The patron saint of DeFi: talk about the new "insurance" track

Source: Orange Book

About two or three months ago, I interviewed a friend in the market who was responsible for the market. Compound is the most basic and lowest-level lending agreement in finance. When we talked about DeFi, this friend mentioned that their team talks with many institutional investors every month. These institutions have a lot of money. I also want to put a deal on the Compound agreement, but they have two biggest concerns.

The first concern is legal compliance. If the organization wants to move the money, how to write compliance documents is a big problem for the company's legal affairs; the second concern is that the DeFi industry lacks a stable and secure insurance business, so they Did not dare to enter. When I asked whether the so-called insurance business refers to centralized or decentralized insurance, he did not know whether it is possible to decentralize or not, but if there is insurance business, DeFi players will be more likely to enter the market. many.

Of course, it seems a bit impractical to expect traditional insurers to offer services in a non-mainstream area such as DeFi or digital currency. Then, the so-called “decentralized insurance” that is more in line with fundamentalism seems to be another big market that DeFi hopes to subvert.

- Introduction to Blockchain | Valuation Models for Blockchain Industry and Its Disadvantages

- QKL123 Quote Analysis | What is Bitcoin? Can be compared to gold (1121)

- After upgrading the multi-mortgage Dai, MakerDao will do these in the next 10 years.

1

idea

Like DeFi, decentralized insurance has many "ideal benefits." One of its main ideas is to empower traditional insurance businesses with smart contracts that cannot be tampered with and enforced automatically. For example, in the traditional insurance industry, claims are often a difficult task that takes a long time. If written in the form of a smart contract, once the conditions agreed between the two parties are met, the claim can be paid immediately even if there is no claim.

Other “imagined benefits” are to increase the efficiency and transparency of the insurance business process through the blockchain, while at the same time allowing the insurance company to take on more responsibilities, because once the terms are written into the code, there is no need to trust the employees under the company. This may save the insurance company a portion of the management costs, while in turn reducing the premium cost of the customer's insurance.

The most important point is that the block-free nature of the blockchain may bring new users to insurance. In many cases, an insurance company needs to obtain a large amount of personal information about a customer before providing an insurance policy. For example, health insurance requires knowledge of the customer to price the policy. But there are many more common insurances, such as property insurance, tenant insurance, flood insurance, etc., which can attract more people without the current cumbersome procedures.

Decentralized insurance agreements, like decentralized financial agreements, all want to lower the threshold of the traditional industry that they correspond to into an open-ended ecology without permission, and ultimately democratize the power of finance and insurance. More individual hands. Decentralized finance may be to add more leverage to the individual. Decentralized insurance hopes to become a firewall for the whole society and provide security for the society.

2

The actual situation

The idea looks very good, so what about the actual things?

There are several different types of insurance agreements in the industry, and the coverage scenarios are different. But in general, just as DeFi is the first to focus on the original assets of the chain, decentralized insurance is also started from the original scene. A large part of this native scene is the DeFi ecology.

Therefore, the insurance agreement mainly provides guarantee services for various DeFi products and lending scenarios. The accident insurance and life insurance services provided by the traditional insurance industry in the world are relatively less involved. Therefore, decentralized insurance has the concept of "DeFi patron".

In the currency circle, several common attacks include: theft of private keys, the attack of the exchange, the theft of the wallet, the manipulation of vulnerabilities in smart contracts, and so on. These are also the things users are most worried about. Therefore, decentralized insurance agreements often provide some insurance services for users to use in these scenarios.

List some of the insurance agreements and products that are available now:

- Etherisc

- Nexus Mutual

- CDx

- oTokens

- VouchForMe

Let's take a look at the patterns of these protocols or products.

3

Several different modes

3.1

Etherisc

Etherisc's idea is very similar to Aragon in the DAO field – first to build a universal decentralized insurance application platform, allowing developers to use this platform to quickly develop new insurance products.

