Data Analysis | Compared with 10 years ago, what is the difference between Bitcoin and price?

Over the past decade, Satoshi Nakamoto's inventions have shown us that code can make a difference. When we pay attention to price all the time, we ignore the paradigm shift brought by Bitcoin.

Therefore, this article will show you some data that is often overlooked beyond the price. This article is mainly divided into three parts:

- Address Growth: View the number of added addresses and the distribution of wealth between them

- On-chain activities: observe the number of Bitcoin transactions and the amount of transfers in these years

- Mining ecology: the growth of Bitcoin computing power, and the miners' gains and returns.

I. Address growth

- Rethinking Ethereum: Understanding the Development of Ethereum in the Past 5 Years with 5 Indicators

- Free and easy week review 丨 RSA accumulator becomes SNARK system cost reduction weapon, DEX and other applications may become the biggest beneficiaries

- Do you know these 16 stalks about Bitcoin?

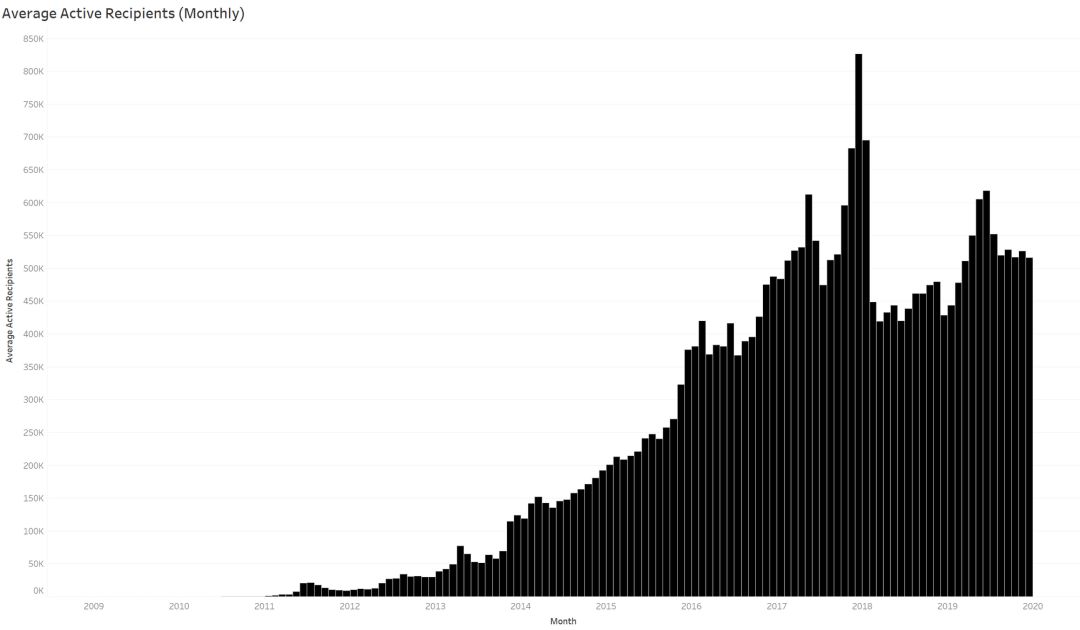

1. The number of active recipients has increased by 40676% over the past decade

Here, the number of recipients per month is taken as the representative of the number of network active persons. As of December 2019, an average of 516,000 unique addresses participated in the Bitcoin chain activities as beneficiaries every day. This number peaked at approximately 1.07 million on December 14, 2017.

However, this does not directly reflect the growth of the network. In order to observe further, we have to look at the number of new addresses in Bitcoin.

