What new changes will be made to the multi-mortgage Dai?

Source: MakerDAO

There are still five days, the multi-mortgage Dai will be officially released, which will mark MakerDAO into a new stage, and also a milestone event in the entire stable currency field.

Multi-mortgage Dai will not only introduce the much-watched Dai Deposit Rate (DSR) and more collateral asset types, but also more new features to look forward to.

New name

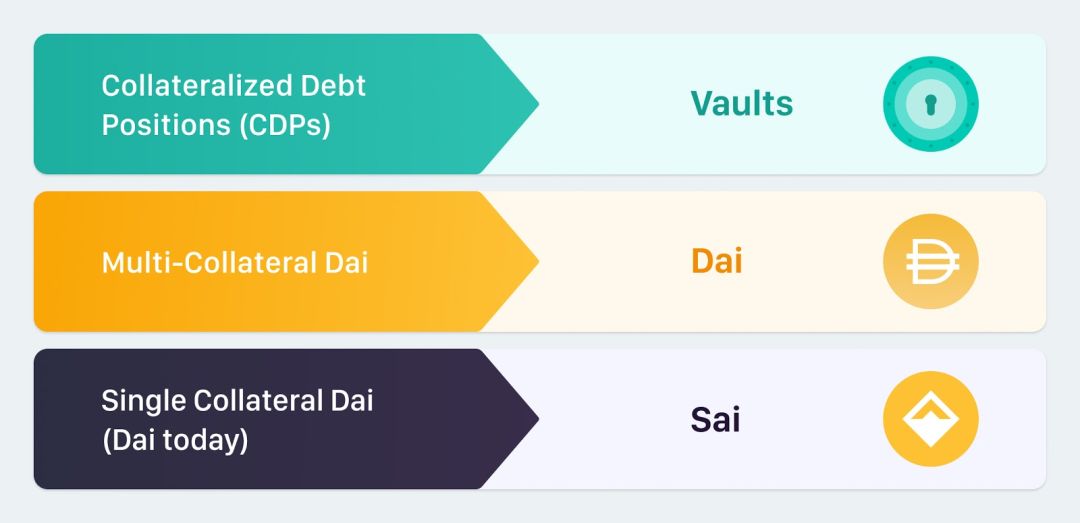

MakerDAO's CDP (mortgage debt warehouse) will be renamed Vault (Vault).

- Li Lihui: Should study and issue a global digital currency implementation plan led by China

- Block.one officially participated in the EOS network upgrade vote, currently holding about $300 million EOS

- If the bull market does not come when the bitcoin is halved, what will the market face?

In addition, in order to allow users to better distinguish between Dai and multi-collateral Dai generated by single collateral, Dai generated by single collateral will be renamed as "Sai", and multi-collateral Dai will officially adopt the name of "Dai" .

