US stocks plunged across the board, mined coins halving VS economic crisis, buy up or buy down?

★

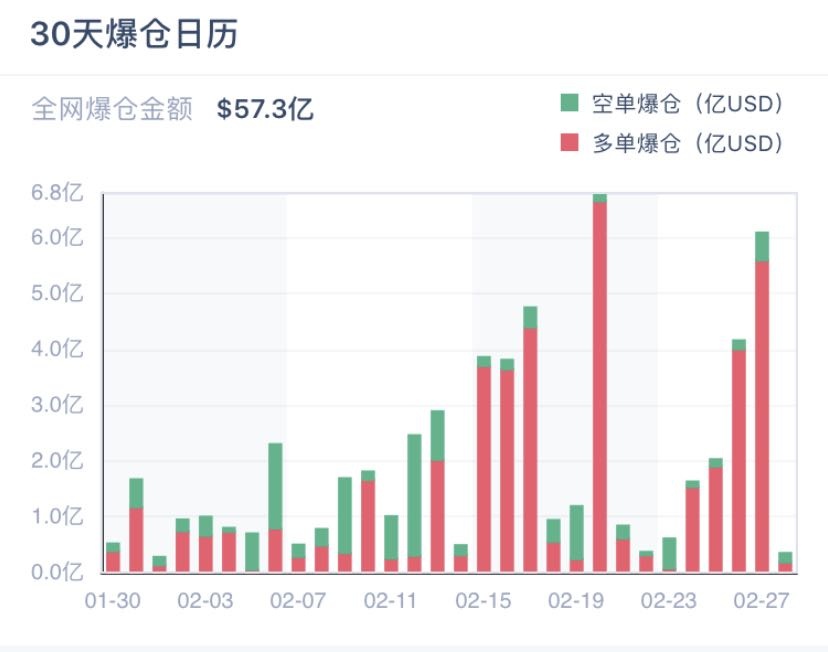

Last night, the currency circle was speechless and even full of tenderness-compared with the bloody cleaning of bitcoin bulls in the past week, there were more short positions yesterday. From the chart, yesterday was an extremely mild day.

The smallest liquidation in the past 30 days was yesterday. Many people who only looked at the price saw a steady rise in prices and immediately thought: Is it enough? Is the cow here?

- Comprehensive analysis of the MakerDAO governance system: Taking 2% governance events as an example

- Research: Serious mistrust of banking system, millennials may tend to turn wealth to Bitcoin

- Not just investing-how can cryptocurrency change the tourism industry?

But it's still the old saying, it depends on the K line, but don't be superstitious about the K line-most of the time the K line sends out the wrong signal.

Height determines field of view. When the direction is not clear, I try to look at the problem from a higher angle-I find that the halving story is very difficult to tell.

Today's article first analyzes from a large economic level, and finally talks about my personal views on later trends.

1,

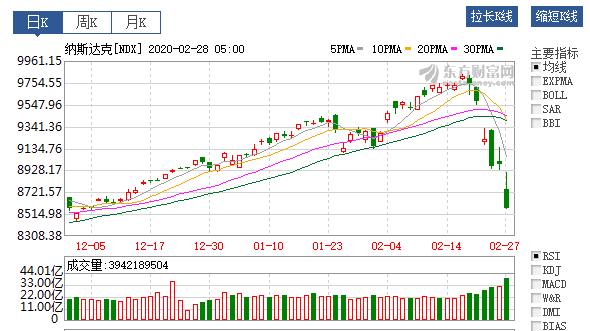

Yesterday, US stocks suffered a huge plunge in history.

At the close, the three major indexes all fell more than 4%, the Dow fell 1199.39 points, the Nasdaq fell 4.61%, and the S & P 500 fell 4.43%. Both Microsoft and Apple fell more than 6%.

Trump is angry at the plunge in U.S. stocks, believing that warnings from US health officials on the outbreak have scared investors.

However, he may have underestimated the situation.

On the same day, the major European stock indexes closed down sharply. The British FTSE 100 index fell 246.07 points, a decrease of 3.49%. The German DAX index fell 407.42 points on the 27th, a decrease of 3.19%. The French CAC40 index fell 188.95 points, or a decline of 3.32%. In addition, the FTSE Italy MIB index fell by 623.17 points, a decrease of 2.66%.

The earliest signs of the economic crisis are always in the stock market.

In 1929, the US stock market plummeted and became a major crash in history. Not only the United States, but the world was swept into this financial turmoil.

Since then, the United States and the world have entered a decade of economic depression. In the four years after the crisis, US GDP fell by 30%, investment fell by 80%, and 15 million people lost their jobs.

Of course, the stock market crash of 1929 was completely different from the current situation, when the bubble burst due to blind pursuit of stocks. But the stock market crash will not happen for no reason. Generally speaking, there are two types:

First, the speculative bubble burst. There is no eternal bull market in the world. The stock market, gold, bitcoin, and real estate are all like this. They all have cycles. They rise too wildly. When the price deviates from the value, the value will return sooner or later.