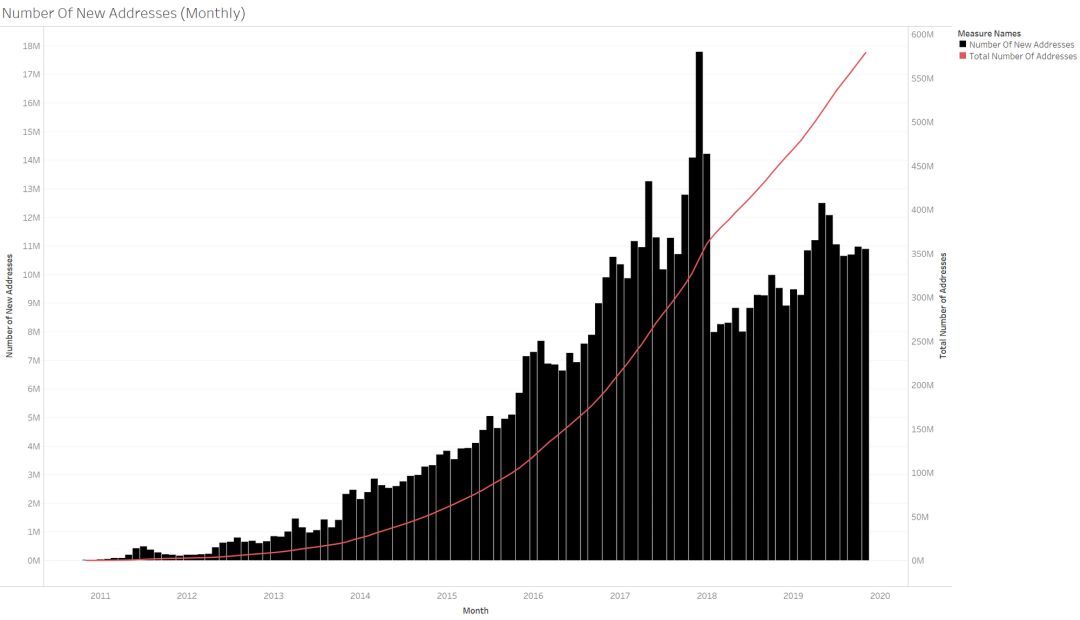

2. Since 2017, an average of 12.4 million new addresses have been added each month

(Black: Number of new addresses per month, corresponding to the left axis. Red: Total number of addresses, corresponding to the right axis)

Adding addresses is a measure of ecological expansion. In 2019, Bitcoin added an average of about 358,000 addresses per day, which is much higher than the 7,100 in 2011.

3.More and more people are inclined to hold

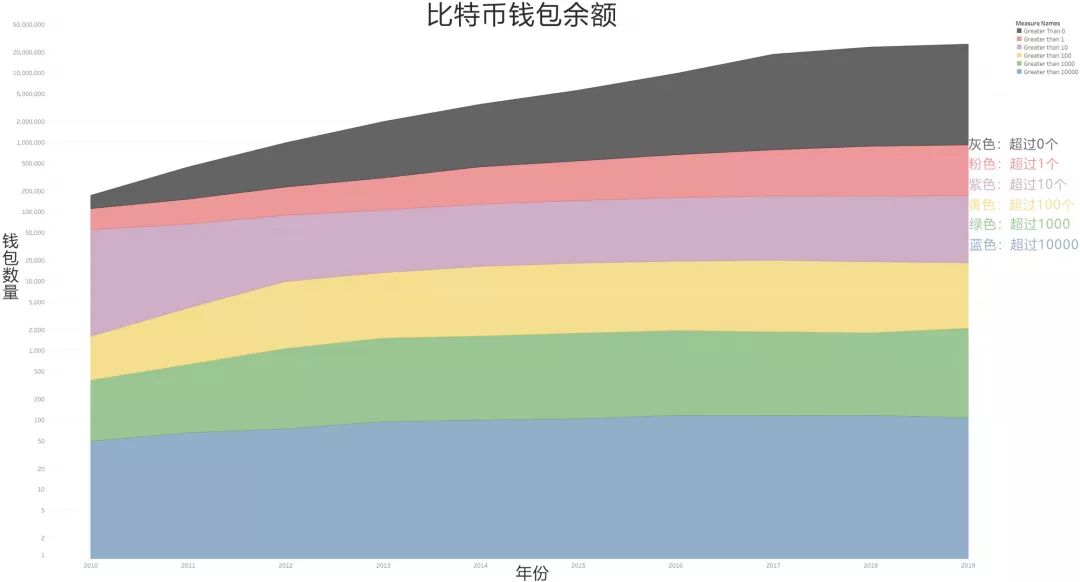

(Note: the vertical axis of the chart is logarithmic)

By studying the number of addresses holding 0, 1, 10 to 10,000 Bitcoins, we can clearly see that "Hold culture" is very obvious in the ecosystem.

