What are the top areas in Asia's top blockchain venture capital? Not DeFi anyway

Written by: Pan Zhixiong, Director of Research

Source: Chain News

Editor's note: This article has been deleted from the original intention of the author.

Asia has always been one of the hottest regions in the cryptocurrency and blockchain industry, and has also been regarded as an important source of investment funds globally. Asia not only has China that vigorously develops blockchain technology, South Korea and Japan have also been the most popular areas for bitcoin or cryptocurrency transactions, and Singapore and Hong Kong as two financial centers have also been selected by many companies as project offshore companies Registered place. These factors are intertwined, making Asia the most popular investment region after North America.

- "Bitcoin Secret History": Bitcoin Forum Discussion on "Snack Machines"

- Investment management company VanEck: institutions should invest in bitcoin, small allocations will significantly increase ROI

- Sneak Peek, Ethereum 2.0 Deposit Contract Interface Flows Out

Understanding the preferences and investment directions of core investors is of great significance for understanding the flow of mainstream funds in the field of blockchain investment. By analyzing the investment targets of Asia's top blockchain venture capital institutions in 2019, we found that the Asian market is completely different from other regions. One of the most obvious features is that the Asian market is still decentralized financial More cautious.

Of course, our findings go far beyond that.

In December last year, X-Order, an innovative research institution focusing on cryptocurrency investment, open finance and data science, and other professional media chains in the field of fintech and blockchain, launched the “Proof of Value Blockchain Venture Capital Fund Rankings” ", Comprehensively evaluate the reputation and popularity of blockchain and cryptocurrency investment funds worldwide.

From this, we selected the top 5 Asian blockchain venture capital institutions in this venture capital institution ranking, and sorted out all the investment cases they have announced from 2019 to mid-January 2020 as the basis for research. Data sources come from open sources.

We find that these top Asian blockchain institutions almost no longer invest in new projects with the STO concept, and they are also cautious about investing in the DeFi concept. They still lock the main capital in entry-level products and the profit model is very clear Exchanges, as well as the underlying blockchain technology itself of cryptocurrencies.

Top 5 Blockchain Venture Capital Institutions in Asia

In the " Proof of Value Blockchain Venture Capital Funds List " jointly launched by X-Order and Lianwen, the top five venture capital institutions in Asia are: IDG Capital, HashKey Capital, Distributed Capital, NGC Ventures, and FBG Capital.

- IDG Capital was founded in Boston, USA in 1992, and entered the Chinese market in 1993 as a foreign investment institution. IDG Capital is involved in the fields of venture capital, private equity and mergers and acquisitions. The main investment industries include TMT (technology, media, communications), medical, consumer & entertainment, advanced manufacturing & clean energy. Early investors in the business.

- HashKey Capital is an investment fund focused on the blockchain industry under the Hong Kong-based financial group HashKey Group. Xiao Feng, chairman of HashKey Group, is also vice chairman and executive director of China Wanxiang Holdings Co., Ltd. and chairman and general manager of Shanghai Wanxiang Blockchain Co., Ltd.

- Established in 2015, Distributed Capital is a venture capital organization focused on investing in blockchain technology-related companies. The chairman of Distributed Capital is also Xiao Feng, the general manager of Wanxiang Blockchain, Shen Bo is also the head of Distributed Capital, and Ethereum's founder Vitalik Buterin was a consultant to the fund.

- Founded in December 2017, NGC Ventures, formerly known as NEO Global Capital, is a venture capital fund focused on the blockchain industry. The founding partners are Gu Tao and Tao Rongqi.

- FBG Capital is a venture capital fund focusing on the blockchain field. The founder is Zhou Shuoji, an expert in digital currency trading and an active investor in the blockchain field.

What do these top institutions like to invest in?

We have divided the projects that these 5 investment institutions have invested in since 2019 into the following categories: public chain technology related, transaction ecology, wallets, DeFi / CeFi, STO, data / media, and other categories, and the following investments can be derived map:

From the figure above, you can see the following investment characteristics:

- There is no doubt that public chain technology and trading ecology will still be the most popular investment track in Asia in 2019;

- Among these 5 investment institutions, HashKey, distributed capital and NGC Ventures are frequently deployed in 2019, while FBG and IDG have fewer actions;

- HashKey Capital and distributed capital investment have a high degree of overlap, and there is a certain "synergy";

- HashKey prefers public chain technology, distributed capital prefers trading ecology, and NGC Ventures' investment is more balanced;

- Compared to the hundreds of DeFi projects and protocols born in 2019, Asian blockchain venture capital institutions were more cautious in deploying the DeFi concept last year, and each institution invested on average only 1 DeFi project;

- Asset tokenization and STO (secure token issuance) have been hot topics since 2018, but only 2 cases of related investment during 2019;

- Compared to centralized escrow wallets, Asian head VCs are more inclined to invest in unmanaged decentralized wallets;

- Of the more than 60 projects, 10 projects have been invested by two of Asia ’s top venture capital institutions: Blockstack, Marlin Labs, CoinFLEX, AlphaWallet, MYKEY, Bitcoin, Wirex, LongHash, Cere Network, and STP.