The Etherisc core team developed insurance-integrated infrastructure, product templates, and insurance license-as-a-services that allow anyone to create their own insurance products.

The Etherisc community currently designs a basic suite of insurance products ranging from flight delay insurance to hurricane insurance to encrypted wallets and loan-backed insurance, but most of them seem to be demo tests.

3.2

Nexus Mutual

Nexus Mutual uses a risk-sharing model that has a risk-sharing pool that is governed by members of the community who hold NXM tokens, and the community votes to decide which claims are valid.

Nexus Mutual was originally launched with Smart Contract Insurance, allowing anyone to purchase any insurance for public Ethereum smart contracts. This means that DeFi users can now protect their money borrowed from Compound or Dharma and the digital currency deposited by Uniswap by purchasing insurance. Nexus Mutual also hopes to offer more blockchain and traditional insurance products beyond smart contract insurance.

This model of risk-sharing pools has actually appeared before the blockchain, which is the “mutual protection” that Alipay introduced before. For the traditional insurance industry, mutual protection of this model is more like a social experiment, and because the partner is suspected of violating the rules and being fined by the Banking Regulatory Commission, the follow-up of the Ant Financial Service also renamed the “mutual security” to “mutual treasures”. An internet-based mutual aid program – this model seems to be falsified in traditional industries.

3.3

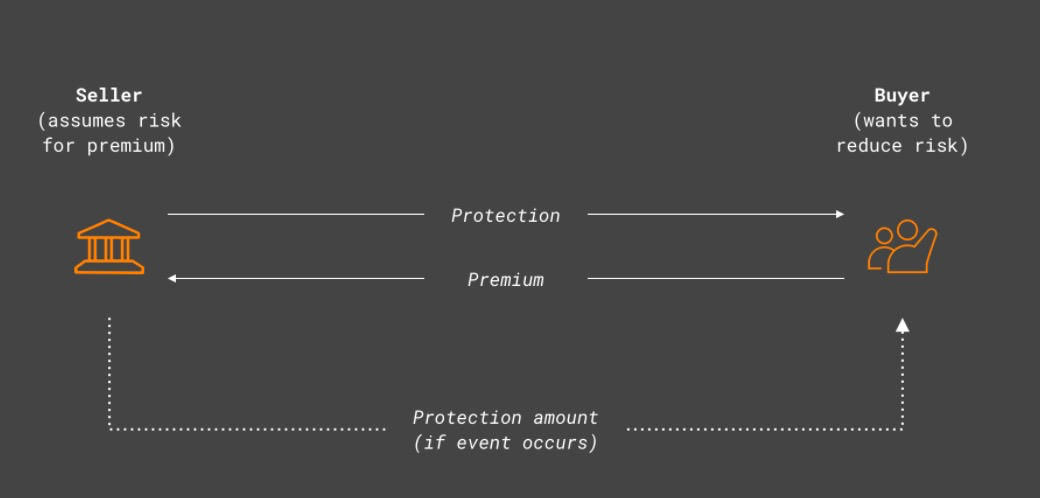

CDx

CDx is a trading platform for tokenized insurance. It is an agreement for credit default swaps. Credit default swap (CDS) is a financial product designed to protect users from the risk of default by the other party. The buyer pays the fee continuously during the insurance period, and receives compensation if he encounters a breach of contract.

Credit default swaps are the most common credit derivatives in the foreign bond market. They refer to a contract in which the buyer and the seller conduct risk conversion for a specified credit event within a certain period of time. The buyer of credit risk protection periodically pays the seller of credit risk protection for the credit event of a reference entity within the contract period or before the credit event, in exchange for the payment after the credit event occurs.

On CDx, this risk-converting contract is called Swap. You can create a Swap by casting a unique token corresponding to the Swap type. When the seller creates a Swap, he sets the total amount of assets he needs to insure, and the amount he wants to receive. Then the buyer can decide whether to buy the Swap after seeing it. This Swap is matched by some layer service providers and finally on the chain. Transaction. At the same time, Swap can trade in the secondary market like a normal token. If a breach of contract is made, the person holding Swap can use Swap to redeem the corresponding payment.