If we look at the addresses of those who hold more than 10,000 Bitcoins, we will find that this number is still growing steadily at 100%. In January 2011, only about 34 wallets had more than 10,000 Bitcoins, and By December 2019, that number was hovering around 130.

By December 2019, users with more than 10 Bitcoins had surged from 51,000 to 152,000. This shows that despite the increase in the balance of early adopters and "whales", it is still the majority of retail investors that are driving demand for Bitcoin.

In addition, from studying these numbers, we can also draw a message: although the media often reports negative news, fewer and fewer people are selling their bitcoins, and more people are testing the water with a small amount of money.

In terms of scale, the number of people holding more than 0 Bitcoin in January 2011 was only 70,000. Today, that number has exceeded 28 million—a 400-fold increase over the past decade.

Second, on-chain activities

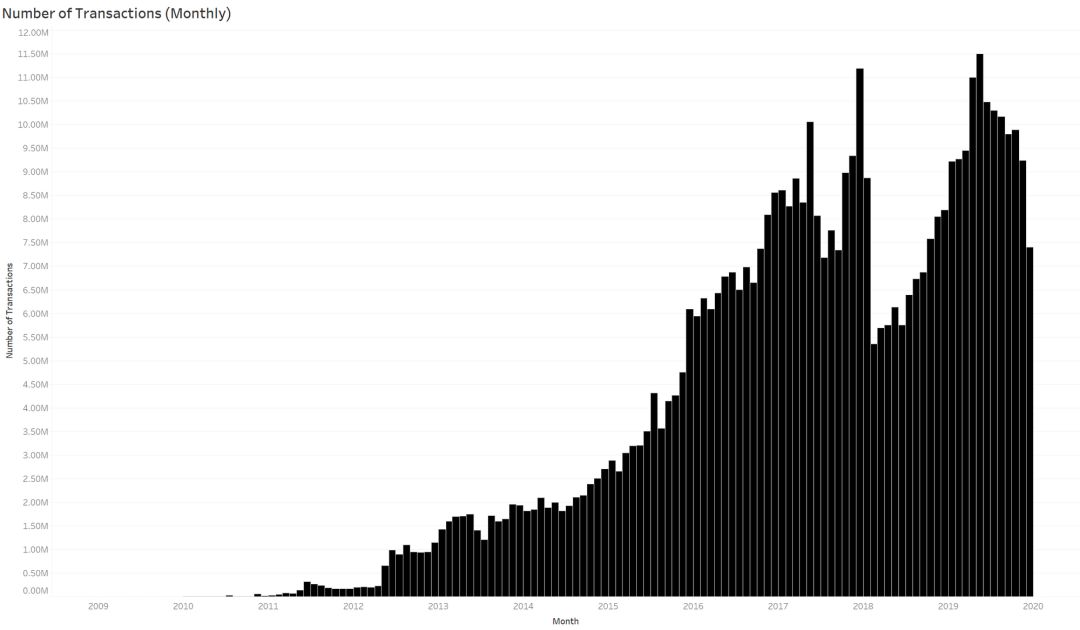

(Number of transactions on the chain)

1. 487 million transactions have been confirmed

Since its birth, Bitcoin has processed more than 487 million transactions. In 2011, that number was only 2 million.

Bitcoin processed an average of more than 300,000 transactions per day in 2019, compared to just 5,000 in 2011. Although it ranked first in a number of indicators in 2017, in terms of total transactions, it ranked first in 2019 with more than 111 million transactions.

Since 2010, Bitcoin's annual transactions have increased compared to the previous year. The only exception was in 2018, which was down 21.7%.

