Both sides are prepared – Bitfinex, Tether and NYAG are on the verge

(1) New York prosecutors first launched

On April 25, 2019, at 16:15 (UTC), the New York prosecutor brought Tether, Bitfinex and its parent company, iFinex Inc., to court for alleged fraud involving fraudulent interests of investors, in violation of the harsh securities of New York State. The law of the Martin Act.

The 23-page prosecution allegation file shows that since 2018, Bitfinex has incurred a huge loss of $850 million in the fund custody process. After the incident, the company did not disclose to investors, trying to conceal the loss, and reached out to Tether to pay the USDT reserve, secretly misappropriated at least $700 million to make up for the financial deficit. The Office of the Attorney General of New York also received a preliminary ban on the freezing of Tether assets and asked the two companies to provide documents worth approximately $625 million and $900 million in line of credit.

The Martin Act, the New York State Blue Sky Act, aims to prevent fraud and protect the interests of investors. Prior to 1933, the United States had no federal management laws for the securities management industry, and states had their own relevant management laws. In 1921, the New York State Assembly passed the Martin Act, which prohibited fraud related to securities transactions and, after the 1955 amendment, authorized the Attorney General to establish criminal and civil proceedings.

- Bitcoin and cryptocurrency in the history of ice and fire: the most unforgettable 2017 and 2018

- Blockchain will solve digital identity security issues? 84% of organizations believe that blockchain is more secure than traditional IT systems

- After five years of grinding a sword, Weizhong Bank's financial technology is fully open source, and the blockchain plays an important role.

The Martin Act is known as one of the toughest anti-fraud laws because it does not require the prosecutor to prove that the defendant "intentionally" or express the defendant's criminal "motivation", but only requires proof of wrong or misleading investment advice. There is a causal relationship with the losses suffered by investors. In the United States, engaging in securities financial activities must not only meet the requirements set by the Securities and Exchange Commission, but also comply with a series of laws and regulations formulated by the other governments of the states.

After the event was fermented, Bitfinex sent a counterattack, insisting that "Bitfinex and Tether are in good financial condition." This $850 million is not a "loss" and is an "accident" when working with third-party payment company Crypto Capital Corp. The huge amount of encrypted capital was not lost, but was seized and protected. Bitfinex’s rhetoric was strong, pointing out that the Office of the Attorney General of New York was seriously overstepped and malicious, and the allegations were full of false conclusions and insisted on fighting the Office of the Inspector General of New York.

But on April 30th, Tether and Bitfinex's general counsel Stuart Hoegner admitted in a written testimony that only about 74% of USDT is supported by cash and equivalents, Tether's lawyer Zoe Phillips wrote in a legal memo that Tether does not need to Each USDT holds $1 for support.

The statement given by the Tether side is in line with the behavior of the official website that was quietly deleted in March, “the token is fully supported by the US dollar”. Prior to this, Tether's official website showed that "Every Tether is supported by the traditional currency of our reserve 1:1, so 1 US dollar Tether is always equivalent to 1 US dollar." In mid-March, the behavior of Tether's modification and deletion of the terms was discovered by netizens, causing an uproar.

Tether, originally 100% supported by the US dollar and paid in a 1:1 ratio, became "each Tether is supported by our 100% reserve, including traditional currency and cash equivalents, and sometimes other Assets and accounts receivable, these assets and receivables may come from loans issued by Tether to third parties, which may include affiliated entities (collectively referred to as 'reserves'). Netizens generally question this and believe that it harms the legality of Tether.

(2) New York prosecutors’ second attack

After Bitfinex’s tough response to the question, the New York prosecutor did not give up. According to coindesk, the New York State Attorney General's Office (OAG) said on May 5 that Bitfinex must disclose the Tether transaction for greater public transparency. The ban does not limit the ability of Bitfinex or Tether to operate normally, as they have continued to operate since the ban. The core issue is that Bitfinex and Tether misled their customers and investors, which only increased OAG's need for timely and organized access to documents and information so that OAG can understand what is happening in these companies and what will happen. thing.

