SWOT analysis of facebook cryptocurrency

Write in front ❖

In 2018, Facebook experienced a leak crisis, so began to study blockchain technology, hoping to protect users' Facebook data through blockchain technology.

In 2019, Facebook began to distribute cryptocurrency, and a cryptocurrency called Libra is about to be released. And today (June 18, 2019), a white paper on the Libra project will be released soon.

Facebook's issue of coinage caused a lot of sensation in the currency circle.

Some people think that Facebook will bring more users to the currency circle. Some people think that Facebook users are aging, no one will use Facebook's cryptocurrency; some people think that Facebook will threaten BTC. Status, while others think that Facebook currency is good for BTC…

- Market Analysis: BTC's outbreak is rising

- Facebook veteran interprets Libra, how does the blockchain realize Zuckerberg’s unfinished payment dream?

- A Brief History of Web3 Thoughts – A Real Blockchain Entrepreneur

❖Libra's positioning structure

Although Libra's white paper has not yet been published, Libra will be a stable currency project based on reports from several US media, such as The Wall Street Journal and Financial Land.

In terms of price, Libra will be a basket of currencies anchoring multiple national laws. [ Source ]

On the technical side, Libra will launch its own blockchain, which is about to be tested and open sourced. [ Source ]

In terms of application scenarios, Libra will be used in the payment field.

The meaning of stable currency

First, in the currency circle, it is necessary to stabilize the currency as a bridge between the currency and the cryptocurrency, so that the legal currency and the cryptocurrency can be exchanged with each other.

Second, outside the currency circle, using cryptocurrencies that anchor the legal currency for payment, blockchain technology can make it more convenient than banknotes and safer than other forms of electronic money.

Third, the stable currency is a blockchain-based currency that enables cross-border payment settlement and breaks down country barriers between legal currencies.

➤ Stable currency profit model

As a publisher of stable coins, Facebook can make a profit by issuing Libra.

On the one hand, users need to use legal currency to purchase Libra, or understand that mortgage money is borrowed from Libra. These two forms of capital flow are the same. If you understand that you are using Lifa to buy Libra, you can only get less legal currency when you sell Libra. If you understand it as a mortgage, lend Libra. Then, when you are still learning Libra, you will deduct a certain fee. Facebook can earn the difference from this process, which is the most basic profit model of stable currency.

On the other hand, if the user buys or borrows, they need to pay the French currency to Facebook, and Facebook may use some of the funds for reinvestment and profit. Of course, this profit method is optional. Facebook does not have to use this method. Users don't welcome this profit.

In any case, Libra's stable currency positioning is in demand, and Facebook is also profitable.

This positioning is no problem.

The question is whether the function of stabilizing the currency can be properly undertaken by Facebook. So, from the perspective of competition, use the SWOT model to analyze the issue of Facebook's issue of stable coins.

❖SWOT analysis❖

➤ advantage (strengths)

1. Stabilizing coins that anchor multinational currency

Although there are many similar products on the market, such as the stable currency USDT and PAX issued by the centralization, the use of smart contracts to maintain stable DAI, etc., these stable coins are only anchored a kind of legal currency.

And we know that there is a risk of currency fluctuations in any country's currency. For example, we saw the price increase of BTC/USDT in 2019. In addition to market expectations, the depreciation of the US dollar is also an influencing factor.

And Facebook's stable currency is a basket of currencies anchored by many countries, which can reduce international risks.

2. Social resources

Not to mention that Facebook is a social media in the Internet industry. It has certain cooperative relationships with other media and entities. Therefore, when promoting the use of stable currency, it will have an advantage over other stable currencies.

3. User groups

Facebook has a large user base. Because everyone is familiar with facebook, TVB will not list the data.

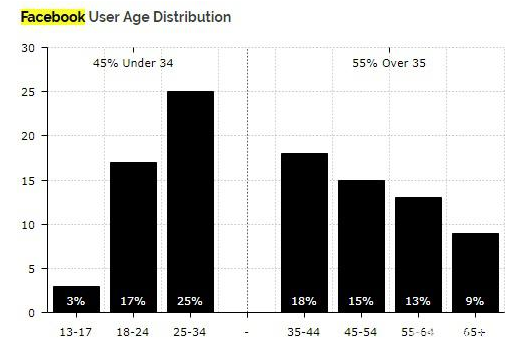

TVB analyzes a question about Facebook on the Internet. This question is that the users of facebook are aging:

This picture is very popular on the Internet, and TVB does not know the original source. It can be seen that there are fewer Facebook users under the age of 24 and fewer users under the age of 18.