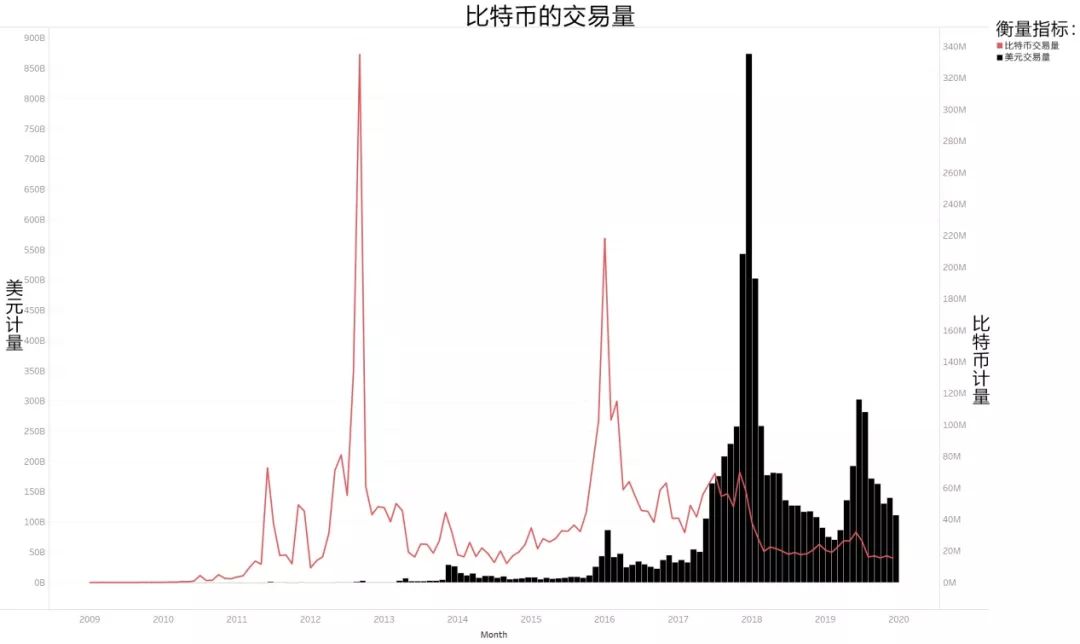

2.Transmission value exceeds $ 7.5 trillion

For a better understanding, the figure separates the number of Bitcoin transactions from the US dollar. Since the birth of the Bitcoin network, a total of $ 7.5 trillion in funds have been transferred, of which $ 870 billion was transferred in December 2017.

An interesting phenomenon is that the total number of Bitcoin transactions reached a peak in September 2012 (331 million), while in December 2019, the total number of transactions was 17 million. That is, as the price of bitcoin rises, people seem to be more inclined to hold most bitcoins, with only a small amount of bitcoins being used for transactions.

(Note: Each bitcoin move once is considered a transaction volume. Because there is a phenomenon of moving back and forth multiple times, this number will be much higher than the actual amount of bitcoin.)

