Weekly market report | overall market value, transaction volume both callbacks, BTC weekly maximum increase of 23.29%

Weekly summary

- Last week, the average daily market value of global digital currency assets was 320.534 billion US dollars, down 5.22%, and the average daily trading volume was 78.522 billion US dollars, down 18.99%.

- Last week's market capitalization TOP200 assets rose 0.07% overall.

- There are 24 new listings this week.

- A total of five projects were closed last week, and the total soft top of the project exceeded $13 million.

- Seven blockchain projects received equity financing with a financing amount of more than $17 million.

Market overview

Last week, the average daily market value of global digital currency assets was 320.534 billion US dollars, down 5.22%, and the average daily trading volume was 78.522 billion US dollars, down 18.99%.

- Morning market: Bitcoin broke through 12,000 US dollars to keep going up, even the market is just around the corner

- The form of money: from physical currency to cryptocurrency

- Research Report | Libra is a fixed income ETF

Market value TOP5 (BTC, ETH, XRP, LTC and BCH) , the average daily market value decreased by 5.05% from the previous week; the average daily trading volume decreased by 19.74% from the previous week. From day to day, the TOP5 currency has risen and fallen, with BTC's biggest gain ranking first, reaching 23.29%.

TOP200 market analysis

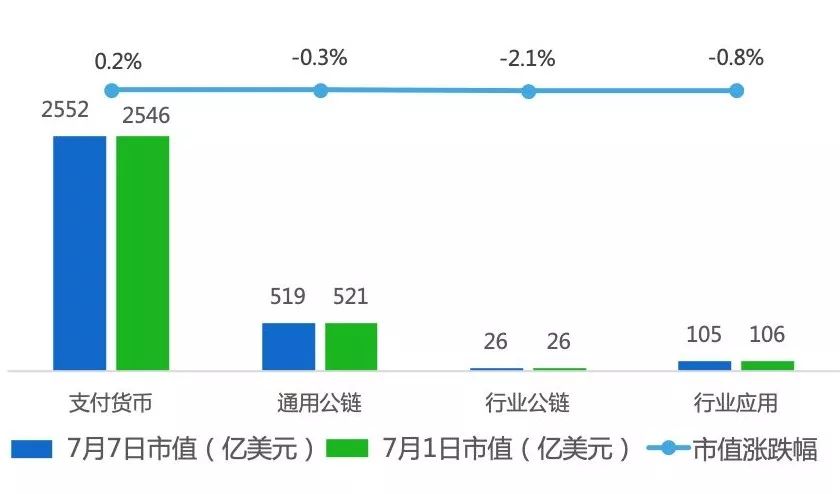

Last week's market value of TOP200 assets rose by 0.07% overall, and the four major sectors only rose in the payment currency sector. In addition, the industry's public chain fell the most, reaching 2.1%.

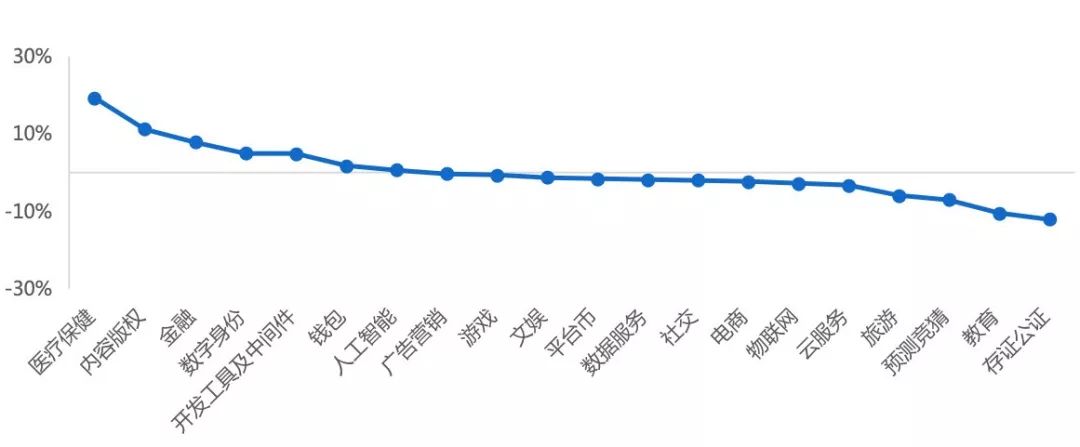

In the industry's public chain and application, according to the industry's further subdivision, a few sub-sectors rose, with the medical care sector showing the largest increase, reaching 19.38%.

In the industry's public chain and application, according to the industry's further subdivision, a few sub-sectors rose, with the medical care sector showing the largest increase, reaching 19.38%.

