With the entry of big players and the halving narrative, is now the best time to buy Bitcoin?

Is now the best time to buy Bitcoin with big players entering the market and the halving narrative?It is not an exaggeration to describe the trend of BTC since June this year as “big ups and downs”, or more accurately, it is “big downs followed by big ups”. The BTC price was first affected by the negative factors such as Binance being sued as a black swan event and the US bond withdrawal of liquidity in early June. BTC fell to a low of 24,800. Just when the market was desperate, with the world’s largest asset management company BlackRock, which owns assets under management of over $10 trillion and a nearly 100% ETF approval record, applied to the SEC for a Bitcoin spot ETF, WisdomTree, Invesco, Fidelity Investments, and other traditional institutions began to apply, and EDX, a trading platform specializing in institutions, was officially launched in the United States.

A series of news about traditional financial institutions entering the cryptocurrency world stimulated investors’ nerves. Against the backdrop of Bitcoin’s upcoming halving, whether institutions choose to enter at this time is to “get on the bus” for this round of halving? Regardless of the answer, the price of Bitcoin has rebounded all the way from 24,800 to a high of 31,000, and it seems that “the bull is back”.

- The European Commission proposes Web4.0, is it a gimmick or a disruption?

- Comprehensive Interpretation of Ripple’s Lawsuit with SEC: Both Sides Achieved “Partial Victory”, Multiple Exchanges Re-listed XRP

- Forbes: How did Craig Wright become “Satoshi Nakamoto”?

Looking back, the native cryptocurrency exchanges Binance and Coinbase were sued by the SEC, causing the market to freeze, but BlackRock and other traditional financial institutions chose to enter at this time. Is it a “coincidence” or a “conspiracy”? It is indeed intriguing.

Regardless of whether the SEC is paving the regulatory red carpet for traditional financial institutions, what we need to understand more is what impact the entry of traditional financial institutions will have on the cryptocurrency world? As an ordinary investor, how should you respond?

First of all, the entry of traditional financial institutions will undoubtedly inject a lot of liquidity into the digital currency market. The feature of ETF is that it can be listed and traded on securities exchanges, which will provide investors with a more convenient Bitcoin trading channel. Through the introduction of ETFs, more traditional and institutional investors can easily participate in the Bitcoin market, and more funds will flow into the market. Markus Thielen, the head of cryptocurrency research at the digital asset service platform Matrixport, once pointed out that “BlackRock’s Bitcoin ETF, after passing, will attract US$10 billion within three months, and US$20 billion within six months-this will greatly support the Bitcoin price.” The participation of traditional financial institutions may bring more stable capital flows to the Bitcoin market, improve market depth and liquidity.

After BlackRock’s application for a Bitcoin ETF was released, the current BTC price has been fluctuating between 30,000 and 31,000. The fact that the medium-term fluctuation time exceeds 20 days indicates that the buying power around 30,000 and the selling power around 31,000 are both strong. In the short term, it is necessary to pay more attention to the behavior of Bitcoin prices. The direction of Bitcoin prices after the fluctuation may gradually become clear due to the stimulation of news such as US macro CPI data, and whether the Bitcoin spot ETF can pass will also be an important news affecting price behavior. In the long run, under the background of halving, according to past “conventions”, Bitcoin seems to usher in a big bull market.

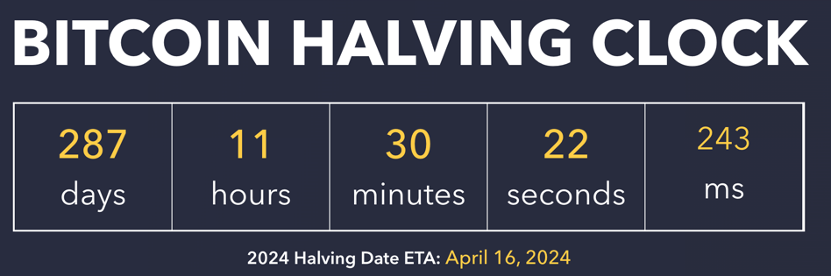

According to Bitcoin’s design, whenever a miner successfully solves a block, they will receive a certain amount of new Bitcoin as a reward. However, in order to control the supply of Bitcoin, the Bitcoin protocol stipulates that the block reward for Bitcoin will be halved approximately every four years. This halving will reduce the block reward to 3.125 BTC.

