The DeFi Déjà Vu: A long text analysis of the current DeFi dilemma

However, on the occasion of the first anniversary of "DeFi", the Dharma Protocol platform was exposed that users could not raise coins normally. After waiting for a long time, there was still no response. The official then responded with "software front-end bugs" and suspended the creation of new loan contracts. Recently, Dharma has shut down the operation of all products. The official said that a major upgrade is underway, but the return period has not been determined.

The forecast market platform Veil was closed in July 2019. As a star project invested by well-known venture capital institutions such as Paradigm and Sequoia Capital, it only ended after six months of operation.

What happened to the once-popular "DeFi" ecosystem?

I. "DeFi" Ecology – Utopia of Idealists

- Babbitt column | Yang Haipo: Bitcoin forks past events

- When I bought Bitcoin for $18,000, the female billionaire regretted investing and called Bitcoin to deceive herself.

- Slow money in the encrypted world: Which assets and communities are most important in the next decade?

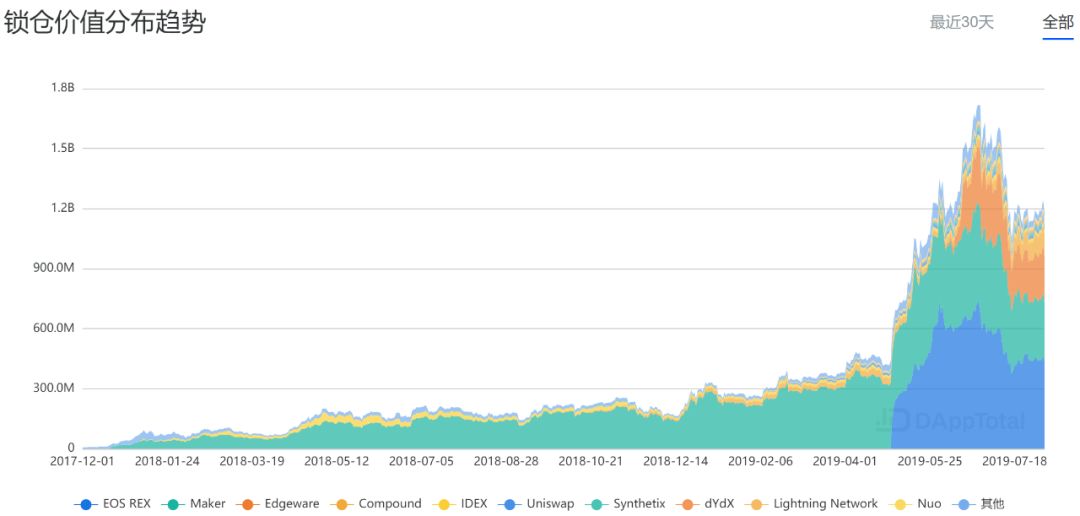

If the lock-in amount is regarded as a measure of the overall size of the "DeFi" market, before April 2019, the total market value of the overall ecology was less than $300 million. In the following two months, the total lock-up amount increased. Nearly 6 times, the highest reached nearly 1.72 billion US dollars, and is currently stable at around 1.1 billion US dollars.