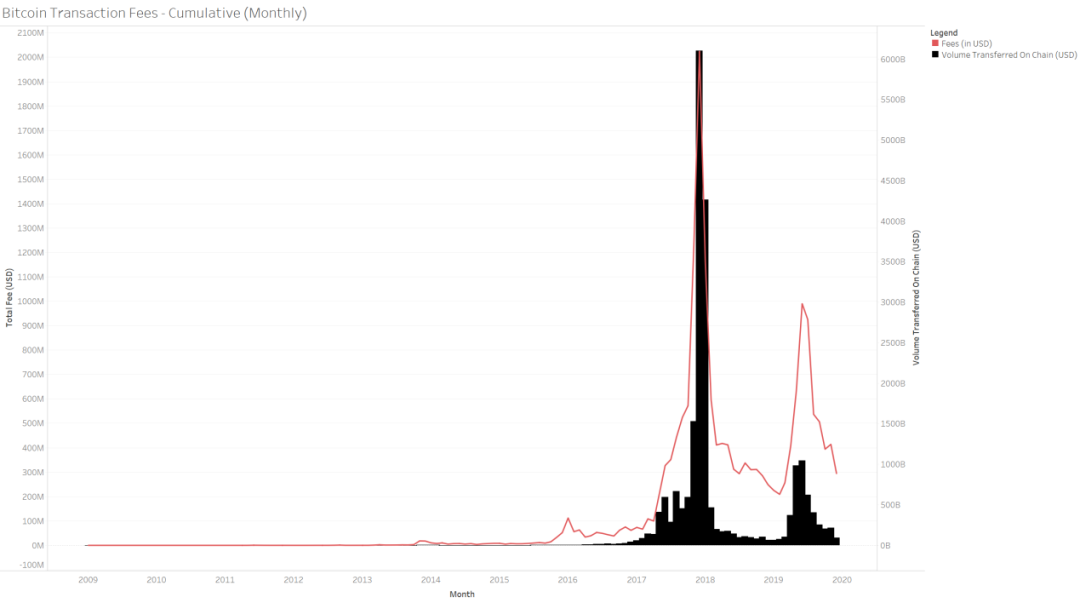

3.Bitcoin paid $ 1 billion in transaction fees

Since its birth, Bitcoin has spent $ 1 billion on transactions. But if calculated based on the number of bitcoins, it is 205,000 bitcoins.

If you look at these data from the perspective of transaction volume (in US dollars), it means that for every dollar of transaction fees spent, $ 75,000 flows on the Bitcoin network. In other words, in order to improve efficiency, we only need to pay a handling fee of 0.01%. But for small transactions, this may not be a suitable choice, because the cost of small transactions has been around $ 1, and in 2017 it rose to $ 53.

3. Mining ecology

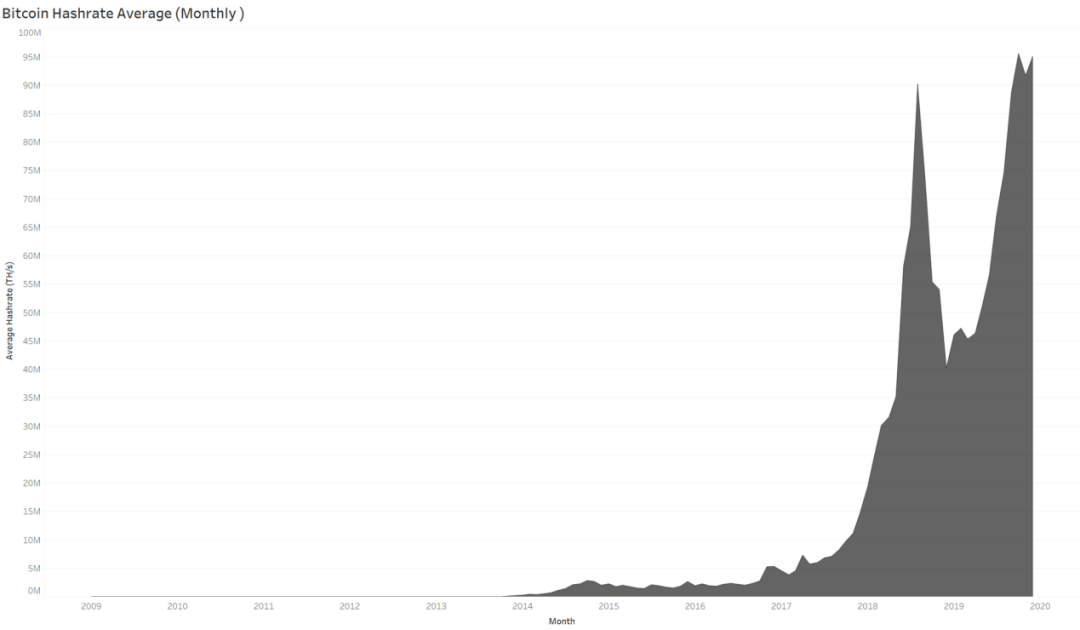

(Bitcoin monthly average hashrate)

1. Since the fourth quarter of 2013, the computing power has increased by 1,000 times

Over the past decade, mining has shifted from a hobby to large-scale, data center-based large mines. As of December 2019, Bitcoin's hashrate has grown to 95 million TH / s.

We can calculate the minimum cost of mining-this may help to explore how much money is invested in the mining industry.