One-click upgrade

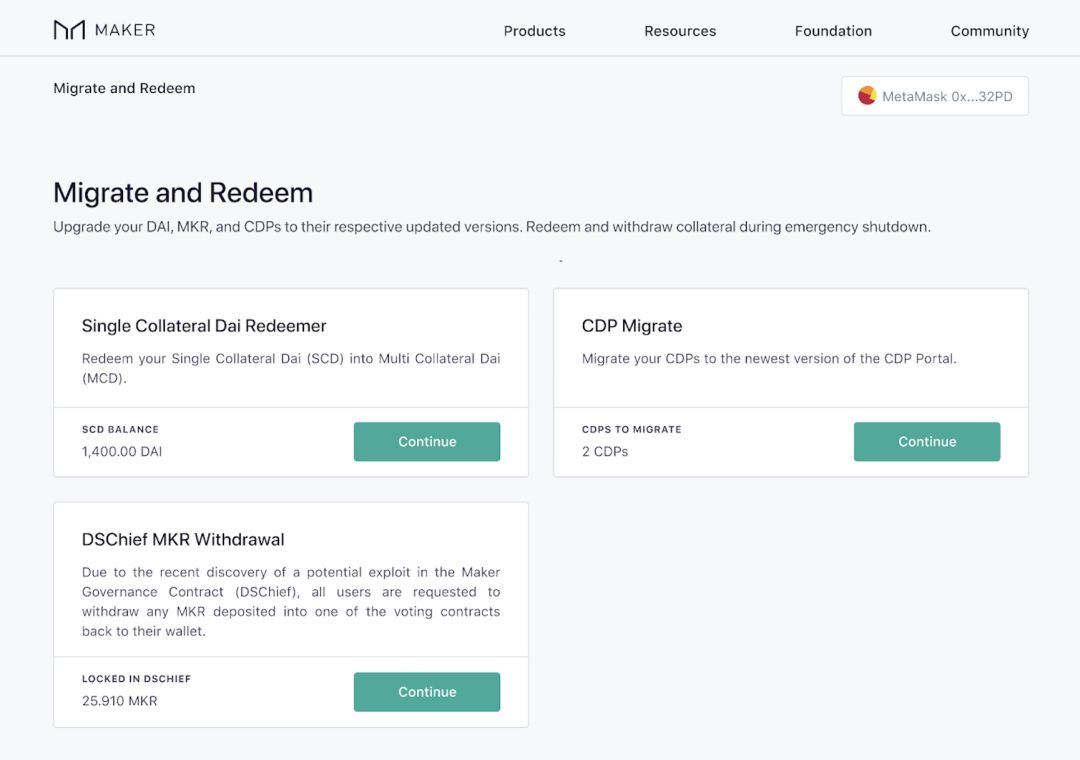

After the multi-mortgage Dai is released, anyone can easily upgrade Sai and CDP to a multi-mortgage version with the migration panel (migrate.makerdao.com).

Maker's integration partners (including trading platforms and wallets) will also support multi-mortgage Dais as soon as the multi-mortgage Dai is released. The single mortgage Dai will run in parallel for several months, and will be “emergency shut down” for the single mortgage Dai after the end of the transition period . We recommend that Sai and CDP holders upgrade as soon as possible after Dai is released .

Maker Eco Participants can view the Multi-Mort Dai Upgrade Guide for comprehensive upgrade assistance.

Multi-collateralized asset type Multi-collateralized Dai's expansion and openness means that under the governance of MKR holders, with appropriate risk parameters, almost all encrypted assets can be used as collateral in the Maker system.

The first multi-collateral assets selected by the Maker Risk Group were ETH and BAT . Next, the Maker community will also evaluate the following cryptographic assets.

Collateral being evaluated by the Maker community

Collateral being evaluated by the Maker community

In addition, the single-backed Dai system requires MKR payment stability fees. In the multi-mortgage Dai system, users can pay the stability fee directly with Dai .

Dai deposit rate

Dai Savings Rate (DSR) is one of the most anticipated features of Dairy Dai, making Dai stand out from other stable currencies. Any holder can lock Dai's interest in the DSR contract for the current interest .

When the multi-mortgage Dai is released, the Maker Foundation will provide an easy-to-use interactive panel for depositing and retrieving Dai.

Dai deposit interaction page

Dai deposit interaction page

The initial value of the Dai deposit rate proposal is 2%. You can view the proposal details in the Maker Governance panel: https://vote.makerdao.com/polling-proposal/qmba2hpv3kcbjgzvlnv7xsogs3jenqdiqo3ffnktgqtepn

One-stop DeFi platform: Oasis

On October 2nd, Maker released the Oasis Trade one-stop Dai trading platform . On November 18th, we will launch two other new products on the occasion of the multi-mortgage Dai release: Oasis Borrow (borrowing) and Oasis Save (deposit) .

Oasis Borrow is a mortgage-backed product for multi-mortgage Dai, where users can mortgage assets (first assets: ETH, BAT) to generate Dai. Oasis Save is a multi-mortgage Dai's demand deposit product, users can deposit Dai, real-time interest (DSR).

Note: After the multi-mortgage Dai is launched, Oasis Trade will stop the trading of Sai and replace it with Dai. We recommend that users cancel Sai's trading order and upgrade Sai migration to Dai to continue trading on the Dai market.

New trading platform support

We are working with exchanges that are expected to support multiple mortgages, and most exchanges will support multiple mortgages within 1-3 weeks. If you have any questions, you can contact the exchange or use Oasis Trade directly. We will publish a report summarizing the trading platform that supports multi-mortgage Dai.