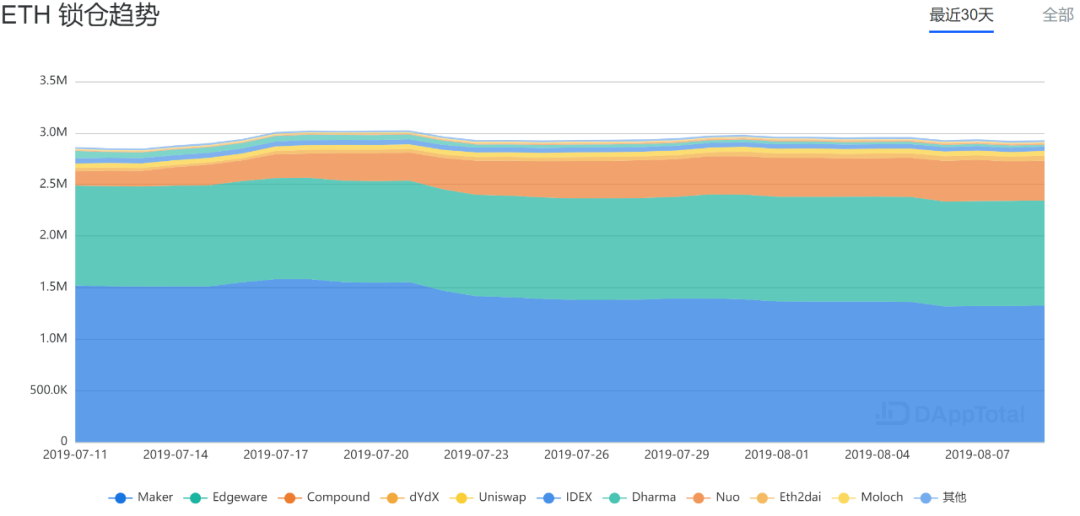

Figure 1: Defi project lock amount distribution Data source: Dapptotal

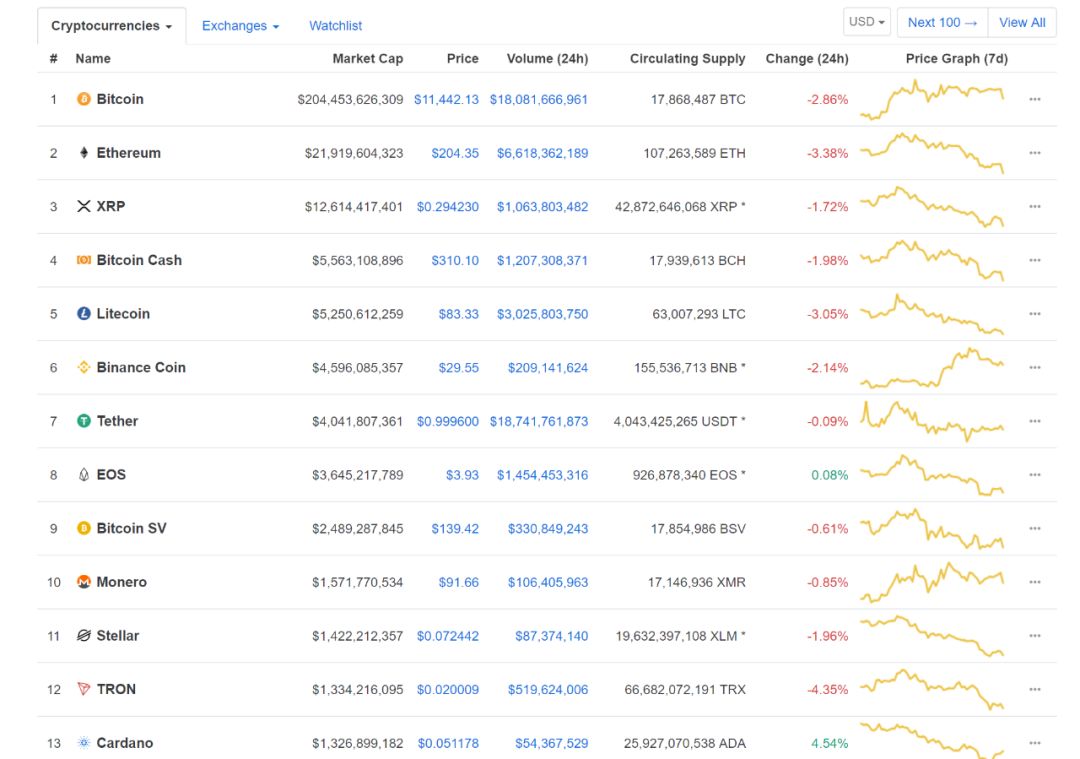

If "DeFi" itself is a single currency, then the market value should be comparable to TRON, Cardano, and the market value is ranked in the Coinmarkcap's 10 (Figure 2).

Figure 2: Coinmarketcap market capitalization data from: Coinmarketcap

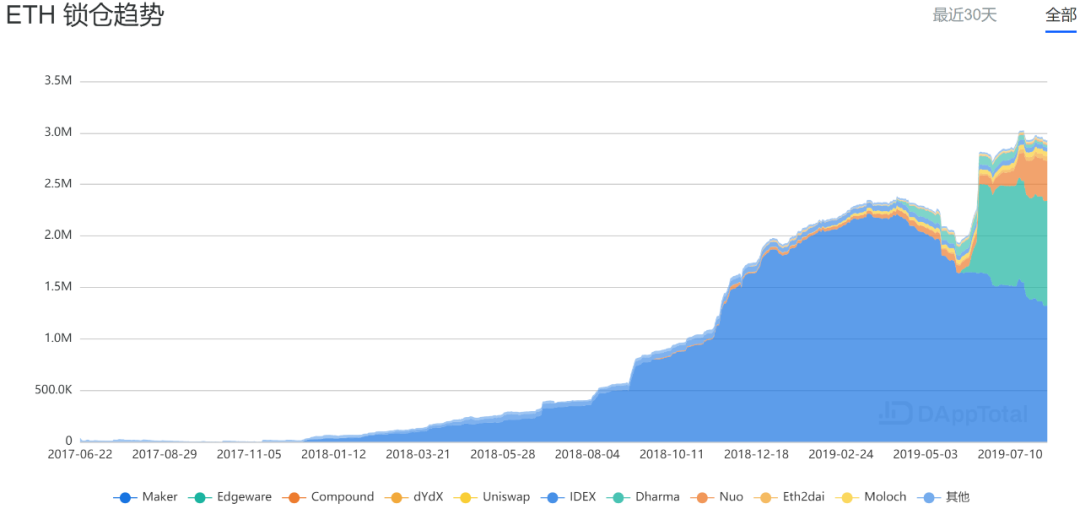

However, when the "DeFi" lock amount is counted according to the number of ETHs (see Figure 3), it can be found that the ETH of the overall lock warehouse has risen from 2.33 million ETH in April 2019 to 2.77 million ETH on June 25. The increase was only 18.8%. The initial "DeFi" ecological lock-up amount surged only because the price of ETH has doubled.

Figure 3: Number of Defi Eco ETH Locks Source: DappTotal

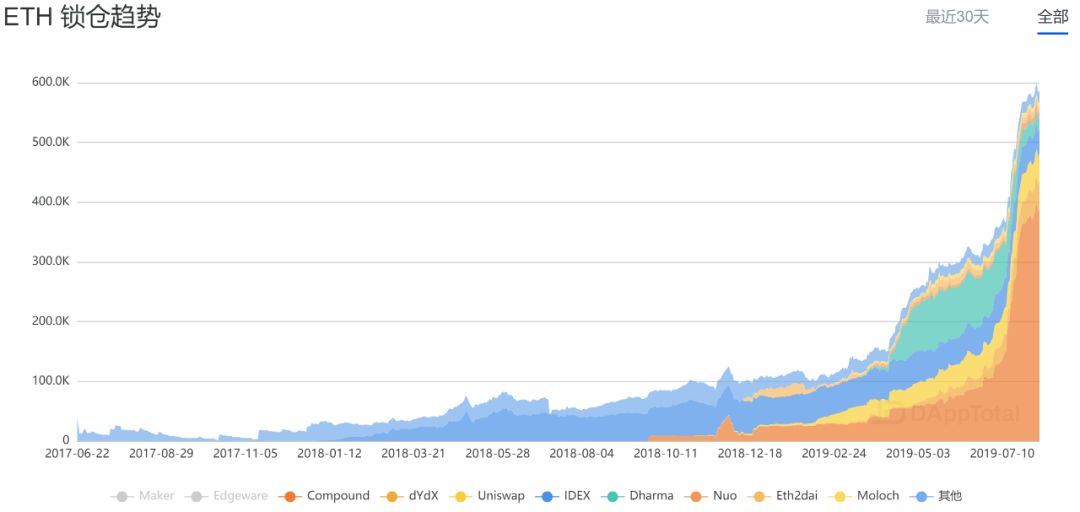

After removing the Maker that occupies more than 50% of the "DeFi" lockout ratio, it can be found that although the remaining "DeFi" projects have not increased slightly in 19 years (see Figure 4), they:

- The total is still very low, only 600,000 ETH, according to the current market value (ETH price of 200 US dollars), but also 120 million US dollars.