Let's take a mining machine from Bitfury as an example, the price is 3770 USD, and the speed is 80 Mh / s. If labor, electricity, logistics, rent and other costs are included, it will cost 47.125 USD per TH / s (actually this figure may be much higher). So if it has a computing power of 95 million TH / s, it should cost at least 47.125 * 95 million = $ 4.475 billion.

Therefore, the Bitcoin infrastructure alone alone has an investment of at least $ 5 billion, accounting for 3% of Bitcoin's total market value.

In traditional centralized systems, the database can be opened or closed by the system administrator at will. Although this investment in Bitcoin looks "inefficient", it is the price that the ecosystem pays for decentralization.

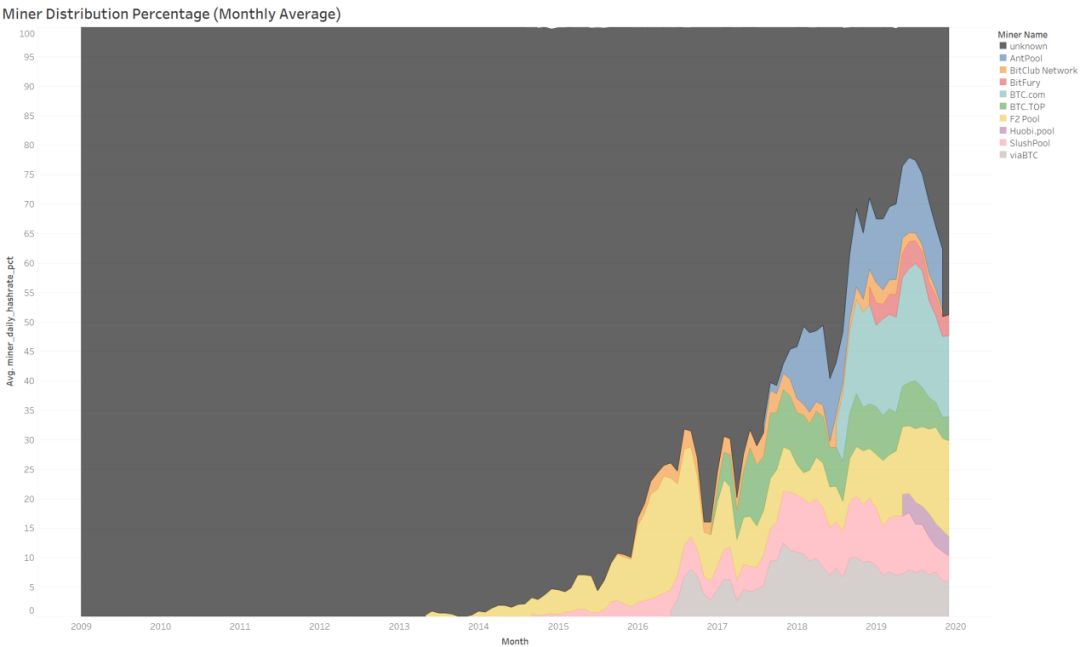

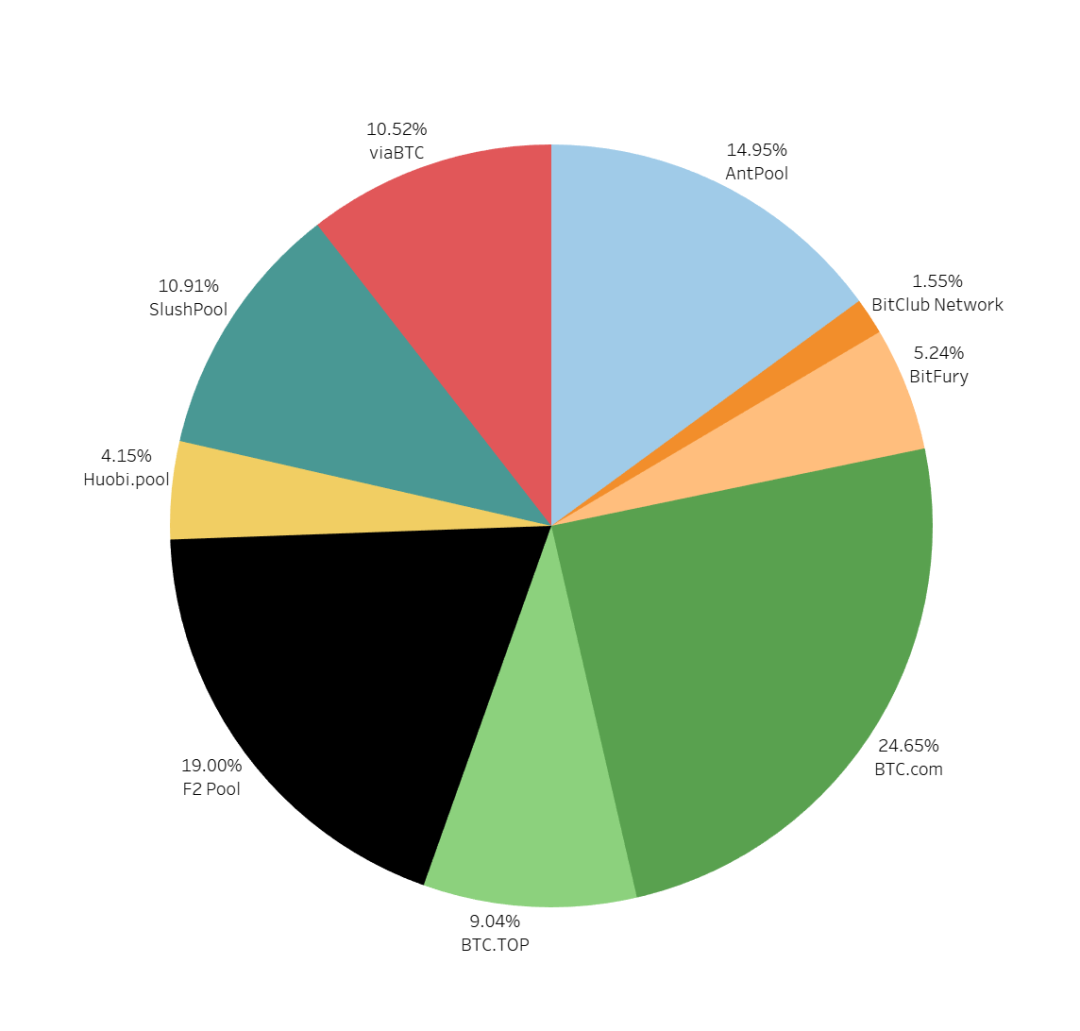

2.This is partly due to mining pools that promote growth

(Mining Pool Power and Mining Pool Name)

However, even a "decentralized" system is accompanied by the risk of monopoly. In 2014, a mining company had 42% of the hash power and was almost able to launch a 51% attack. At the time, God V also suggested that Bitcoin establish a bounty pool to encourage the development of peer mining pools.

