Q3 Crypto Dapp Report Daily active wallet count increased by 15% compared to the previous quarter, NFT transaction volume hits a new low in the past year.

Q3 Crypto Dapp Report Daily active wallets increased by 15% compared to the previous quarter, while NFT transaction volume reached a new low in the past year.Author: Sara Gherghelas, DappRadar

Translation: Felix, LianGuaiNews

The pace of development in the third quarter of 2023 has been relatively slow, which is often reflected in economic cycles, especially when many participants take seasonal breaks. However, even in the current calm, there are signs that the current market downturn may have entered its final stage. This report will focus on key areas, challenges, and the potential contained within.

Key points

- LayerZero’s Full-Chain Narrative Security Prospects and Ecological Opportunities

- What happened during the first week of the SBF case in a comprehensive article?

- Layoffs, restructuring, strategic adjustments, Yuga Labs, the Web3 Disney wakes up from its dream

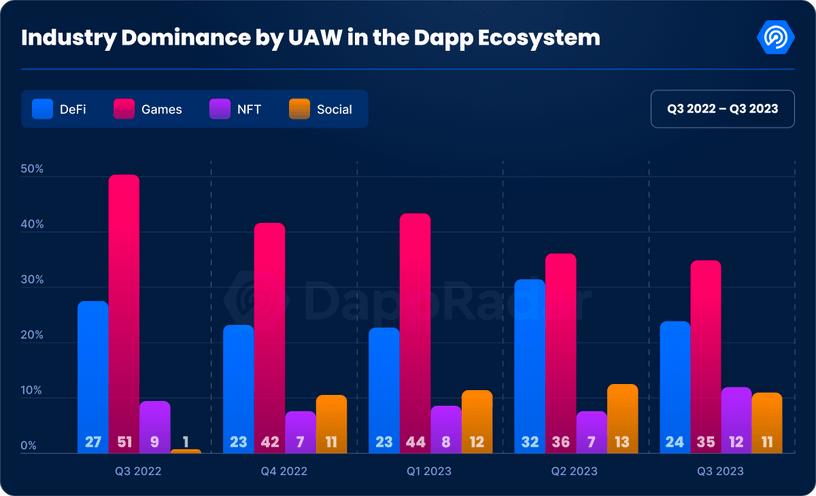

- The number of daily unique active wallets (dUAW) interacting with DApps increased by 15% in the third quarter of 2023, reaching 2.2 million.

- The dominance of games in the market has slightly decreased compared to the previous quarter, while the influence of the NFT track has performed well, accounting for 12% of total industry activity.

