There are three reasons behind the rise of anonymous and altcoin cryptocurrencies in the first week of the new year

Text: Interchain Pulse · Black Pearl

In the second half of 2019, the cryptocurrency market is still out of the bitcoin market.

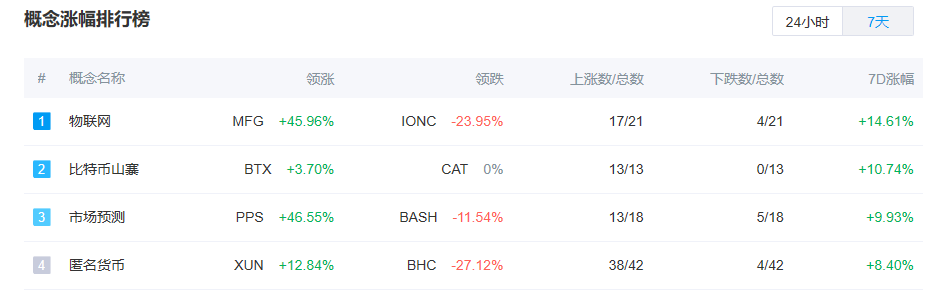

In the afternoon of January 7th, according to the non-small concept gain list data, out of 25 types of cryptocurrencies with different concepts, a total of 23 sectors rose in the past 7 days, and the cryptocurrency market rose.

This round of rally is dominated by anonymous coins and altcoins. The highest gainers on the 7th were the Internet of Things, Bitcoin cottage, market forecasts, and anonymous currencies. Among them, the four sectors were led by MFG, BTX, PPS, and XUN, and the seven-day gains reached 45.96%, 3.70%, 46.55%, and 12.84%.

- What will happen to the Bitcoin ETF in 2020? This company dedicated to blockchain ETFs raised $ 17 million in funding

- US $ 2 million user funds locked up, this exchange suddenly said to upgrade

- Iran attacks U.S. military bases on safe-haven assets

(Source: non-small)

Compared with Bitcoin's 8.83% increase in the past seven days. It can be seen that almost only the rise of Bitcoin in the past year has been reversed. Crypto market capital flows to "edge" currencies.

The mutual chain pulse observes the trend of public opinion in the investment market in the past two days. Multiple platforms and analysts believe that the crypto asset boom has been affected by the turmoil in Iran.