- The growth trend has slowed down, and the number of locked ETHs has barely increased in the last 30 days (see Figure 5).

Figure 4: Defi Eco Project Lock ETH Data Source: DappTotal

Figure 5: Defi project lock position in the past 30 days Source: DappTotal

Therefore, it is not difficult to conclude that the "DeFi" ecology is still: the carnival of a small group of people, the loneliness of most people.

Second, the "DeFi" dilemma

Zhang Xiaolong, the father of WeChat, explained his product concept: " Don't make a big change from the beginning, and make the most urgent and core needs to the extreme."

To give another example: In August 2008, just 11 years ago, a website called AirBed&Breakfast was launched, providing Internet services for guest accommodation on sofas.

The website that was just launched is very simple. The service provided is "Staying in a stranger" and claims to make people "forget the hotel". This company is now called Airbnb. Although there are various problems at the beginning (such as security issues, number of listings, etc.), the problem it has to solve is simple: to give travelers a cheaper and more convenient accommodation than to stay in the hotel, the problem is from the very beginning. Successfully solved.

Figure 6: The earliest interface on the Airbnb website

If the blockchain industry subverts the Internet is not just a slogan of the moment, it is undeniable that in the product design and commercialization level, it is still very necessary to extract the essence from the successful experience of the Internet.

Then, in-depth exploration around the core functions of "DeFi", first throwing away the debate on the use of virtual currency, we assume that the current virtual currency is only used for trading, "DeFi" products provide two kinds of tools to serve this business:

- Lending products

- Trading products

Lending products

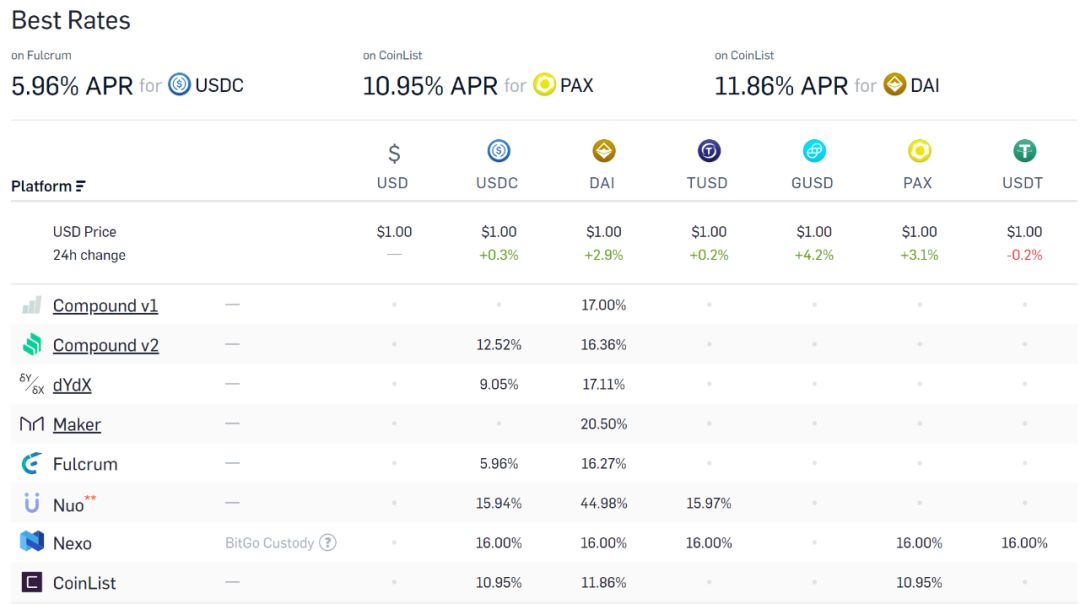

According to the data of Loanscan.io, the “DeFi” lending statistics platform (Figure 8), the interest rate of the “DeFi” product financing (by the stable currency bound to the legal currency, which can be regarded as long) is USDC, the minimum year. The interest rate is 5.96%, while the average annual interest rate of the USDC is about 11.74%. The average annualized currency rate of the most commonly used stable currency DAI in "DeFi" is 20%.

Figure 8 Defi-like project stable currency loan interest rate Source: Loanscan

The interest rate offered by the currency to the USDC is 0.02% per day (initial customer VIP0), corresponding to an annualized 7.3%, slightly higher than the 5.96% Defi minimum interest rate and lower than the average interest rate. So for Defi users, the interest rate compensation that comes at the expense of the convenience of the big exchanges is not obvious, and even many financing rates exceed the centralized products.

Therefore, financing in "DeFi" is not a very attractive option. In addition to poor user experience and high barriers to use, interest rates are not more attractive.

