Standing on the shovel of Staking, who is the new Bit Continental?

A quarter of the past 2019 has been passed. If there is anything big enough to affect the development of the industry during this period, the Ethereum consensus mechanism will gradually shift from PoW to PoS or can be selected. Ethereum, the second-largest cryptocurrency market value, “turned around” directly expanded the market for PoS, and the main online line of the public chain Cosmos also attracted a lot of attention. Staking, which was born with PoS, has quietly become a new hot spot in the industry.

As a public interest reward, Staking's high income has attracted many players to enter the market. This business is becoming more and more attractive, but how to draw a blueprint for Staking, there are still many places worth exploring. To this end, PANews interviewed Li Chen, CEO of HashQuark, a PoS pool under the Hong Kong HashKey Group, to gain insight into Staking's business opportunities from an industry perspective.

Staking is still a blue sea

Under the consensus mechanism of PoS (Proof of Stake), nodes need to be responsible for packaging transaction information, maintaining network operations, and participating in community governance. This process is Stake. As a reward, the node can obtain the system's additional tokens. The way of this kind of income is Staking, which is essentially rewarded by exercising power. Because the responsibilities of the nodes are similar to those of the miners in the PoW, the process of the node Stake is also referred to as “mining”, and Staking is equivalent to mining rewards.

- Cross-chain interaction and continuous steady state thinking based on the main chain structure of the main sub-chain structure

- "Zombie coin" resurrection, "model" value is difficult to see

- IBM applies for a new blockchain patent to manage autonomous vehicle data and human-car interaction

At present, the mainstream Staking has two ways, one is to hold the currency, that is, mining, for example, in the typical PoS public chain Cosmos or IOST, the holder of the currency will mortgage the token to the node and can directly obtain the corresponding dividend. The other is “delegation” mining, which usually occurs in the DPoS chain of the derivative mechanism of PoS. At this time, the holder of the currency needs to vote for the node (the currency is mortgaged to the node), and the selected node receives the proceeds and then returns it privately. user.

In addition to the above-mentioned holding and mining, the PoS pool also has some emerging models, such as Filecoin's LPFS storage, ie mining. But Li Chen said frankly, "This new model is not like the first two have been tested by many practices, so we just want to explore and understand, if it is good, we may have to deal with it."

Compared to PoS mining, PoW mining has long formed a complete commercial closed loop. In this closed loop, there are chip manufacturers and mining machine manufacturers in the upstream, mines and mining pools in the middle, and miners in the downstream. Mining machine manufacturers sell miners to miners, and miners dig out coins that benefit the market. This business model may even be the only mature model in the blockchain industry. With the record highs in 2017, the participants in the early PoW mining have gained excess profits and earned a lot of money. However, in the bear market in the second half of last year, the price of coins fell, the computing power increased, and the cost was high. PoW mining fell.

The bear market has exposed the drawbacks of PoW mining, which is that it increases the energy consumption while accumulating the power, which means the increase of fixed costs and the decrease of income. More importantly, this will trigger a chain reaction when the income is insufficient to support the cost. At the time, the mining machine, the reduction of miners will increase the security risk of the PoW public chain, and 51% of attacks become easier. It is precisely to see these shortcomings, Li Chen judged, "The future public chain of PoW may be led by bitcoin, no more than ten, and the remaining public chain will be PoS or DPoS, and even other consensus will emerge in the future. The market for Staking will be quite extensive."

Moreover, PoS mining is a light asset-type business, with no high cost due to site, machine, and energy consumption. Because PoS mining requires only one server, "one server can dig a lot of currencies, which is quite In the installation of a wallet, Li Chen further explained.

But there is a more important reason for attracting players like HashQuark to enter PoS mining – the market for Staking is still a blue ocean. In this blue ocean, there is no mine tyrant such as Bitumin. "The core of PoW mining is the chip. The chip is not a day's work. It requires a lot of manpower and material resources, and the giant has already done so mature. It’s really hard to catch up with them.” On the contrary, Staking’s segment is still in its early stages, although there are fire coins, squid hatching Cobo wallets and Bit.Fish, Babbitt’s MATPool pool, but there is no There is a giant who eats all over the world, so in the eyes of Li Chen, the market of Staking is full of opportunities, everyone is on the same starting line.