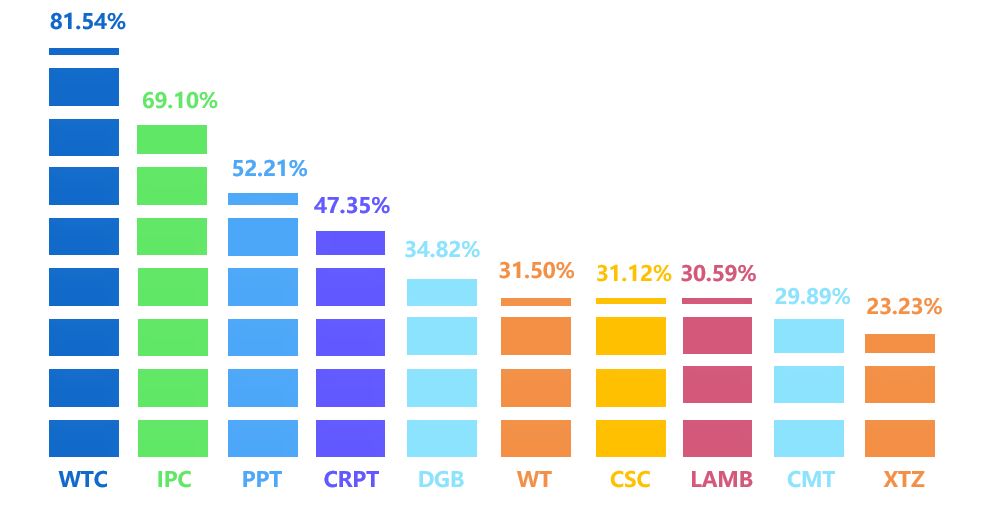

Judging from the increase in the price of the local currency, among the assets of the TOP200 market value last week, the WTC rose by 81.54% from the previous week.

New listing assets analysis

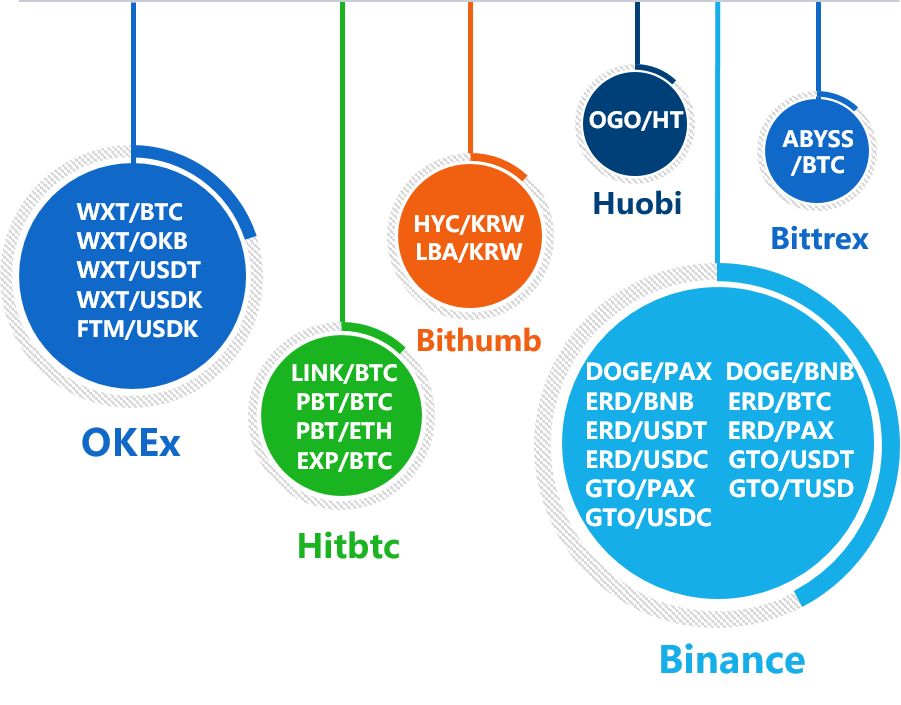

30 trading platforms including OKEx, Binance, HuobiGlobal, Bitfinex, Bitmumb, ZB.com, Upbit, HitBTC, Bittrex, and Poloniex, with 24 new listings.

Primary market financing

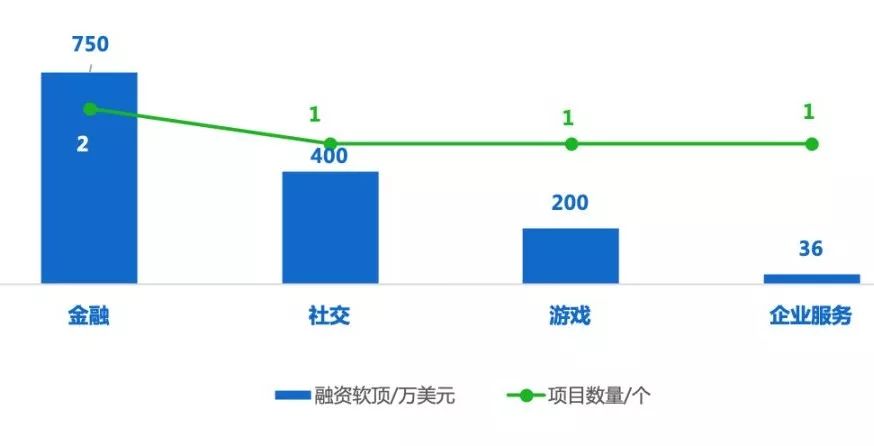

A total of five projects were closed last week, and the total soft top of the project exceeded $13 million. Among them, the total soft top of the financial sector project reached the largest, reaching $750.