At the same time, Bitfinex and Tether's parent company, iFinex, responded to the filing of the New York Attorney General's Office (NYAG), which stated that "(the ban) was issued based on incomplete or incorrect facts and erroneous legal standards." Bitfinex and Tether believe that "there is no ongoing fraud and no 'victims' need to take mandatory remedies to protect them." The document also stated that NYAG first needed to lay the foundation for its authority to "regulate this area." iFinex pointed out that NYAG misused the term "investors" when it comes to Bitfinex and Tether customers. These customers are not investors, and "they have no right to disclose information like investors." Bitfinex also said, "Tether is still trading today."

At the hearing on May 6, Joel M. Cohen, a judge of the Supreme Court of New York, said in the case that the Office of the Attorney General of New York at the end of April had doubts about the scope of the preliminary ban imposed by Bitfinex. The judge pointed out at the meeting, "The current preliminary ban is vague and open, and there is not enough tailoring, which may lead to the imminent damage of reality. Therefore, NYAG, Bitfinex and Tether lawyers need a week to be serious. Negotiate, finalize the scope of the ban, and propose reasonable revision documents."

Although companies such as NYAG and iFinex have a week to negotiate the ban, at the same time, the exchange Bitfinex seems to be facing difficulties in withdrawing cash. Some users reported that the legal currency could not be taken out of the exchange. Some users said that the US dollar withdrawal application has been submitted for one month and has been postponed. Some users have been frozen because of the withdrawal of legal currency. According to cryptoslate, the Tether and Bitfinex events caused Bitfinex's cold wallets to transfer more than $430 million in cryptocurrencies (including BTC, ETH, stable currency and other cryptocurrencies), and the wallet activity seems to be processing the withdrawal business.

On the one hand, it confronted NYAG. On the other hand, Bitfinex began to solve the problem of users' difficulty in raising coins. After all, in February 19th, Bitfinex's withdrawal business was blocked. According to Zhao Dong, founder of Dgroup, Bitfinex will carry out IEO fundraising to solve this problem. The full name of the IEO is Initial Exchange Offerings, which is the first transaction, which refers to a way for the exchange to directly help the project to raise funds and sell its tokens.

On May 8, Bitfinex today announced a white paper on the fundraising project LEO, saying that its tokens will not be available in the US or sold to Americans and other prohibited personnel. On May 13, Pafine Ardoino, chief technology officer of Bitfinex, announced on Twitter that it had completed a $1 billion LEO token private placement within 10 days. In theory, if you raise $1 billion in a short period of time, Bitfinex can solve the problem completely, because the frozen funds will be 850 million US dollars.

The fundraising was completed in such a short period of time, and the industry was amazed at the influence and appeal of Bitfinex, but the New York prosecutor did not think so. Unexpectedly, the $1 billion raised by LEO did not dispel the concerns of the New York prosecutors. Instead, it became a handle of Bitfinex and was counterattacked in July.

The consultation time of the week passed quickly, but according to a new document submitted to the court on May 13, the New York Attorney General's Office (NYAG) and Tether's lawyers failed to agree on the ban, and NYAG wanted to block "any subsidiary. The entity "uses Tether's reserves and enforces a 90-day ban, but Tether and Bitfinex parent iFinex's lawyers hope to have only a 45-day ban, and hope that iFinex's affiliated entity Tether will also reduce the ban. iFinex's lawyer wrote in a letter to the court on Monday that they would agree to some modifications to the preliminary injunction, but would not abandon the previously proposed motion to completely revoke the NYAG unilateral injunction. Judge Joel M. Cohen, who is in charge of the case, may arrange a hearing to resolve the matter.

At the hearing on May 16, Judge Joel M. Cohen approved Bitfinex's request to amend the NYAG office's ban on Bitfinex and stated that the original ban was ambiguous, too broad, and time-limited. The New York Supreme Court allowed Bitfinex and Tether to continue their normal business activities, but the ban will still expire in 90 days. Cohen believes that the New York State's Martin Act "does not provide a mandate to regulate business activities." The judge's submission also stated that the order for Bitfinex and Tether executives and employees stopped lending Tether's reserves to Bitfinex and any other party, except for normal business.