The bear market is “daytime” for Staking, which allows the market to see the advantages of Staking. Moreover, "Tianshi" also brought "human harmony". In Li Chen's view, "When the market is stable at a relatively low position, everyone's willingness to trade is reduced, but they hope to have a profit, so they will participate in PoS mining. ”

Staking's huge imagination

Want to stand on the shovel of Staking, we must first understand the essence of Staking.

In Li Chen’s view, “Staking is a savings business.” But this kind of savings is not the same as bank savings. The more money you save, the more you get. The blockchain industry has its own rules of the game. "Staking has a mechanism. The principle is not that the more coins, the more you must dig. This is not linear. Staking core is the more coins you pledge, the higher the probability of mining. So how much is the main network every day? The token being used by Stake is a very important variable in PoS mining."

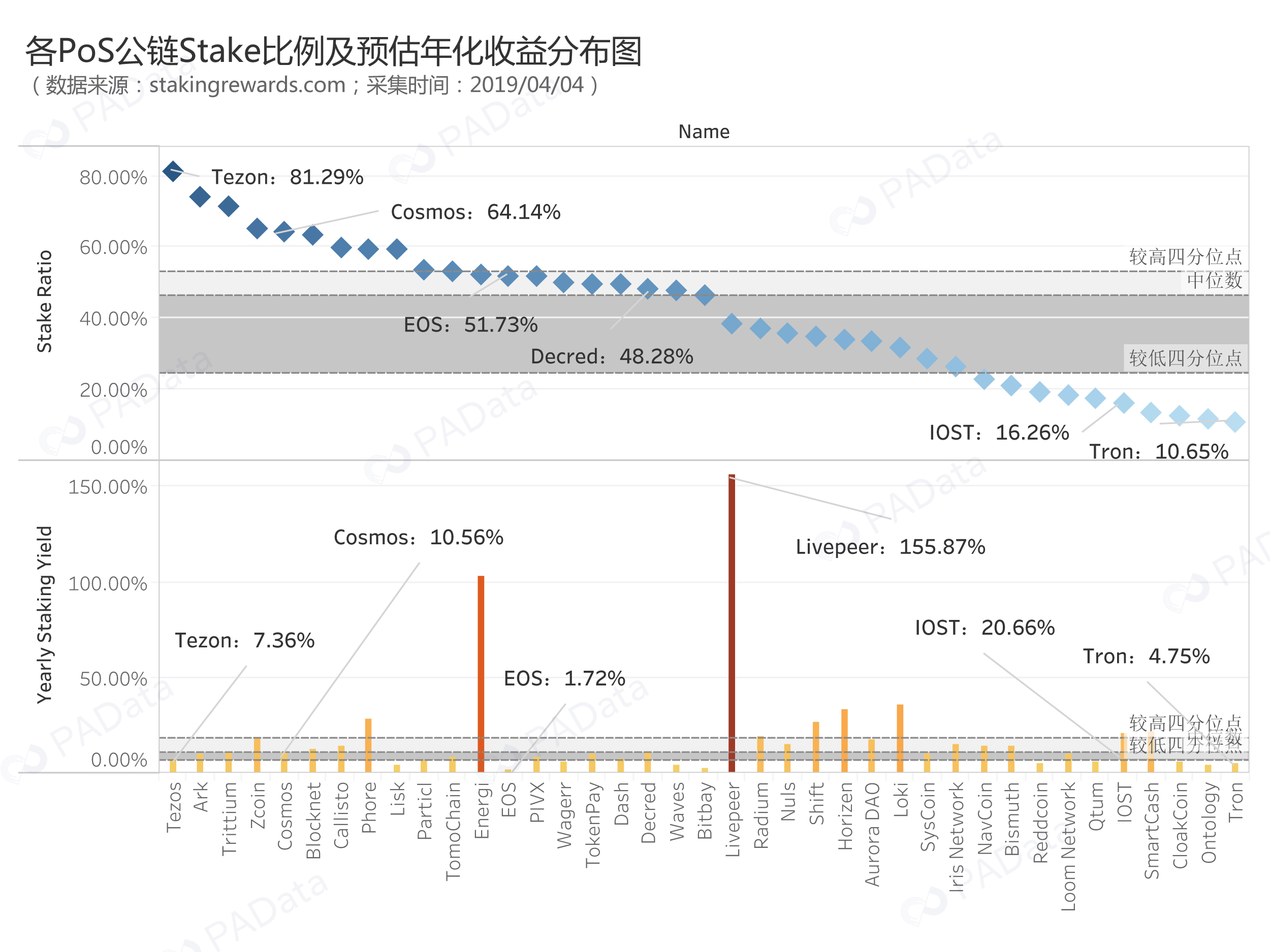

According to the data of stakingrewards, the Stake ratios of various public chains vary greatly, with a maximum of 81% and a minimum of about 10%, but half of the PoS public chain in the statistical range has a Stake ratio of more than 46%. Moreover, there is no correlation between the Stake ratio and the annualized income. The median annualized income of the PoS public chain in the statistical range is about 10.5%. Surprisingly, the annualized income of Etaking, the origin of Staking, is only 1.72%. In the eyes of the industry, the benefits may be too high or too low.

From the HashQuark official website PANews found that the HashQuark mining pool mining revenue is higher than the main net mining revenue, Li Chen introduced, which is mainly due to the algorithm model developed by HashQuark. “This is our core competitiveness, because Staking is a probabilistic event. By calculating the Stake rate, we can find a model, that is, at a certain ratio, the income can be the highest.” This is also the PoS mine pool compared to the individual directly digging The biggest advantage of the mine.

The savings model is not only good for individual money holders, but also an opportunity for the Token Fund. Especially in this downturn, the Token Fund has a very low trading frequency, but at the same time it hopes to add value. Because of the large amount of money from the Token Fund, Staking is like a “free lunch” for them.

