Viewpoint | Why is the correlation between digital currency prices so high?

How to reduce the relevance of digital currency | Why is it so high?

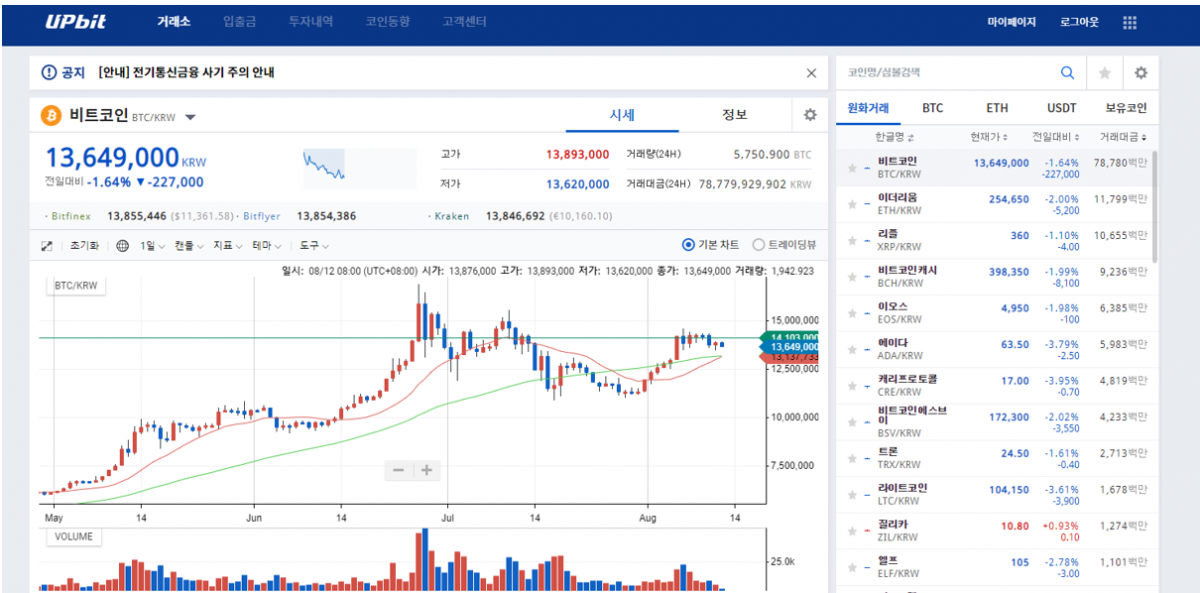

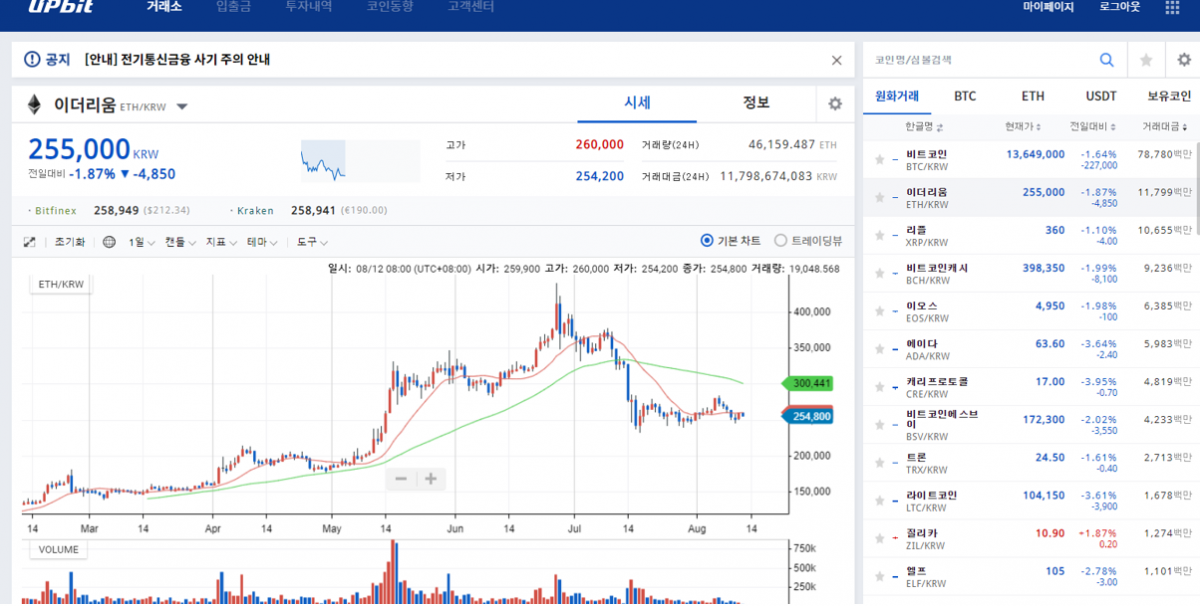

This sentence also shows how high the correlation between the whole industry and BTC is, but many investors often ask, why is the correlation so high? In fact, I have always asked myself this question, BTC and EOS, ETH, Cardano have a relationship? Strictly speaking, there is really no relationship. BTC is a payment-type digital currency. The main reason why everyone calls it is because its market value is still far ahead of other currencies. The three EOS, ETH, and ADA are the ecological certificates of three different public chains. The ecology of each public chain is actually inconsistent, so in fact, there should not be such a big correlation. At least these three should be able to go out of their respective Independent market.