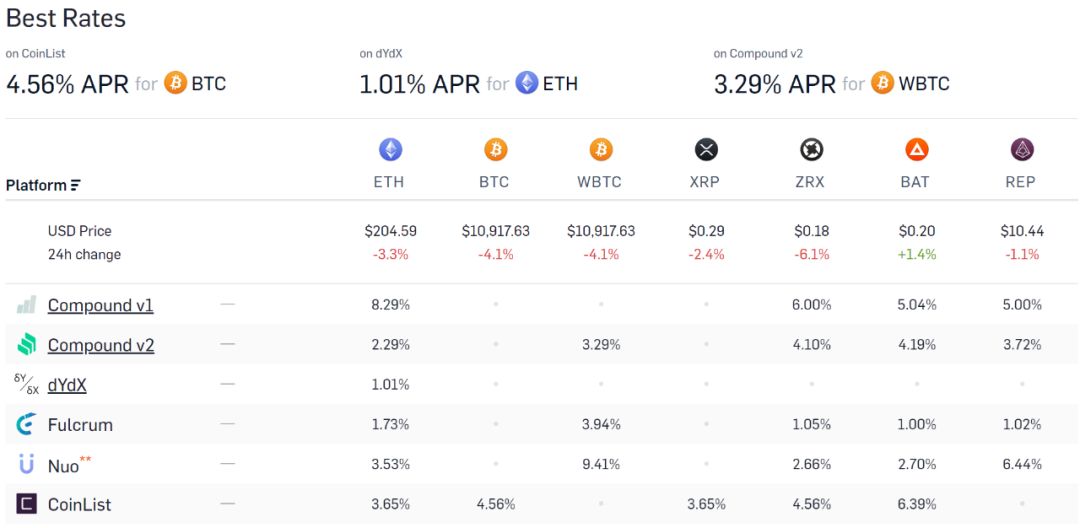

Look at the interest rate of "DeFi" to provide currency, ETH can provide an annualized interest rate of 1.01%, and the average interest rate is only 3.4%, which is more than half of the annual interest rate of 7.3% (and OKex). The borrowing rate of the fire currency is higher.) So is it more cost-effective to borrow ETH in the "DeFi" product?

For example, Dydx, which provides the lowest borrowing rate, requires an initial pledge rate of no less than 1.25 times and a minimum pledge rate of no less than 1.15 times, which means that the user must borrow $100 of ETH, and the assets that need to be mortgaged cannot. Below $115, the initial stage is no less than $125, and users need to have excess assets to collateral behind the currency.

Figure 9 Defi-like project digital asset lending rate Data source: Loanscan

When the Margin Level of the currency is ≤1.1, the system will perform the forced liquidation process. The risk rate is the ratio of the market value of the total assets to the sum of the loan and the interest. Therefore, the user must borrow 100 US dollars of ETH. Only $90.9 in assets are required. It can be seen that although the "DeFi" product is more advantageous in terms of the interest rate of ETH, the efficiency of capital utilization is relatively inefficient because of the need for over-collateralization.

2. Trading products

The decentralized exchange represented by the 0x agreement and IDEX is the main direction of decentralizing financial products before the concept of "DeFi".

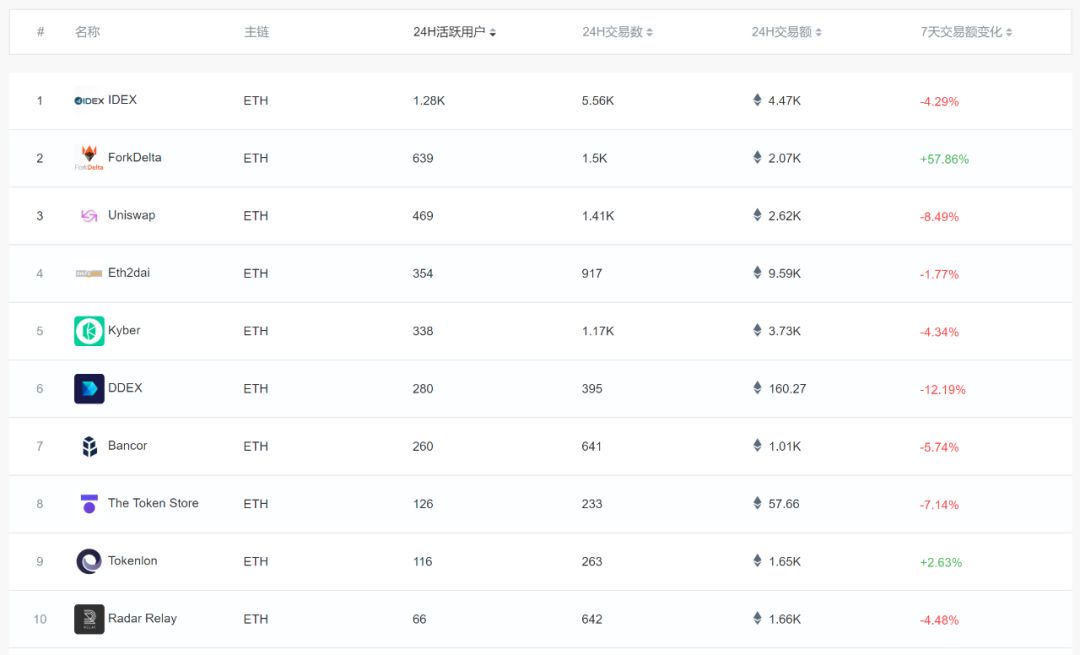

According to DappTotal statistics, the total transaction volume of the top 10 exchanges in 24 hours is 27000 ETH (August 15, 2019), which is roughly equivalent to about 60 ETHs in all transactions. This means that the volume of all currencies in the Top10 Decentralized Exchange adds up to the amount of a trading pair of a small exchange ETH.

Figure 10 Dex class project statistics Source: DAppTotal

The lack of trading volume reflects the problem of liquidity. Berkeley University researcher Justine Humenansky divides the centralization of liquidity into two categories: order mode (0x) and market-based mode of converging liquidity (eg Kyber). Among the market makers that gather liquidity, there is a special category called Automated Market Makers (AMM), such as Bancor and Uniswap.

