Viewpoint | What is the ultimate ideal for blockchain economic system design and blockchain technology?

The development of blockchain economic system and the development direction of blockchain technology have always been two important issues worthy of further discussion. Before we dismantle one by one, we need to reach a consensus that finance is an important application of blockchain, the application of blockchain technology in traditional finance and the creation of a new financial system based on the core idea of blockchain, fundamentally Look, there are two problems. The former relies on the compliance design improvement of the blockchain technology solution. The latter will be a market game for ten years.

In the long run, blockchain finance and compliance is an issue of innovation and change in systems, ideas, and doctrine. To predict its direction after many years, we must first answer a question – what is the core idea and value proposition of the blockchain?

In fact, what is the value proposition about the blockchain? There is no standard answer. After all, the Bitcoin white paper completed by Nakamoto 10 years ago is a technical system description rather than a declaration of value. Therefore, regarding the cognition of this issue, I feel that I still have room to continue to improve. In fact, many specific issues mentioned in the past, I still have no answer at present. It is best to give me some new after the chat. Inspiration and opinions.

Our thinking about the core idea of blockchain can be based on two concepts and two books.

- I left the project side and went to the exchange.

- Babbitt Column | Blockchain Project Governance, Rules and Influence

- "The Eye of the Government" Chainalysis: Most Bitcoin mixed currency transactions are legal transactions

First, you need to understand Bitcoin and the "non-nationalization of money."

The book "Non-State of Currency" should be familiar to everyone. Hayek put forward the idea of freely competing currencies in this book. He believes that the central bank system should be abolished, private money is allowed to be issued and competition is free. This competition process Will find the best currency.

The creator of Bitcoin has never said that it wants to be the best currency, but we have a constant total of 21 million bitcoins, deducting the release of anti-inflation, peer-to-peer networks and other characteristics, it is not difficult to guess, it is the current international currency shortage A response and challenge to anchor discovery.

In 1976 , the Bretton Woods system was disintegrated, and the currency issue lost the final barrier of gold. The issuance of global currencies began to rely on the monetary regulation policies of governments. For governments with political turmoil and poor macroeconomic regulation and control, currency abuse and constant devaluation, hyperinflation has become a very serious problem.

Second, you need to understand the new concept of Defi , as well as the book "The World Without Banks."

It needs to be clarified here. In many articles, the financial business of mapping traditional financial assets to the chain is also included in the scope of Defi, but the Defi I am talking about here emphasizes the blockchain world such as ICO and MakerDAO. A new financial model such as decentralized financing and decentralized lending.

The book "The World Without Banks" actually does not fully address the issue of decentralized finance. The key point is to talk about the development trend of financial intermediation and put forward the concept of "community." We have seen that in the past decade or so, behind the innovation of financing and lending models such as crowdfunding and P2P , it is precisely the development appeal of financial intermediaries. The Internet solves the problem of information asymmetry. The blockchain further solves the problem of credit asymmetry. The value of traditional financial intermediaries as information and credit centers is further compressed.

Then, the main features of the blockchain system design, the core of the summary is three: 1. No access barriers; 2. No super power, no dependence on specific credit centers; 3. Without borders, globalization is widely connected.

Therefore, I think we can get such an answer. The core idea and value proposition of the blockchain system design is to create a new financial system, more full market free competition and cooperation, and a further balance between fairness and efficiency. The unity of personal property ownership and management rights.

In fact, with the further development of human society and economy, more and more works have been discussed: the importance of fairness, the importance of collaboration, the importance of individual will and freedom.

Focusing on the financial sector, to compete freely, or to monopolize, control and macro-control, is an ancient problem and a problem. In fact, I think that this issue should have different answers at different historical stages. Because no matter the allocation of social resources or the design of social systems, there are certain historical limitations in each period. As the business environment and technical programs change, the last limitation will be broken, and new changes will be formed. .

We are currently seeing that it is imperative to go to financial intermediaries, but can we really go to the financial center? Is it really possible to abolish the central bank system and remove top-down overall control and even economic macro-control? To be honest, I don't have an answer to this question right now, but I think we need to keep thinking about the possibility of such a possibility.

