Starting to sell 8 bitcoins in 2 hours, is Bakkt’s bull market myth gone?

On September 23, at 8 pm EST, Bakkt, a cryptocurrency trading platform under the US Intercontinental Exchange (ICE), finally started. The first bitcoin futures contract was sold at $10,115.

This marks the first US-regulated bitcoin futures product with physical delivery.

The deal was "too late" for Bakkt. In August last year, the ICE Intercontinental Exchange announced plans to set up a subsidiary, Bakkt, which had a high-profile shot of Wall Street's cryptocurrency market. At the beginning of its birth, Bakkt received $183 million in financing from Li Ka-shing's Victoria Harbour investment, Tenspers, the largest shareholder behind Tencent, Microsoft Venture Capital M12, and Goldman Digital, Goldman Sachs. The valuation exceeded 740 million. Dollar.

In ICE's ambitions, Bakkt will be a new platform for financial institutions, commodity traders and consumers to deliver digital asset trading, storage and payment services. At that time, Bakkt also had the aura of “cryptocurrency NYSE”.

- Bakkt officially launched, taking stock of the advantages of Bakkt, why is the bull market still not coming?

- Bakkt is officially open for trading, there are 5 things you don't know.

- Dutch oil and gas giant Dietmann uses blockchain platform to simplify the deployment of projects on the chain

However, since Bakkt's first futures product has been required to collect three licenses including transaction (DCM), liquidation (DCO) and custody, it has suffered three delays since its announcement.

In August of this year, Bakkt announced on the official blog that it was approved by the New York State Department of Financial Services (NYDFS) and the New York State Trust Licensing Authority, officially took the last license, and finally ended the one-year jump ticket career.

Bakkt, which has experienced many difficulties and started in the eyes of the public, did not explode on the first day. This has caused some disappointment, but many people still optimistic about it.

Is Wall Street underpowered? Bakkt underperformed on the first day

Is Wall Street underpowered? Bakkt underperformed on the first day

What is the Bakkt score?

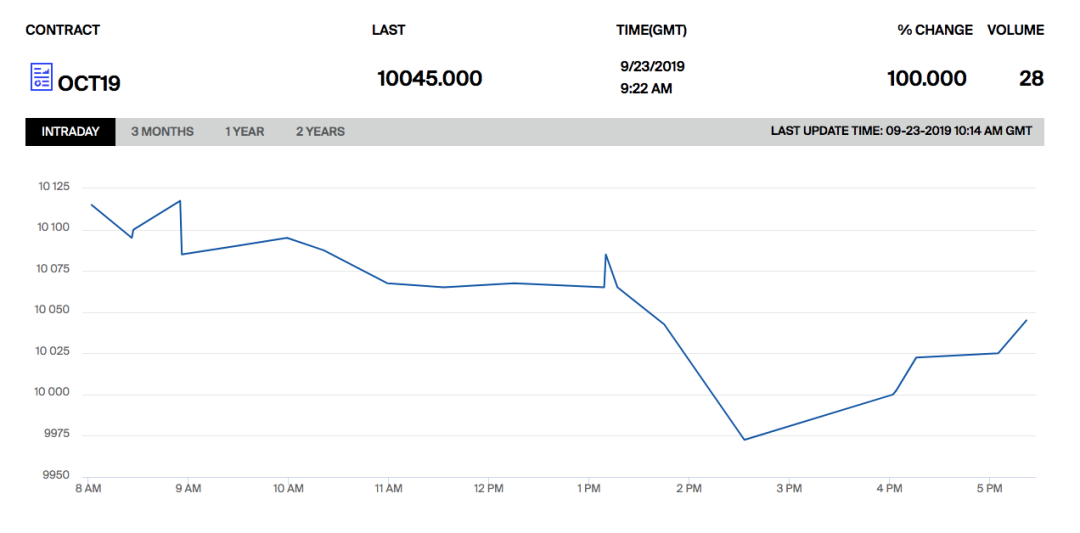

Bakkt's Bitcoin (USD) futures products are divided into daily contracts and monthly contracts. Two and a half hours after Bakkt started, Bakkt showed that 8 transactions had been completed and 8 bitcoins had been sold. It is still growing. As of 5 pm, 28 bitcoins have been sold.

Two and a half hours of eight transactions, and a total of about eight BTC transactions, is clearly far from the expectation of "Wall Street funds come to the fore". In contrast, CME Group Bitcoin Futures is Its first week's transaction volume was $460 million, and the current transaction volume is about $700 million.

In addition, although there is a halo of “bull light”, the spot market of Bitcoin does not seem to be bought, and the reaction is dull. Before the deadline for publication, the price of Bitcoin only rose by 0.5% to about US$9,950. Recently, Bitcoin has been trading for more than $10,000 for several months.

The high expectations of the fall have caused many negative voices to emerge. Some people pessimistically sighed that "Bakkt's good fortune has already been exhausted", "Does professional institutions have faith in Bitcoin? Don't dream.", "Continued for one year." "The hype"; others ridiculed that "Well, Wall Street is for us to take over?", "The real trading volume of the currency circle, all in Bakkt?", "It is time to release the old leeks that Bao Erye raised in the country."

In fact, the above guess is not unreasonable. The weakening of Bakkt's enthusiasm may be one of the reasons for Bakkt's poor performance on the first day. After all, since the first announcement at the end of 2018, with the continuous delay of the launch time, the cryptocurrency community has turned to Bakt's mood from high to calm, and there is no shortage of patience.

Yesterday, cryptocurrency analyst Alex Kruger conducted a poll on 2,777 people on Twitter. The test found that people who thought that Bakkt would be hit and that Bakkt would not be hit were equally divided: 49% voted for " Failed, and 51% voted for "success."