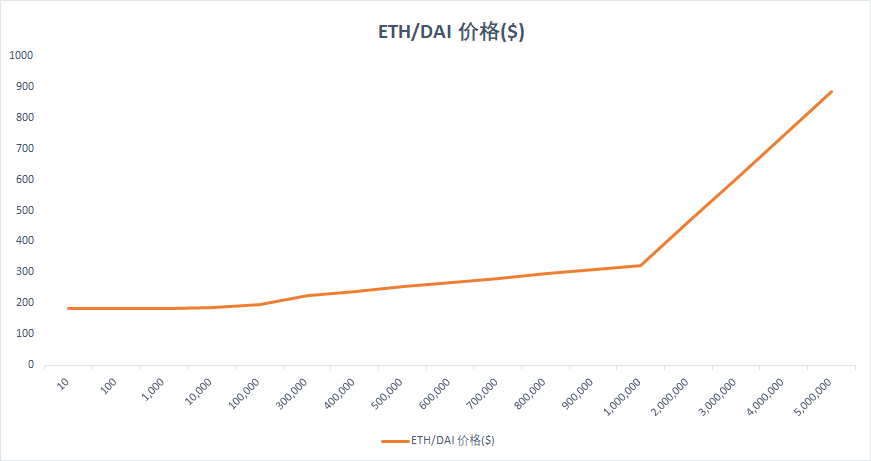

The order mode has obvious liquidity defects, and no specific analysis is done here. Automated market makers provide ready-to-go liquidity by algorithmic quotes based on pre-defined formulas to market makers. Alex Evans of Placeholder Funds compares them to MMORPG games, and users only need to trade with asset pools. But for Uniswap, the index-level trading slippage for traders makes big deals very uneconomical.

As shown in Figure 11, the price starts to rise significantly after the transaction amount exceeds $10,000, and the price slippage increases sharply after $100,000, and the price has been exponentially higher after $1,000,000.

Figure 10 Price variation relationship between ETH and DAI under Uniswap

Relatively optimistic, Uniswap is well suited to meet the transaction needs of a single amount below $10,000, calculated according to Defi Pulse's current Uniswap total lock position of 43.9K ETH, at the same price (1ETH=$180 market) Under the premise of the price, 790 can be sold for orders of 10,000 US dollars. (Note: The actual number of transactions should be much smaller than this number, because the slippage of the transaction will become larger after the reserve pool becomes smaller.) If you further reduce the transaction amount for each transaction, take $10 as an example (due to the transaction and gas charges, single The amount of the pen is not too low, and it can accept 790,000 pens. The number of transactions can already meet the application of some small redemption scenarios.

The problem is that if a small redemption scenario is opened in the future, the total 790,000 capital load will not be sufficient for more high-frequency demand. For the current speculative trading market, it is clear that the transaction carrying capacity of just a few hundred million US dollars orders is indeed insignificant.

Third, "DeFi" or Dilemma

In the development of cryptocurrency, there have been countless cases to prove the fact that the original intention of the creator is often based on the idealistic spirit and self-interpretation of the future, but the reality is always unthinkingly using the familiar context to give new Things give the final definition.

Coincidentally, Ethereum, whose market value is second only to Bitcoin, was originally conceived to build a decentralized "world computer platform." At the time of 17 years of crowdfunding and market capitalization, the Ethereum community may not think of itself as the most profitable “crowdfunding machine” in the world. Co-founder Joseph Lubin recently proposed a more pragmatic vision for Ethereum: "Decentralized Global Settlement Layer." From the "world computer" to the "global settlement layer", we can see that the vision that was once too idealistic is gradually coming.

From the above, it is not difficult to sum up the simple value scale of the commercial society: efficiency, money.

The value that a successful commercial product needs to provide to the user is either to increase its production efficiency, or to bring profits and cost savings to the customer. Regardless of the technical solution or the design philosophy, it is still necessary to return to the two value scales for measurement. This is also the "first principle" of business.

Recalling the initial reason why we expect "DeFi", there are several reasons:

- Anti-censorship

- Transparency

- Programmable finance (combinability)

- Self-hosted (no centralized counterparty risk )

For the time being, regardless of whether features must rely on blockchain completion or what are “pseudo-demands”, we assume that they are all necessary for the future financial environment and rely on highly decentralized blockchains.

So what is the cost?

Contradiction 1: anti-censorship <> capital utilization efficiency

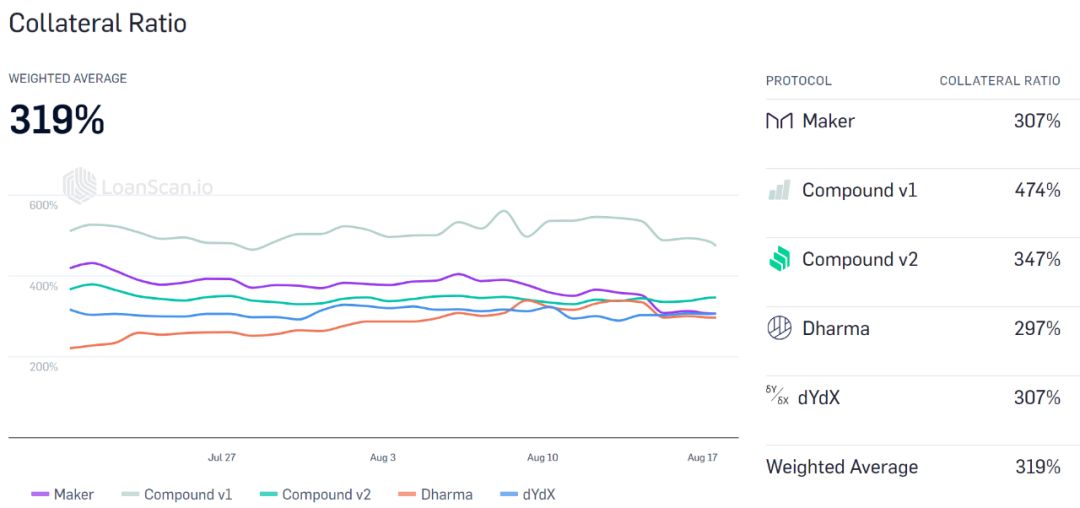

The average pledge rate of the "DeFi" project on Loanscan is more than 3 times (319%), and the highest Compound v1 requires 4.74 times the asset pledge, which means that you have to borrow 100 dollars and need to mortgage a value close to 500 USD. assets. The currency is safe for users to borrow 100 US dollars of ETH, only need 90.9 US dollars of assets, the ratio of the utilization rate of the two funds can be said to be huge.