Bitcoin’s halving mechanism is designed to limit the total supply of Bitcoin and gradually slow down its growth rate. Through the halving mechanism, Bitcoin’s scarcity and resistance to inflation are maintained.

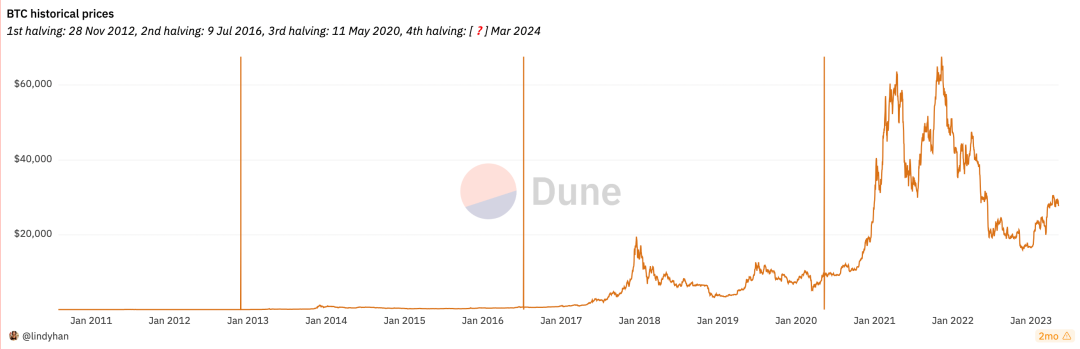

Less than 300 days left until the fourth Bitcoin halving. Looking back at the history of Bitcoin halving, it seems that every halving is accompanied by a rise in Bitcoin prices:

- November 28, 2012 – First halving, block rewards dropped to 25 BTC, and Bitcoin prices rose from $12 to $1,217.

- July 8, 2016 – Second halving, block rewards dropped to 12.5 BTC, and Bitcoin prices rose from $647 to $19,800.

- May 12, 2020 – Third halving, block rewards dropped to 6.25 BTC, and Bitcoin prices rose from $8,787 to a high of $64,507.

Through the three halving events in Bitcoin’s history, we can see that each halving is accompanied by a surge in Bitcoin prices, which seems to support the notion that halving does indeed have a positive impact on Bitcoin prices.

In terms of demand, with the popularity of BRC-20, the Bitcoin ecosystem seems to have reached a turning point. Bitcoin, which previously only represented “digital gold” as a store of value, will also boost demand for Bitcoin due to the richness of its ecosystem. In addition, institutional entry and trading demand will also lead to an increase in Bitcoin demand.

In terms of supply, the total amount of Bitcoin was determined to be 21 million at the beginning, and the halving every four years will lower Bitcoin’s inflation rate and reduce the supply. For goods with low supply elasticity like Bitcoin, an increase in demand and a decrease in supply will most likely result in a price increase.