The second is the economic downturn, the corporate survival environment is bad, the profitability of listed companies has declined, and the stock price has fallen. In 2018, due to the friction between China and the United States, there was a great downward pressure on the economy. A paragraph.

Under the current circumstances, how bad is the survival environment of the enterprise? Take a look at some of the companies we are familiar with: the biggest discount in Evergrande's history, Xibei could not survive for 3 months, and Haidi lost 5 billion.

All this is related to the spread of new coronaviruses, and there is a greater risk of global economic growth. Investors have doubts about the economic outlook and the stock market. There are many signals in the spot and contract markets that indicate that the stock market is beginning to panic.

2,

Look at the situation of the new crown.

The latest statistics released by the Korean Disease Management Division on the 27th showed that 171 new cases of new coronary pneumonia were confirmed in Korea, with a total of 1766 confirmed cases and 13 deaths. On the 28th, a total of 505 new confirmed cases were reported, creating a single day. new highs.

At 18:00 on February 27, a total of 912 cases of new coronary pneumonia were confirmed in Japan, and a total of 8 people died of new coronary pneumonia. According to the Japan Broadcasting Association television station, a total of 705 cases of "Diamond Princess" cruise have been diagnosed.

In Europe, the total number of confirmed cases in Europe (including Russia) has exceeded 500. And including Germany, France, Spain, Austria, Macedonia, Greece, Georgia, Sweden and other countries also have the first confirmed cases of new coronary pneumonia.

Newly confirmed 75 cases of new coronary pneumonia and 2 new deaths in Italy in a single day. A total of 528 confirmed cases and 14 deaths have occurred in Italy.

In the United States, the United States Centers for Disease Control and Prevention (CDC) confirmed on the evening of the 26th that the 60th case of New Crown Pneumonia was confirmed in the United States and the source of the infection is unknown. This is the first case of New Crown virus transmitted in the American community.

I'm a bit sensitive about the epidemic. In response to the epidemic, although there are many controversies, for example, on specific issues such as mask control, there are some different voices, and there are "experts" suggesting that market-based methods should be used for regulation and control (I personally disagree), but no matter what I think our country must respond better than many other countries.

Now, the consistent measure of many other countries is to use market-based measures to control it. How effective it is will soon be known.

Once the new coronavirus spreads in some countries (I don't think China, the hardest time for China is in the past), and when capital is withdrawn from the market (such as the US market), then the "nuclear bomb" that set off the economic crisis will officially appear .

The economic crisis will cause the devaluation of banknotes and intensified inflation. The government will use a lot of funds to reverse the economy (such as Haidilao, will it fail like this? Banks will grant billions of credits). Well, the unemployment rate has risen, funds have fled from the stock market, consumption levels have fallen, and the stock market has continued to plummet, forming a vicious circle.

Do you still laugh at the trembling now?

Hello, the holiday has been extended for seven days due to the outbreak;

Hello, due to the impact of the epidemic, the holiday continues to be extended for seven days;

Hello, due to the impact of the epidemic, the holiday continues to be extended for seven days;

Hello, because the epidemic affects the company's closure and is not used for work …

3.

This time it is very different from the previous SARS and H1N1. The internal environment and the external environment have changed. Generally speaking, it is not optimistic-there are too many evaluation indicators because they are too boring and will not be displayed one by one.

In general, most indicators send a signal, this time for the world, the impact will be greater. Take one of the indicators as an example: leverage ratio, we refer to the macro and sub-sectoral leverage ratio of different countries in the second quarter of 2019.

Horizontally, China's macro leverage ratio has surpassed that of the United States, followed closely by Japan and the United Kingdom.

Among them, the leverage ratio of non-financial companies is as high as 154.5 percent, which is twice that of the United States and 1.5 times that of Japan, which is the second largest. Brazil and India; only government leverage is relatively low, only higher than Russia.

Enterprises and households have higher leverage, which means that they need to pay more interest and face greater risk of bankruptcy. Therefore, it is more difficult for enterprises to deal with the negative impact of the epidemic. After the epidemic, businesses and households borrowed money. There is also less room for consumption and investment, which means that economic recovery will be slower.

The more the economy is turbulent, the more the funds seek security, and Bitcoin is obviously not a "safe" investment product, even the current price of gold is falling.

The reason is simple. When the economy is tense, people will spend more money-especially in countries that rely only on market regulation. At the same time, consider a series of factors such as corporate bankruptcy, worker unemployment, soaring prices, and stock market crashes.

Will there really be a lot of money invested in the currency at this time? From the analysis of a large range, will you find that the halving story is a bit dry?

Whether it ’s a small plate or not, it ’s easy to pull, but our investment in the currency circle must be prepared for the worst. The more anxious to become rich, the more it will become a loss—I collapsed a few days ago In China, tuition has been paid in USDT.

4.

When talking about mining, Jiang Zhuoer said that mining often does not make money, why do miners still dig? Because the advantage of insisting on mining is not to miss the bull market, the bull market is digging, the bear market is still digging, and not leaving the market means that you can eat fish head from fish head. At the same time, the tall factory building is also a good financing tool-yes, he is very proficient in the use of off-market leverage, although he emphasizes that adding on- and off-site is to kill.