Figure 11 “DeFi” project pledge rate Source: Loanscan

Linda Xie of Scalar Capital believes that the use of "DeFi" products is extremely inefficient, due to the lack of a proper decentralized identity and reputation system. One solution is to open up data on personal credit information from government and banking institutions to confirm personal credit; another solution can be based on traditional financial P2P lending, introducing scores similar to the FICO scoring system, and providing some additional data information, such as Home ownership, income and employment time, social media reputation, previous loan repayment history, and other reputable user guarantees.

But in any case, the use of personal credit to increase capital leverage requires exposing personal information, contrary to the original intention of "DeFi" against censorship.

Contradiction 2: Transparency <> Safety

– "DeFi" products emphasize their transparency characteristics in particular, and they can be checked on the transaction chain. There is no risk that the centralization organization will do evil. However, on the other side of the coin, taking the 0x order form as an example, the pending order of the open order Maker is summarized by the relay party. At this time, the TMiner side sees the order flow summarized by the relay party (the so-called transparency is reflected). You can make a deal in advance by paying a higher Gas Fee, called Front-Running.

For the Front-Running problem, different solutions have emerged, such as the improvement scheme based on Bancor protocol proposed by Nate Hindman, StarkWare and 0x in cooperation with Starkdex based on zero-knowledge proof solution. But overall, they are still in the research or testing phase, and the actual results are still unverified.

– The oracle is playing a vital role as a tool for the openness and transparency of "DeFi". Since "DeFi" is built on smart contracts, smart contracts must obtain a non-blockchain data through a class of tools. That is the prophecy machine. The oracle is used to ensure that the process of "DeFi" ecology and external interaction is fair and transparent.

However, a single point of risk has also arisen. The asset platform Synthetix suffered an oracle attack in June 19, and the attackers captured more than 37 million sETHs. If you create multiple Oracle feeds to extract data, it means that the system will increase in complexity while increasing the complexity.

Contradiction 3: degree of decentralization <> liquidity

The performance limitations of the underlying blockchain technology are a long-standing problem, but this is far from fully explaining the lack of mobility of the "DeFi" ecosystem. Compared with the Ethereum, the public chain is dozens of times faster, and some "DeFi" applications do not need high-frequency chain interaction, but they have not been able to get rid of the common end of liquidity.

For example, because of the operability of the product, the complexity of the technology, and the Gas fee, it is difficult to imagine professional traders providing liquidity in the market of decentralized trading, and the current stage of market development, even Most of the liquidity of centralized exchanges also comes from market makers.

