The first day of the listing suffered a huge earthquake: the world's second largest bitcoin mining machine manufacturer Jia Nan Zhi Zhi opened 40%, and finally broke

Source: See the US stocks

On November 21st, Jianan Zhizhi's US IPO opened up 40% on the first day of trading. The biggest increase was over 44%, but the opening price fell below the issue price in less than half an hour. It fell nearly 9% and eventually fell. 0.11%.

On the first day of the open market, Jia Nan’s performance as the world’s second-largest bitcoin mining machine manufacturer was as full of twists and turns as the road to market.

On Thursday (November 21), Jia Nan Zhi Zhi officially landed on Nasdaq under the name of Jia Nan Technology, coded "CAN", opened at 12.6 US dollars, and rose 40% at the opening, up to 13 in intraday trading. The dollar, the biggest increase in the day more than 44%, but the opening price fell less than half an hour to fall below the issue price, the lowest fell to 8.21 US dollars, the decline approached 9%. By midday, Jianan Technology's decline narrowed significantly, eventually closing down 0.11% to $8.99.

- 197 blockchain concept stocks true and false transcripts: less than 30%

- EOS CPU congestion index reaches 100%, only 13% of available CPU

- just! "The first block of the blockchain" Jianan Technology listed, 26 questions responded to everything | Ling listen exclusive

This time, Jianan Zhizhi publicly raised 10 million American Depositary Shares (ADS). The ADS issue price is 9 US dollars, which is at the low end of the issue price guidance range of 9-11 US dollars. Based on the issue price, Jianan Zhizhi has a market value of more than 1.4 billion U.S. dollars, and IPO has raised 90 million U.S. dollars. The financing amount is significantly lower than the planned financing amount of 400 million U.S. dollars when applying for listing at the end of October this year.

Although the financing has shrunk from the original expectations, it is already clear from the twists and turns of Jianan’s listing. Before going to the US market, the mining machine giant based in Hangzhou tried to list in mainland China or Hong Kong.

In 2016, Jia Nan Zhi Zhi tried to borrow A shell to land in A shares. Luyitong Electric, a listed company on the GEM, announced that it had planned to acquire the entire share capital of Jianan Zhizhi at a price of 3.06 billion yuan. After repeated inquiries from the regulatory authorities, Lu Yitong eventually gave up the transaction.

In August 2017, Jia Nan Zhi Zhi sought listing on the New Third Board. But a month later, domestic regulators began to rectify ICO, virtual currency chaos, and closed virtual currency exchanges in China. Under the turmoil of the industry, the company also received multiple rounds of inquiries from the national SME share transfer system. In March of the following year, the company announced that it would voluntarily give up its listing.

In May last year, Jia Nan Zhizhi submitted a listing application to the Hong Kong Stock Exchange, but the listing document was not updated within 6 months and the application was automatically invalidated. The Hong Kong Stock Exchange has responded to bitcoin mining machine manufacturers, saying that it does not meet the core principle of the Hong Kong Stock Exchange "marketing adaptability."

As a mining machine manufacturer, more than 99% of Jianan Zhizhi's revenue comes from the sale of bitcoin mining machines and related parts and components, so fluctuations in bitcoin prices have a direct impact on business performance. Last year, Bitcoin plunged more than 70%. Also last year, Jia Nan’s rivals, the other two major miners’ producers, Bitcoin and Yibang International’s Hong Kong listing plan also failed.

In the prospectus submitted on October 28 this year, Jia Nanzhi said that he hopes to support artificial intelligence and blockchain research and repay debt through financing.

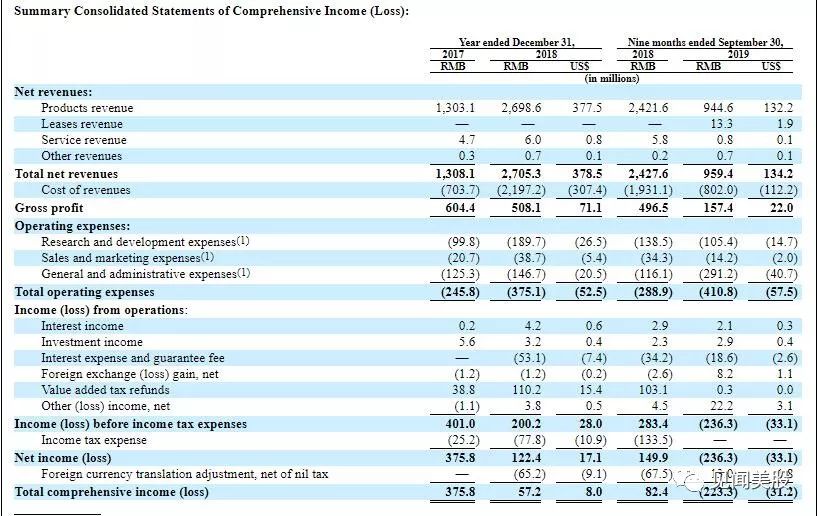

According to the prospectus, Jianan Zhizhi's profit dropped sharply last year. In the first half of this year, the income fell sharply, and the profit turned into a loss. When the income resumed in the third quarter, it returned to profit. Net revenue in 2018 was 2,705.3 million yuan (about 394 million US dollars), an increase of 106.8% compared with 2017, but the profit during the year was greatly reduced. The net profit in 2018 was 122.4 million yuan, a sharp decrease of 67.4% from 2017. In the first half of this year, Jianan Zhizhi's net revenue was 288.8 million yuan (about 42.1 million US dollars), a year-on-year decrease of 85.2%. The net loss for the quarter was 330.9 million yuan (about 48.2 million US dollars), compared with a profit of 216.8 million yuan in the same period last year. Net revenue for the third quarter was 670.6 million yuan (about 93.8 million US dollars), and the profit was 94.6 million yuan (about 13.3 million US dollars).

Jia Nan Zhizhi warned in the prospectus that after the bitcoin crash last year and the first quarter of this year, although the currency price has rebounded to some extent since the second quarter, it directly affects the market demand and price of bitcoin mining machine. .

“Although operating conditions are expected to improve as bitcoin prices pick up, operating results generally lag behind bitcoin price increases. In addition, bitcoin price volatility will directly affect the trading price of ADS (Jianan Technology).”

It is worth mentioning that after Jia Nan Zhizhi moved to the US market, Bitumin, the world's largest bitcoin mining machine manufacturer, also reported that it was seeking to go public in the US.

At the end of October this year, Bitcoin had secretly submitted a listing application to the Securities and Exchange Commission (SEC), and the sponsor was Deutsche Bank. In order to increase the chances of success for this listing, Bittland even hired Zheng Hua, the former representative of Nasdaq's former China region, as a consultant to the company.

It is foreseeable that as the first share of the Bitcoin mining machine, the performance of Jianan Zhizhi will become the touchstone of US investors' attitude towards Bitcoin. It will also reflect how the capital market views cryptocurrency and other mining companies such as Bitcoin will focus on the block. Chain transformation.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A picture to understand the gap between the rich and the poor in the "BTC World"

- "The first share of the mining machine" Jianan Technology's listing "core" journey

- Hangzhou launched “government service chain” “One main multi-side” technical structure to meet government needs

- Why is the project of Stanford University becoming more and more in China?

- Behind the "per-billion dollar bitcoin permanent loss": Bitcoin almost died

- Viewpoint | Checking the block Nonce distribution to track changes in mining equipment

- The patron saint of DeFi: talk about the new "insurance" track