Public chain technology

Since it is the blockchain industry, the public chain project and related technology research and development directions must be the most concerned by venture capital institutions, and most of the new public chains are compared with Ethereum, and they hope to completely get rid of the world through their own solutions. The performance of the first public chain network is too poor.

In 2019, the top 5 blockchain investment institutions in Asia have invested in 19 blockchain-related projects, many of which are public chains, and some from Layer 0, Layer 2, privacy, applications, developer tools, consensus The mechanism and other aspects have begun to make breakthroughs.

Skale is trying to expand capacity through Layer 2. CasperLabs is implementing a better consensus mechanism. Blockstack hopes to use the DApp application as a platform entry point. Cartesi is providing development tools for developers familiar with the Linux environment. Nym is the data transmission layer of the blockchain. Provide privacy and more.

These projects will explore various possibilities for the blockchain technology itself. For example, breaking through the bottleneck of performance means a wider range of user capacity and can support consumer-grade payment platforms; solving the development tool problem can make it easier and faster for non-blockchain developers to develop and deploy blockchain applications; By enhancing user privacy, users are more motivated to abandon centralized platforms that track user data.

Among these 5 institutions, HashKey is the most preferred to invest in blockchain-related technologies, and almost all are public chains. Dash Chao, CEO of HashKey Capital, has shared some ideas about public chains. He believes that blockchain-related technologies are in the midstream of the industry, second only to upstream chip manufacturing, mining industry and general technology research and development. Regarding the alliance chain, he said that although a relatively complete alliance chain already existed in 2016, when the blockchain technology was recently promoted to a national strategy, the voice of the alliance chain has increased, but it is still not very good. Business application scenarios.

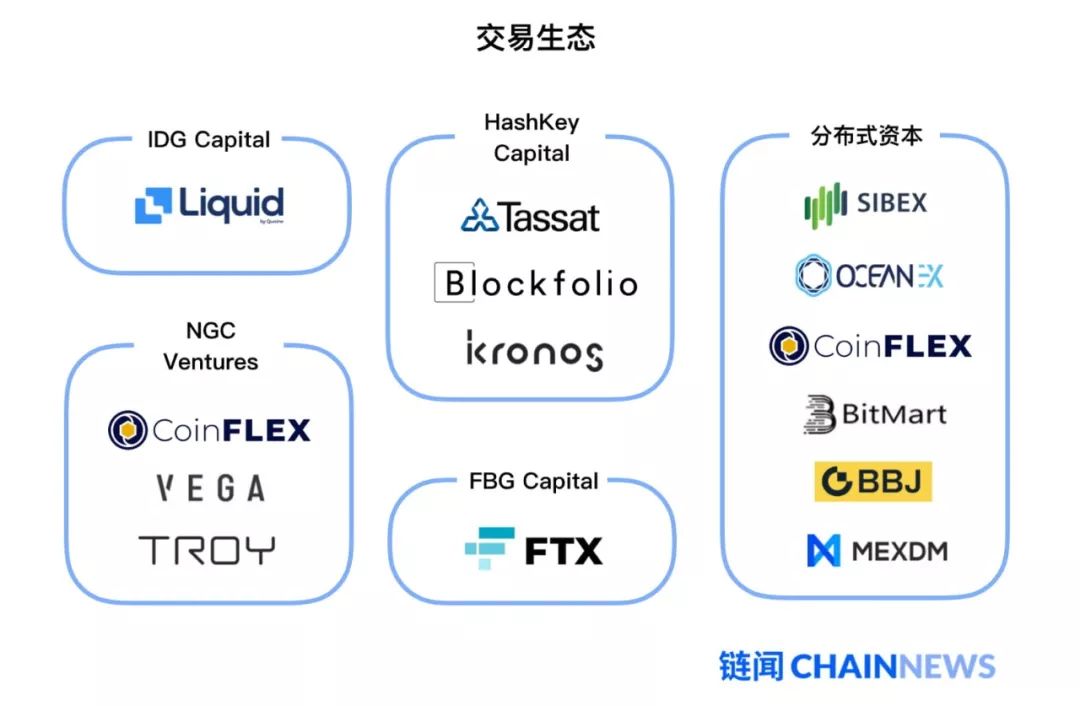

Transaction ecology

Since the current use scenarios of cryptocurrencies are mainly transactions, beyond blockchain technology, transactions and related ecology are the second areas of concern for venture capital institutions.