But what's more remarkable is that Bakkt's main customers are also regarded as the most likely institutional funds to bring new upgrades to the cryptocurrency market. Where else? Maybe still waiting to see.

Previously, the Odaily Planet Daily was in the "Bakkt of Li Ka-shing's exchange, can you really let Bit Street buy Bitcoin?" The article pointed out that although Bakkt is expected to solve the problem of compliance and hosting, but the traditional investor's interest in encrypting digital currency, Bakkt can not be changed at a time, the Institute of Credit Research said that the encrypted digital currency appears to be intrinsically intrinsic. Value, or the inability to use traditional valuation methods to calculate intrinsic value, has led many investors to “don’t understand” or believe that their investment has a very low margin of safety, which makes them uninterested.

In addition, the expected optimism about institutional funding is also the reason for this failure.

Despite the recent frequent action of the organization, it is considered to be the biggest driving force for the recovery of the digital currency market in 2019. According to Zhao Changpeng, CEO of the Onkyo Exchange, retail investors are still playing a key role in promoting the sharp rise in bitcoin prices. The growth rate of institutions is growing at a faster rate. Although the institutions and retail transactions of the company are growing, the proportion of retail investors in trading volume is about 60%, which is roughly the same as last year.

Zhao Dong, founder of DGroup & Bitfinex, also told the Odaily Planet Daily that the admission of institutional funds is not as optimistic as we imagined. He said that with regard to its observation and experience in the OTC market, when a large amount of incremental funds come into the market, huge amounts of money often do not ask for price. "The craziest time is to sell one or two billion bitcoins a day, can sell A 10% premium, this is called a bull market. Now this wave is called a family office. For crypto assets, it is a small asset allocation, and there is no resonance in the whole market."

However, there is still a voice that does not have to amplify the initial trading volume of the downturn.

Todaro, director of research at TradeBlock, an institutional trading instrument provider, said optimistically: "As the digital currency space matures and the time goes by, we should see an increase in the volume of these products relative to the spot." However, he also said that demand Will not increase immediately.

But this can be seen as a positive beginning. The current Bakkt trading volume is about one BTC per hour. If you continue at this speed, you can complete a lot of trading volume in one month.

Su Zhu, co-founder and CEO of Three Arrow Capital, is also optimistic that he believes things will eventually change.

He publicly stated that “Bakkt is likely to be a trickle first, then a flood break. The reality is that most regulated futures contracts receive very low adoption rates on the first day, just b/c. Not all futures. Brokers are ready for liquidation contracts, and many futures brokers want to wait and see, stock quotes are not even included in the risk system."

Still not to be underestimated by Bakkt

Still not to be underestimated by Bakkt

Even if the first day is not performing well, at present, as the best hub for linking the cryptocurrency industry to the traditional financial industry, Bakkt is still expected in the future.

Compliance is Bakkt's most obvious advantage. ICE's credibility, coupled with its compliant physical delivery products, creates a compliant channel choice for traditional institutional funding that will encourage those who want to invest in bitcoin but not Institutions that regulate investment channels participate in the bitcoin market.

In addition, Bakkt's approach to compliance, especially on managed services, not only provides a successful model for competing products to deliver physical delivery futures products. Currently, LedgerX and ErisX, which is supported by TD Ameritrade, are planning to introduce the same physical delivery contract with Bakkt.

It also paved the way for the launch of the Bitcoin ETF. Previously, the SEC had repeatedly rejected the Bitcoin ETF application because it was unable to confirm that Bitcoin's custody and market prices were not manipulated. In June of this year, SEC Chairman Jay Clayton reiterated the preconditions for the approval of the Bitcoin ETF: “Hosting is the main question. How does the SEC really know that investors have digital assets?” Bakkt's upcoming hosted services are transparent and secure, meeting regulatory The escrow requirement for the currency ETF excludes the biggest obstacle to the introduction of the Bitcoin ETF.

But compliance is not all. The CBOE (Chicago Options Exchange) and CME (Chicago Mercantile Exchange) launched at the end of the last bull market are all compliant exchanges, but because of the lack of physical delivery of their products, they can be short-selled without bitcoin and accelerate the following year. The arrival of the big bear market.

In contrast, short selling is no longer an unrestricted, bitcoin futures product that can be physically delivered every day, and is the cornerstone of its trust. After all, traders must have a sufficient amount of bitcoin in kind to support the day's trading, thus significantly reducing the possibility of market prices being manipulated.

In addition, the prosperity of Bakkt futures has also formed a long-term positive for BTC prices. Metropolitan Capital founder BMan said: "This mechanism means that it is more difficult to short the institutional funds, because no matter how long it is short, you need to prepare the bitcoin physical deposit. The short money is depreciated. Shorting is to short your position. ”

However, Bakkt's performance today has also dropped a lot of "fire" for this year-long high exposure. For investors, perhaps it should be realized that the bull market is not as fierce as we think.

Text: Aloe

Source: Odaily Planet Daily (ID: o-daily)

Original article; unauthorized reprinting is strictly prohibited, and violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Funds Fair Win and imitation led to the congestion of Ethereum in the past few days, and the number of confirmed transactions was as high as 120,000.

- Demystifying the airdrop ecology of “nothing to be born”: Some people bought a house, and some people got nothing.

- Ethereum 3.0 plans to surface, resisting quantum computing attacks

- Non-serious discussion on blockchain finance from "self-tearing" (3): reality and future

- 8 years to start again, BTCC returns

- A new attempt at traditional finance, the technology of the Stock Exchange enters the currency circle

- Shenma Mining Machine Yang Zuoxing: Bitcoin will rise to 1 million US dollars, mining giants face the challenge of “decentralization”