechanism combined with Trader Joe, even Trader Joe’s official push has cued to $LOTUS, and “white lotus” has quickly bloomed.

Then it “withered”… Because only the seller’s tax plus the LOTUS/USDC pool tax on Trader Joe and the Uniswap pool tax did not work, the protected bottom price did not rise as expected. At the same time, the direct liquidity of 10% ETH as a “smashing buffer” is not enough to withstand the first big negative line. After the direct liquidity of 10% ETH was eroded by huge selling pressure, a liquidity vacuum appeared between the bottom price and the current price, and the last thing players saw was a big negative line.

Meanwhile, the “Suicide Squad” run pledge (dev deployed the contract on the mainnet for testing) of $LOTUS was completely locked in the contract, causing a certain degree of division in the community. Dev’s high-intensity work caused a low-level mistake of missing curly brackets in the code of the pledge contract, which led to the $LOTUS run pledge unable to be withdrawn, causing a loss of over a million dollars. Dev said “there will be no refund”, and the community went from unity to a confrontation between run pledge holders and holders on the first day of the launch…

FOMO has risks, and run pledges need to be cautious.

Conclusion

The attractive part of the “meme season” is the high potential returns with short cycle multiples, but the dangerous part is also corresponding to it. Hotspots change quickly, possible malicious behavior of project parties, unpredictable contract bugs… and even playing, the “meme season” quietly passes, leaving us in tears on the mountaintop.

Opportunities and crises often occur in an instant. For example, when $LOTUS started, those who entered and left after reaping several times the increase in price, or fell back and lost blood even if they ran away or took the shuttle, were all three different outcomes. It is very important to develop a risk strategy based on one’s own funding level.

Do not put yourself in an unknown anxiety because of the imagined high returns, which is very dangerous. First, protect your investment when it goes up, do not interact with any unconfirmed contracts to “run” and do not think that “xx Token is the only opportunity in my life”. Increase the probability of seizing opportunities and reduce the probability of entering crises, eat stably and become a “fat man” step by step.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Project Research | Aptos In-Depth Study Report on MOVE’s New Public Chain

- MEV vs. Flashbots: A Story of Natural Rivals and the Delicate Balance of Building DeFi Systems

- From Wealth Effect to Organic Growth: Revealing the Secrets to the Success of High-Quality Cryptocurrency Projects

- HyperCycle: An innovative blockchain architecture for AI algorithm data

- Project Research | Canvas: Focused on DeFi, Layer2 Protocol Based on StareWare ZK Rollups

- Neutron: A new cross-chain DeFi blockchain on Cosmos

- Standing at the forefront of the Meme trend, how did Ben become a cryptocurrency legend from an unknown person?