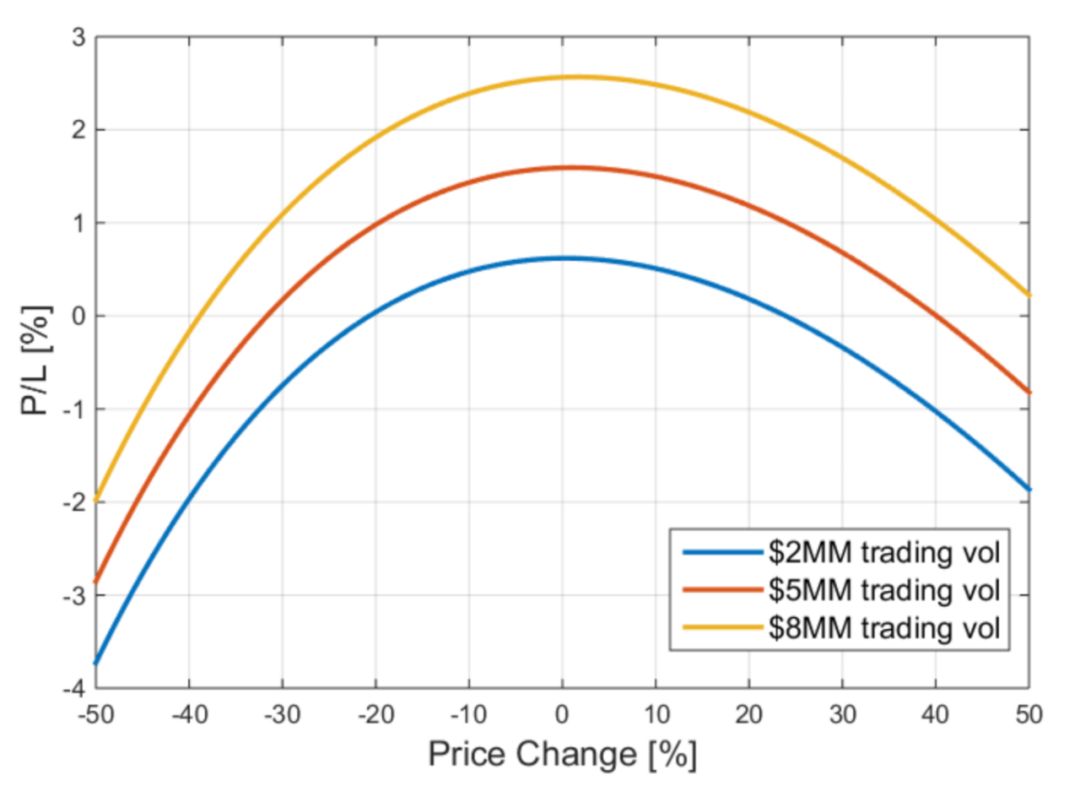

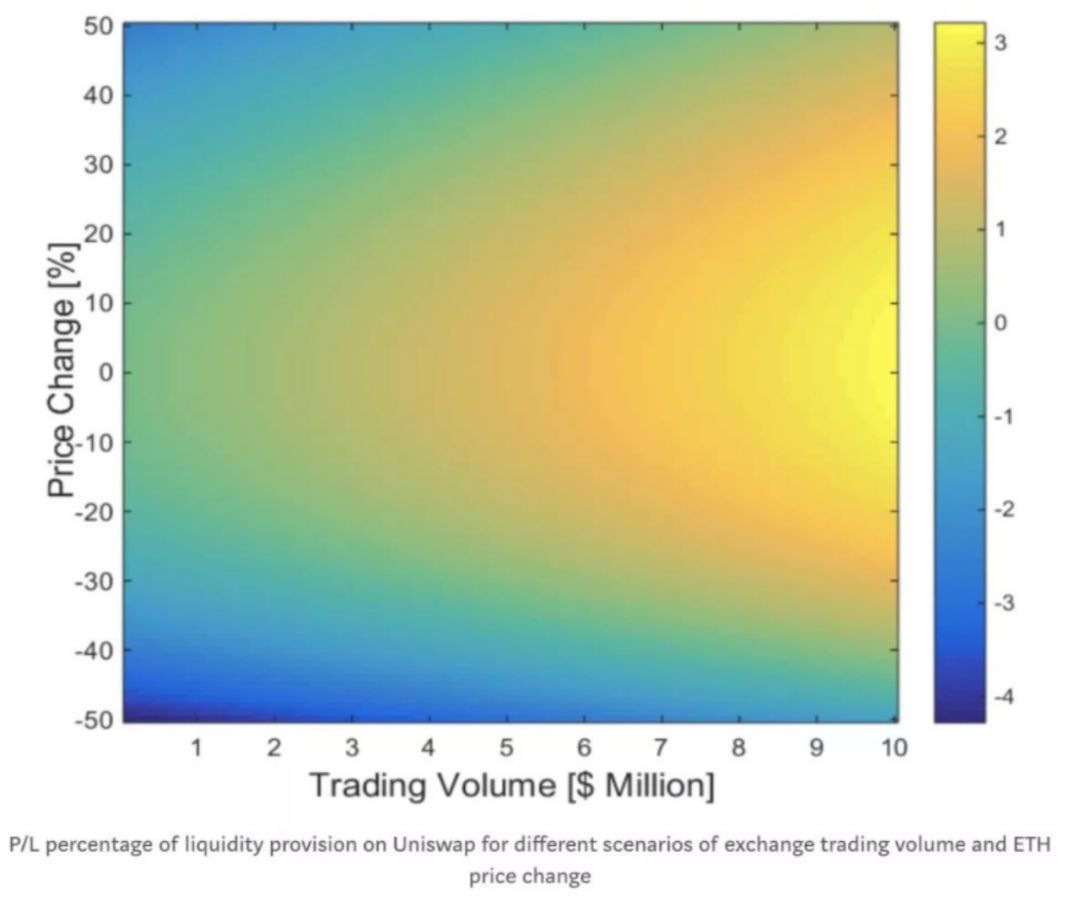

In the trading environment of Defi, Uniswap skillfully designed the automatic market maker mechanism, that is, the market maker only needs to deposit the currency to provide liquidity, that is, the income can be obtained. The income is the accumulated transaction fee and the temporary loss caused by the price fluctuation. The difference between (impermanent loss).

Mohamed Fouda measures the market-making gains under different trading volumes and price changes in the Uniswap Market Making Profit and Loss Analysis article. The results show that: 1) When the price changes significantly, especially when the transaction volume is still low, the market-making activities will cause the market maker to suffer losses, and the return is not as good as holding the assets. 2) The larger the transaction volume, the higher the transaction fee and the higher the profit of the market making business.

Figure 13 Uniswap market makers yield analysis (2) Source: Uniswap.io

Therefore, for users of decentralized "DeFi" products, it is more convenient to use "liquidity market makers" who provide liquidity to make money. More strategies are to increase or decrease the amount of tokens supplied according to price changes, and The choice between calculating whether to hold assets or providing market-making services may even offset the convenience that “automated market-making mechanisms” bring to retail investors.

Institutional investors will use the more centralized and higher-yielding centralized market to make the market. This further narrows the volume of transactions on Uniswap, resulting in lower market-making gains and a negative cycle of negative feedback.

4. Where is the front line of "DeFi"?

As the largest P2P file sharing protocol, BitTorrent once occupied 70% of the entire Internet traffic during its peak in 2006. The online update of World of Warcraft is based on BT technology for download and distribution. It is no exaggeration to say that BitTorrent is a decentralized application that aggregates the most user traffic.

However, in 2018, it was acquired by the wave field for only US$140 million. On the 30th day after the acquisition, the founder Bram Cohen announced his departure. For the bleak ending, the experience of several decentralized applications summarized by Simon Morris, a ten-year-old employee who worked at BitTorrent, is worth mentioning here:

- Although the BitTorrent ecosystem has grown to scale and has gained enough industry influence, BitTorrent itself seems to have never succeeded in technology itself as a disruptive innovation.

- Although BitTorrent is a very great idea, it is not a good business model. Decentralization has unleashed a "thug" that attempts to subvert traditional rules and is unstoppable, but we cannot mistake rulebreakers for the future winners of the Internet.