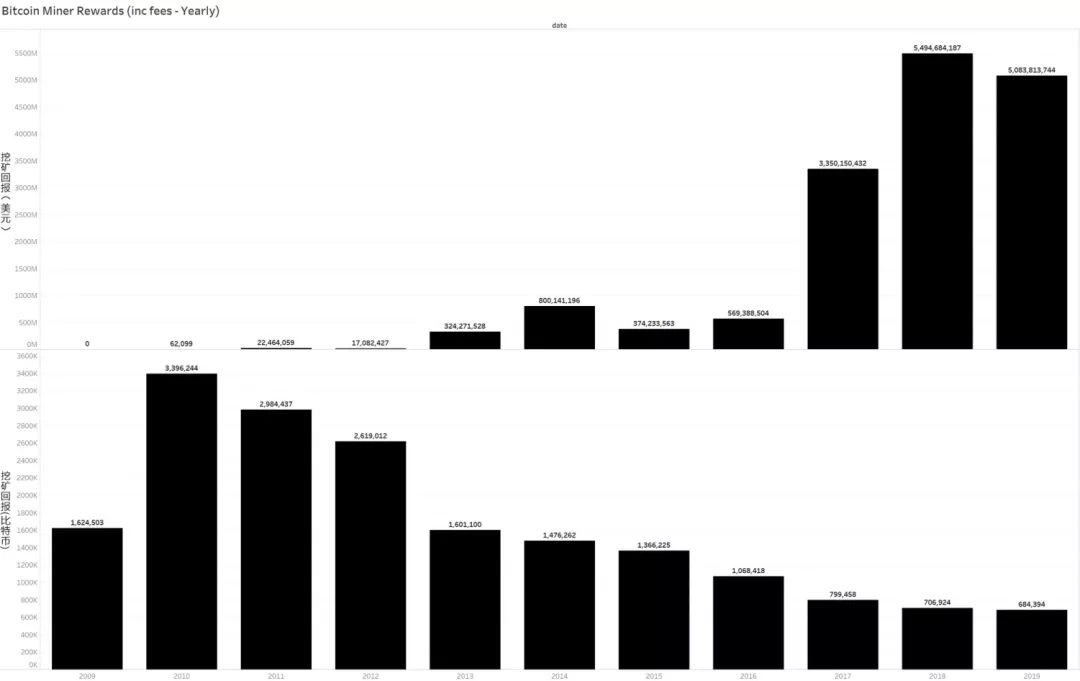

Since January 2009, the mining pool has issued $ 16 billion in rewards to miners working on the network.

Interestingly, the Btc.com mining pool (2018) and Huobi mining pool (2019) soon integrated into the mining ecosystem. In addition, over time, the percentage of "unknown" mining pools in the network has slowly decreased.

3.Who paid $ 16 billion to miners

Add transaction costs-miners have harvested 18,318,525 bitcoins or more than $ 16 billion. It can be said that in the past 10 years, about 240,000 bitcoins have been used to pay fees.

I think as mining difficulty increases and rewards are halved, mining will become an increasingly institutionalized game. We will see more and more infrastructure service providers dedicated to promoting the facilitation of mining, the development of ASICs, manufacturing and supply chains, and green energy.

In addition, if you want to know how these costs are allocated, take a look at the figure below. Here is a chart of the mining fee allocation for 2019 (excluding fees paid to unknown pools):

What does all this mean for us?

I have always thought that Bitcoin is the most important financial experiment in the world. It is based on more than 40 years of cryptography and decades of digital currency experiments. And when many people look at today's bitcoin ecosystem, what they see is the noisy crowd on social media, speculative fanaticism, and a chaotic culture.

Many people overlook the fact that these are well-designed because Bitcoin cannot compete with existing paradigms in fintech. Otherwise, Satoshi Nakamoto might sell to Silicon Valley venture capitalists instead of writing to a crypto punk mailing list. The value of bitcoin far exceeds the controversy we see on the Internet, far more than the hype of the media, it is a code change.

When Zimbabwe is experiencing an inflation crisis, Greece's debt crisis, or India's waste money, we see people awakening and realizing that there is another option. As Nick Carter once wrote- Bitcoin is the most peaceful change in human history. For me, this is the charm of Bitcoin.

The above indicators simply explain the growth of the Bitcoin ecosystem. Whether these trends will remain the same for the next 10 years, or whether the price will rise to $ 100,000, is not a problem- as long as the transaction can be confirmed, Bitcoin has solved its own problems.

Finally, note the transcript of Bitcoin over the past ten years:

Original author: Joel John

Compilation: Masaka

Original link: https://www.decentralised.co/bitcoin-in-numbers/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- US CFTC Chairman: Ripple (XRP) may be considered a security by the SEC

- Ba Shusong, Chief Chinese Economist at HKEx: Libra will make some economies increasingly dependent on fiscal policy

- Ethereum 2.0 reward and punishment mechanism analysis, one article teaches you how to make good nodes

- How does Ethereum 2.0 achieve "swipe-level" speed?

- The era of personal crypto bonds: NBA players, Ethereum, and personal bonds

- Latest report: Lightning Network's privacy and scalability advantages are lower than expected

- Israeli startup Atomic closes $ 2.5 million seed round, led by Hexa Group