What data have we neglected during the ten-year development of Bitcoin?

Source: Medium

Translation: First Class (First.VIP)

The continued rise in the price of Bitcoin is often both a gospel and a bane. The gospel is because it can inspire people to participate in the Bitcoin network. The bane is because people inevitably pay too much attention to its indicators, especially when "prices rise and fall". It simplifies the complex financial ecosystem into a bubble economy, where speculation seems to be the most important use case.

- Blockchain written into Chinese government decision-making documents on a large scale: the experimental period has passed

- Comments | There is no "prospect" for the public chain. Is it easy for the alliance chain?

- Morning Quotes: Crypto Markets Collective Up, Bitcoin SV Goes Crazy

However, this article is not intended to compare digital assets with traditional assets based on their growth stages. The purpose of this article is to explain the data that we often ignore when discussing Bitcoin. Satoshi Nakamoto wrote in 2010 that WikiLeaks knocked down Ma Honeycomb when integrating Bitcoin, and he may not have foreseen the true role of Bitcoin. Over the past decade, bitcoin has enabled inflation-torn economies to find another option, allowing those autocratic economies to transfer wealth and conduct fruitful experiments in the fintech space.

Long before DeFi, loans, remittances, and trading tools were all based on Bitcoin. Over the past decade, Satoshi Nakamoto's achievements have told me that code can also spur a revolution. These ideas can provide individuals with different options. Even if the entity you are facing is a superpower with military bases all over the world, the nuclear arsenal may tremble the gods. When we were obsessed with paying attention to the price of Bitcoin, we all ignored the paradigm that existed before Bitcoin. We also ignore the fact that in an age where cash is increasingly becoming digital, authoritarian regimes use increasingly sophisticated mechanisms to find, distinguish and target dissidents, while Bitcoin offers another option. Whether they use it as a store of value or a payment mechanism depends on them, but for me, this is Satoshi Nakamoto's life.

This article uses ten different charts to describe the development of Bitcoin over the past decade. To make this article more concise and clear, I divided the article into three sections:

Address growth-see the number of addresses added and the distribution of wealth between them

On-chain activities-observe the number of transactions and the amount of transfers over the years

Mining ecosystem-observe how Bitcoin's hashrate has proliferated over time, how miners dominate, and the returns they receive.

Address growth

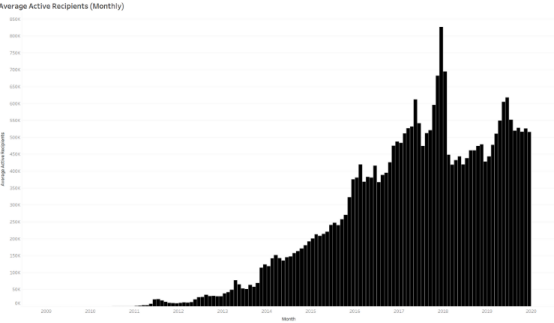

Over the past decade, the average effective recipient address has surged by 40.676%.

I represent the average monthly number of recipients as the number of users participating in the Bitcoin network. As of December 2019, an average of about 516,000 unique addresses participate in the Bitcoin blockchain every day. On December 14, 2017, the number of addresses reached a peak of about 1.07 million. However, this does not reflect the growth of the network itself. To take a closer look, we must look at the number of new addresses on the Bitcoin blockchain.

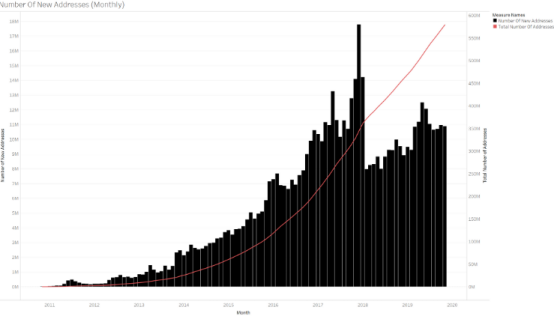

Since 2017, the number of new addresses has averaged 124 million.