Exchange insurance may be one of the most current types of insurance for all types of insurance. CDx hopes to allow users to secure their own assets on the exchange through a credit default swap agreement.

3.4

oTokens

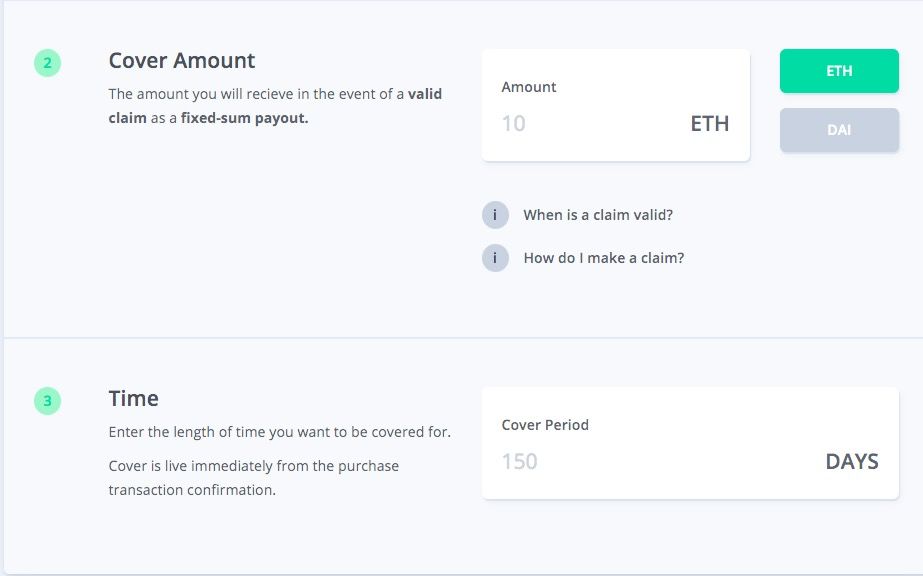

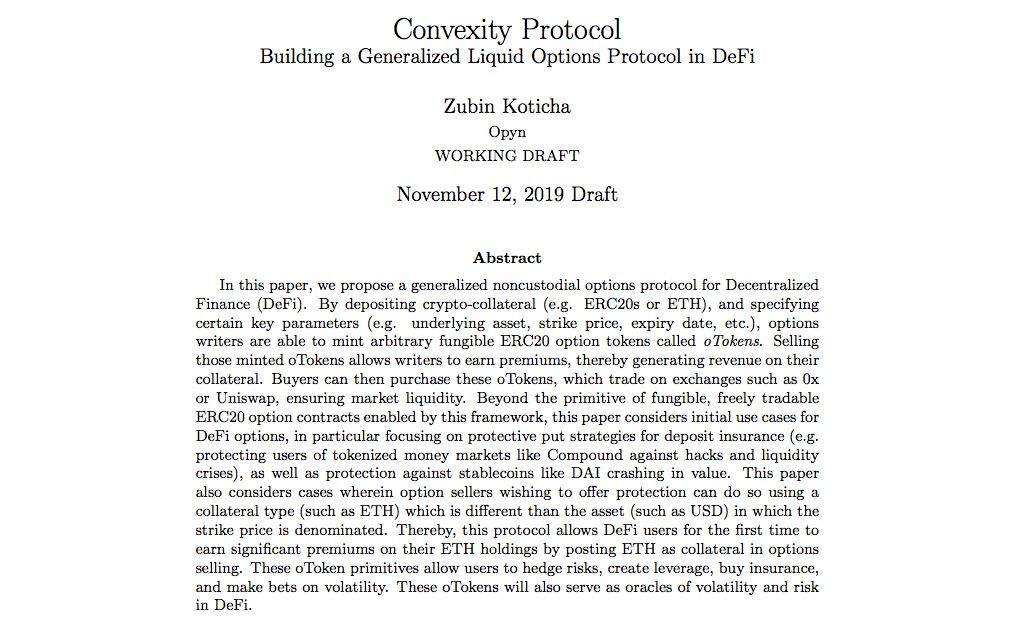

Convexity Protocol is a new option agreement based on ERC20 homogenization tokens in DeFi recently. It is only a proposal and there is no actual product. In this proposal, oTokens (option token) can be used as an insurance tool, and its operating mechanism is closer to financial derivatives and options trading.

oTokens' team believes that dYdX is DeFi's earliest derivatives trading agreement, and there are some natural flaws in the original proposed model, such as only supporting 0x protocol, option writers can only charge for performance assets, etc. So the oTokens team wanted to come up with a more complete set of protocols to replace dYdX, the Convexity Protocol.

With Convexity Protocol, users can protect their assets by buying put options.

In the traditional financial sector, an investor buys a stock for $50/share. If he is worried that the stock will drop to $20, he can ask the option seller to buy a $40 put. Investors have the right to exchange $40 in cash at any time, and at the same time, when the price is stable or even rising, there is no obligation to redeem, so he can enjoy the profit of this stock and only bear up to 40 dollars. The lowest price is equivalent to a form of insurance protection in disguise. The option seller earns money for himself by selling the option.