Or, from another angle, under what preconditions, can you really get to the financial center? I want to include at least these aspects. In the future, a market-oriented, freely competitive and self-managing system can firstly achieve further optimization of efficiency and fairness, and can cope with the complexity of financial market systemic risks. And to prevent money laundering, terrorist financing and other risks that threaten social stability.

In the long run, the new financial system that the blockchain wants to create is subversive and revolutionary. It is far from being a compliance issue, but it is creating new rules. We are just getting started now.

We have now completed the first step and have resolved the legality of Bitcoin in most countries ; currently there are only 12 countries in the world that explicitly prohibit and limit Bitcoin.

The second step has also been completed to further clarify the legal identity and management issues of the BTC . Different countries have different definitions of BTC, including commodities, securities, assets, legal payment methods, currency, etc. According to different definitions, different tax policies have been adopted, including taxation on transactions against legal currency, purchase of goods and Service taxation, property tax, capital gains tax, etc.

At present, the third step is to solve the problem of ICO compliance guidance. At present, the United States, Switzerland, and Singapore are leading countries in ICO compliance guidance. The core idea is to define whether the Token substance has the nature of “securities”. "Securities" are regulated by the relevant laws and regulations such as the traditional securities law, generally including registration approval requirements, the size of the issued funds, the number of circulation and restrictions on qualified investors.