The new address is a measure of ecosystem expansion. Discarding the created account will increase the marginal contribution error. In 2019, the Bitcoin blockchain added an average of about 358,000 addresses per day, which is much higher than the 7,100 in 2011. From these data, we can also observe an interesting point. Of the 1 million independent addresses using the Bitcoin blockchain on December 14, 2019, more than 800,000 are new addresses. It turns out that new retail investors are likely to reach their peak at the time. This conclusion cannot be reached without studying the wallet holding mode at that time.

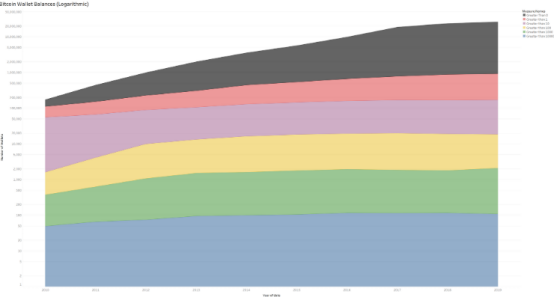

Holding pattern shows holding flexibility

By studying the average number of addresses holding more than 0, 1, 10, and 10,000 Bitcoins, it is clear that holdings in the ecosystem are very common. However, this indicator only focuses on the number of addresses, so it is also possible for individuals to transfer tokens from one address to another, or to distribute their tokens to multiple different wallets. However, if we look at the number of addresses holding more than 10,000 bitcoins, we will find that it is still growing steadily at a rate of 100%. Inactive accounts peaked on December 17, with more than 28 million accounts holding more than 0 Bitcoin. By April 1, that number had dropped to 21 million, which made one wonder whether it was multiple addresses owned by the same person (in many parts of the world, March 31 is the end of the fiscal year). As of December 5, more than 28 million addresses held more than 0 Bitcoin. As of January 2011, only about 34 wallets processed more than 10,000 Bitcoins. By December 2019, that number was hovering around 130. By December 2019, users with more than 10 Bitcoins had surged from 51,000 to 152,000. This shows that although the number of early adopters and "whales" has increased, it is still retail investors that are driving the demand for Bitcoin.

The most important information I have learned from studying these numbers is that in all held user statistics, regardless of price, the address count for each market segment is at ATH. According to negative media sources in this field, fewer and fewer people are flipping coins, and more and more people are testing the water with small sums of money. In terms of scale, the number of people holding more than 0 Bitcoin in January 2011 was only 70,000. Today, this number has exceeded 28 million, a 400-fold increase over the past decade.

On-chain activities

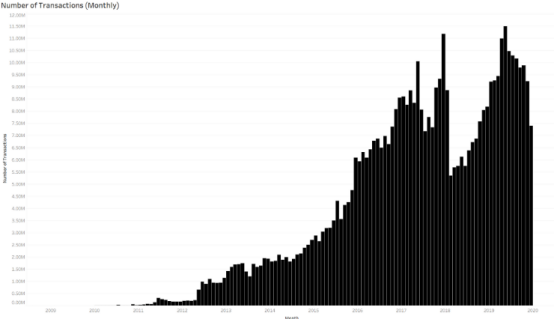

487 million transactions have been confirmed …

Since the launch of Bitcoin, over 487 million transactions have been processed. Compared to only 2 million transactions in 2011, the numbers are already huge. This number peaked on December 14th, when more than 490,000 transactions were processed in just one day. Judging from the trading frequency of price activities in the figure, it is clear that a large number of transactions are made by retail investors. Bitcoin processed an average of more than 300,000 transactions per day in 2019, compared to just 5,000 in 2011. Although 2017 ranked first in many indicators, in terms of total transactions, the number of transactions in 2019 ranked first with 111 million transactions. Compared to the previous year, Bitcoin transaction volume has increased every year since 2010. However, 2018 was the only exception, with Bitcoin trading volume down 21.7%. In terms of scale, India's unified payment interface processed 500 million transactions in one quarter (compared to Bitcoin's ten years), exceeding the number of Bitcoin transactions in the past ten years. Alibaba's Double 11 Carnival processed 1.5 billion transactions a day. But the difference is that some transactions cannot be closed because a few companies decide so.