In addition to this most primitive and basic savings-free savings model that does not involve transactions, Li Chen believes that Staking's business model still has a lot of imagination, and these imaginary spaces need to be associated with specific scenarios. For example, Staking can empower a wallet. Most of the wallets on the market today are relatively monotonous, only storage functions, and there is not much added value. But in Li Chen's view, if the wallet is combined with Staking to empower the wallet business, "the tokens stored in the wallet, if used for mining, will have a fixed income every day."

The far-reaching impact of Staking may be to increase the user's revenue, thereby activating and even attracting more people to hold the currency. Originally, it was a hosted process for users to have coins in their wallets. The user needs to pay the escrow, but in Staking mode, the managed buyer and seller are reversed. Because Staking's hosting can continue to generate value, the host will naturally benefit the user in order to win more hosting. Li Chen said that he is very optimistic about the new business model that may be derived from this situation.

There is also an airdrop business that can also be empowered through Staking. "Now the airdrop service is to find an address to vote, it is very inefficient and blind, because it can not judge the real situation of the address", but Staking can solve this problem, because the process of mortgage, voting can naturally determine the authenticity of the address Sex, as a result, airdrops can be targeted, which is a way for the project side to improve resource utilization.

In fact, in terms of the combination of Staking and application scenarios, the rental of DAPP on EOS is a relatively good business model. Already some EOS super nodes have started the EOS leasing business, and the current 7-day annualized income of leasing one EOS is about 0.03%. Because EOS is behind the CPU and RAM resources, the DAPP's sizzling and super-node campaign mechanism has made the leasing industry more prosperous.

Staking is the realization of the team's comprehensive ability

For PoS or DPoS mining, it is important to be a node, and only nodes are qualified to mine. Although PoS mining does not require a lot of fixed costs, it is also necessary to invest a certain amount of money to become a node. For example, last year's smash hit EOS super node campaign is a "capital war."

Therefore, the market has always questioned the “capital determinism” of PoS or DPoS consensus, but Li Chen has different opinions. He believes that “To be elected as a node, you do not necessarily need to have a lot of coins, and more importantly, you To attract others to vote for you, from this perspective, the cost pressure of the node campaign is shared by the node team and the community, and in the case of EOS, even if it cannot become 21 super nodes, entering the top 100 candidate nodes is still There are gains."

