What are the most profitable blockchain funds going on?

Text: Little Parker

Source: Planet Daily

Compared with direct investment cryptocurrency, there is a kind of financial product that allows investors to enjoy the dividend growth of the cryptocurrency market without facing the problems of exchange, storage, short-term price fluctuations, etc. This is the encryption fund.

According to Grayscale Digital's official website data, the Grayscale Bitcoin Trust (GBTC, Bitcoin Trust Fund) has so far averaged 199.24% in the past 12 months, while Bitcoin's spot gains were 143.55%. This article will focus on crypto funds that are higher than Bitcoin.

- Resolution: Bitcoin block timestamp protection rules

- Analysis: Bitcoin cash has increased fluctuations in hash rate last month. Will this continue?

- Wuzhen·Genesis Mining CEO: Only the most innovative companies and the most efficient miners can survive

Cryptographic Trust Fund

Cryptographic Trust Fund

Similar to the characteristics of traditional trust funds, cryptocurrency trust funds are issued by specialized investment institutions in the form of contracts or companies, issuing fund vouchers, raising investor funds, and handing them over to investment institutions for investment in accordance with the principle of asset portfolio. Investors share revenue based on the proportion held and bear the corresponding risks.

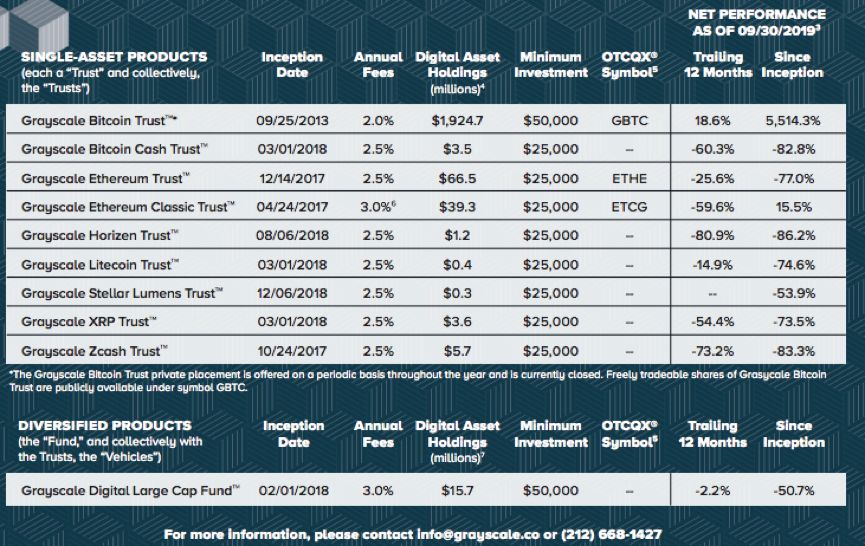

The largest trust fund in the encryption market today is the Grayscale Bitcoin Trust (GBTC, Bitcoin Trust) of cryptocurrency investment firm Grayscale Digital. Grayscale Digital was founded in 2013 by the investment group Digital Currency Group. On September 25th of the same year, it established the first bitcoin trust fund GBTC on the market. The fund's asset management scale is now $2 billion . In addition, Grayscale Digital has created eight single asset trusts, including Bitcoin Cash Trust, Ethereum Trust, Ethereum Classic Trust, Horizen Trust, Stellar Trust, Lumens Trust, XRP Trust, Zcash Trust, and five types of currencies. Multi-asset trust fund, Grayscale Digital Large Cap Fund.

(Grayscale's 10 Trust Funds List, October 16, 2019)

(Grayscale's 10 Trust Funds List, October 16, 2019)

So what is the difference between direct investment in digital currency and purchase of trust funds? Take the Bitcoin Trust Fund as an example (other trust funds are the same):

1. Traditional investors who are unfamiliar with digital currency can enter through the trust fund without having to redeem and store digital currency.

2. To purchase a GBTC you will receive 0.00097368 bitcoins and a GBTC price of $9.28 (10 October 2019 price). According to the bitcoin market price of $8,175.10, 0.00097368 bitcoin is worth $7.60. Therefore, the premium of the two is 32%, and when the historical premium is the highest, it is as high as 85%, which brings a lot of arbitrage space.

3. Because GBTC's price fluctuations in the secondary market, the yields of the two are also different, but from the data of OTCmarket, the positive rate of return of GBTC is always higher than the positive rate of return of bitcoin.

(market price is the market price of GBTC, Bitcoin Holding Share is the bitcoin yield, October 16th data)

(market price is the market price of GBTC, Bitcoin Holding Share is the bitcoin yield, October 16th data)

4. The operation mode of GBTC is similar to that of the gold trust fund: the large gold producers consign the physical gold to the fund company, and then the fund company relies on the physical gold to publicly issue the fund shares in the exchange and sell it to various investors. Commercial banks act as fund custodian banks and physical custodians respectively, and investors can freely redeem during the life of the fund. The difference is that GBTC's bitcoin is hosted by security company Xapo, so the value of GBTC also depends on the security of Xapo's IT system.