From the perspective of spot investment, the risk of investing in bitcoin to zero is extremely small, but I am afraid to be cautious about investing in bitcoin spot to achieve high returns in the next round of bulls and bears.

Compared to thinking that Bitcoin will rise to 100,000, 200,000, 300,000, I am more inclined to think that even if it reaches such a high price, the crash will be faster. Because the price will never leave the value for too long.

Bitcoin is valuable, but the value of Bitcoin (decentralization, immutability, etc.) has not yet been well reflected, because the value of everything is in a market that is extremely small and manipulated by large capital Looks very misty.

Li Xiao said that "value investment is silly" or the "truth" of current currency investment-don't get me wrong. I am also a value investor. Among my 800,000 spot, mainly BTC and KEY, especially KEY, in other When the currency rises, it can still fall. If it is not because of value investment, but short-term speculation, there is really no reason to touch it.

But when I understand that the currency market has been speculatively occupied by the mainstream market in the past, present, and future, my choice is to face difficulties and learn everything in this speculative market-because I will compare my future with this block The chain world will anchor in a long, long world.

Yesterday, I opened a 5x order at a low position and today is very profitable. I originally planned to keep it, but before publishing today's article, through research, I finally chose to clear the profit and settle the profit. Now I continue to open Wait for an empty order (only 10USDT, please follow me, please do not use more than 10U, learn now, don't rush to get rich).

In a speculative market, both ups and downs are opportunities. I do not lack opportunities. What I lack is the perspective of seizing opportunities. At present, the market is calm, but like everyone, I am waiting for a direction.

I personally think that direction is not the stars, but the sea.

5.

When we are investing in digital currency and belief in Bitcoin, how many people dare to talk to friends, newcomers and colleagues around us? For outsiders, many of them will persuade you to stop playing with regretful tone. You tell him to decentralize and he tells you not to gamble. When you talk about value investment with him, he feels that you are going crazy.

In the eyes of many people, Bitcoin is a scam, a risk, a gambling, and even illegal. Why do they say that? But it's because they don't understand.

They are used to going to work, taking wages, and saving money. The most common investment behavior is to deposit money into Yu'e Bao and enjoy an annualized rate of 3%.

If I make a suggestion to them: people who do n’t study or study Bitcoin will suffer, and people who do n’t know how to invest will suffer a lot.

Today's article talks about economic issues at the macro level, and asks an economic question at the personal level: If a person with a monthly income of 5,000 finds a certain investment opportunity (assume) and needs to invest 2 million, what should he do?

Don't know, right? Except for borrowing money, it's nothing but banks and credit cards, but it's easy to say. The specific operational knowledge is worth a lot of money. When you hear about loans and credit cards, you think it's gambling. When you think of risks, that's not what smart people do. Don't negate any Something you don't understand.

So it's important to understand some things. As for not to do it, how to do it is another question.

In my recent article, I often mentioned contracts-not mentioning that contracts were politically correct at first, and there were some objections at the beginning, but I'm glad that many people also started to write contracts-after all, there are things you learn Or she didn't learn, she was there.

Many people do n’t know anything about the contract. They are scared when they see a short position. They feel that the contract is equivalent to gambling. In fact, think about it, all mature financial markets are in the world of derivatives in the end. Do Wall Street traders and investors come together to study how to lose out?

One of the biggest reasons I did n’t play contracts in the past was that injections were too abominable. In a very short period of time, the website is stuck, the network is stuck, and it is both short and long-where is the money? Where did you top up, where did the money end up? Generally speaking, both the long and short sides play a long-short game under the adjustment of the capital cost, but when the power is obviously unbalanced, the significance of the injection is great, and the long and short positions are spiked. Finally, the exchange As long as you pick up money, this unregulated market is very dangerous.

I agree with all the terrible advice about contracts: don't touch the contract. But if you are as confident as me and agree that contracts are just tools, then you must learn.

Regarding life, the safest way is to go home and farm, raise pigs, grow vegetables, and live in Taohuayuan. Once going out, there will be many risks. The environment will bring changes and challenges, but the environment will also bring opportunities.

In such a bear market, hurrying to learn is the only thing that matters-wealth is always a subsidiary of cognition.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Perspective | How to Assess and Reduce the Risk of Participating in Digital Asset Investment

- Was the plunge completely a whale? This person has completed a short sale and made a profit of $ 20 million

- From Bitcoin to Libra, a blockchain in the eyes of a financial man | Babbitt Industry Welcome Class

- South Korea's NH Bank and SK Telecom launch blockchain “mobile employee ID”, decentralized ID has become the general trend

- When all Bitcoins were mined in 2140, what is the final value of Bitcoins purchased today 120 years later?

- If 21 million bitcoins were evenly distributed to the world's 7.8 billion people, how much would each person get?

- Non-contact is more comfortable, new experience of Shenzhen blockchain electronic invoice during the epidemic prevention period