FTX shatters Taylor Swift’s crypto dream, $100 million collaboration also falls through.

FTX ends $100M collaboration with Taylor Swift, crushing her crypto aspirations.Compiled by: Blockchain Knight

Taylor Swift’s partnership with the now-bankrupt crypto exchange FTX has been a subject of much speculation, with a previous report from CNBC suggesting that the pop star had agreed to the deal before the exchange ultimately backed out.

This contradicts previous claims made by a class-action lawsuit lawyer, who suggested that Taylor had already backed out of the contract.

According to CNBC, after six months of negotiations, Taylor’s team signed a $100 million deal with FTX.

- Vertex: A rising star in the derivatives DEX market, with a daily trading volume market share of around 10%.

- Multichain, the cross-chain bridge, is once again caught in controversy

- Some thoughts on heavy collateralization: What are the opportunities and challenges?

The signed agreement sat in FTX founder SBF’s inbox for weeks until a group of executives convinced him not to go through with the deal.

It is unclear whether this news will impact the ongoing legal action against FTX and SBF.

However, Taylor had agreed to a partnership agreement with FTX. While this was publicly denied previously, it may weaken the credibility of some statements made by the exchange and its executives.

FTX’s withdrawal from the agreement after Taylor had agreed to it indicates that the company may be facing financial difficulties or other internal issues.

Regulators or other authorities investigating FTX and SBF for alleged wrongdoing may see this as a warning signal.

Overall, all parties involved in the legal action are likely to take an interest in this news and may consider it as part of their investigations. However, it is too early to tell whether it will have a significant impact on the outcome of the case.

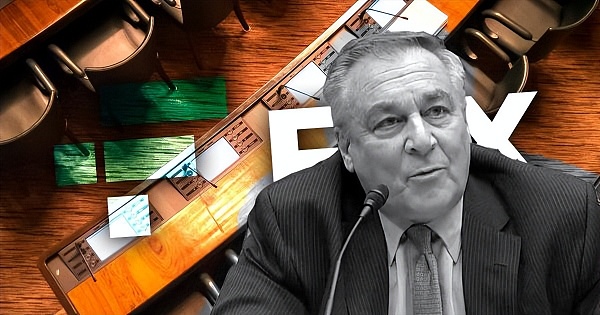

FTX founder SBF has been charged with multiple crimes by a New York court for stealing billions of dollars from customers.

On Tuesday, Judge Lewis Kaplan rejected the dismissal of 10 out of 13 charges against SBF, including charges related to campaign finance violations and bank fraud.

Kaplan also denied SBF’s legal team’s previous argument that “some charges were added after he was extradited from the Bahamas, so they should be dismissed.”

Last December, the U.S. government initially charged SBF with eight counts, including telecommunications fraud and conspiracy to launder money.

In February, prosecutors added four more criminal charges, one of which alleged that SBF conspired to bribe Chinese officials, and in late March, a fifth charge was added.

The decision was made on the day after John Ray, a former manager at Enron, published a report.

John Ray took over as CEO of FTX after it applied for bankruptcy and publicly disclosed the inner workings of the crypto company prior to its collapse in November last year.

In addition, SBF has been charged with a 13th felony for bribery by federal authorities.

The federal authorities allege that SBF attempted to bribe Chinese officials with $40 million worth of digital assets to unfreeze his hedge fund Alameda Research’s account. The prosecutors claim that the frozen accounts contained digital assets worth more than $1 billion.

SBF has pleaded not guilty to eight of the charges, and it is worth noting that if he is found guilty of all charges, he could spend “more than 155 years in prison.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis of the Massive Abnormal Outflow of Multichain Tokens: Not Simply a Hack, Nor Loss of Complete Control due to Uncontrollable Factors

- A glimpse of the emerging new use cases for ZK: zkML, ZK Games, ZK ID

- Decoding the DEX newcomer Vertex: average daily trading volume of about 40 million US dollars in the past 7 days, with a daily trading volume market share of about 10%.

- Can ERC’s Finalize establish its orthodox status?

- Inverse Finance: A Rebirth from the Brink of Death?

- “The Three Pain Points” of Digital Asset Trading

- Multichain crisis reappears as over $130 million in token liquidity is withdrawn