In 2019, Asia's leading blockchain investment institutions have invested in 13 ecological trading projects.

These 13 projects are mainly based on trading services, especially derivatives exchanges, such as Japanese exchange Liquid that supports contract trading, Tassat with a US futures trading compliance license, CoinFLEX that specializes in physical delivery of bitcoin contracts, and obtains Binance Derivatives trading of new investment FTX, OceanEX based on VeChain ecology, and coin machines focused on perpetual contracts.

Of these five institutions, only distributed capital and NGC Ventures have invested in the field of decentralized exchanges, namely SIBEX and Vega Protocol. SIBEX is invested by institutions such as Distributed Capital and the Swiss Stock Exchange (SIX), with the aim of establishing a real-time on-chain settlement decentralized exchange (DEX) based on P2P networks. Features include that users can choose not to disclose transaction prices, On-chain settlement, trading of Bitcoin and Ethereum utilize the Hash Time Lock Contract (HTLC), etc. Investors in the Vega Protocol include NGC Ventures, Pantera Capital, and Xpring. The protocol can create or trade financial derivatives in a fully decentralized network.

Deng Chao, CEO of HashKey Capital, which has invested in the entry-level market and asset management tool Blockfolio, disclosed once that the number of users of the product is about 5-6 million. This order of magnitude product is a very important part of the cryptocurrency trading ecosystem. Not only is it an asset management tool for users to get started, but it can also help exchanges realize and monetize.

Kronos released the dark pool product WOOTRADE last year, hoping to solve the problem of insufficient liquidity in the entire market. Although there are a large number of exchanges in the cryptocurrency ecosystem, compared to the traditional financial transaction volume, there is a huge space for liquidity. Traditional financial giants may not be able to enter this field because of poor liquidity. WOOTRADE will aggregate the liquidity of many market makers and Kronos itself, and further establish a liquidity infrastructure for the industry.

FTX is a rising star in the cryptocurrency contract and derivatives trading market in 2019, supported by the incubation of liquidity provider Alameda Research. After receiving $ 8 million in seed funding in August last year, it also received Binance's strategic investment at the end of the year. The exchange is impressive in developing exclusive and innovative derivatives. For example, it launched tradable volatility contracts, leveraged tokens, index contracts, etc., and developed a tokenized US presidential election Trump re-election forecast. The futures contract TRUMP launched the Dragon Index, the benchmark Chinese public chain.

The field of derivatives trading has become a hot spot in 2019 and is likely to continue in 2020. Last year, the United States approved several compliant derivatives exchanges, such as Tassat invested by HashKey Capital, and many exchanges launched options contracts other than futures. For example, FTX also recently added bitcoin options. Although the size of the transaction is still relatively small, with the improvement of the entire trading ecosystem, such as surrounding market makers, liquidity providers, brokers, asset management tools, etc., these layouts will have a profound impact on the cryptocurrency trading ecosystem in 2020. Impact.

wallet

Among the 5 wallet projects, each has very distinctive features, and it is interesting to note that although we found that in 2019 many domestic wallet tools will tend to promote centralized hosting, and these venture capital institutions are more active in the field of exchanges. Concerned about centralized exchanges, but in the field of wallets, these investment institutions apparently prefer unmanaged decentralized wallets.

AlphaWallet is favored by HashKey Capital and Distributed Capital. The team is exploring the application of NFT (non-homogeneous tokens), cooperated with Bloom Sports to launch 20,000 tokenized NFT 2020 European Football Championship VIP tickets, and also launched an open standard called Tokenscript, which is an industry standard Provide infrastructure.

MYKEY and the cryptocurrency community platform "Yuanhu" belong to the same parent company, KEY Group, and have also received investments from HashKey Capital and Distributed Capital. MYKEY is a decentralized wallet. It tries to help entry users solve the problem of experience through product-level design. It becomes an identity entrance for users on the blockchain and digital assets, and then realizes users by accessing other exchanges, custody, and DApps. Demand for blockchain platforms. For example, last month, MYKEY brought nearly 3,000 new users to Ethereum's important DeFi infrastructure MakerDAO during a two-day event. It can be seen that MYKEY is also an entry-level traffic product.