On May 21, Bitfinex and Tether filed a new document with the court asking the judge to dismiss NYAG's lawsuit against them, saying they had no customers in New York State. In addition, professional lawyers also believe that NYAG’s allegations have loopholes in scope definitions. “Even in general, no 'victims’ in New York have been identified, but the Justice Department is using New York law, ie, jurisdictional securities and The Martin Act of the goods, and the stable currency USDT is neither a security nor a bulk commodity."

Whether or not there is a trading service for citizens of New York State has become a lifeline for Bitfinex and Tether to prove their innocence. Therefore, the transaction record of the New York prosecutor’s evidence became the key to the case.

(3) New York prosecutors made three incidents

On the surface, the calm from the end of May to the beginning of July is a crucial moment for the two sides to collect evidence. Here, bitcoin prices have risen from $8,000, up to $14,000, or nearly 75%.

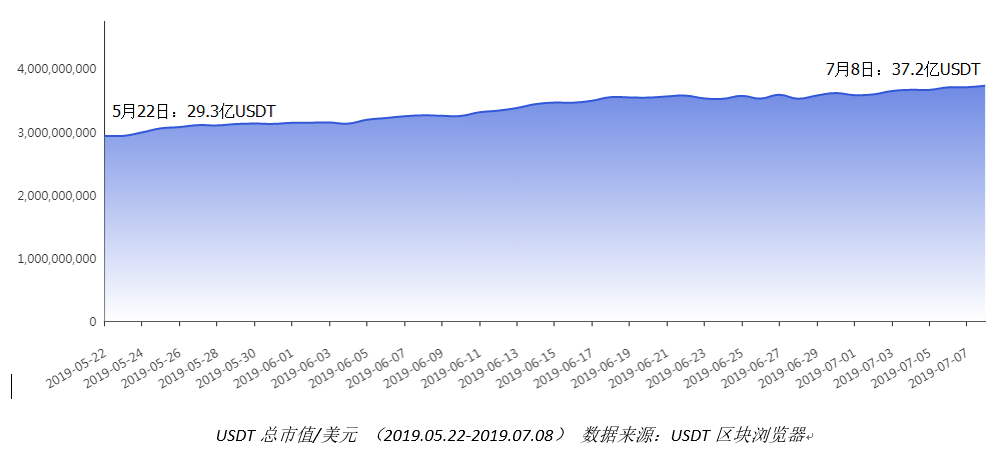

The highly anticipated USDT experienced several additional issuances before this period. The total market value increased from 29,3076,5020 USD to 37,2456,5868 USD, an increase of 27.08%.

On July 2, Bitfinex announced that it had repaid $100 million in outstanding loans to Tether on July 1 based on its financial status at the end of the second quarter of 2019 and has not yet paid Tether. On July 6, according to CoinGecko's data, Tether's transaction volume in June exceeded $1 trillion, which is a high-speed turnover rate of at least 277 times for the USDT with a market capitalization of only $3.6 billion at the end of June. The volume of transactions reached has intensified market speculation that "Bitfinex and Tether have been manipulating cryptocurrency market prices."

On July 8, a new document submitted by the New York State Department to the New York State Supreme Court showed that Bitfinex and Tether provided cryptocurrency transactions to New York State users longer than they claimed. On July 9, Frank Chaparro, head of blockchain media The Block News, said on Twitter that the New York State Department of Financial Services (NYDFS) provided evidence that the exchange Bitfinex serves New York State users.

At the same time, the New York prosecutor accused Bitfinex and Tether of allegedly issuing illegally traded securities (USDT, LEO) in New York State and is a non-registered securities operator. The prosecution’s memo stated that “LEOs in the IEO should be bound by the Martin Act and have reason to believe that their issuance activities are related to the matter under investigation”.

