Bitcoin becomes a sovereign currency? There are three obstacles to overcome

Time pulled back to 2008, a programmer named "Zhong Ben Cong" published a paper on the cryptographic mailing list on the "metzdowd.com" website, entitled "Bitcoin: a peer-to-peer The Electronic Cash System, however, was a stone that was thrown into the sea at the time and did not set off waves.

To the surprise of many, the decentralization, confidentiality and scarcity of Bitcoin have made it increasingly popular, and there has even been a call in the industry for Bitcoin to become a world-class currency.

Saifedean Ammous, author of Bitcoin Standard, once said that the establishment of a sound monetary system will be one of humanity's greatest achievements. Once the monetary system collapses, human civilization will also be destroyed. At the beginning of the creation of Bitcoin, Satoshi Nakamoto hoped to create a global free-flowing, unregulated currency, use the Internet to perform traditional currency functions, and solve the ancient topic of “transporting value across time and space”.

Many people have considerable expectations for this system, and believe that Bitcoin will replace the sovereign currency of some countries and become a hard currency of globalization. However, some people think that it is not realistic to become a sovereign currency. Bitcoin does not have the conditions to become a currency, let alone replace the legal currency endorsed by state credit. Based on this problem, we will analyze the function of sovereign currency and explore the feasibility of bitcoin becoming a sovereign currency.

- Blockchain and healthcare: By 2025, the value of the blockchain in the medical market will exceed $1.6 billion

- The technical path of WEB3: from economic logic to the development of blockchain technology architecture

- Analysis | How will fragmentation technology achieve blockchain expansion?

The so-called sovereign currency is based on the currency of a sovereign country as the international reserve currency. It has three main functions: value storage, payment methods, and accounting units. As a means of payment, international currency acts as a medium of exchange in capital transactions. As a unit of account, the sovereign currency is used for the valuation of commodity trade, that is, the value of various commodities is expressed as a certain amount of money, and the value of the commodity is expressed as the amount of money. As a means of storing value, it refers to the function of money to maintain or increase purchasing power for a period of time. Generally speaking, this currency cannot be easily depreciated, so the inflation rate must be controlled within a certain range.

Value storage

In general, the higher the inventory flow ratio, the greater the scarcity. The high inventory-to-traffic ratio and strong scarcity of gold make it the commodity with the lowest price elasticity.

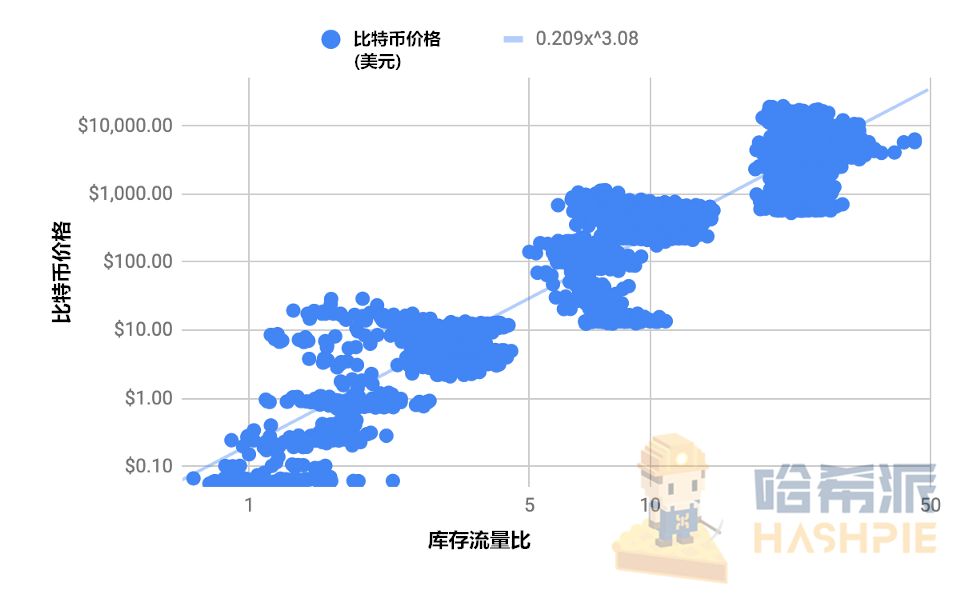

Figure 2 Bitcoin price change trend under different inventory flow ratios The above chart shows the change in bitcoin price under different inventory flow ratios. In the period of 2008-2012, the ratio is about 2; during the period of 2012-2016 with the output Declining, the ratio has risen to 8; the ratio has been around 25 since 2016. The higher the inventory flow ratio, the higher the price of Bitcoin. According to the change in the inventory flow ratio, it is estimated that this ratio will reach 60 by 2020. According to the conversion formula between the inventory flow ratio and the inflation rate, the inflation rate at that time will be around 1.7%, which is lower than the central bank's annual target of 2%.