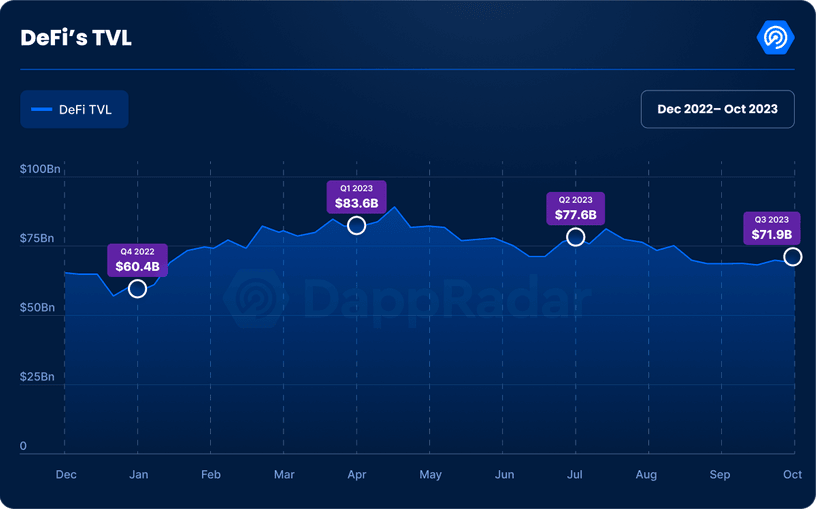

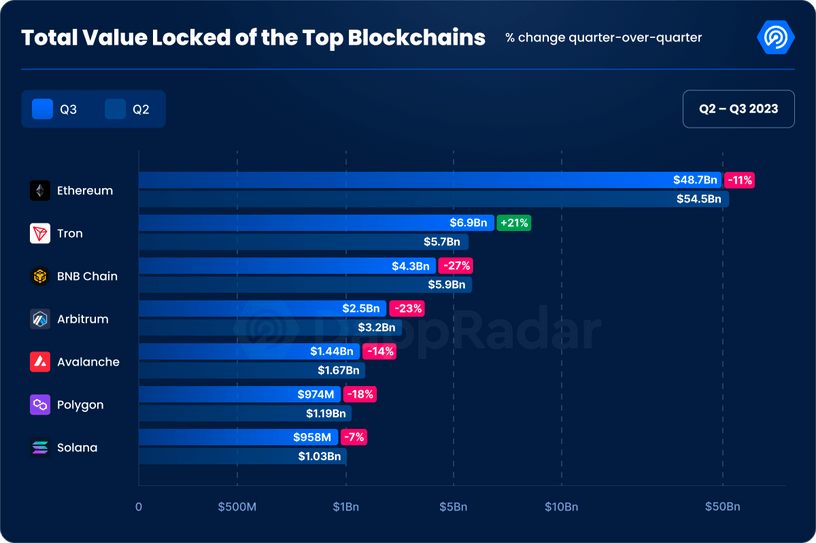

- The total value locked (TVL) in DeFi decreased by 7% to $71.9 billion. Although the TVL of Ethereum decreased by 11%, it still maintains its leading position.

- Base has become an important player in the DeFi field, quickly accumulating a TVL of $378 million.

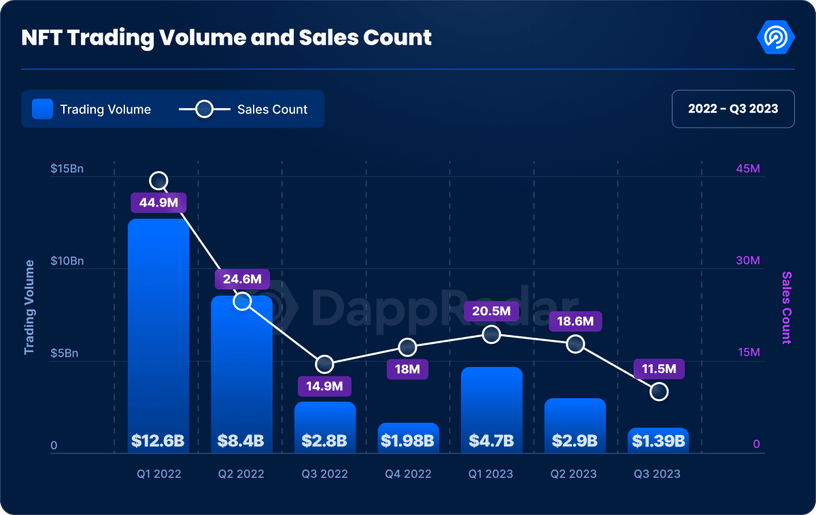

- NFT market indicators such as trading volume and sales volume have reached their lowest levels since the first quarter of 2022, suggesting a shift in the market and changing interests.