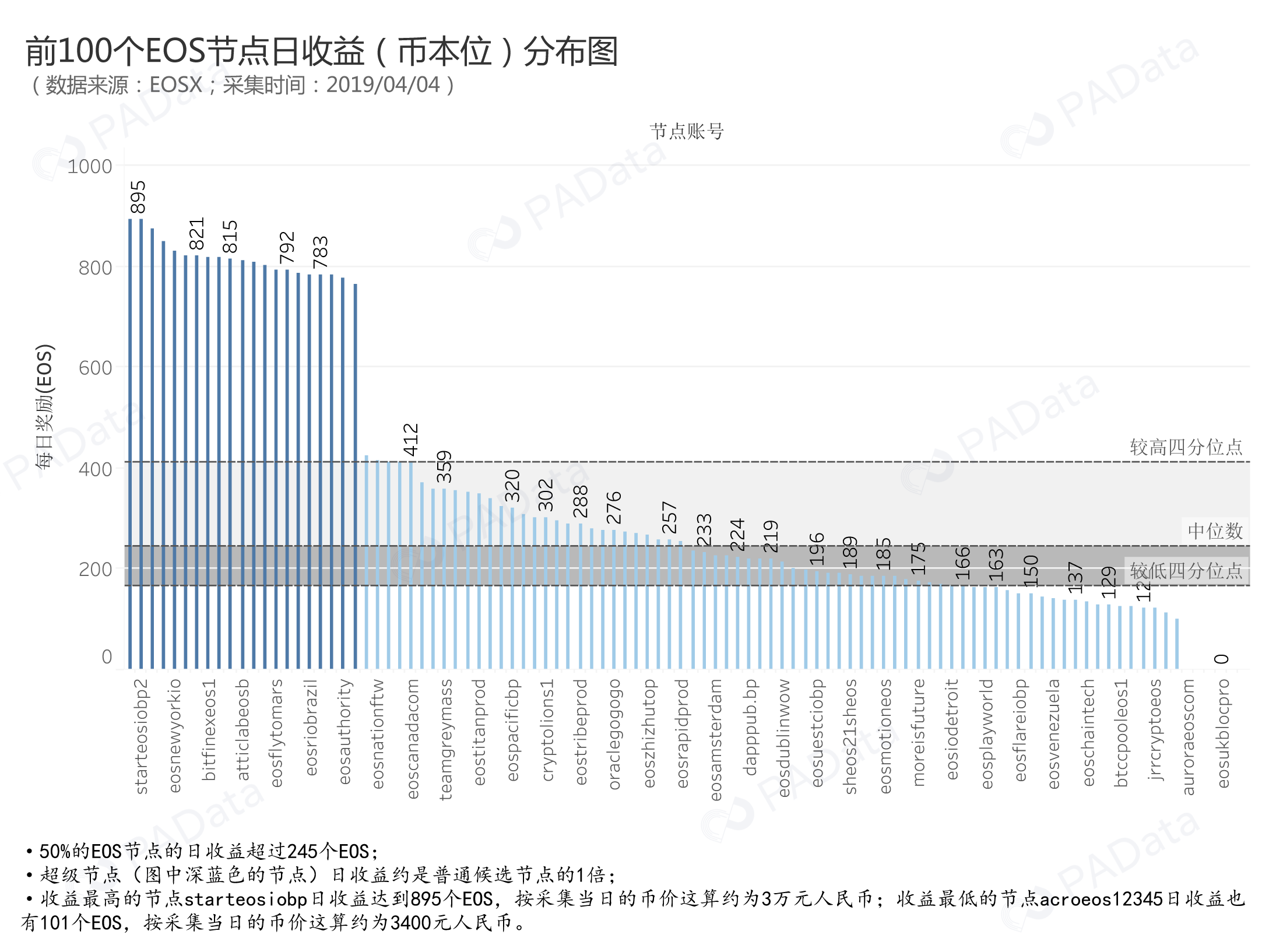

According to the statistics of the blockchain browser EOSX, it takes nearly 100 million EOSs to become one of the 21 super nodes, and the top 100 nodes to enjoy at least 10 million EOS. These costs are almost entirely borne by the node team. It is impossible. Moreover, although the daily income of the super node is 1 times that of other candidate nodes, more than 50% of the nodes in the first 100 nodes can obtain daily income of 245 EOS or more, and the lowest daily income of 101 EOS, which means Estimated by the price of the currency on April 4 (around $5), even the lowest-income node team can earn about 3,400 yuan per day. This data supports Li Chen’s judgment.

If capital is not the core of Staking, what is the core of Staking?

Li Chen's answer is that Staking is the realization of the comprehensive ability of the node team.

This comprehensive ability includes many aspects, Li Chen explained, the first is the reputation of the node team itself. Because everyone needs to vote for him, some people who do not support voting still need to transfer coins, so the prestige is very important.

The second capability is the security capability. The security of PoS mining should be investigated from two aspects. Internally, it is necessary to ensure that the node can continue to block. Externally, if it is necessary to deposit coins, the node should also prevent it. Hackers steal money.

Furthermore, cashing in also considers the community influence of the node team. Node campaigns and political elections are very similar. Voters look at how much the node team does in the community and how much it contributes. For example, Li Chen said, “I have seen some nodes. They don’t have any money. They rely on community governance, constantly making voices, and constantly doing activities. They can also become a node.” This is also an important reason why HashQuark is deeply involved in the community. They hope to promote community governance by freely translating technical articles and disseminating research results to improve their community influence.

The importance of the above safety capabilities stems from the fact that safety is one of the factors that PoS mining is currently questioning. This may be related to the nature of Staking. Li Chen explained, “The essence of Staking is online mining. In fact, it is straightforward. It’s the hot wallet mining. So the security risks facing Staking may be similar to the hacking attacks that DAPP suffers.”

In this regard, according to Li Chen, HashQuark has some unique countermeasures. “The mining machine we mine does not connect directly to the main network, but it has a lot of bends in it, and there are many obstacles and traps. On the other hand, we also cooperate with some better security teams. Time to get all the security information."