Figure 2 Bitcoin price change trend under different inventory flow ratios The above chart shows the change in bitcoin price under different inventory flow ratios. In the period of 2008-2012, the ratio is about 2; during the period of 2012-2016 with the output Declining, the ratio has risen to 8; the ratio has been around 25 since 2016. The higher the inventory flow ratio, the higher the price of Bitcoin. According to the change in the inventory flow ratio, it is estimated that this ratio will reach 60 by 2020. According to the conversion formula between the inventory flow ratio and the inflation rate, the inflation rate at that time will be around 1.7%, which is lower than the central bank's annual target of 2%.

Exchange medium

The amount of the reward is driven by a hash, and the total hash represents the power of each miner on the network. In order to keep the rate of production of new blocks stable, the difficulty of bitcoin mining will undergo an automatic adjustment at regular intervals, and the difficulty will increase with the increase of miners.

In fact, in order to maintain a stable rate of new block production, the level of computing power has also declined several times. Here we introduce the concept of price-earnings ratio (PE) in an encrypted asset: the NVT ratio, which is the network value-to-transaction ratio. In contrast to the P/E ratio (PE), since the cryptocurrency is different from the enterprise, it is not profitable, so it uses the “daily transaction volume” that represents the potential utility of the blockchain to reflect its performance indicators to gauge whether the currency price is overvalued or underestimate. Since the essence of Bitcoin is the payment and storage value network, we can regard the funds flowing through its network as “company income”, so NVT is the ratio of company income (NV) to transaction amount (T). The formula is:

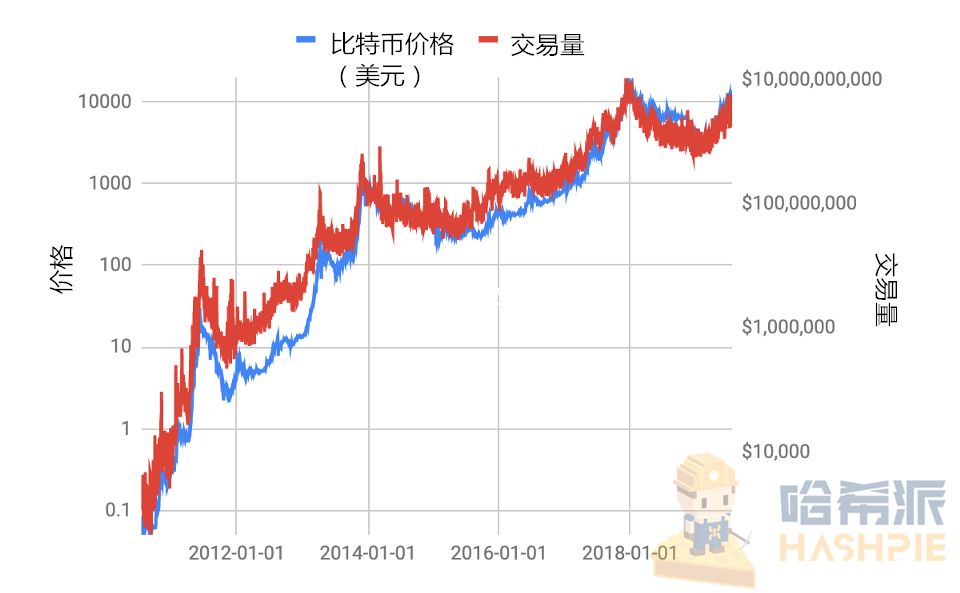

Figure 4 Bitcoin price and trading volume change trend We can get through the above figure, the trading volume and bitcoin price curve are similar. The larger the trading volume in US dollars, the greater the value of Bitcoin. This logic is similar to the development of SaaS companies like Amazon: its pre-global business has been losing money in the early days, but as the volume of transactions increased, it pushed the revenue of its platform to achieve profitability.

Figure 4 Bitcoin price and trading volume change trend We can get through the above figure, the trading volume and bitcoin price curve are similar. The larger the trading volume in US dollars, the greater the value of Bitcoin. This logic is similar to the development of SaaS companies like Amazon: its pre-global business has been losing money in the early days, but as the volume of transactions increased, it pushed the revenue of its platform to achieve profitability.

However, the original setting of the NVT ratio ignores the function of cryptocurrency as a value store. For example, a decrease in transaction volume leads to an increase in NVT, which does not necessarily mean that the price of the currency is overvalued. This may also be because more and more long-term The volume of transactions caused by the currency of the currency has decreased.

