Staking Economics: Avoiding the centralization of network power, how does “reverse incentives” work?

Author: stakefish

Source: stakefish

Editor's Note: The original title is "Avoiding the centralization of network power, how does "reverse incentives" work? 》

The issue of power concentration faced by various blockchain networks has been a topic of extensive discussion among researchers and currency holders. In fact, this is also an important issue in the eyes of blockchain designers and developers. It is hoped that the power will be dispersed as much as possible in the design, and the original intention of the decentralized network will be adhered to.

- Twitter CEO: Twitter will never join Facebook's Libra project

- Viewpoint | Is the exchange the only way out for the project?

- The rebound of the market is insufficient, pay attention to short-term risks

On the PoS network, this centralized discussion is reflected in the fact that nodes have an imbalance in network power (voting power, consensus power), as reflected in the Gini coefficient on the Cosmos network. Different design attempts are underway. This time, we have seen the proposal to start with the design of the “penalty mechanism”.

A question about "redistribution"

The problem of centralization is mainly about two aspects: how to distribute and redistribute tokens . The former is “ token economics ” – what kind of contribution can be made to the initial network power; the latter is “ staking economics ” – how the acquired power generates new benefits, and according to what rules are rewarded and punished .

Specific to staking economics, we have gradually clarified the concept of pledge to get rewards. This positive incentive allows people involved in staking to gain the benefits of online “issuing”. Over time, the voting rights of the network or the power to make consensus will never participate. The hands of the person are transferred to the hands of the participants. The reason is very simple. The number of tokens in the hands of the non-participants remains the same , but the proportion of tokens has gradually decreased because they have not received the rewards generated by the block.

"reverse incentives" that cannot be ignored

The "reverse incentive", that is, slashing, has always been the main role of maintaining network security. If you "do evil" or misbehave, part of the pledge token will be confiscated by the network. With reverse incentives, the verification nodes are more committed, stay online, and avoid double signing .

(Source: Cosmos Hub official website)

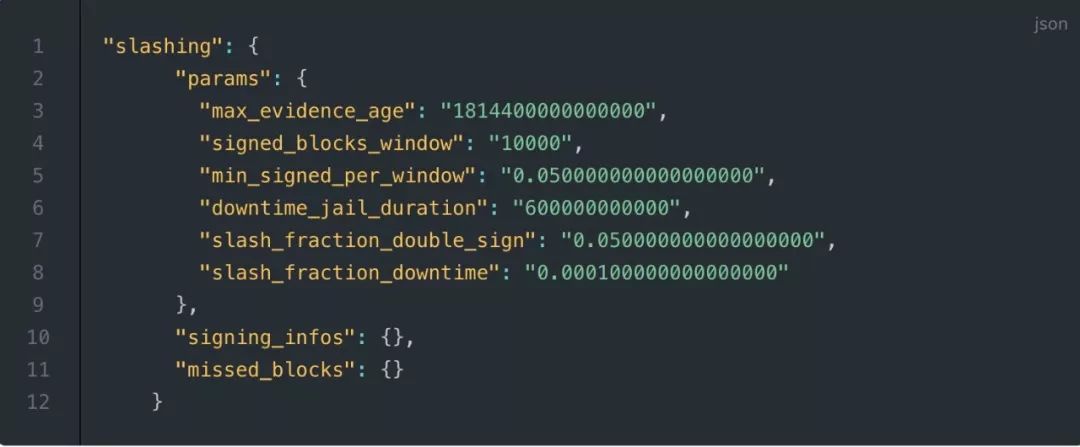

In the creation of the Cosmos Hub main network, we can see three aspects of the current penalty in this parameter:

-

Temporary ban due to poor availability (long offline time); -

The percentage of impaired availability is 0.01%; -

The proportion of double signatures being punished, 5%;

The design of the degree of penalty on the Polkadot/Kusama network is similar to that of Cosmos, and the double signature is regarded as a serious misconduct. The articles we have shared have been introduced.

In June of this year, there was a penalty for the first double sign on Cosmos, causing the node and the client to lose a total of $60,000 in tokens. Although on the Tezos network, the penalty is only for the verification node, and a long list of network penalties makes people aware of the need to set up and select a reliable node .

Suffering the punishment like double signing is a huge blow to the reputation of the node, although most of the "double sign" is deliberate and deliberate, mostly due to technical misoperation. In any case, the punishment measures are mostly related to cybersecurity, until the concept of “proportional penalty” is raised, causing people to think about the role of punishment in mitigating network centralization.

"Proportional penalty" broadens the role of reverse incentives

Cosmos core developer Sunny Aggarwal has released a draft of ADR (Architecture Decision Records) to improve the penalty, and proposed proportional slashing. The discussion of the form of penalty is not only for cyber security, but also for the game of participants. Strategies, which in turn make nodes tend to be smaller and more dispersed. The program pointed out that the current trend of concentration on the Cosmos network is not good for the network: it will increase the risk of review, and it may cause a decrease in activity and a fork attack, etc., which is a negative externality.

And because of the existence of " single attack ( a node in the network actively operating multiple identities at the same time )" , there are always some obstacles in designing attempts to avoid centralization. That is to say, the same node operator can use the rules of the protocol to create different identities to offset the actual effect of decentralized participation caused by redundant storage of blockchain. For example, split a large node into many small nodes .

