Bankless Why does the US Treasury Bond Trigger the Widespread Adoption of RWA?

US Treasury Bond drives widespread RWA adoption- BanklessAuthor: Jack Inabinet Translation: Huohuo/Baihua Blockchain

While TradFi is recovering, cryptocurrency is still in a bear market, and some people are considering ways to seize this upward space. Today, we delve into the world of Real World Assets (RWA) and explore the potential of tokenizing US Treasury bonds to drive more cryptocurrency adoption.

BlackRock CEO Larry Fink boldly referred to the crypto industry as the “next generation of the market,” and Boston Consulting Group expects the scale of this opportunity to be 42 times larger than the current TVL of DeFi in the next seven years.

What does TradFi fancy in the world of cryptocurrencies? Tokenized assets, of course! Fans of Real World Assets (RWA) have long predicted that a bull market dominated by tokenization is on the horizon, but until recently, the industry has struggled to gain traction in the cryptocurrency field.

- GameFi caught in controversy Is it a bubble that will eventually burst or a completely new game mode?

- 10 Tips for Web3 Entrepreneurs

- Notice on the Issuance of the Three-Year Action Plan for the Innovative Development of the Metaverse Industry (2023-2025)

While protocols like RealT and Centrifuge have successfully created on-chain representations of real-world assets, they have been struggling to attract a market of significant scale. Due to regulatory uncertainties, TradFi institutions with underwriting capabilities have been hesitant to lend, and the opaque off-chain nature of these products (as well as relatively lower returns) hinder the participation of native cryptocurrency holders in these markets.

Tokenization has been progressing very slowly for a long time, but fortunately, there is one asset class that is emerging as a champion for mass adoption: US Treasury bonds!

Today, we will use MakerDAO as a case study to validate the optimistic arguments behind putting US Treasury bonds on the blockchain, reveal why upgrading Uncle Sam’s debt into financial products will stimulate the next wave of RWA adoption, and contemplate the next steps in the development of tokenization.

1. MakerDAO’s Journey with RWA

MakerDAO is no stranger to real-world assets. Since April 2021, its stablecoin DAI has been partially backed by RWA.

Early on, Maker acquired RWA through bespoke credit agreements. However, the protocol quickly realized the limitations of such facilities. Customized credit is difficult to scale and carries high risks; each loan requires a time-consuming due diligence process and is collateralized by relatively illiquid assets (such as real estate contracts or receivables).

In pursuit of scale and risk reduction, Maker chose to completely bypass the difficulties of bespoke credit and become a lender to the US government!

First came Maker’s Monetalis Clydesdale vault, which earns returns by investing in a liquid US Treasury bond trading platform. This was followed by the BlockTower Andromeda vault (a similar investment tool) and the Coinbase Custody vault, which helps to return a portion of the earnings from US Treasury bonds held by Maker USDC.

Especially the introduction of these insurance vaults ultimately allows Maker to leverage idle stablecoins by deploying them at scale into real assets. Their high liquidity enables Maker to manage maturities like traditional financial entities, increasing and decreasing positions as stablecoin reserves grow and shrink.

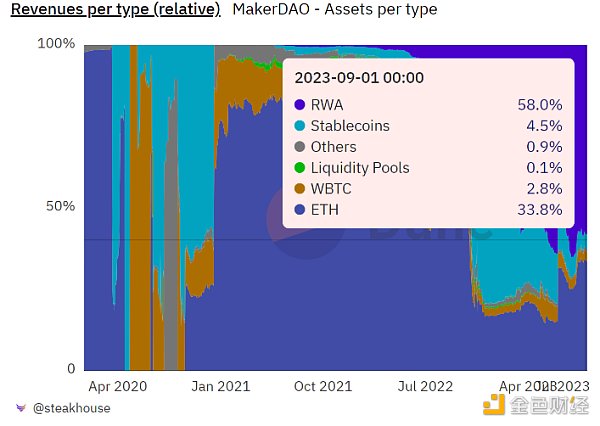

Although before the launch of Monetalis Clydesdale in October 2022, only 2% of DAI was collateralized by RWAs, Maker’s balance sheet composition has fundamentally changed in the 10 months since its launch. Currently, 47% of outstanding DAI is collateralized by RWAs, and these vaults contribute 58% of Maker’s revenue.

Source: Dune

With the significant income inflow from RWAs in 2023, Maker is able to provide returns for MKR and DAI HODLers by restarting MKR burn and increasing the Dai Savings Rate (DSR).

Since July 19th, the marginal repurchase pressure caused by the burn undoubtedly played a role in helping the token rise 40% against ETH.

