The application of transaction cost theory in the blockchain industry

Author: James Kilroe

Translation: DUANNI YI

Source: Encrypted Valley

- Report | Top Ten Trends in the Cryptographic Industry

- Monthly report|In October, the volume of digital currency transactions increased significantly, and the equity financing market was hot.

- How to prevent personal information from leaking? Here are 2 big data blockchain application cases

Thanks to Messari's Wang Qiao, his series of "company theory" inspired this article.

From the beginning, the Internet has structurally reorganized many industries, such as traditional publishing and printing. The Internet empowers aggregators and platforms that serve customers by forcing suppliers to compete on cost or attention. For example, the e-commerce industry builds its own website and invests a lot of money to optimize their Google rankings. By relying solely on algorithm-driven ranking mechanisms, Google has fundamentally reorganized countless industries that rely on traffic.

But at present, this economic structure has received some resistance. We believe that in the next 10-15 years, decentralized and unlicensed business models will once again change the way economic activities are coordinated. We have thought about decentralization to replace the time node of centralization, and thus developed a thinking model. We redefine Cos's Law, starting with The Nature of the Firm, and show how a new paradigm of economic coordination is possible.

Nature of business

In 1937, Ronald Coase's groundbreaking paper, The Essence of Business, was officially published, which deeply analyzed the organizational principles of partners, companies, contracts, bilateral transactions, and other commercial entities.

The paper raises a simple question: If the market is so good at allocating resources and stimulating individual behavior, why do companies still exist? Under the guidance of the “invisible hand” of the market, isn’t it possible that all transactions can be carried out between individuals in a completely decentralized manner?

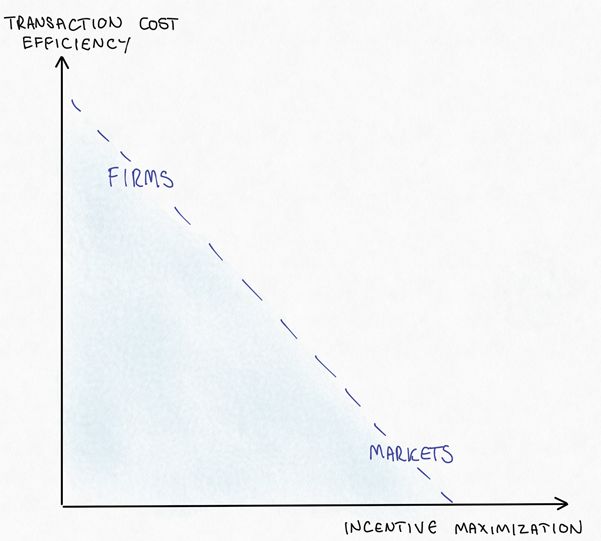

Wang Qiao shows how to balance the boundaries by stating that companies can optimize transaction costs and improve efficiency by sacrificing personal incentives.

How companies and markets interact

To delve deeper into this problem, Coase tries to understand what constitutes the transaction costs of the market and how to make them effective. Market transaction costs consist of three parts that are independent but coupled to each other. Through the organizational form of "company", it is usually significantly reduced:

- Search and information costs: The flow of information within the enterprise is more liberal, and entrepreneurs can more easily find the right employees to perform specific tasks.

- Negotiation and decision-making costs: Entrepreneurs can assign only one employee to complete a task without negotiating or negotiating.

- Regulatory and Execution Costs: Entrepreneurs use resources to punish underperforming employees (such as dismissal) and reward those who perform well.

Therefore, Coase concluded that companies exist to reduce the transaction costs of certain economic activities. This also helps explain why companies are generally less efficient than the market.

Web 2.0 platform

We believe that Coase's theory explains why the Internet platform dominates different industries. Often, the Web 2.0 platform replaces previously inefficient analog market processes with digitally centralized alternatives. In this process, these centralized platforms reduce the transaction costs of users by reducing the three costs that constitute market transactions. This in turn forces suppliers to compete fiercely in the market to commercialize their services or products. On the other hand, once the platform has achieved a certain size, it will “seek rent” by charging for each transaction, which is the origin of the aggregation theory.