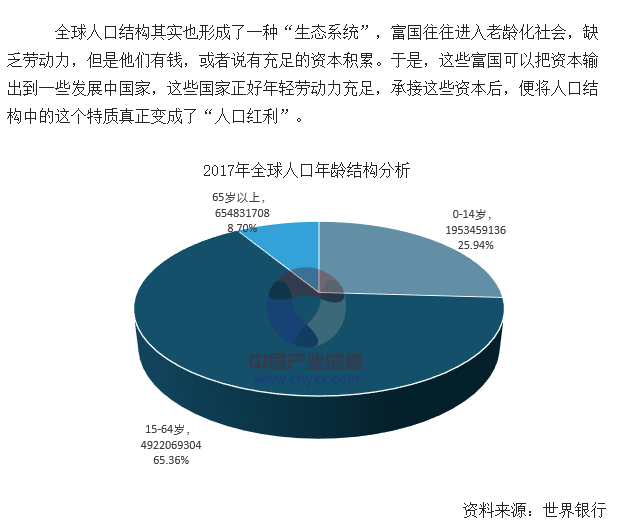

TVB does not agree with the idea that Facebook users are ageing. Take a look at the screenshot below:

Click here to view the data source

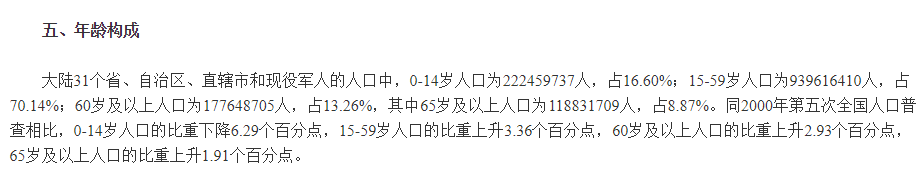

Let's take a look at this screenshot from the 2010 China Census Report:

Click here to view the resource source

Seeing it, it’s not that the Facebook user is aging, it’s the aging of the world’s population. Facebook's user distribution is no problem, user size is still the core advantage of facebook.

Weaknesses

Governance

Since the white paper has not yet been released, we are not aware of whether the project is a public or private chain. However, as a centralized organization, even if it is a public chain, Facebook is prone to centralization during governance.

2. On the line late

The USDT and PAX have the same principle and are not audited, but the USDT is still more popular. This is because the USDT went online early and seized the opportunity.

XRP is also a project that works closely with traditional finance, but XRP is online earlier.

So in terms of time, Facebook still suffers a bit.

3. Inexperience in the financial sector

Facebook's stable currency is used in the payment field. This project is more about the blockchain and Internet sectors, but the financial sector. If you control the circulation and liquidity, how to deal with the user's purchase of libra or mortgage funds when borrowing libra.

Issuing currency, this should be the central bank, at least the bank's business. Facebook is obviously inexperienced in finance.

Opportunities

1. Information society

Digitalization and informatization are the general trend, and the same is true for the digitization of money. However, digital currencies face security risks.

Blockchain technology can make digital currency safer.

So the stable currency used for payment in the real world is what we need in the future. Facebook is looking at this trend, so the stable currency project was launched.

2. Bitcoin bull market is coming

From the outside, Bitcoin is in the early days of the bull market, at least no longer a bear market, and the cryptocurrency has received a lot of attention. Therefore, when Facebook's stable currency is promoted, the difficulty is lower than that of the bear market.

Threats

1.XRP

The stable currency of Facebook is different from the application scenario of USDT, but it has certain competition with XRP. XRP is also a cryptocurrency issued as a centralized organization, dedicated to payment settlement using XRP. XRP has been landing early, and it has close cooperation with financial institutions. Although it is slightly different from Libra's application field, there is still a certain competitive relationship.

2. Supervision

In addition, pressure from regulation may also limit the development of Facebook's stable currency. You know, if facebook is like the USDT, it is not fully mortgaged, it has the function of creating money. This poses a threat to both traditional finance and government.

Written at the end

TVB believes that there will be a cryptocurrency Facebook's stable currency that can be supported and widely used by society. TVB feels that at present, cryptocurrency is still facing difficulties in the wider payment field, and Facebook has also faced great challenges as a non-financial institution has entered the financial sector.

First, how can a basket of currencies that anchor multinational legal currency be realized? How to get the exchange rate of the national currency? How do you determine which French currency is in this basket of currencies, and what is the ratio of various legal currencies?

Second, it is simply the security of the blockchain. At this stage, it is not enough to convince users to use libra.

The significance of Libra's stable currency is that it can be paid at low cost and high efficiency, without bank remittance. However, if it is a private chain, it loses the decentralized nature of the cryptocurrency, which is easily regulated by the government and difficult to circulate.

However, if libra's blockchain is a public chain, who will contact the user to use libra? It is more difficult to guarantee Facebook's control and bonus in the public chain.

These questions are expected to give an answer in the white paper. Of course, the white paper may not give a satisfactory answer.

In any case, a stable currency that is not subject to national or geographical restrictions but has a legal currency anchored is what we need. Therefore, we cannot arbitrarily deny the stable currency issued by facebook. Facebook still has certain advantages. Whether its stable currency can develop, we can only say that things are artificial, we have to wait and see.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- See the degree of centralization of POW and POS through data

- Libra vs Ethereum: Should ETH holders worry about it?

- Japanese social giant Line may launch cryptocurrency exchange at the end of this month

- At the age of 25, he founded the Encrypted Castle. Once the unicorn founder, the celebrity genius hacker was the sofa guest here, but now nobody cares…

- Dry words | Algorand Economic Report

- Libra has given global regulators an "anxiety disorder"? Facebook Chief Operating Officer responds like this

- Chang Yong: Facebook's Libra is an important innovation but the future is unknown