The value of hedging is second only to MakerDao's Defi project Synthetix. What support is behind?

Author: Pakistan leek special

Editor's note: The original title was "SNX, which has increased more than 30 times this year. What support is behind it?" 》

SNX's domestic attention is not high, however, SNX has increased more than 30 times this year, and its market value has rushed to about 30. Synthetix's hedging value also rushed to the second position of DeFi, second only to MakerDao.

More people in China have started to pay attention to it. Blue Fox Notes and TokenGazer wrote articles about it a few days ago. DeFi Labs also invited the CEO of Synthetix to share it in China.

- Venezuela will start airdropping petroleum coins this week, earning $ 30 per person

- Introduction to Blockchain | Unknown Secrets in "Blockchain Village" …

- Fidelity: Bitcoin is becoming an entry-level product for institutional investors, and Ethereum support may be added next year

I did research out of curiosity and wanted to find out.

Behind the 30-fold increase of SNX, what operation logic is supporting it? What other gameplay and profit points does it have?

What is Synthetix?

Synthetix is a decentralized synthetic asset distribution protocol built on Ethereum.

Users can mortgage Synthetix's ERC20 token SNX to generate synthetic assets (Synths) through mintr (a Dapp on Synthetix). Synthetic assets can be stable coins, or long / short assets corresponding to certain tokens, and can be exchanged through Exchange. synthetix makes a trade profit.

What's the use of Synthetix?

The value of Synthetix lies in synthetic assets, and gives synthetic assets other trading attributes to obtain benefits from them.

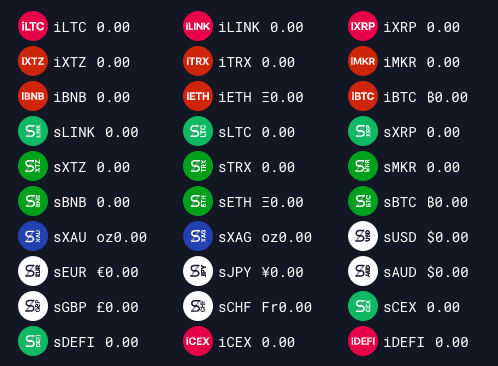

Currently it can synthesize three types of assets, including stablecoins , cryptocurrencies (a token used to go long or short), and commodities .

Stablecoins and commodities are relatively stable and both start with s. When they do not match the price of the underlying asset, users will flatten them through arbitrage.

The synthetic token asset represents whether the target token is long or short, and the price of the synthetic asset will change accordingly through the change in the price of the underlying object.

White represents legal tender, sUSD, sUER, sJPY, etc. correspond to the US dollar, the euro, and the yen. Blue represents commodities, sXAU is synthetic gold, and sXAG is synthetic silver.

Green represents long cryptocurrencies, such as sBNB. The red ones are short cryptocurrencies such as iBNB.

Synthetix's method of synthesizing assets is similar to MakerDao. It also over-collateralizes certain volatile tokens to generate another token or asset .

Currently, MakerDao supports more asset type mortgages in addition to ETH for Dai. The difference between Synthetix and MakerDao is that its collateral is currently only the ERC20 token SNX of the Synthetix protocol.

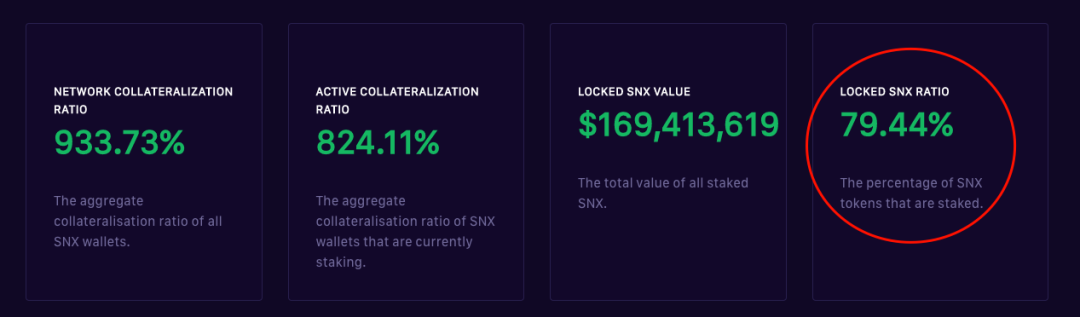

Because the volatility of SNX may be much higher than that of ETH, Synthetix set a 750% over-collateral to generate stablecoin sUSD.

Source: https://dashboard.synthetix.io/

According to official data, the current mortgage rate is close to 80%, which can be described as very high.