As the prosecution’s accusations increase, the engagement between the two sides is getting closer. There were two minor incidents between Bitfinex and Tether before the final response was made on July 22.

Around 20 o'clock on July 11th, Bitfinex said on Twitter that the exchange is undergoing temporary maintenance, the transaction is temporarily suspended, all wallets are not affected, and the recovery time is unknown. The problem was fixed at 23 o'clock on the day but it was not announced what the reason was and the transaction was resumed.

On July 14, Tether Treasury issued a total of 5.05 billion USDT in the wave field chain and destroyed a total of 5 billion USDT twice. The operation took place within 1 hour. Subsequently, Bitfinex's CTO Paolo Ardoino tweeted that this was an oolong event because of a problem with the data tag when the USDT was preparing to move from Omni to Tron.

There is also a rather strange thing, Bitfinex's bitcoin long-short position ratio has always been a classic indicator in the industry, but in May of this year, there have been several large short positions in short positions.

On June 30, short positions closed more than 20,000 bitcoins, and on July 11, the shorts again closed nearly 10,000 bitcoin shorts. This sudden operation has caused many people to question whether Bitfinex's long and short positions are true. In the case of the apparent lack of depth in the digital currency exchange, such a large position can be quickly closed and has to be doubtful.

On July 22nd, Bitfinex filed the latest legal documents against NYAG's allegations, saying that the claims that the two companies served New York residents by 2018 were misleading. Its general counsel, Stuart Hoegner, said the two trading platforms only operate with foreign entities that do not have physical entities in New York, including the former partner Mike Novogratz's encrypted asset investment bank, Galaxy Digital, whose address is listed in New York. city.

Bitfinex ceased to serve New York residents in January 2017 and ceased to serve all US residents in August of the same year. One year later, US physical and corporate customers were banned on the platform. Hoegner also stated that NYAG did not provide documents to Bitfinex, Tether or other affiliates in a timely manner in accordance with the law. These companies did not intentionally use the opportunity to do business in New York. USDT is not a securities or commodity defined by the Martin Act, and the law cited by the NYAG Office Not applicable, so the Supreme Court of New York should be asked to dismiss the case.

In the end, whether USDT or LEO transactions were attended by Americans became a hot topic on the Internet. Coindesk reports that both Arrington XRP Capital, based in Seattle, USA and Arca, based in Los Angeles, say they invested in LEO tokens, although Bitfinex claims to refuse to sell them to US residents or entities.

But the two investment management companies said they did not buy tokens from Bitfinex, but legally obtained them from third parties. Theblockcrypto has also made similar reports, although it is said to ban transactions in the United States, but as a US user, trading through Bitfinex is still quite easy. After easily creating an account and accessing Bitfinex with New York State IP, users only need to select one option. If they are not American residents, they can continue to use the exchange.

On July 26th, General Counsel Stuart Hoegner responded to Coindesk in Twitter, reaffirming that LEO is sold through private placement, and that these tokens are not available to Americans. Americans and non-US registered qualified participants controlled by Americans are not allowed. Buy or trade LEO tokens. Later, Bitfinex also issued a statement saying that the account IP has been properly identified and disabled, and the platform will continue to be monitored and refused to serve US users.

(4) The two parties finally go to court

Whether it is the evidence submitted by the New York prosecutor or the documents submitted by Bitfinex and Tether, it is finally focused on one point: whether the transaction services of the two companies have been provided to New York residents. Once the evidence submitted by the prosecution can prove the transaction of a New York user, the subsequent charge of securities fraud is only established in New York State, and the Martin Act is applicable. Conversely, the two companies are registered overseas and the laws of the State of New York have no jurisdiction.

In any case, the two sides will face each other at a hearing on July 29. The key to the problem at the time is to see if the evidence submitted by the prosecution is sufficient.

(5) Bitfinex and Tether pre-tracking

Why do New York prosecutors focus on these two companies in the digital currency arena? We believe that there are two main reasons, each of which is half.