5. This product structure is a passive investment method. In addition to Bitcoin, there are no other assets and no leverage strategy. Those who plan to hold long-term may have the risk of shrinking the asset premium, while short sellers can get the asset premium (excluding the 2% fee).

6. This premium will not exist for a long time. As Bitcoin is recognized and used by more people, the threshold for direct purchase of Bitcoin will be lowered, and the premium between Bitcoin Trust and Spot will be gradually eliminated unless the GBTC team changes investment. Strategy, using other methods to make the fund's income higher than buying and selling spot income.

However, for traditional investors, digital currency participation is high and there is no legal protection. The existence of trust funds fills this gap.

Compared with the public offering form of trusts, digital currency venture capital funds are more in the form of private placements, and investors are partners.

Digital currency venture capital fund

Digital currency venture capital fund

Digital currency venture capital is similar to traditional venture capital, but the difference is that traditional VCs help to get listed companies to obtain capital appreciation and liquidity, while digital currency venture capital funds help them by trading on the exchange (on the exchange) Get an exit opportunity.

At present, there are two main forms of digital currency venture capital funds participating in investment:

(1) Participate purely in the form of tokens. Once the project is on, it can sell the token through the secondary market to recover the funds.

(2) The structure of equity + tokens, the combination of stocks and tokens varies from fund to fund, but is more inclined to hold stocks. Although different funds have different strategies, there are two main directions for investment targets: equity of encryption companies (such as financial services and technology companies), and companies that use blockchain technology in non-encryption fields (such as blockchain concept companies). ) equity.

Compared with the above trust funds, the characteristics of venture capital funds are as follows:

Low liquidity

The venture capital and equity of venture capital funds are generally valued on a quarterly basis and are not affected by the real-time price of publicly traded tokens. Therefore, risk funds exhibit low liquidity and are not suitable for investors seeking short-term profits.

2. Equity valuation model hedges currency fluctuation risk

The equity held by the venture fund has a clear and effective valuation method, which can also bring returns when the token is highly uncertain.

For example, in the August 2017 and October 2018 rounds of Round D and Series E financing, Coinbase's private equity valuation increased by 381% (from financing to pre-financing). During the same period, Bitcoin rose 84%. This hybrid approach clearly has a lower risk than having only encrypted assets. This model can even help venture funds perform well even in a bear market. For example, Bitcoin fell 53% in 2018, but the venture fund Pantera Capital Venture Fund II rose nearly 60% in the first three quarters of 2018.

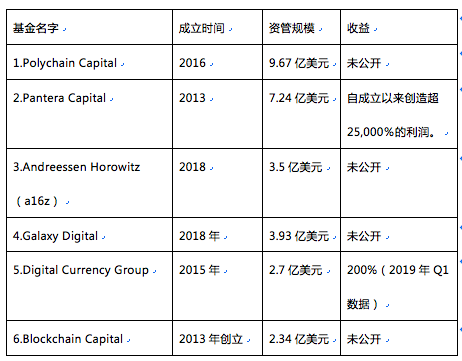

With regard to the scale of digital asset management, we have identified six crypto-risk funds with a size of over US$100 million this year and tried to compare their portfolio strategies:

Global top6 encryption venture capital fund list:

1. Polychain Capital

Polychain Capital has a broad portfolio of investments: basic agreements (39%), R&D (21%), exchanges (15%), DeFi (18%), and custody (6%). Polychain Capital's asset management scale has reached US$967 million, making it the largest digital currency venture capital fund, with more attention to basic agreements and R&D than other investment institutions.

Polychain Capital Investment Map:

2. Pantera Capital

Pantera Capital's investment distribution is: financial services (16%), technology (11%), trade and investment (10%), financial technology (9%) and blockchain (7%). In addition, the game industry is favored by Pantera Capital, accounting for 8% of its portfolio. Unlike other venture capitalists, most of Pantera Capital's investment is initial coin issuance or ICO, rather than initial round of equity investment, which is also the recent Pantera Capital's recent “stop” ICO project by the US Securities and Exchange Commission (SEC). The main reason.

Pantera Capital's recent investments are: Korbit, Circle, Polychain and Earn.com with a total investment of over $1 billion.

Pantera Capital Investment Map (The Block Chart):

3. Andreessen Horowitz (a16z)

A16z's portfolio is: financial services (20%), trade and investment (17%) and blockchain technology (13%), which together account for 50% of its portfolio.