In addition, can I think that the value of its hedging is the value of collateralized SNX tokens, or it depends on the amount of collateralized SNX and the price of SNX.

From these two perspectives, the number of locked positions has reached 80%, and the new locked-up tokens will not increase significantly. The token price has also risen more than 30 times this year, and the market value has ranked 36. Larger.

In this way, it can be predicted that the short-term value of Synthetix's hedging will not increase rapidly.

And I think there are still some risks, because the price rises too fast and there is a possibility that large households will hit the market. SNX has increased so many times this year, and users who participated in the hedging in the early stage will most likely unlock the smashing disk. From the recent decline in their prices, this can also be seen.

How do I make money on Synthetix?

Synthetix is probably one of the most complicated protocols on Ethereum at the moment. It involves not only collateral, but also long and short derivative transactions. When you hold an asset, you can get a certain amount of income through price changes. . In general, it is more difficult to play, and the general gameplay and process are like this.

The first is to purchase SNX for collateral .

Currently, the channels of SNX purchased are Uniswap, Kyber, and KuCoin. According to data on CoinGecko, the highest transaction volume is actually the SNX / ETH trading pair on Uniswap, and KuCoin only accounts for less than 20% of the circulation.

Source: https://www.coingecko.com/en/coins/synthetix-network-token

Source: https://mintr.synthetix.io/

Source: https://mintr.synthetix.io/

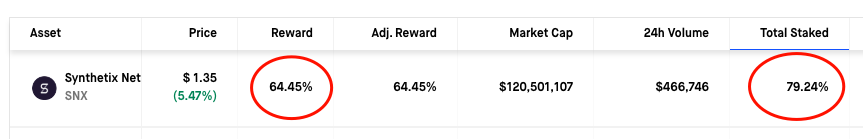

Please note that the mortgage rate is 750% so that you can get the mortgage reward . The first is the additional SNX reward. This is similar to the Staking bonus issue. The interesting thing is that it combines the minting of stable coins and Staking.

According to data from StakingRewards.com, Synthetix's current mortgage rate is 79.24%, and the mortgage reward is 64.45%. The additional issue is still very high. This also makes the subsequent selling pressure have greater hidden dangers.

Source: https://www.stakingrewards.com/ followed by dividends on transaction fees .

Source: https://www.stakingrewards.com/ followed by dividends on transaction fees .

That is, the transaction fee generated by users when they trade through Exchange.synthetix. 0.3% of each transaction fee is put into the dividend pool and distributed to users who mortgage the tokens.

It is interesting that there is no counterparty in this, not to buy iBTC, but to bear the entire "debt pool". The debt pool can be understood as a pool of all synthetic assets, which changes with the price of synthetic assets.

Source: https://synthetix.exchange/

Exchange.synthetic is not a DEX order book model. There are no orders and orders. All transactions in it are equivalent to the title of the token. For example, if you sell sBTC, you will be directly exchanged for sUSD tokens of the same value.

The advantage of this is that you can sell it directly, but the risk is that everyone will share the value change brought by the debt pool. So even if you hold sUSD, you may lose money when the debt pool changes. . .

Because the token price is obtained from the off-chain through the oracle, they have also previously been manipulated to change the currency. This is one of the risks. Although they claim to cooperate with Chainlink, it seems that it has not yet start using.

Innovation and risk

In conclusion, SNX's model design is very interesting. It combines minting stablecoins and staking to attract users to lock their positions by adding rewards and dividends on transaction fees. Secondly, there are more ways to play through synthetic assets, such as making bitcoins.

Of course, there are also some risks. The first is that the liquidity of the token is poor, and the increase has been too high. There is a possibility of unlocking the disk. The second is because it is necessary to share the changes in the assets of the debt pool. There are also risks such as oracles.

I look forward to your discussions and sharing with Synthetix CEO.

reference:

https://www.synthetix.io/uploads/synthetix_litepaper_mandarin.pdf

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Data analysis: a summary of the geographical distribution of Bitcoin / Ethereum global nodes

- Coinbase becomes Tezos' largest verification node, will it be a new trend for exchanges?

- Summarize the 2019 | The current development status, trends and the nature of user behavior on the chain

- Babbitt weekly election 丨 China's central bank digital currency (DC / EP) trial is imminent, but Libra is still deleting the white paper

- Interpretation: what is atomic swap "changing"

- Featured | Dragonfly Capital discusses three things that DeFi needs to solve next year; a blockchain year-end summary letter from Pantera

- View: DCEP's mission is to replace cash, Bitcoin's mission is to become cash