1. Bitfinex's predecessor was inferior . The Tether audit, known as the “digital central bank”, was opaque and the company's profits were extremely high.

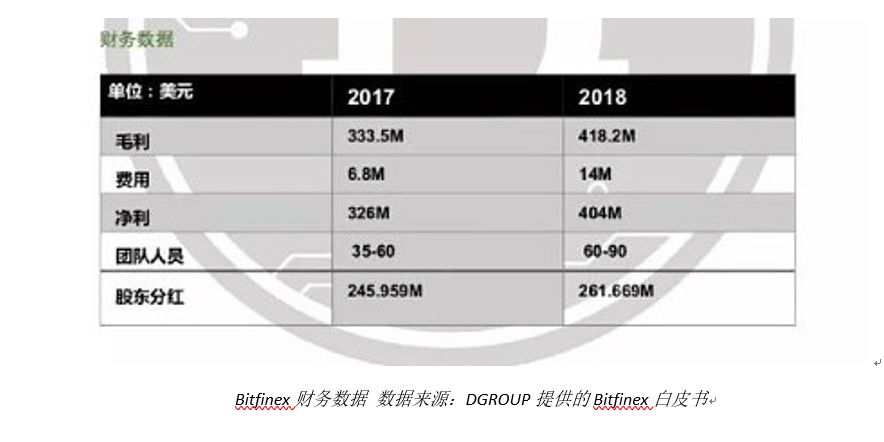

Looking at this financial data sheet alone, I believe that many people will be shocked. In 2017, Bitfinex team members 35-60 people, net profit of 326 million US dollars; 2018 60-90 people, net profit of up to 404 million US dollars, per capita profit of more than 36 million yuan.

Under such a profitable business, it is hard to imagine that Bitfinex has a large security risk and encrypted assets have been stolen several times. On May 22, 2015, Bitfinex was hacked and the $400,000 cryptocurrency was stolen, accounting for 0.06% of the exchange's encrypted assets. On August 2, 2016, Bitfinex was hacked to steal nearly 120,000 cryptocurrencies, which was worth about $75 million at the time. It was announced that almost all users shared 36% of the losses at the same time, but Bitfinex did not disclose the full details of the hackers.

What is puzzling is that BitGo, a security company that provides digital signature services, claims that its servers have not been compromised. Of course, Tetherye is not safe. On November 19, 2017, Tether was hacked and the 31 million USDT was transferred from Tether's wallet to an unauthorized bitcoin address.

Tether was established in September 2014 and until November 7, 2017, it all claims that Bitfinex and Tether are two completely separate entities. However, in November 2017, the leaked documents of “Paradise Files” showed that Bitfinex and Tether were operated by the same people. Tether and Bitfinex insist that "business is separate."

Because of the opaqueness of the Tether audit, the user's legal currency deposit has been questioned, and the channel of access to the gold bank that was previously cooperating with Bitfinex has been cut off. After splitting with Wells Fargo and Noble Bank, and no one bank is willing to provide banking services for Bitfinex, which makes it difficult to make money.

In October 2018, Bitfinex claimed to have a business relationship with the Delce Bank & Trust Limited Bank of the Bahamas, but subsequent evidence indicates that Tether had deposited deposits with deltec Bank but had withdrawn funds. As a last resort, in November 2018, Bitfinex began to use the "pseudo bank" of Crypto Capital to provide deposit and withdrawal services. This laid the foundation for the later "East Window Incident".

Many traditional banks are reluctant to cooperate with encryption companies for reasons such as money laundering, and have spawned “shadow banks” such as Crypto Capital. The parent company of Crypto Capital is Global Trade Solutions AG, which is licensed by a financial institution in Switzerland, as a banking service provider. According to Wei Zhou, chief financial officer of the company, and Christina Lee, chief brand officer of the Kraken exchange, the two cryptocurrency exchanges, Chanan and Kraken, have cooperated with Crypto Capital in the past, and lost $190 million due to the accidental death of the CEO. The Canadian cryptocurrency exchange QuadrigaCX is also an important partner of Crypto Capital.