A16z portfolio map (The Block map):

4. Galaxy Digital

Galaxy Digital currently manages two types of funds, active funds and passive funds. Active funds mainly refer to venture capital funds. Passive funds refer to the BGCI (Bloomberg Galaxy Crypto Index) jointly launched with Bloomberg in 2018. The performance of this cryptocurrency market. The investment strategy of the venture capital fund actively managed by Galaxy Digital has not been publicly disclosed.

Galaxy Digital Portfolio Map:

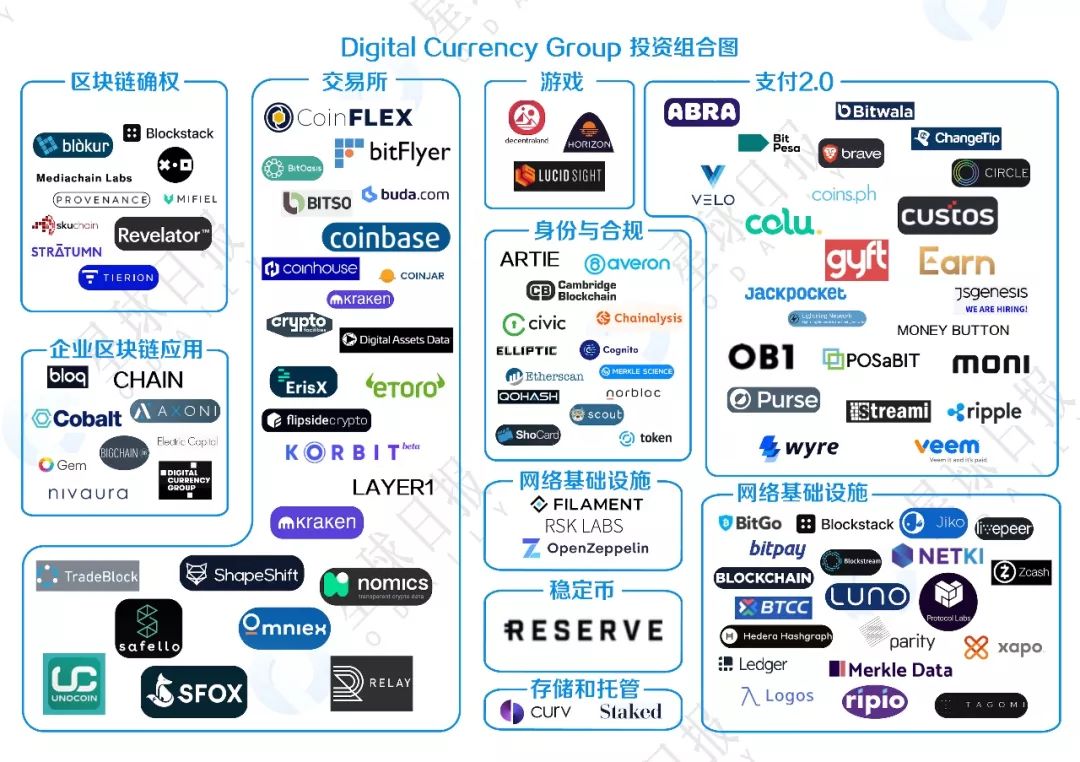

5. Digital Currency Group (DCG)

DCG's investment distribution is: financial services (20%), trade and investment (13%), financial technology (12%) and payments (8%), accounting for 53% of its total investment portfolio. 51% of the investment is concentrated in the seed round financing of blockchain companies. The idea is to make a profit in the last surviving companies through a large number of companies that are in the initial stages of investment.

For example, DCG is an early investor in Kraken, Ripple and Ledger, and today these projects are valued at billions of dollars.

DCG investment map:

6. Blockchain Capital

Blockchain Capital's portfolio is: financial services (16%), financial technology (16%), blockchain infrastructure (12%), transactions and investments (11%), which together account for 55% of all investments. In addition, approximately 4% of the portfolio consists of blockchain healthcare startups. Blockchain Capital believes that blockchain + healthcare is an area of concern.

Blockchain Capital Portfolio (The Block Cartography):

Original article; unauthorized reprinting is strictly prohibited, and violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Zhang Yifeng, Wuzhen·China Banknote Block Chain Research Institute: Distributed Digital Identity is the entrance to the blockchain

- Ma Qianli, Vice President of Wuzhen Babbitt: The "Product" Thought of Industrial Blockchain

- Wuzhen • Tencent Blockchain Cai Weige: Application into the outbreak period, how to achieve the link from the chain to the chain?

- Sun Lilin, founder of Wuzhen·PlatON: Thoughts on Blockchain Governance in the Age of Privacy Computing

- Wuzhen·Baidu Blockchain Xiao Wei: Integrating blockchain, AI and other technologies to promote the construction of smart cities into a new stage

- Ali, Jingdong, Suning, "chain" battle double eleven

- Babbitt Column | Blockchain/Digital Currency: Analysis of Legality of Currency Trading