Basically, Convexity Protocol wants to replicate this functionality in traditional finance to the DeFi world and offers option sellers more flexible options and fewer restrictions. One can cast an ETH oToken by mortgage Ethereum ETH. This oToken represents the Ethereum put option, and others can buy this option to get the ETH crash. The user who casts the oToken is equivalent to the mortgage ETH sell option to get extra income, and the ETH can also make money.

3.5

VouchForMe

The idea of VouchForMe can be seen from the product name, they hope to use social networks to reduce the cost of insurance. Your family and friends know you better than others and are more aware of your risks. VouchForMe wants to collect guarantors from users who are willing to endorse you from social networks and social relationships, and let the insurance company believe that you are in compliance with the guarantor. Requirements, thereby reducing the cost of insurance. When making a guarantee, you need to sign a financial commitment linked to the insurance claim. The more people you guarantee, the lower the premium. If there is a claim, the guarantor will bear the proportion.

3.6

Other modes

In addition to insurance-original agreements, and models of financial products such as derivatives trading and options agreements, the forecasting market can actually be used as an insurance mechanism. For example, on Augur you can hedge against the risks you may be exposed by establishing a forecasting market, but this model requires that you have enough people to participate in predicting market bets.

4

Insurance vs financial derivatives vs forecast market

From the above several models, we can see that in order to achieve the purpose of "insurance", in addition to the original agreement for insurance design, financial derivatives, forecasting the market, the existing models in DeFi can also be used as a means of insurance to provide users with Security, whether it is risk hedging or fund guarantee.