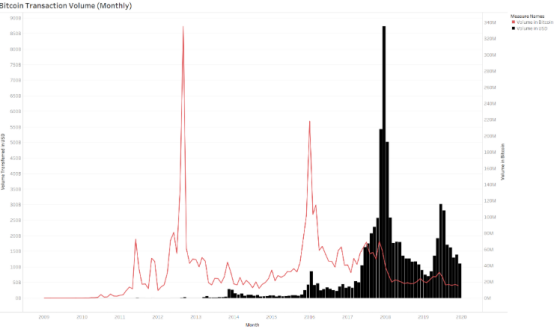

Transfer value exceeds $ 7.5 trillion

It doesn't make much sense to discuss the number of transactions but not the total amount. Therefore, I show the total amount of Bitcoin transactions in USD and Bitcoin. In this way, it can be seen that the rise in the price of Bitcoin may mean that a large number of "whales" sold tokens to the market that day, resulting in a large amount of transactions. Furthermore, looking at this chart, it is clear (as expected) that the rise in the price of digital assets has changed the way individuals transfer bitcoins. Since the birth of the Bitcoin network, a total of $ 7.5 trillion has been transferred, of which about $ 870 billion has been transferred within a month. I don't know the data of December 2017, but this month seems to be very important (I also want to know why). I also found an interesting phenomenon, the total amount of bitcoin peaked in September 2012 (331 million), as of November 2019 it was 17 million. As the price of bitcoin rises, users seem to be more inclined to hold more bitcoins, and the number of bitcoins used for transactions is very small.

Note: Each bitcoin is counted as one move. Since the same coin can be transferred back and forth multiple times, this number will be much higher than the supply.

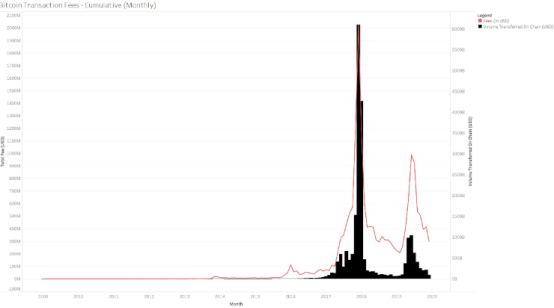

Up to $ 1 billion in fees paid

Cost indicators that do not consider transaction fees are incomplete. Throughout Bitcoin's entire life cycle, transaction costs have cumulatively cost $ 1 billion. In bitcoin terms, the transaction fee is 205,000 bitcoins. The highest single-day fee is on December 22, 2017, and the transaction fee alone cost Bitcoin over $ 22 million. If this data is expressed in terms of transaction amount (USD), that is, for every USD 1 transaction fee spent, USD 75,000 is transferred to the Bitcoin network, or about 0.01%. To increase transaction efficiency, I can also increase transaction costs. The problem with this concept is that a large amount may be transferred in a single transaction, which is contrary to 0.01%. Since transaction costs have been stable at around $ 1, and soared directly to $ 53 in 2017, this is not suitable for small transactions.

Mining ecosystem

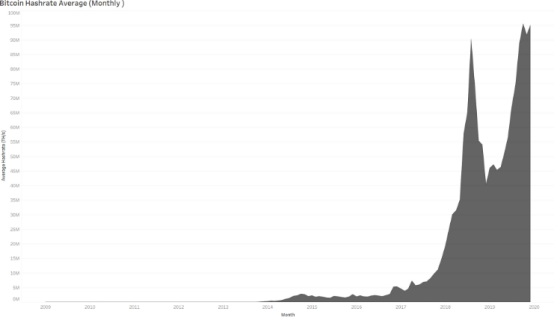

Since the fourth quarter of 2013, Bitcoin's hashrate has grown 1,000 times.