The wallet project ZenGo invested by HashKey Capital is worth watching. This is a product that can maintain decentralization and provide a high-quality user experience. Users do not need to learn the concept of mnemonics, and only need facial recognition to recover the private key. I believe that used users will lament that the registration process of the wallet is so simple, which will further reduce the threshold for using cryptocurrencies and help more new users get started quickly.

The wallet project edge of distributed capital investment and Dapix invested by NGC Ventures are somewhat “associated”. Edge was renamed from the bitcoin wallet tool Airbitz released in 2014. This multi-currency decentralized wallet integrates exchange tools and FIO protocols. The first version of the FIO protocol was developed by Dapix (with the investment of NGC Ventures), which is a protocol used to improve the readability and availability of the "address" or "public key address" of a cryptocurrency wallet. After the FIO protocol is deployed in the wallet, Transfers between users can be performed using human-readable strings, rather than a string of random garbled characters.

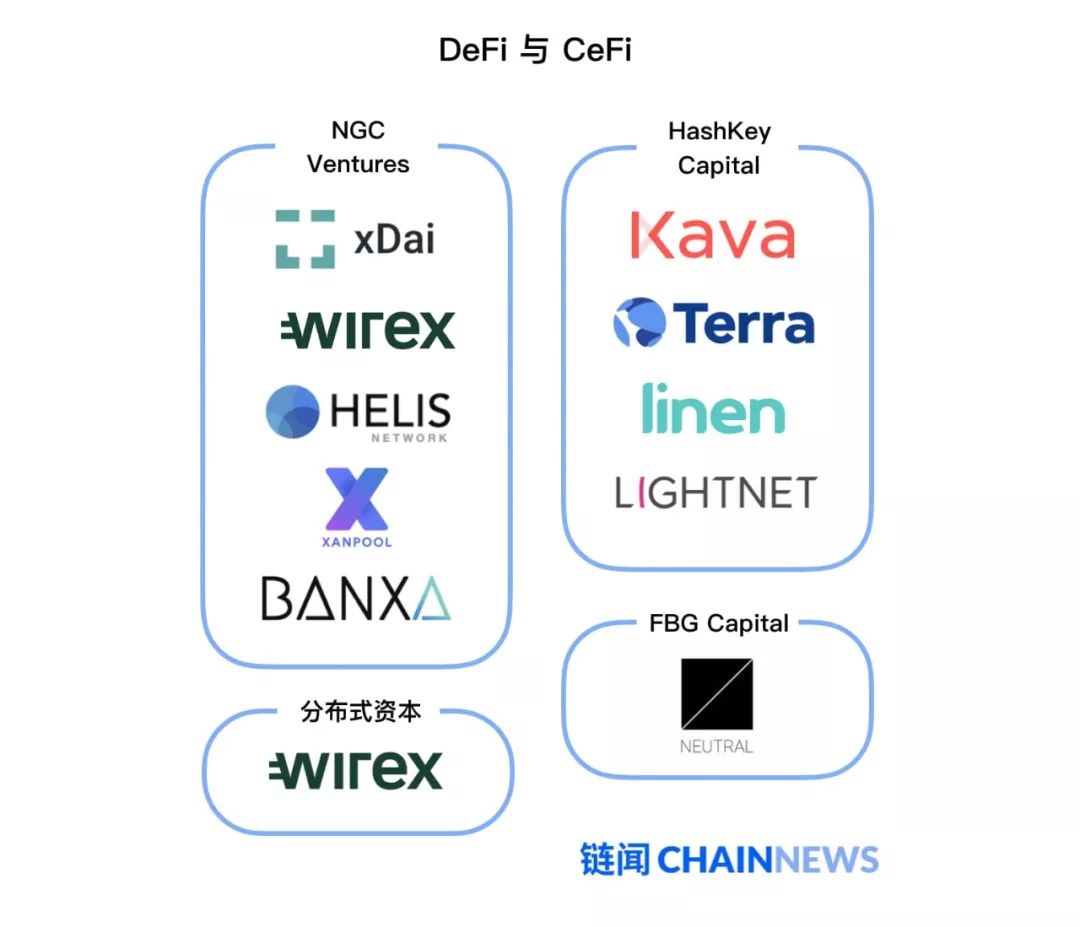

DeFi and CeFi

Cryptocurrencies are inherently financial in nature, and these 5 Asia's top venture capital institutions have invested in a total of 10 finance-related projects. With the rise of the concept of decentralized finance in 2019, we divide these 10 financial projects into two categories: decentralized finance (DeFi) and centralized finance (CeFi).