Overall, Bitcoin has a strong trading capacity and can be viewed as an exchange medium.

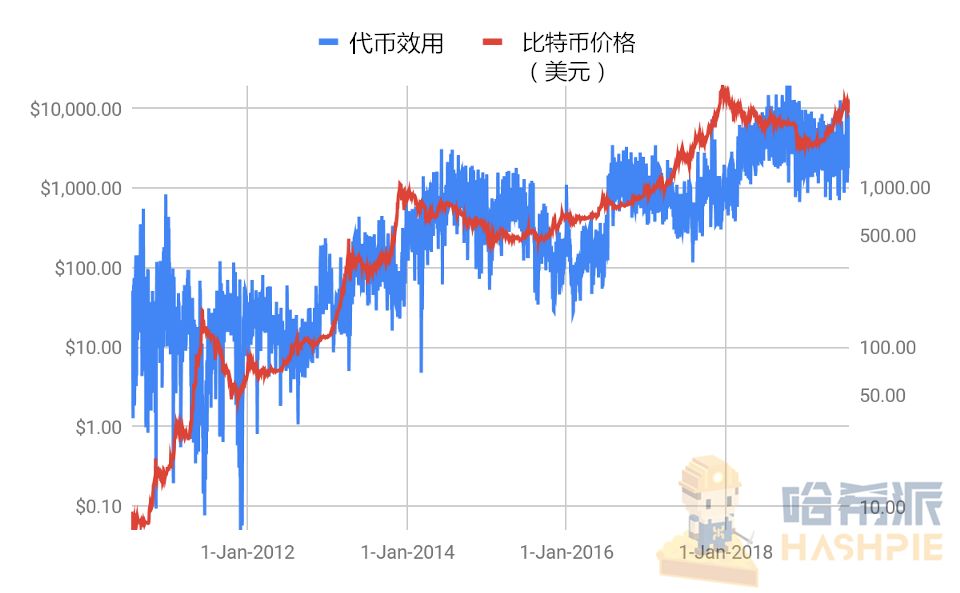

To better measure bitcoin prices, we combine value storage and exchange media in one indicator. Tobacco researcher Liu Yulin provided a new idea. He suggested measuring the value of Bitcoin by turnover rate, mortgage rate and dilution rate:

Mortgage rate and dilution rate are regarded as indicators of value storage, and turnover rate is used as an indicator of exchange medium. Researcher Liu Yulin believes that at the end of 2013 and 2017, PU ratio (bitcoin price/token effect) exceeded normal twice. Range (between 50 and 200), this is the embodiment of the Bitcoin bubble.

Accounting unit

Sovereign currency, as a unit of account, is used for the valuation of commodity trade and financial transactions, and is used by the official sector for anchor money. Then if Bitcoin is to be used as a unit of account, we need to discuss the comparability of its prices.

Using the volatility analysis of the EWMA model, it can be found that the average annual volatility of bitcoin is more than 100%.

Although its volatility is declining (from the previous level of more than 300% to the current 100%), the volatility is expected to fall to around 20% in 2021, but this volatility is still much greater than the volatility of about 8%. Legal tender currency.

Therefore, it can be concluded that the current volatility of Bitcoin is too high and is not suitable as a unit of account. Although it is possible to reduce the volatility below 8% according to the trend of continuous decline in volatility, this is a very long road.

to sum up

If Bitcoin is to become a sovereign currency, it needs to reach the above three sovereign currency indicators. At present, Bitcoin can achieve borderless transfer and stable inflation rate due to its pre-programmed characteristics. However, compared with sovereign legal currency, its price has very high volatility and has not yet become sovereign. The condition of money must be comparable to that of sovereign currency. Bitcoin still has a long way to go.

Original: https://hackernoon.com/can-bitcoin-be-considered-as-a-sovereign-currency-7z7m35y8?source=rss

Compile: Hash Pie – Adeline

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Heavy Coinbase plans to launch the IEO platform, while waiting for the opportunity to launch STO products

- Order Pizza Win Bitcoin Award, Domino's plan gives 100,000 Euro BTC

- Futures Exchange Industry 2019 Phase II Research Report

- QKL123 market analysis | Bitcoin risk avoidance highlights, long-term still bullish (0911)

- Hong Kong's anti-acquisition new deal will take effect, and the "coin stock" of the fire currency will be renamed as a risk

- Ling listen to the micro-public bank blockchain open source observation: throw the code out, take the trust back

- Jimmy Song: All those who are not optimistic about Bitcoin will eventually escape the "true incense" theory.