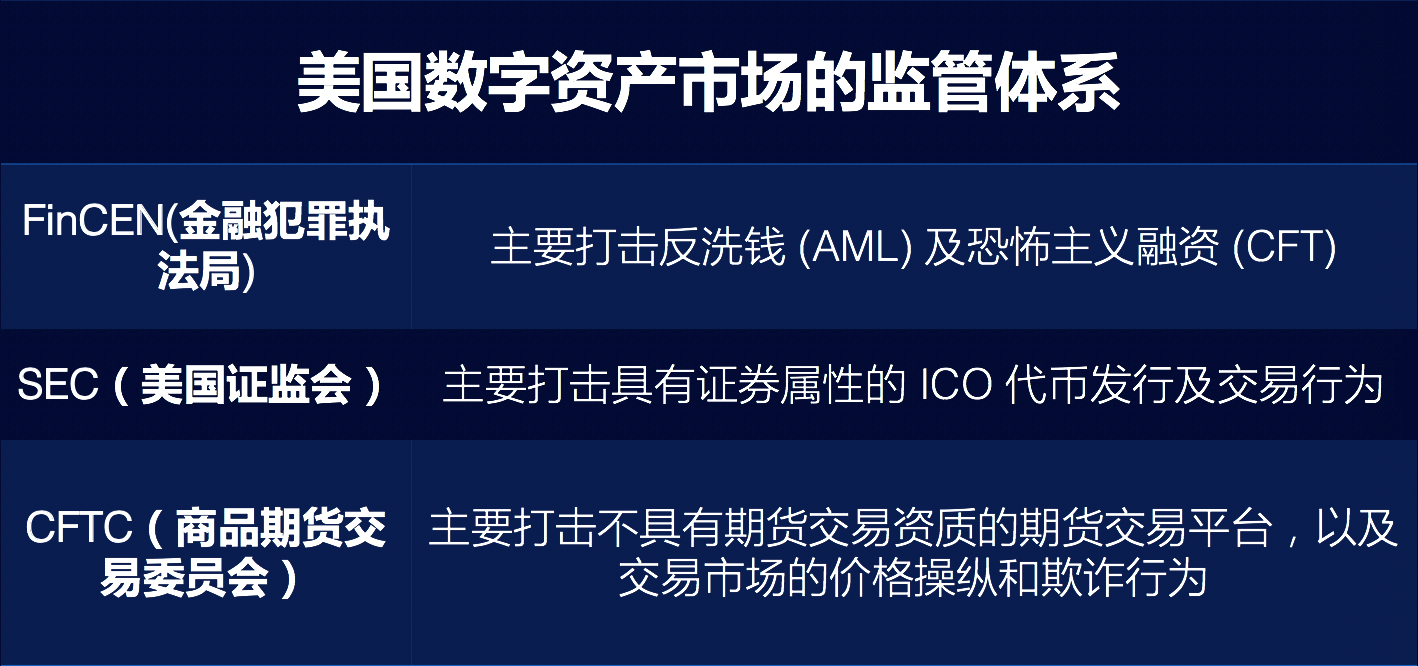

The fourth step is to establish a management system for the digital asset market . We have seen that the regulatory beacon country of the United States has established a system of joint supervision with FinCEN , SEC , and CFTC .

It is worth noting that the third and fourth steps seem to have made some progress, but in fact, the regulatory layer has incorporated the Defi business into the regulatory framework of the traditional financial system, and there is no realization of the decentralized finance of the blockchain. Any meaning. If the ICO or STO is fully compliant and becomes an IPO or IPOLight version, it will lose its innovative value. Therefore, the introduction of a new set of regulatory measures similar to those of Gibraltar, Malta, and the deregulation of decentralized financial services may be a new step.

So based on this perspective, we can think together about a question. What is the true meaning of STO ?

It must not be completely in accordance with the old normative system, but create new compliance conditions and promote innovation in regulatory regulations. The development of STO in 2018 led a large number of audit service providers, law firms, and custodians to enter the market and began to build a compliance infrastructure for digital assets. In essence, this is an industry self-discipline, even a passive self-discipline. Behind it is the power of free competition in the market.

Only when the industry strengthens self-discipline, let good money drive out bad money, strengthen the protection of the rights and interests of market participants, and let the innovation of decentralized financial model create sustainable value. When the market's value identification and demand continue to expand, can it be Opportunities drive innovation at the regulatory level and ultimately enable the construction of a new financial system.

The financial supervision system has never been static. The regulatory restrictions and blows have never been a certain model, but the risks behind the model. After 10 years, we look back. If the financial system includes a major change in the financial regulatory system, it must be because of the new changes in the identification and defense of market risks. It must be because of a certain innovation force. The market value is recognized within a sufficiently large range.

All changes concerning institutions, ideas, and doctrine must be a difficult, long, and even repetitive path of exploration. Moreover, there is always a very open discussion space on this topic.

Next, from another perspective, what is the nature of the blockchain technology system? What are the core values? What are the characteristics? This question is obviously a good answer, and can give a more certain answer.

First, the essence of blockchain technology is distributed shared ledger and payment settlement systems.

What I want to emphasize here is that the blockchain is not suitable for recording because the blockchain essentially protects network trust by increasing storage costs (multiple redundant storage) and reducing the efficiency of recording (consensus consensus is required). And transferring a large amount of data, is not a specialized storage solution, only those data and account-based data and those data fingerprints that have strong demand for authenticity and non-tampering, that is, hash values, are suitable for placement. On the chain.

So what is the core value of blockchain technology? Regardless of the number of complex blockchain applications, the core values can be grouped into these three categories. Deposit certificates, asset registration transactions and automated execution of multi-party agreements.

These three types of values are very important for many traditional financial businesses, so since 2014, many traditional financial giants have realized that the blockchain technology system has obvious advantages in improving the efficiency of traditional financial services, and has carried out a large number of explore.

So far, there are more than 100 banks exploring the application of blockchain in the world… Whether it is domestic Internet technology giants such as BAT and JD, or IBM, Microsoft, etc., they have also explored blockchain applications in the financial sector, including cross- Environmental payments, supply chain finance, invoices, digital notes, letters of credit, credit information, auto bonds ABS, etc.

This is a summary of the technical characteristics of the blockchain, including security and credibility, equivalence and consistency, risk of non-adversity, openness, anonymity, openness and so on. What is interesting is that the blockchain technology system was originally designed to serve a decentralized financial system concept, so many of its technical characteristics can not meet the compliance requirements of traditional financial services.