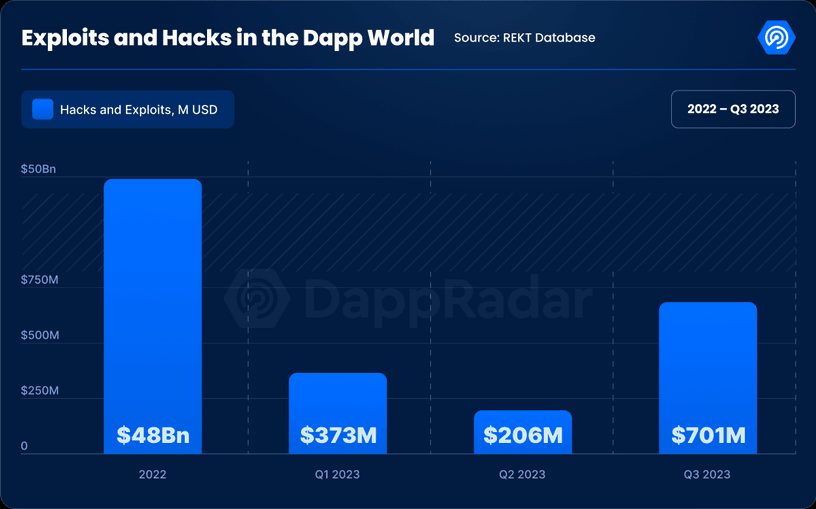

- Exploits and hacker attacks in the DApp field have increased dramatically, growing by 204% compared to the second quarter, resulting in losses of up to $701 million. The Multichain exploit alone caused a loss of $231 million.

1. Overview of the DApp industry

In the third quarter of 2023, the DApp field observed a significant increase in the number of daily unique active wallets (dUAW), with a 15% increase compared to the previous quarter. The average number of participants reached 2.2 million. The main driving factors behind this are the increase in interactions with NFT DApps and the increase in the number of DApps listed and monitored by DappRadar.

Chain games continue to dominate the DApp field in terms of activity. However, their dominance has slightly decreased since the beginning of this year. On the other hand, DeFi has strengthened its cyclicality in the DApp field.

An unexpected situation in Q3 is that 12% of the activity comes from NFTs. Considering the current data indicators and the decline in NFT popularity, this phenomenon is worth noting.

2. Status of total locked value (TVL) in DeFi

In the third quarter of 2023, the total locked value (TVL) in DeFi decreased by 7% to $71.9 billion. This decrease is largely due to the decline in token prices. Taking ETH as a reference, the price of ETH fell by 13% in Q3 and is currently stable at around $1,600.

When evaluating the TVL of major public chains, Ethereum’s dominant position in the DeFi field stands out. Although it has decreased by 11% compared to the second quarter, it can be seen that the overall TVL of public chains is declining.

It is worth noting that the emergence of Base network has quickly attracted market attention. Since the launch of Base, its TVL has soared to $378 million.

3. Overview of the NFT Market

Q3 was an important low point for the NFT market, with trading volume hitting the lowest point since Q1 2022. The negative reports widely seen in the media were indeed confirmed in the data. However, is it fair to judge the entire NFT market based solely on these data indicators?

Although the overall trend of NFTs may be discouraging, there is also a ray of hope in Q3, as the traditional web2 sector has entered the web3 through NFTs. It is worth noting that the sales of generated artworks have surged. An example is 99-year-old algorithmic artist Vera Molnár, who entered the NFT market for the first time and achieved a trading volume of 992 ETH in just one week.

Therefore, although the trading volume in the NFT field may no longer be as astounding as in the past, its utility and recognition have undergone significant changes. The era of super collectibles and avatars may be fading, but in their place, there is a growing demand among crypto enthusiasts for the practicality of NFTs. Consumers are attracted to NFTs that can provide real value, such as membership passes or other functional benefits.

4. Top 5 NFTs by Quarterly Trading Volume

Looking at the top 5 NFTs in Q3, Yuga Labs stands out once again, demonstrating its dominant position in the NFT field. However, interestingly, despite the overall declining trend, the sales of three of these five series have actually surged, possibly due to a significant drop in floor prices, with the floor prices of most NFTs dropping by over 40%. The price reduction has provided newcomers with a more affordable price and the possibility to expand the user base.

Azuki and Yuga Labs performed well in Q3, but the most outstanding series in Q3 is undoubtedly Pudgy Penguins. With the launch of Pudgy Toys and the Pudgy World in September, it has redefined innovation in the NFT field. Pudgy Toys, as the first mass-market NFT product, is directly authorized by the community. The intention behind these innovations is commendable – to unveil the mysterious veil of the complex blockchain world and present it as a bridge or “Trojan horse” to enter the traditional toy market.