- The Beijing News: The central bank’s digital renminbi is coming out, and the Bitcoin Librae currency is going to be cool?

- The fund tray project BHB organizer was arrested. The Feng sister, who once stood on the platform, said that the dividend for the day was 11%.

- August 14th market analysis: Gold fast diving with BTC?

So, what is the reason for such a high correlation? Future Brother sorts out his own views:

1. [Relationship with BTC]

This is actually understandable, because almost all trading pairs have BTC trading pairs, such as EOS/BTC, ADA/BTC, ETH/BTC, because BTC is not a stable currency, so BTC fluctuations will generate The greater impact, I believe that everyone will also have a sense of identity. Secondly, encrypted assets have not become mainstream assets. BTC is the most famous “coin OL” in the entire encryption asset. Any policy or decision that affects BTC will have an impact on the entire industry, so this is one of the reasons why BTC is directly used as an index. . And because of its popularity and unique never-added 21 million fixed value, every four years halved and other fixed routes, but also many large institutions are willing to hold for a long time, thus having a giant whale effect.

2. [Speciality of speculative & technical analysis]

There are also many pure speculators in the currency circle. In fact, this is also a portrayal of many people. They almost don't know much about the details of a project, but they all know what news will bring benefits. There are also people who have pure technology investments and quantitative arbitrage, and they don't care about the details of the project. Directly set up program trading, contract trading, etc., so each coin is almost the same in its eyes, just different code symbols and trend graphs, and no other special value and meaning. Therefore, the difference between the projects will not affect too many investment decisions, thus increasing the correlation, which also has a huge whale control. Therefore, if we only look at the distribution of tokens, distributions, and locks, it is true that each family becomes a digital game, and this itself is out of the project.

3. [educational & learning deficit]

Similar to the previous reason, except that the former does not need to learn too much and through program arbitrage and technical analysis. The lack of education in this article is one reason why it is more popular. First of all, the Blockchain blockchain is not a particularly well-understood technology. Although it is distributed accounting and various kinds of consensus, it can be understood at a glance. Learned carefully), but in essence blockchain technology is still cryptography-based technology. It is recommended to look at the white papers of Cardano and Algorand, because the white papers of the two projects are complete academic papers, which is more suitable. And the nature of technology is not so easy to understand. However, after the completion of the entire industry in the future, more traditional industry applications can be popularized, and the popularity of various valuation and learning methods will make everyone's understanding of the entire industry more comprehensive.

At present, many people can't really tell the difference between EOS, Ethereum, Cardano, Algorand, Cosmos, Dash, and GRIN. A good little friend might say: EOS is DPOS, and then BM has had any experience comparing the academic and research level between Vitalik and Charles and Silvio's zero-knowledge proof. Cosmos is a cross-chain-oriented project (cross-chain details?), Dash and GRIN are private currency, Dash daily water flow is huge, GRIN's underlying protocol Mimble is more popular. I think, if you can tell these little things at the same time, Future can already give him 80 minutes of leeks, it is really not easy to prove to learn.

But more people don't understand this. Even the practitioners may not be able to tell the difference between the other 5-10 projects except for the projects they are responsible for. Of course, if you don't understand these, you can directly buy the coins, so the actual Many people who buy coins don't know about the industry and the project (some are not interested in understanding, as long as they make money), it also causes this kind of strong correlation, BTC may rise, BTC falls, basic Full plunge, and often there is a very consistent chart (especially when the BTC falls)

4. [The industry is still very young]

As we all know, the blockchain industry is still a very early season, and many people are also looking forward to the emergence of singularities. It is precisely because of this that it is necessary to take the lead of the big brother, because the other wings are completely full, which is also an important reason why BTC can be called the index. Any news that favors BTC or digital assets may make the whole industry one. This is not a bad thing, but it is also growing. When the blockchain technology and ecology grow up, it is generally understood that when the level grows up, it can generate more real value cash flow, etc., the whole industry will definitely come out more healthy independent market. The correlation of digital assets will also gradually decline, approaching a more benign cycle, and of course it may not change at all. After all, the great man of Sir Newton, the short-sleeved shorts that still speculated in his later years are gone. This proves the love of speculation in human nature.

So how to reduce the relevance of the blockchain industry?

i. More detailed and easy to understand universal education and concept communication, let more people understand their intrinsic value and difference.

Ii. The support of technology and regulatory and promotion policies is still the driving force behind the development of the industry, and the correlation of technology maturity will be further reduced.

Iii. Reduce the blindness of follow-up investment, even if it is speculative, and speculate on the evidence of the internal content.

▌ Note : Please reprint the article at the beginning of the article to indicate the author and source .

▌ Source : Original article

▌ Author: Future little brother

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Directly hit the supply chain financial fraud event blockchain technology can effectively solve the pain point?

- Mainstream currencies have different trends, can they break away from the BTC downturn?

- The issuance mode, development process and nine key issues of the central bank's digital currency

- Bitcoin extorted new tricks, Canon SLR was hacked, and White Hat used a hole to redeem the photo.

- They look for the most valuable projects through 27,000 codebases: Bitcoin and Ethereum win

- Soul torture: What is missing in the blockchain?

- A brief history of distributed computing: the development path from mainframe and time-sharing systems to DApp