Crypto Capit is an unregulated Panamanian company. In early May this year, two people related to Crypto Capital were accused of money laundering. They used Global Trading Solutions LLC to provide banking services to encryption companies, handling various illegal transactions, involving hundreds of millions of dollars. Dollar. Global Trading Solutions LLC is recognized as one of Crypto Capital's shell companies and has a financial relationship with Bitfinex. It was not the first time for Bitfinex because the account was in trouble with the bank that was suspected of money laundering. In April 18, suspected Colombian drug group money laundering, Bitfinex's cooperative bank account in Poland was frozen 400 million euros. But Bitfinex subsequently clarified that it did not find any connection between its business and the two shell companies that controlled fraudulent Belgian government and money laundering in Colombia.

In fact, Bitfinex and Tether were “not so simple” at the beginning of their birth. Brock Pierce, the mastermind behind the scenes, always cleverly hides the associations of his company and registers them in different offshore locations. In 2012, Bitfinex was incorporated in Hong Kong, China. In 2014, Tether was incorporated in the British Virgin Islands. In the same year, Noble Bank was incorporated in Puerto Rico. All three companies have Brock Pierce, Tether controls the issuance of USDT, Bitfinex is responsible for providing circulation for USDT, and Noble Bank is responsible for opening the encryption world and banking system. The huge hidden business channel was gradually exposed due to the delay in the announcement of third-party audit results by the USDT.

2, The New York prosecutors make good use of the "Martin Act", which can not only clear the financial market, but also the people's heart.

Why investigate the hidden money laundering channel business in the underground, the New York prosecutor has been tracking Bitfinex and Tether persistently since 18 years? In the meantime, it involved the power of the Martin Act. Many of the New York State Attorneys have relied on the Martin Act to punish financial chaos and fight against financial crimes to gain higher support.

From 1929 to 1933, the collapse of the US stock market caused numerous losses to investors. After the incident, Thomas Dewey, the chief prosecutor of New York, used the Martin Act to send criminals engaged in securities business on Wall Street to prison. Thomas was later elected as governor of New York State. When the "Black Monday of the United States" took place in 1987, the then New York State Attorney General Rudy Giuliani would use insider information to profit from Ivan Bursky and Michael Milken. .

After 1999, Jewish Eliot Spitzer served as the chief prosecutor of the State of New York. "As long as the media mentioned that he was eyeing an industry, it would cause panic, and the stock price of the industry would The CEO will talk about the discoloration, and the crisis management consultants will cancel the vacation. Because of the excellent regulatory deterrence, they will be ranked as the governor of New York.

The current New York State Attorney General is Ms. Letitia James, and before her appointment, Barbara Underwood published the "Virtual Market Integrity Survey Report" in September 2018 in the name of the New York State Attorney General, pointing out many virtual currency exchanges. The lack of basic security measures makes investors and their exploitation vulnerable to market operators. After the current Attorney General, Letitia James took office, the focus was on investigating FaceTime eavesdropping incidents, investigating the business relations of the President Trump family, and investigating the violations of Bitfinex and Tether.

It must be said that the Attorney General of New York State has always been a "hard-bone" character. The biggest deed of this year is to get Trump's tax return to do everything, and to make President Trump angry. This allegation that Bitfinex and Tether are the results of more than a year of investigations by the New York prosecutors, is also an opportunity for Letitia James to report on the achievements of the former Attorney General. In short, the New York prosecutors are prepared.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- zkSNARKs contract library "input pseudonym" vulnerability, many mixed currency projects

- The currency circle succeeds in marketing? Gold Daxie: Bitcoin is just that.

- From Libra concept to USDT or thunderstorm: all stable coins are essentially simulations of French currency

- Bitcoin tax is coming: 10,000 tax warning letters are on the way

- Viewpoint | By the end of 2020, encrypted derivatives or 20 times the size of the spot market

- Exploring Ethereum in depth: What are the pros and cons of using Ethereum blockchain?

- Ethereum: Please don't call me a cottage coin!