In the draft, Sunny Aggarwal said:

We recommend implementing a "proportional penalty" proposal to combat witch attacks. That is to say, in this network system, each node is no longer subjected to the same degree of punishment according to a single percentage, but different penalty ratios are implemented according to the verification of the network power of the node.

Sunny uses a progressive formula that shows a step-by-step process of thinking:

Slash_amount = power

// power is the faulting validator's voting power.

Slash_amount = (power_1 + power_2 + … + power_n)

// where power_i is the voting power of the ith validator faulting in the period

Slash_amount = (sqrt(power_1) + sqrt(power_2) + … + sqrt(power_n))^2

Slash_amount = k * (sqrt(power_1) + sqrt(power_2) + … + sqrt(power_n))^2

// where k is an on-chain parameter for this specific slash type

In summary, in fact, it is more intuitive to say –

Assuming that a node has 10% of network power, then we gradually add conditions, and finally form the penalty formula determined by (4):

(1) The number of fines is determined according to the voting power of the network, and the penalty is set to 10% (temporary assumption is the same as the network power);

(2) What if I split it into small nodes? According to the correlation , the voting rights of the simultaneously faulty nodes are added together for a period of time to determine the network penalty ratio. Take two splits into two, for example, the penalty ratio is 5% + 5% = 10% , and there will be no less penalty.

(3) In order to further suppress the split node and let the penalty degree of the splitting behavior be higher than the actual network power ratio, then on the basis of (2), calculate the square of the sum of the square roots of the network power of each small node. In this case, the penalty ratio of two 5% network power nodes will increase from 10% to 20% .

(4) Determine different K values for different types of mistakes, and then multiply the result of (3) by K to distinguish the different degrees of punishment for different errors.

The new proposal is more "organic" than the two penalty standards of 0.01% and 5%.

Promote diversification staking

If you follow this new penalty mechanism, operators with higher network power will likely suffer a greater percentage of punishment. As stated by Sunny Aggarwal:

"In a certain period of time, the voting power of the wrong node and the number of nodes that have failed at the same time can affect the penalty standard."

On the one hand, this will make the client more willing to choose a small verification node. On the other hand, the risk of large node splitting is actually greater unless a safer strategy can be found. Sunny believes that because “relevance” is an important criterion, professional participants will conduct research on “ de-correlation ”, such as “ avoiding the same data center, popular cloud hosting platform or Staking-as-a-Service The service provider. This will promote a more flexible and decentralized network. "

Plans to be refined

It is undeniable that the design of the penalty system does help to improve the “Gini coefficient” and further de-decentralize the technology to promote a safer and more stable blockchain network.

Some community members agree and ask questions and suggestions , such as: Is the criteria for determining relevance too broad? Preventing "witch attack" is a good idea, but is it too strict, should we set another parameter? Some people reiterated the importance of setting the upper and lower boundaries of the penalty ratio, advocating the establishment of a reasonable upper limit to avoid excessive punishment, and because such a system may make the cost of doing small nodes lower, it is necessary to seriously consider the minimum penalty value.

The voice of concern is that although it is a good idea, it is believed that the token principal is currently unaware that this is a risk and only focuses on profit. There is also a view that the expected effect is based on the assumption that the verification nodes are very rational, but in fact it is not the case. I hope that the scheme can change the strategy of some rational verification nodes first, and at the same time, various tools. It should also suggest the difference in the ratio of the penalty.

There is a view that this is only a " placebo " for centralization. The reason is that the zero commission for some big nodes is so attractive that people only care about choosing a free and convenient solution regardless of the future.

Others believe that this will not really help to improve centralization, because it may allow large nodes to increase investment in infrastructure security, while small nodes have more capital constraints in this regard. In the long run, it may make the client think that the risk of small nodes is higher.

More thinking about centralization

People's views on network centralization come from many aspects, and they hope that through the system design, the network power will be decentralized.

In May of this year, the verification node Chainflow announced an organization called Decentralized Staking Defenders, which aims to change the possible oligarchic trends on the network and jointly maintain a “more balanced, fair, and joinable” ecosystem. And it seems that the discussion of distribution and redistribution is more of a technical issue than a social topic.

Social and governance topics are more difficult than technology, as Vitalik once stated. For example, we can achieve “equality” from a variety of means, but how to achieve “equity” may be just for people.

Fortunately, the developer’s exploration of design has never stopped. We not only see the participation of many nodes and communities, but also the core developers like Sunny Aggarwal from the current largest node in Cosmos, Sikka. The road to exploration of a centralized blockchain network.

Reference materials:

- Https://hub.cosmos.network/docs/genesis.html#slashing

- Https://forum.cosmos.network/t/proposal-draft-proportional-slashing/2887

- Https://github.com/cosmos/cosmos-sdk/blob/sunny/prop-slashing-adr/docs/architecture/adt-014-proportional-slashing.md

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- New bank Current receives $20 million in Series B financing, investment in Galaxy Digital, etc.

- Vitalik: Eth2 Fragmentation Chain Simplification Proposal

- Gartner's Top Ten Strategic Technology Trends in 2020: Blockchain will be fully scalable by 2023

- The turnover of Bakkt hit a new high on the day of the 1023 plunge, and the netizens wondered why the organization always went short.

- Litecoin, the whole line of mining machines approaching the shutdown price… Bitcoin machine S9 is also "hard"

- A Venezuelan self-report: In Caracas, I used Bitcoin to pay for the medical expenses of my son’s birth.

- DeFi Series Report | Measuring DeFi Trends with DAI Eco Data