- With the advent of BitTorrent, the concept of the entire "file" seems to have disappeared from people's sights. We found that many old media were reborn in a new and better form. The most typical example of this is music streaming. Spotify and video content service provider Netflix.

- BitTorrent technology does bring subversive innovation, but the “winners” who use this technology are actually getting rid of the decentralized appearance. For companies like Spotify and Netflix, there is no need to adopt decentralization techniques because it adds complexity and results in worse things and worse user experience. But it is undeniable that their success benefits from the so-called “paradigm shift”, a subversive innovation that abstracts “documents”.

Specifically, a more likely way to develop "DeFi" in the future is to develop in two phases:

In the first phase, a single function is 100% available, forming a closed loop of business scenarios.

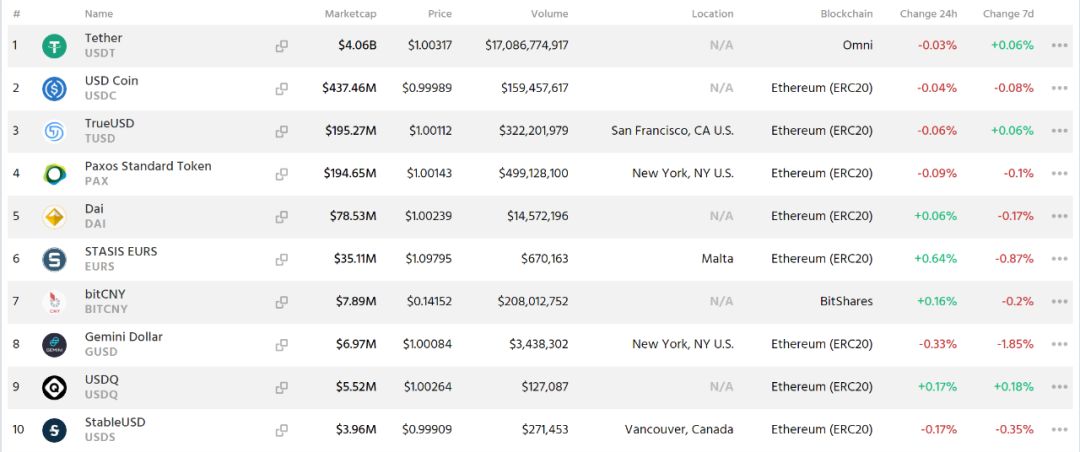

"Leveraged lending transactions" can be said to be the biggest scenario of decentralized financial products applications, but the Maker with the highest mortgage amount of "DeFi" assets has effectively leveraged, but lacks trading functions. According to StableCoinindex, DAI currently has a 24-hour trading volume of $14 million and ranks 5th in stable currency. Although the ranking is not low, it is quite different from the top 4, compared to the first USDT 24 hours of $17 billion. The transaction volume is only 0.08%.

Figure 14 Stable currency market value and trading volume ranking Source: cryptoslate

In terms of the number of transactions, according to Coinmarketcap data, there are about 77 transactions for DAI (excluding zero transaction volume), while USDT transactions have more than 400 transactions for incomplete statistics.

If Maker's current work progress is 50%, then the follow-up Maker needs to find the trading scene for DAI, and continuously increase the number of transactions and the transaction amount of DAI on the exchange. Don't put a shackle on yourself because of "DeFi". Cooperation with a large centralized exchange is not an option.

Looking at Uniswap, the model of AMM has already run through. The next step is to achieve the closed loop of the scene. What is needed is the exchange of small and micro transactions. The above article has shown that large-value transactions are not suitable for AMM, so what are the possible scenarios? The exchanger of the token in the game, or is it a small payment (recharge of the phone / offline shopping…)?

The second stage, the birth of paradigm shift.

After BitTorrent technology wiped out the "download", streaming media and online audition Sportify, Netflix rose in the will of software retailers.

When decentralized technology (blockchain may be just one of the options) is enough to promote the paradigm shift of the function of a part of traditional finance, the construction of new commercials can begin to surface.

All in all, the designers of "DeFi" must first remove the utopian fancier's high status, from the loose organization of the community to the evolution to the more efficient commercial operation, and start the construction of real application scenarios.

Conclusion

Placeholder VC researcher Mario Laul used the term “the DeFi Déjà Vu” to describe the feeling of embarrassment caused by the “DeFi” ecological fading. Looking back at the “DeFi” craze, there have been many words that subvert the traditional financial scenes as if they were separated. .

But perhaps, it is the time when "DeFi" falls into the valley of despair, and it is the best time for Buidl to build a new financial order in Babel.

"Space View" by Partho Mondal

Note: The content of this article is only for individuals and does not represent the opinions of the institutions.

【references】

- "P&L analysis of Uniswap Market Making", by Mohamed Fouda

- "Trade-Offs: Decentralized Exchange", by Justine Humenansky

- "DeFi: What it Is and Isn't", by Justine Humenansky

- "The future of decentralized finance" by Linda Xie

- "Uniswap Deep Dive" by ZPX | Satoshi&Co Newsletters

- "UniSwap Traction Analysis" by Ganesh

Source: Foreseeer Foreseer (Public Number: yujianjia2020)

Author: Jiang new JX

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis of the legality and privacy of DApp and the security of tokens in the ecology

- Nearly 80% of Bitcoin addresses are profitable, and the number of Bitcoin holders has reached a new high

- What is the value of 1 bitcoin? Bitcoin pioneer Hal Finney: $10 million

- International Monetary Fund (IMF) Report: The Rise of Digital Currency

- A war triggered by an account: Why did the BCH supporters of the past take off the powder and step back?

- Guangming Daily Review: New technologies such as blockchain build a "firewall" for copyright protection

- 4 days skyrocketing 9 times? Bitcoin brokers follow the trend of "smashing shoes" business