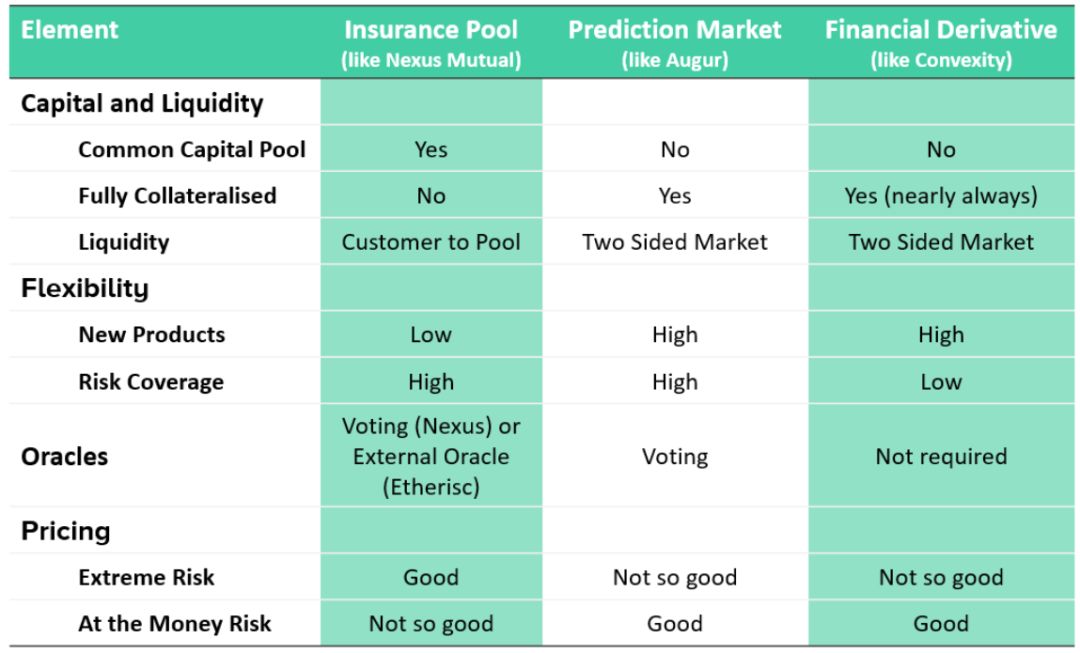

So, are these models better or worse? If we can use DeFi's existing models and protocols to achieve insurance purposes, do we need to develop new protocols specifically for insurance? The founder of Nexus Mutual recently wrote an article specifically to answer this question. He compared the pros and cons of insurance, financial derivatives and forecasting markets.

In his view, the biggest difference between insurance agreements and financial derivatives and forecasting markets is that insurance has a risk-sharing pool, because with this pool for risk sharing, risk compensation can be made at a lower cost. In the financial derivatives and forecasting markets, 100% of the mortgage funds are needed to make payments. Especially when there is a very low risk probability, such as a 1% chance per year, then obviously the insurance model is much lower than the cost of financial derivatives and forecasting markets. Another benefit of the risk sharing pool is that the product will be better and faster when it starts.

But in terms of flexibility, when financial derivatives and forecasting markets want to develop a new product, because they are standardized and meet technical standards, development is easier, lower cost, and faster. Insurance agreements are relatively less flexible, and when you start a new risk-sharing pool, you need to do a lot of research to make pricing to ensure that it works.

Other differences include: On the Oracle oracle, Nexus Mutual and Augur are similarly voted through community voting, while Etherisc uses external oracles as a basis for payouts, while financial derivatives have no oracles, user redemptions. When you call a call, you can pay directly using a predetermined price. This is an advantage of financial derivatives as a means of insurance.

5

to sum up

As the entire DeFi industry continues to evolve, insurance is expected to continue to expand the reach of DeFi as an important component of DeFi. DeFi offers an interesting opportunity for third world countries, underdeveloped regions, and markets with insufficient financial services capabilities. With the growth of DeFi lock assets and the emergence of a variety of new DeFi products, smart contract insurance, exchanges Insurance, wallet insurance and other DeFi insurance may be the next focus of blockchain investors.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Nasdaq ringing the bell soon, taking you back to Jianan Zhizhi, a three-year IPO road.

- SheKnows 丨嘉楠耘智 will become the "first block of the blockchain", can blockchain companies usher in the tide of listing?

- Regulatory policy is not clear, one of South Africa’s “five major banks” announced the closure of the bank account of the cryptocurrency exchange

- Outlook for 2020: Will US stocks, A-shares and Bitcoin be seen in the long-term and long-distance?

- Subverting the dominant position of the dollar, all countries are in love with the central bank digital currency

- Russian Federal Savings Bank receives blockchain patents to reduce counterparty risk in the repo process

- Twitter selection | The first SEC compliance ICO still breaks 50%, retail investors are bruised