First, openness means lack of an authorization access mechanism and lack of “qualification approval” for financial service providers, that is, license requirements;

Second, anonymity, the lack of funds traders "identity verification", does not meet the requirements of financial compliance KYC , AML , CFT ;

Third, reciprocity, that is, without “legal super power”, the user has absolute control over the account and has “anti-censorship.

Knowing this, it is not difficult to understand why Libra's hearing has not been, because its public chain technology solution does not solve these problems.

Blockchain technology needs to be applied in large scale in the traditional financial field. There are clear three steps to go: First, we must explore the financial application scenarios with strong transformational capabilities.

Our research team completed a “Panel Chain Financial Industry Panorama and Trend Report” at the end of last year, which carried out a very comprehensive and specific analysis of the blockchain's various application models and progress in the financial industry. Some cases.

The preliminary conclusion is that in the next 2-3 years, the blockchain application opportunities will be concentrated in the business of non-standardized assets such as “supply chain finance”, “tickets” and “private equity transactions”.

The second step is also a very critical step to form a compliant blockchain technology solution.

The three types of solutions we have seen so far include the alliance chain, Stella and lightning network; but the alliance chain sacrifices many valuable features of the blockchain in order to meet the compliance requirements. Therefore, how to do compliance on the basis of the public chain should be It is a key breakthrough direction, Stella and lightning network have certain progress.

However, in fact, the lightning network development team has never said that it is a compliance solution, they mainly solve the problem of efficient micropayment. However, our research team found in the past few months that the lightning network is equivalent to adding a layer of “clearing layer” on the blockchain network. This idea is very suitable for compliance construction and is likely to become a new one. The ideal solution.

The third step of blockchain technology + traditional financial applications is actually its ultimate step, which is the transformation of financial infrastructure FMI based on blockchain technology.

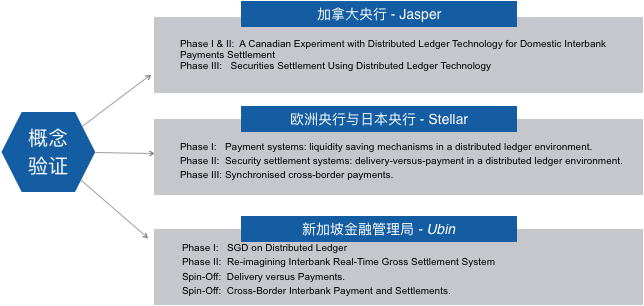

FMI is also a very large system of financial market infrastructure. After the financial crisis in 2008, it has been optimized and improved. At present, we have also seen many traditional financial giants carry out financial foundation based on blockchain technology. Theoretical research and proof of concept for facility renovation.

This will be the most important development direction of blockchain technology in the next decade.

Finally, share with you a three joint research project that our research team has been working on recently.

One is the study of the application of blockchain technology in the supply chain finance field in conjunction with the Chinese University of Science and Technology Blockchain Research Center;

The second is the study of the application of blockchain and DLT technology in FMI (Financial Market Infrastructure) in conjunction with the Tsinghua Wudaokou Finance Institute Blockchain Research Center.

The third is a study of the rule of law recommendations on the issuance and trading of digital assets in conjunction with the Center for Blockchain Research at the University of Political Science and Law.

These three topics are also based on several important issues that I have shared today, blockchain finance and compliance. I hope that with clear progress, I will have the opportunity to share with you.

The above is taken from the speech by Zhou Zihan, General Manager of the Research Department of OK Group, at the "China Blockchain Technology Application Forum and the Inauguration Ceremony of the Xiamen University Information Institute-Chain Block Chain Research Center".

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The so-called "Defi", how much do you go to the center?

- Programmer Xiao Ge told: What is the experience of all the wages only bitcoin?

- Babbitt column | Shenzhen digital currency mobile payment pilot zone prequel

- Ethereum was “occupied” by USDT, with network utilization of 90%

- BTC 徘徊 "万" word area long and short into the tug of war

- Getting Started with Blockchain | Opening the "Three Locks" for Bitcoin Smart Contracts

- 0.32 dollars to buy 40 bitcoins: the currency exchange will not work hard, the regular army will come