Last week, there were 7 blockchain projects that completed the completion of equity financing, and the financing amount exceeded US$17 million.

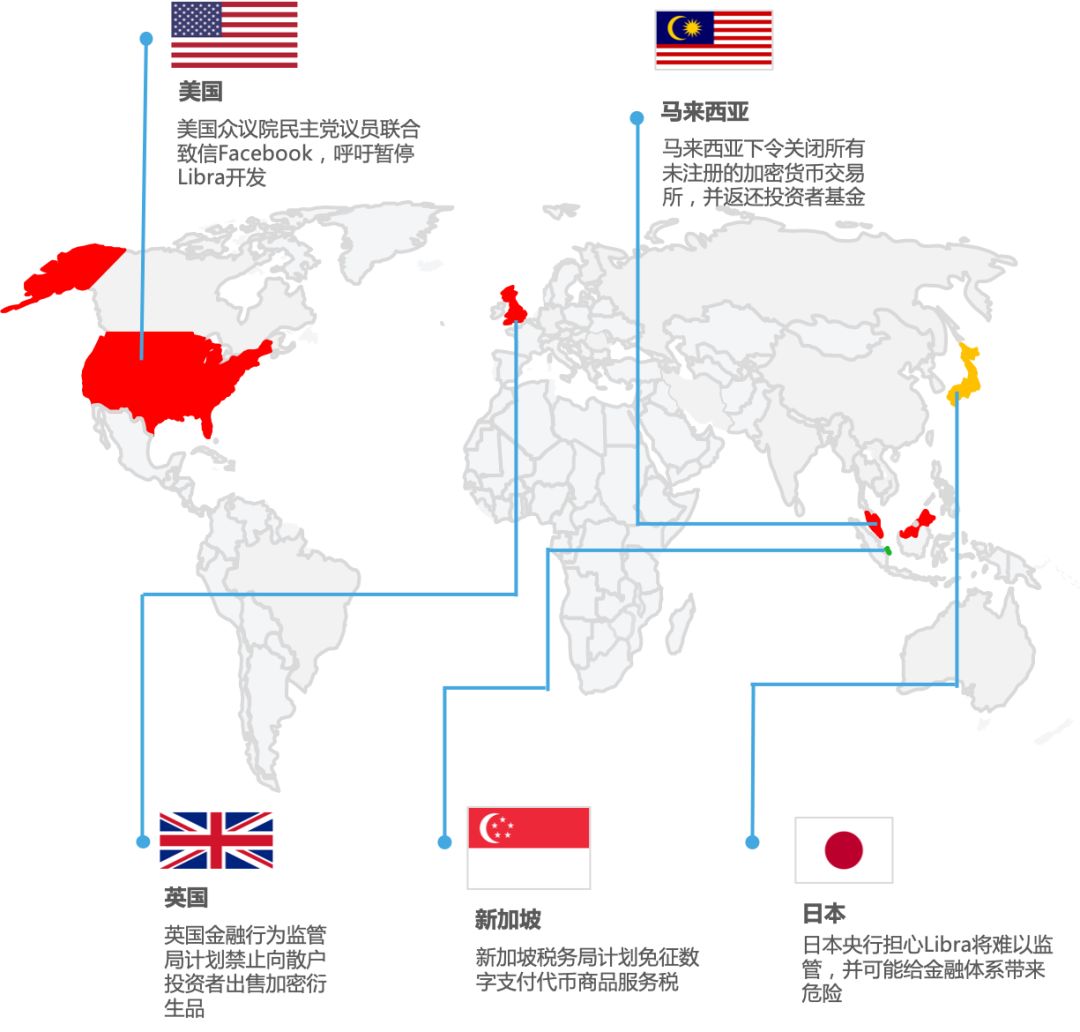

List of regulatory policies

Giant layout

Big coffee said

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- When Libra meets the Chinese central bank: Libra's potential, risks and central bank response are here.

- Why is Tether, who has been criticized, still standing still?

- For the sake of financial freedom, how does the CoinEx public chain create a new generation of decentralized financial systems?

- Ethereum rose 7.5% today, and CME Group is preparing for Ethereum futures.

- Will the next bull market be "epic-like"? 7 major factors may become "pushing hands"

- Huang Butian released an open letter, revealing three important directions after the VNT Chain main online line

- Use the Crypto.com scan code payment function to enjoy the consumption of world-renowned merchants and improve the practicality of CRO