PoS mine pool may become an industry fuse

"We hope to form a win-win situation." Li Chen said that the win-win includes PoS pools, users and project parties. For the PoS mining pool, the more mining coins on the line, the more likely it is to attract users of different public chains, and the user base of natural mining pools has expanded. For the user, through the mine pool, the user may discover and hold other tokens. In the same way, for the project side, the users of the other public chains can be contacted through the mining pool to expand the market. Therefore, Li Chen repeatedly mentioned that what HashQuark has to do is actually the link point of the whole industry, and the goal is to open up the liquidity of the entire industry.

Of course, this effective connection is based on quality projects, and only then can a virtuous cycle be established. Li Chen provides two criteria for judging the quality of the project, which also has the same reference for ordinary users to choose the type of currency.

The first criterion is the technical clearance. However, ordinary users are not everyone who is proficient in blockchain technology. At this time, it can be judged from the private placement time and the main online line. “In general, private equity for more than one year can have a high probability of avoiding a lot of air coins, and if the public network of the public network is already online, it is likely to be a good project.” The second criterion is community activity and community activity. The higher the project, the more likely the project will continue to grow.

If the PoS pool can become a fusion agent in the industry, the impact on the entire industry is undoubtedly huge. In addition to the technical bottleneck, the number of participants is not an important factor in the development of the industry. Perhaps Staking can attract more people into the blockchain industry through real gains.

(Source: PANEWS)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The gambler's bitcoin carnival: the world financial situation changes, and bitcoin is a future pass

- Market analysis: BTC high shock, short-term retracement risk increased

- Blockchain should not pursue efficiency: stratification of blockchain system

- Blockchain Manager Index released: March industry outlook is generally good

- V God's latest autograph: "How did you get cheated?"

- Is the blockchain + shipping flower opening right?

- The lightning network was bombarded, and BM said its purpose was to "hijack the core protocol of Bitcoin"