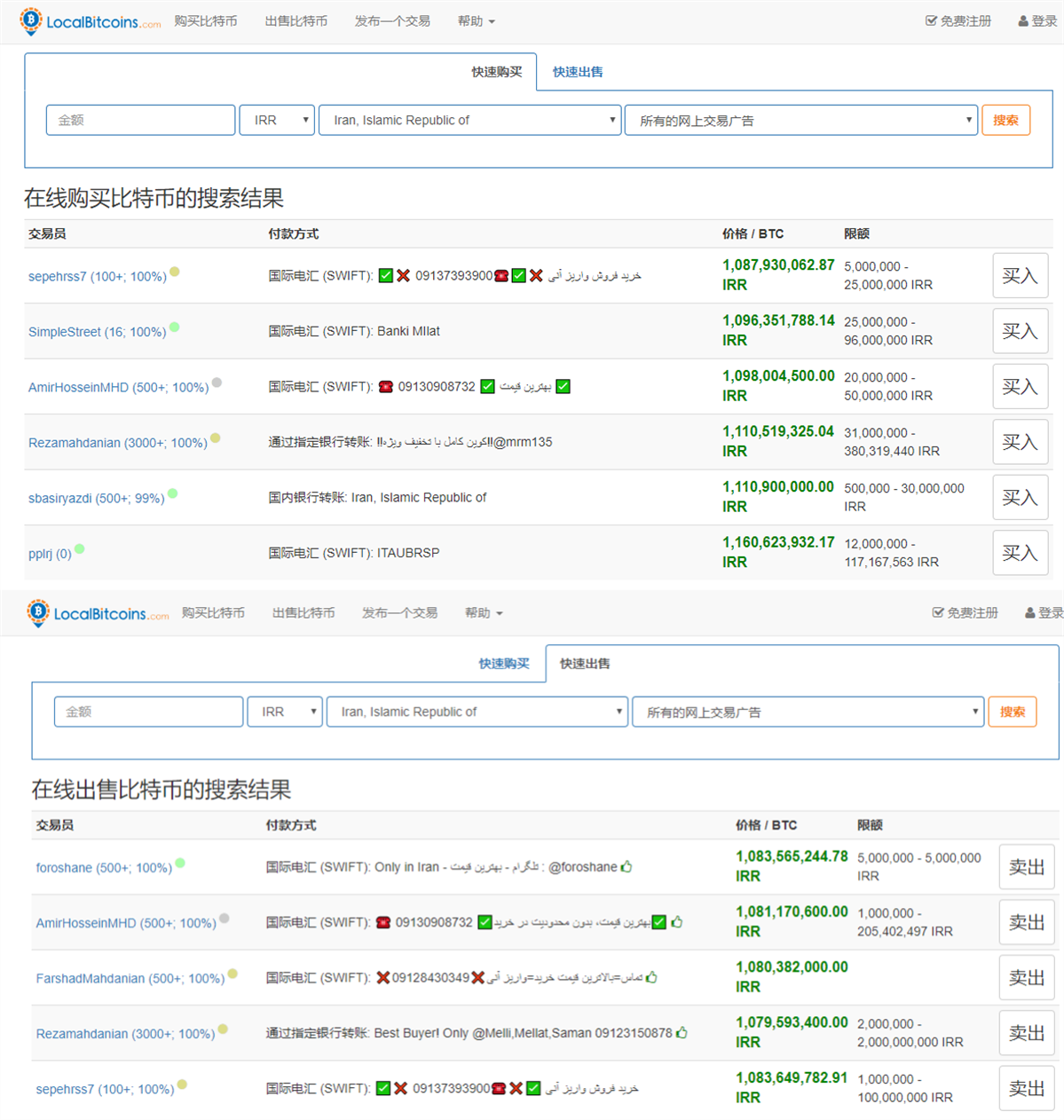

On January 3, the U.S. air strike on Baghdad International Airport in the Iraqi capital caused the death of at least eight people, including Qasim Sulaimani, commander of the "Holy City Brigade" under the Iranian Islamic Revolutionary Guards. After the turmoil, BTC rose 5.46% on the day, and the local BTC price in Iran reached up to 23,000 US dollars. As of the evening of January 7, LocalBitcoins, a peer-to-peer trading platform, showed that the price of bitcoin on the Iranian side was as high as about 1.1 billion Iranian rials, about 26,000 US dollars.

(Source: LocalBitcoins)

The founder of crypto-analysis agency Messari Ryan Selkis has said that, especially in the context of strained US-Iran relations, the premium may be due to Iranians' belief that their currencies may depreciate and sell off.

This has affected the entire crypto market, and people may be more inclined to use cryptocurrencies represented by Bitcoin as safe-haven assets. Coindesk author Sebastian Sinclair said on the 7th that since January 3, the tension between Iran and the United States has continued, and discussions around BTC as a safe asset use case are dominating investor channels.

However, this reason does not seem to be sufficient to explain why in addition to the rise of Bitcoin, the price of the currency has generally risen, and it is led by anonymous coins and altcoins. And three possible reasons are: by the international situation and the rise of bitcoin, dealers have driven other currencies to rise; bitcoin's security and anonymity are difficult to guarantee, so some investors turn to other currencies; other currencies have been After the downturn we ushered in a technical rebound.

When cryptocurrencies were born, there were a lot of examples of dealers in the trading market. The Wall Street Journal conducted research and the results showed that at the time there were dozens of trading groups in the market manipulating cryptocurrency prices on several of the largest crypto asset exchanges. The four leading currencies mentioned above, MFG, BTX, PPS, and XUN, have not seen the same increase or increase date in the past week. .

(Source: non-small)

The technical rebound after a prolonged oversold is also one of the possible reasons. In fact, when Bitcoin dropped to $ 3,000 in May 2019, it also accompanied the overall plunge of cryptocurrencies. Although bitcoin is now recovering to more than $ 7,000, it is difficult for other currencies to rise. In the second half of 2019, the central bank's digital currency R & D boom in various countries may also bring favorable environmental conditions and trigger a rebound.

In addition, in the past, Bitcoin, Monero, etc. were widely traded on the dark web due to their transaction privacy. The total number of Bitcoin transactions on the dark web in 2018 was approximately $ 600 million, with an average of $ 2 million per day. But now, Bitcoin's anonymity is working. On October 16, 2019, the U.S. Department of Justice revealed that a child sexual assault video transaction case was cracked through the transaction records of Bitcoin. McCormack of a law firm in Hong Kong said that in the past 2019, the tools that can analyze Bitcoin transactions have developed to a very high level.

Based on this, copycat bitcoin and some of the more "marginal" anonymous coins are now replacing bitcoin as new privacy transactions.

This article is the original [Interlink Pulse], please indicate the source when reproduced!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion | Can blockchain technology eliminate your distrust and fear of ETC consumption?

- Iran's attack on U.S. military bases, BTC surged by $ 500, can the "hedging" attribute actually be hammered?

- Watch | What exactly is the appeal of the MAS Digital Banking License?

- The market value increased by more than 20 billion US dollars a week. Is Bitcoin a "real cow" or a "fake cow"?

- Blockchain Weekly Report | Central Bank steadily advances fiat digital currency R & D in 2020; Zhanke sends open letter against Bitmain layoffs

- Digging the "foot of the wall" in Zhongguancun, 100 million yuan to grab academicians, local governments set off a battle for blockchain talent

- US-Israel conflict bitcoin gets attention again, "hedging" will become the main theme of the bull market?