Decentralized network

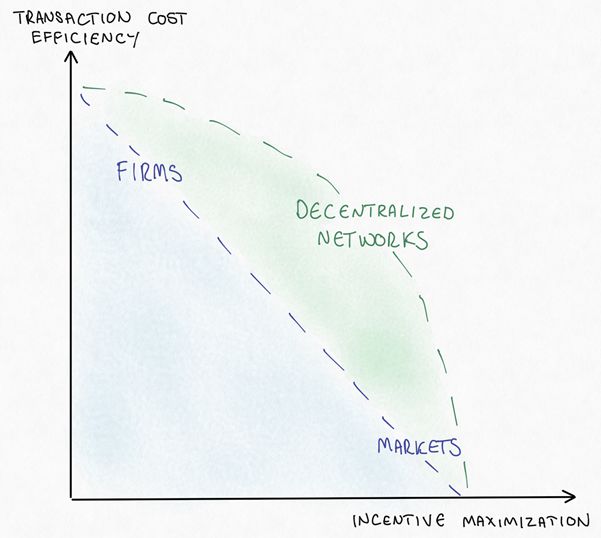

We agree with the aforementioned view that decentralized networks have more potential than markets, centralized platforms or enterprises, and they can break the line between maximization and cost efficiency. More importantly, we believe that decentralized networks can eliminate platform rent-seeking.

How to decentralize networks to expand efficiency boundaries

Decentralized networks can reduce transaction costs in the market by:

- Search and information costs: Decentralized networks reduce this cost because trusted information can easily flow across the public blockchain. This information is always stored in a publicly accessible, auditable, and immutable ledger, and information asymmetry is eliminated. On the other hand, this adjustment reduces the cheaper deals.

- Negotiating decision-making costs: Negotiation is a process of discovering signals and accepting signals, occurring between interested buyers and sellers. The blockchain embodies this decision through open source software and price discovery mechanisms. The combination of public data and auction technology reduces the cost of negotiation.

- Regulatory and implementation costs: through the implementation of consensus mechanisms and internal logic, without manual intervention.

Thinking model

So, in a broad sense, where is the decentralized network superior to the centralized platform? We believe that the decentralized network will succeed in the following areas:

The "cost" here is in a broad sense, including opportunity costs and hidden costs (such as convenience).

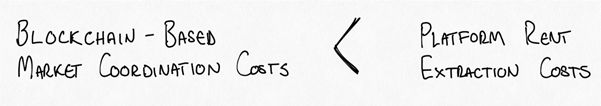

We believe that the exponential improvements brought about by these new market efficiencies will break the current pattern of companies acquiring rents and economic surpluses from the market. A successful network based on blockchain will follow the above formula, which we call: "Blockchain Coordination Frontier".

Model application

Let us apply this thinking model to the original use case of BTC, namely P2P transfer. The early BTC was used as a P2P fund transfer channel in the gray market to illustrate this point:

Market coordination cost

- Transfer costs (for BTC, these costs are low);

- Volatility (high cost, much higher than legal tender);

- The cost of importing fiat money (from a convenience perspective, the cost of using local BTC is high);

- Poor universal availability (sending and receiving BTC requires technical education);

In summary, high volatility, high legal currency entry and high availability costs are their natural market coordination costs. In addition, there is the cost of extracting the platform rent as follows:

- Regulatory cost;

- Platform risk (the bank may freeze your account);

- Traceability costs (bank transfers are easy to track and all accounts associated with wrongdoing are identifiable);

- Blacklist cost (no bank account);

In the gray market, regulation, traceability and blacklisting costs are high. Wire transfer to drug dealers via banks is dangerous. Therefore, people use cash as much as possible, but this is geographically limited because you have to meet somewhere.

In summary, “the market coordination cost based on blockchain” is high, but it is still far below the “platform rental extraction cost”. As the transaction cost of BTC declines exponentially, the gray market will be dominated by BTC and will be successfully adopted.

In subsequent articles, we will use this model to predict which industries will be reshaped in the future blockchain. At the same time, we will show how the blockchain network can surpass the centralized platform represented by Web 2.0 by reducing market transaction costs.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Fun! Use the Google form as a side chain and send and receive ETH with an email address.

- The listing was delayed until December, and the first coal miner will be listed on November 21.

- Counterfeit legal digital currency, "Li Gui" is rampant! The central bank reminded me three times, and there is a lot of information.

- Yao Qian: The “Before and Present” of the blockchain and the central bank digital currency

- Building a group defense group governance platform Wenzhou enterprises use "blockchain" to create a "chain of trust"

- Smart Contract Series | Smart Contract Engineering Brief: Smart Contract Engineering

- Wyoming, USA Announces First Encrypted Hosting Rule for Blockchain Banking