It took 37 months for Bitcoin's dedicated mining hashrate to reach its first TH / s (from January 2009 to March 2011). In the next 37 months, this number has risen to 495,624 TH / s. As of December 2019, Bitcoin's dedicated mining computing power averaged 95 million TH / s. Part of the reason is that at first, only amateurs were mining, but later it evolved into large-scale, data center-based mining operations. Key factors such as access to short-term credit, government subsidies, and electricity can determine the winners of mining today.

In simple terms, it may be helpful to calculate how much money is invested in mining and how much money can be invested in mining. As far as TH / s is concerned, the best one is Bitfury's Tardis, which costs $ 3,770 (80 Mh / s). If the costs of labor, electricity, logistics, data center leasing are included, the TH / s invested in the Bitcoin network is about $ 47.125. However, the number may be much higher because Bitfury Tardis was only released at the end of 2018, and the unit economics of early miners may be worse. At about 95 million TH / s, the low-end market should be $ 47.125 * 95 million = $ 4.475 billion.

This number may be higher or lower, depending on

Subsidy

2. Discounts for bulk purchases

3. TH / s of old model is better

The point is that the low-end market has invested at least $ 5 billion in Bitcoin infrastructure alone. It accounts for 3.65% of the total market capitalization. This investment seems traditionally "inefficient" because system administrators open and close databases as they please, but this is the price the ecosystem pays for decentralized management.

Note: Moore's Law states that the cost of USD per TH / s will gradually decrease. I have calculated the best price of TH / s. Based on the models available at the time, we would tend to consider the best USD / year cost per year in TH / s, plus the estimated time it might have been running, to plot rent and labor costs around the world.

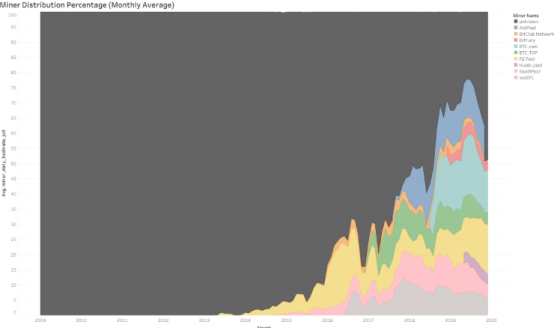

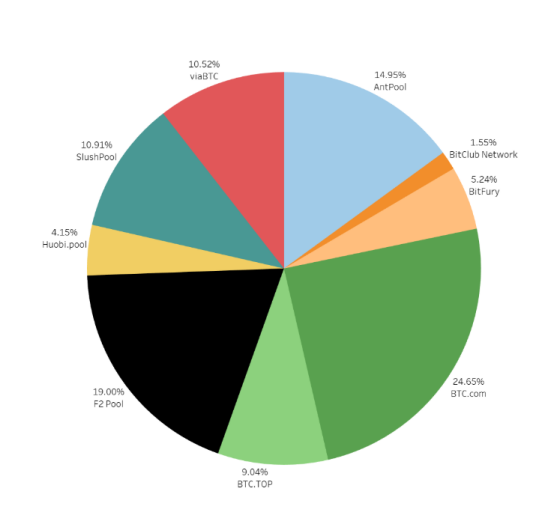

The mining pool has also promoted economic growth.

However, this "decentralization" is also accompanied by "cartels (multiple companies jointly control prices and restrict competition)" and unified risks. In 2014, a mining pool pooled 42% of Bitcoin's computing power, and almost launched a 51% attack. At the time, a "Bitcoin developer" named Vitalik Buterin (known as V God) suggested the establishment of a bounty pool to encourage the development of P2P mining pools. That was five years ago, and one might say that there are more and more economic incentives, and equity holders don't want to try similar things again. Since January 2009, the mining pool has issued $ 16 billion in rewards to miners working on the network. What I find interesting is that the launch of Btc.com (2018) and Huobi Mining Pool (2019) soon attracted people's attention and successively joined the mining ecosystem. Hardware manufacturers such as Bitfury have also found it easy to bring mining pools to market over time. The percentage of "unknown" pools in the network has also gradually decreased.