Five of them are called DeFi, they are:

- HashKey Capital invested in Cosmos-based DeFi platform Kava, and the project is about to enter the CDP test phase;

- HashKey Capital has invested in Linen, a lending platform, which is connected to Compound to provide users with interest income;

- NGC Ventures invested in xDai, a stablecoin network focusing on payment scenarios. It is an Ethereum sidechain with a block time of only 5 seconds, which is fast and economical;

- NGC Ventures invested in Helis Network, a comprehensive DeFi entry-level platform that integrates other DeFi protocols;

- FBG Capital has invested in Neutral, which aggregates a basket of stablecoins to protect against the risk of problems with a single stablecoin.

The other five projects are more biased towards CeFi, namely:

- HashKey Capital has invested in Terra. Although it will also issue stablecoins, it has been focusing on the payment scenario. In cooperation with BC Card, a Korean payment processor, users can use Terra's mobile payment platform CHAI to purchase goods directly from merchants;

- HashKey Capital invested in Lightnet, a cross-border remittance, payment, clearing and settlement platform;

- Distributed Capital has invested in Wirex, which is a service similar to bank cards. It provides users with one-stop service of digital banking + VISA debit card + fiat currency exchange. It has obtained EU electronic payment licenses and has claimed more than 2 million users. ;

- NGC Ventures has invested in XanPool and Banxa, two projects that can open legal and cryptocurrency payment channels for individuals and merchants. It is worth mentioning that after the completion of NGC Ventures' investment in Banxa, Banxa achieved a reverse takeover and listing on the GEM of the Toronto Stock Exchange, and the listed company Hoist Capital Corp. will be renamed Banxa Holdings Inc.

Compared with the hundreds of DeFi projects and protocols born in 2019, and the US blockchain investment institutions making great strides in this field, Asia's leading blockchain venture capital institutions are more cautious in deploying the DeFi concept last year. These five DeFi projects focus on providing users with a decentralized financial infrastructure in three basic scenarios: stablecoin, lending, and payment. Converged DeFi entry-level products such as Helis Network may be the focus of investment in the next stage, because when other lower-level protocols provide enough reliable facilities, the entire industry needs to provide more new users with more friendly User interface and experience.

The CeFi application invested by Asian venture capital institutions focuses on providing a bridge for fiat and digital currencies, which is also a preparation for incremental users. Unfortunately, these platforms are currently unable to serve mainland users.

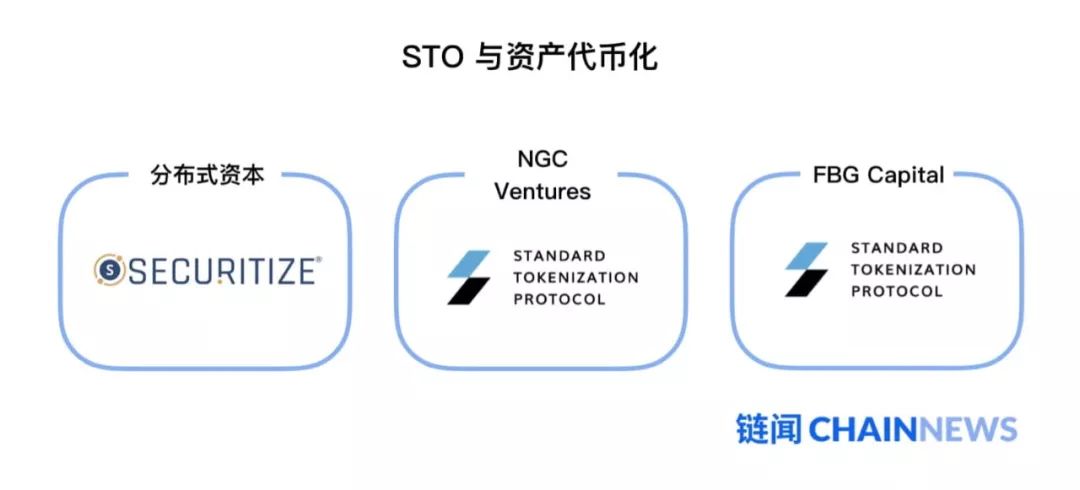

STO and asset tokenization

Asset tokenization and STO were a hot topic at the end of 2018. At the time, due to the burst of the ICO bubble, some investors thought that the issuance of securitized tokens might be one of the directions for ICO compliance, so it was born. The word STO.