To top it off, these toys have entered the mainstream market in the United States and found a place on the shelves of major retail giants such as Amazon and Walmart.

These innovations not only enhance the market position of Pudgy Penguins, but also demonstrate the potential and adaptability of NFTs, reflecting the feasibility of gaining wider consumer recognition.

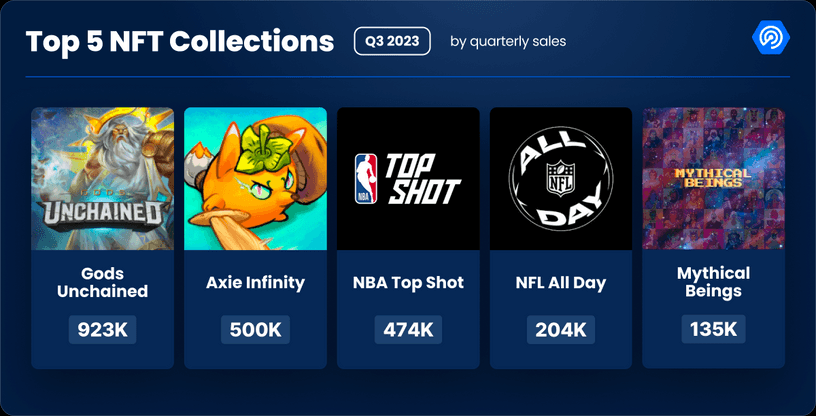

5. Top 5 NFTs by Quarterly Sales Volume

The top 5 NFTs all belong to the gaming industry. This consistency reinforces the notion that NFT games have the greatest appeal in the Q3 NFT field. Clearly, the synergy between gaming and NFTs continues to attract users, highlighting the ongoing momentum and potential of this unique intersection in the digital space.

6. Exploitation and Hacks Increase by 204%

The number of vulnerabilities in the Q3 Dapp field has significantly increased, resulting in hacker attacks, exploitation of vulnerabilities, and fund theft. The losses in just this quarter amounted to a cumulative total of $701 million, a 204% increase from the previous quarter.

The Multichain vulnerability incident is one of the most serious security events in Q3, causing $231 million in losses. On July 10th, Multichain experienced a major vulnerability, allowing unauthorized attackers to infiltrate their system. This intrusion resulted in a large amount of funds being stolen from different chains, highlighting the urgent need for strong security measures in the Dapp field.

7. Conclusion

As Q3 2023 comes to a close, the Dapp field continues to evolve and presents a complex development trend. The daily number of unique active wallets (dUAW) is steadily increasing, primarily due to the increased interaction with NFT Dapps and the addition of new Dapps to the ecosystem. Ethereum continues to maintain its dominance in the DeFi field.

The NFT market, despite facing some resistance, has demonstrated resilience and adaptability. The convergence of traditional industries with the Web3 space, especially in the gaming sector, highlights the intrinsic value and immense potential of NFTs.

However, it is important not to overlook the challenges. The sharp increase in losses due to vulnerabilities and hacker attacks (especially the Multichain incident) indicates the urgent need to strengthen cross-platform security and vigilance.

In conclusion, the third quarter of 2023 is a period full of challenges, resilience, and potential. The lessons learned in Q3 will undoubtedly contribute to shaping the strategies and approaches for future development.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Not getting rich by speculating on coins, this user received a multimillion-dollar reward from the tax authorities for paying taxes on a trading platform.

- Port3 Network Research Report From Web2 to Web3, Building a New Social Data Layer

- Opinion Change in Speaker of the U.S. House of Representatives may be detrimental to the crypto world.

- Former close friend to testify against SBF, list of other witnesses revealed.

- Weekly Financing Report | 16 public financing events; Oracle Supra completes over $24 million financing, with participation from Animoca Brands, Coinbase Ventures, and others.

- Su Zhu being sentenced to prison, will the four-month imprisonment time be extended?

- Amazon’s participation and the skyrocketing value of AI company Anthropic become FTX’s biggest hope of repaying the debt?