Source: DexScreener

The high returns of the DSR have failed to offset the decrease in outstanding DAI (except for USDT, nearly all stablecoins have experienced this unfortunate fate), but they undoubtedly stimulate the use of the SLianGuairk Protocol in the Maker money market.

Since the initial increase in DSR, the TVL of the SLianGuairk Protocol has surged and is currently close to $450 million.

Source: DeFi Llama

Maker is the fifth best-performing cryptocurrency among the top 100 cryptocurrencies so far this year, and the unique factor that sets it apart in 2023 is undoubtedly the revenue-generating machine of its RWA investment portfolio.

2. Why Choose U.S. Treasury Bonds?

In TradFi, U.S. Treasury bonds are the most important collateral, and adopting them in the decentralized financial system seems natural (to some extent).

Unlike other types of securities such as corporate bonds or trade receivables, U.S. Treasury bonds have almost zero default risk and are labeled as “risk-free” because the government has the ability to print new money to repay old debt. In fact, this means that holding a portfolio of short-term U.S. Treasury bonds faces similar risk conditions as holding U.S. dollars, while providing additional yield.

Stablecoins like USDT can serve well as payment settlement tools, but the current stablecoin model is not feasible for consumers seeking returns!

Due to TradFi’s yield reaching levels unseen in decades, and native cryptocurrency yields far from their bull market highs, now is the best time for protocols to leverage RWA; Maker is just one protocol attempting to gain a competitive advantage by using US Treasury bonds as collateral.

Ondo Finance has attracted nearly $160 million in deposits for its Ondo Short-Term US Government Bond Fund (OUSG). Ondo’s related money market Flux Finance has a TVL of nearly $40 million, with outstanding loans of $25 million, and its fUSDC deposits receipts are even composed of DeFi protocols such as Pendle.

Credit-based RWA protocols also do not embrace the Tokenization game of the US Treasury. Maple Finance recently launched a cash management pool that puts funds to work by investing in US Treasury bills and reverse repurchase agreements (another form of extremely low-risk securities).

Frax Finance is another stablecoin issuer looking to expand its V3 product range by issuing FraxBonds. A recent governance vote approved FinresPBC as the financial channel for V3, which will provide a channel to access US Treasury bonds, establish a high-quality income source for FraxBonds, and provide unlimited scalability.

3. The Future of Tokenization

US Treasury bonds may be the starting point for the widespread adoption of Tokenization, and other forms of high-quality debt securities will be accepted by the money market with little to no scrutiny or management, such as AAA-rated mortgage bonds and bond deposits. They also refuse to fall behind, as their secure income streams can easily be transformed into various financial products, which will help meet the insatiable appetite of market participants for passive returns.

There is no doubt that the biggest obstacle to the future of Tokenization is the current lack of regulation. Large financial institutions are just waiting for further clarity on cryptocurrency regulation before getting involved, and the success of Tokenization depends on the resolution of the pending regulatory and legal issues surrounding cryptocurrencies.

The globally inconsistent regulatory framework is also a major risk for Tokenization. Cryptocurrencies may be a global phenomenon, but different regulations in each country will only isolate markets. This will present significant challenges for companies forced to deal with different characteristics of digital asset frameworks and hinder the formation of a truly global asset market, thereby limiting the full potential of Tokenization.

Once cryptocurrencies gain clear regulation, paving the way for institutions, our initial Tokenization products will dominate the traditional financial markets!

Companies like to create operational and cost efficiencies, and once they realize they can save costs through Tokenization, they will quickly move everything onto the chain. Everyone will flee the traditional financial system in exchange for liquidity in the global blockchain market, where they can achieve instant settlement and full transparency.

Despite regulatory barriers, one certainty remains: tokenization will continue to exist!

While we wait for a clearer future, one thing that can be confirmed is that the increasing popularity of US Treasury bonds in the crypto space (as well as specific types of securities accepted by the currency market) is laying the foundation for an inevitable future bull market dominated by asset tokenization.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Founder Team Explains EigenDA Bringing Scalable Data Availability to Rollups

- Three executives resign, Binance faces challenges.

- Bankless Partner David Burning Man Exploration – Unstoppable DAO Experiment and the World’s Largest Networked Nation

- Will Micro-Rollup be the next wave when applications become Rollups?

- One of the biggest competitors of Maestro and Unibot, how does Banana Gun perform in terms of data?

- Synthetix Founder Reassessing Synthetix’s Multi-chain Vision and Liquidity Sharing

- Vitalik Buterin’s latest paper How Privacy Pool Protocol Protects User Privacy and Meets Regulatory Requirements.