Judging from the investment results of Asian blockchain venture capital institutions in 2019, the concept of STO is still at the conceptual stage, and there are not many projects that are really being promoted. The two items in this category are Standard Tokenization Protocol (STP) and Securitize. STP was launched by Block72, a blockchain consulting company, to develop a digital asset investment banking business based on the traffic side, which can be used for compliant and programmable on-chain crowdfunding and digital asset issuance services.

And Securitize's progress is faster. In cooperation with Algorand, publishers will be able to issue digital securities on the Algorand blockchain through Securitize's DS protocol. Other actions are also very frequent, including financing (Coinbase, Eight-dimensional Capital, SBI, Algorand), acquisition (Japanese blockchain consulting company BUIDL), strategic cooperation (Algorand, Elevated Returns), etc.

I look forward to seeing more tokenization of physical assets in 2020, issuing digital securities through platforms such as Securitize, AlphaWallet experimenting with asset or commodity chaining through NFT, or blockbusters similar to the PAXG gold coin launched by Paxos Commodities circulate on the blockchain.

Data, media and other items

Under this category are some peripheral ecology outside the core investment projects, including media, DApp aggregation platform, tax platform, enterprise-level tools, etc. There are relatively few projects in each segment. In addition to its preference for transaction ecology, distributed capital has also invested in many projects around the blockchain ecosystem, and is also the most active Asian blockchain venture capital institution in these two categories.

The items with media attributes are LongHash, Token Pass, The Block, and Yuanhu. In addition to LongHash, it also has an incubator and a data tool platform. In addition to the core of the operating community, the other three are mainly media platforms that generate text-based content, including news, in-depth analysis, data analysis and research reports.

DappReview and Dapp.com can be seen from the project name that they are data platforms focused on exploring decentralized applications (DApps) for users. Different from traditional App, DApp is based on the blockchain platform, so it has the characteristics of the blockchain itself, such as decentralization, trustless and so on. As the number of DApps increases, how users choose the right and popular DApps can rely on these platforms. With Binance's full acquisition of DappReview, NGC Ventures' investment in DappReview has exited.

Among other categories, MixMarvel is a blockchain game producer and publisher, and it is also the only blockchain game company that has won the favor of the top five blockchain venture capital institutions. In addition, MixMarvel has also hatched the Rocket Protocol of the Layer 2 technology of the blockchain. More games will be easily run on various main chains to get rid of the problem of transplantation and significantly reduce costs.

In addition, Chengdu Chain Security is a blockchain security company. Vid is exploring the combination of VR and blockchain. The tax platform Verady, the enterprise-level application platform BlockApps, and the customer relationship management (CRM) platform Cere Network are products that are relatively far away from ordinary domestic users, but will also provide support for the blockchain ecosystem around the core circle.

Worth double attention?

After cross-comparing the projects invested by these five venture capital institutions in 2019, it was found that 10 projects were invested by two of them, Asia's top venture capital institutions. Compared to the above investment layouts, the following projects deserve more attention, not only have received more financial support, but also have more ecological support.

- Public chain focusing on application platform: Blockstack

- Layer 0 public chain scalability solution: Marlin Labs

- Derivatives Exchange: CoinFLEX

- Wallet (Ethereum): AlphaWallet

- Wallet (EOS and Ethereum): MYKEY

- Community: Coins

- Bank Card / Payment: Wirex

- Incubation / Data / Media: LongHash

- Customer Relationship Management: Cere Network

- Digital asset issuance on the chain: Standard Tokenization Protocol

The above 10 projects are similar to the overall investment trend of these 5 venture capital institutions. Their investment priorities are still public chain technology, exchanges, decentralized wallets, and other projects later, and there is no DeFi. Related applications.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Future decentralized data storage for blockchain

- Analysis: Bitcoin and its value growth logic for bull market entry

- Industry Blockchain Highlights: Central No. 1 File Named Blockchain Central Bank Trade Gold Blockchain Platform Business Volume Exceeds 90 Billion

- Perspectives | Two Sides of Ethereum

- Mining mystery: when halving prices encounter epidemics

- Blockchain under the epidemic: inefficient and predictable future

- Weekly development of listed companies' blockchain business: In the first week of market opening, 5 companies invested in blockchain business