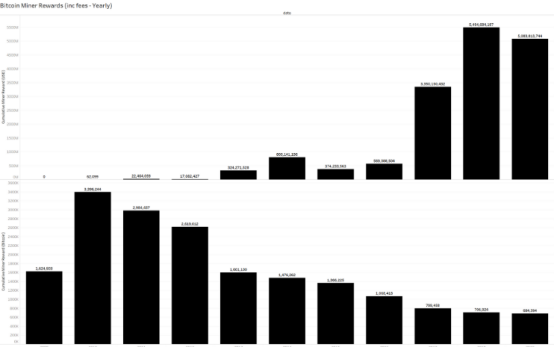

Who cumulatively paid $ 16 billion to miners

Including transaction fees, miners have received 18,318,525 Bitcoins (or over $ 16 billion). Given that 18,076,100 Bitcoins are in circulation in December 2019, we can say with certainty that in the past decade, approximately 242,525.09 Bitcoins have been used to pay transaction fees. In my opinion, as the difficulty of mining increases and the halving is approaching, mining will become increasingly institutionalized. We will see more emerging unicorns from convenience mining (retail), ASIC development, manufacturing and supply chain (such as Xiaomi's contribution to mobile phones), and infrastructure service providers focusing on green energy enterprise. As Bitcoin's mining operations in the region significantly boost the region's economic capacity, we may also see government subsidies for real estate and energy increase gradually.

The following is the mining fee allocation table for 2019 (excluding fees paid to unknown pools)

What does all this mean (for me)?

I have always regarded Bitcoin as the most important financial experiment in the world. It builds on the 40-year advancements in cryptography and the value of decades of digital currency experiments. When many people look at today's ecosystems, they may see the thunderous people on Twitter, speculative fanatics, and possibly a chaotic culture. They ignore the fact that these are carefully designed because Bitcoin cannot compete with existing paradigms in the fintech space. Otherwise, Satoshi Nakamoto would choose to sell to Silicon Valley's venture capital companies instead of writing emails to crypto punks. This is a necessary condition if Bitcoin is to become a true alternative. When we have a "real identity" or "headquarters", these systems may be destroyed. Bitcoin is not just the hot spot we see on Twitter, it's not just the media hype. It's unusual code.

Just look at the country where the currency can be abolished within a few hours and you can see why we need an alternative. As with all technology, regulators need to be aware that the elves have escaped from their pockets. They can push it to the brink, slander it, and list it as a crime. But they have not been able to tame it. We can see this phenomenon when people turn to Bitcoin when the yuan devalues, Zimbabwe's inflation crisis, Greece's debt crisis, or India starts to waste money. The point is, people are starting to realize that there is another alternative. As Nic Carter once said: "Bitcoin is the most peaceful revolution in human history." For me, this is the charm of Bitcoin. These metrics simply show how the Bitcoin ecosystem has grown significantly. Whether these trends will remain the same for the next ten years, or whether the price of Bitcoin will soar to $ 100,000, (for me) is not a concern. As long as the transaction is confirmed, Bitcoin has solved its own problems.

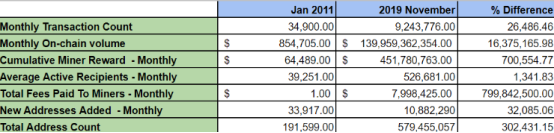

Finally, let's take a look at Bitcoin's ten-year transcript.

Since the data for December was incomplete when I started writing this article, the figure is for November.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- "No madness, no survival" —— The refining of the demon coin BSV

- "Blockchain First Share" Financial One Account Suddenly Dropped Over 20%

- Bitcoin mining difficulty soared again by 7.08%. In 2020, the halving of the currency has skyrocketed across the board. Is the market halving?

- "Learning Times" article: Blockchain invoice is a good thing

- Chongqing Daily: Blockchain's "hot", Yuzhong blockchain industry innovation base competitiveness ranked fifth in the country

- CME Group launches "Bitcoin Options" on the first day: Bitcoin price hits 2 month high

- Analysis: Why has the US SEC consistently rejected the BTC ETF, and how can it promote dialogue between the two parties?