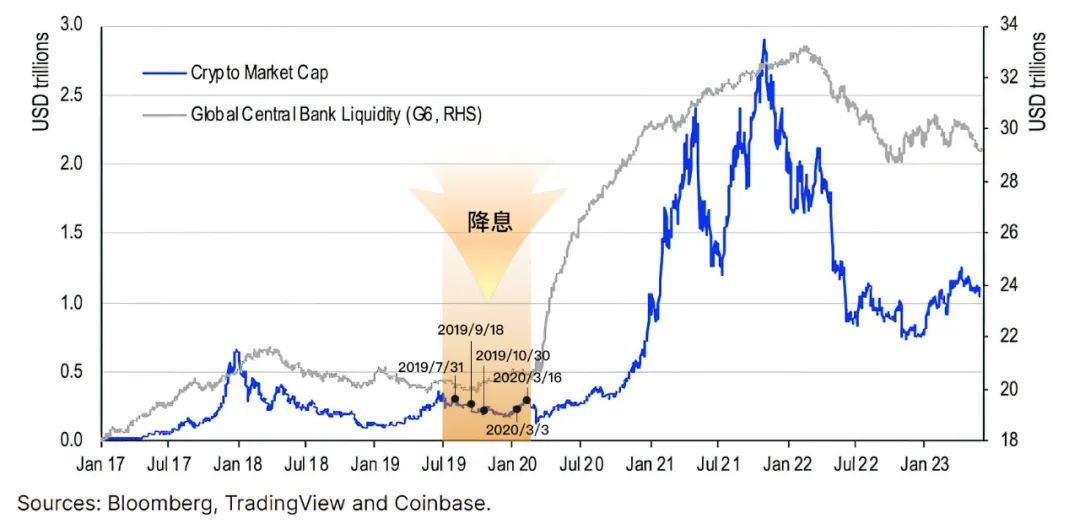

By observing past Bitcoin bull and bear markets, we can see that macro liquidity has had a significant impact on Bitcoin prices. Specifically, the Bitcoin bull market of 2012 occurred against the backdrop of the Federal Reserve’s implementation of the third round of quantitative easing and the European Central Bank’s easing policy; the bull market of 2016 was related to Brexit, with the Bank of England restoring its bond purchase program to cope with uncertainty, further releasing liquidity. At the same time, the launch of Bitcoin futures attracted a large amount of off-market funds into the market; the bull market of 2020 was affected by the global epidemic, and the United States adopted a large-scale loose monetary policy, including unlimited quantitative easing, injecting a large amount of liquidity into the market. This led to a large influx of funds into the cryptocurrency market, pushing up Bitcoin prices. In contrast, bear markets usually coincide with global liquidity tightening. In the bear markets of 2014, 2018, and 2022, global liquidity tightening led to capital flowing out of the Bitcoin market, putting downward pressure on Bitcoin prices.

These results indicate that the monetary policies and liquidity conditions of global central banks have a significant impact on the Bitcoin market. Loose monetary policy and ample liquidity tend to push up Bitcoin prices, while monetary policy tightening and liquidity tightening may put downward pressure on Bitcoin prices.

By the end of 2022, global liquidity seems to have bottomed out, which means that Bitcoin may have reached its bottom. At the same time, US inflation has ended, and the Federal Reserve announced in June this year that it would suspend interest rate hikes. In this case, investors may seek returns and flow capital into the stock and crypto markets, so it is expected that asset prices will continue to rise in the future.

According to the statistics of Cailian Press, among various assets in the first half of this year, Bitcoin leads all assets with a 83.81% increase. Whether to “ride the momentum” or “lay low”, R3PO believes that in the context of halving, the approval of Bitcoin spot ETF is likely to become the “catalyst” for the next round of Bitcoin bull market. In addition, Bitcoin has rebounded several times after touching the ground, and its bottom features are also more obvious in the price trend.

However, while maintaining optimism and confidence, risks still need to be taken into account. First of all, due to the unclear regulatory framework and imperfect system, the application for Bitcoin spot ETF may still be rejected by the SEC; secondly, the influence of macro liquidity on crypto assets cannot be ignored. The Federal Reserve may continue to adopt a tightening monetary policy, which may affect liquidity. It is necessary to continue to pay attention to US inflation and employment data and evaluate the possibility of future interest rate hikes.

However, these uncertain factors also provide a good opportunity to build positions. In the long run, WealthBee is optimistic about Bitcoin and other crypto assets. Although there is uncertainty in the short term, entering the market during uncertain periods is the right choice, so it is currently possible to consider gradually entering the market by averaging costs.

References:

https://www.defi4fun.com/bitcoin-halving-understanding-the-phenomenon/

https://www.theblockbeats.info/news/37141

https://xueqiu.com/1903522932/250655586

https://www.panewslab.com/zh_hk/articledetails/ujg4cufl.html

https://mp.weixin.qq.com/s/_VVM_ewVgpDcWhPfaKdcyg

https://www.coindesk.com/business/2023/06/07/bitcoin-halving-is-coming-and-only-the-most-efficient-miners-will-survive/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bull market signal? How much longer will Bitcoin stay at $30,000?

- Bitcoin stays stable at $30,000, is this a signal of a bull market?

- Galaxy Digital Founder: Bitcoin ETF Will Become SEC’s “Stamp of Approval”

- CoinMarketCap: Overview of the Overall Status of Trading Platforms in the First Half of 2023

- An Explanation of Taproot: Consisting of Three Different Bitcoin Improvement Proposals

- Boring Ape’s decline continues, where should the NFT market break the ice?

- 2017 vs 2023: Fink’s Institutional Bitcoin Perspective