New brand, official website and content

After months of collecting opinions from the community, I constantly research and think about the future shape of Dai. We hope that Dai will not only be widely used in the field of cryptocurrency users, but also make multi-mortgage Dai more close to people's lives, as a stable global currency, and lead the large-scale application of DeFi. To this end, we have introduced brand new design and content to optimize user experience and understanding.

New logo

New economic white paper

In December 2017, MakerDAO released an initial white paper introducing the single-backed Dai system. After the multi-mortgage Dai is released, Maker will release a new economic white paper that provides a complete description of the multi-mortgage Dai system.

Developer guide

Developers can build a variety of Dapps on top of the Maker protocol. We provide open source SDKs, APIs, and repositories, as well as a series of tutorials and tutorials to help developers create new products in the Maker ecosystem through smart contract interaction: https:/ /github.com/makerdao/developerguides

Multi-language support

When the multi-mortgage Dai is released, we will release both English and Chinese versions , and continue to introduce other localized versions. In addition, translations of economic white papers, blogs, etc. are provided.

Frequently Asked Questions

We will provide a richer FAQ for multi-mortgage Dai, providing personalized assistance to partners, vault owners, Dai holders and participants of different identities in the system.

Auction mechanism, care machine and oracle document

The auction mechanism, the care machine and the oracle will have new ways of working and functions in the multi-mortgage Dai system. In order to better understand the relevant mechanisms, we provide the following documents:

– Auction mechanism: https://github.com/makerdao/developerguides/blob/master/keepers/auctions/auctions-101.md

– How to run an automated auction care robot: https://github.com/makerdao/developerguides/blob/master/keepers/auction-keeper-bot-setup-guide.md

– Prophecy V2 version

The first institutions that provide feed prices in the V2 version of the oracle

The first institutions that provide feed prices in the V2 version of the oracle

In addition, the multi-mortgage Dai system joins a predictive machine security module (OSM), which delays the feed price by one hour and freezes the feed price when the predictor is potentially attacked, thus better protecting the Dai system. The relevant parameters will be MKR holders are determined through governance.

Key Maker Governance Voting

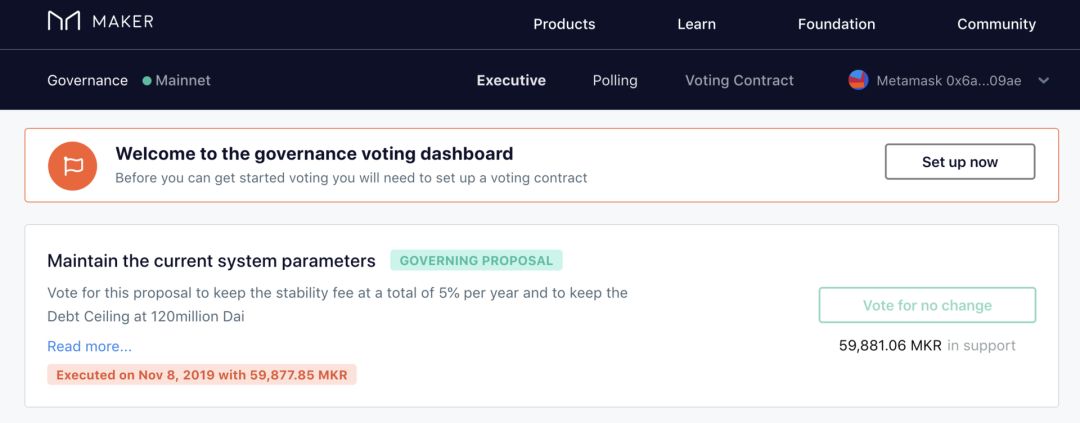

In the process of multi-mortgage Dai online, Maker will conduct a series of poll voting and execution voting to ensure the stability, transparency and effectiveness of the system. Voting will focus on collateral increase, risk model, asset priority and Dai deposit rate setting.

On November 15th, Maker will make an important executive vote before going online (vote.makerdao.com) . We hope that MKR holders will actively participate and help the multi-mortgage Dai to go online.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Former Federal Reserve Chairman: Libra and the central bank's digital currency are meaningless

- With AAX entering the game, can the Lun Stock Exchange and ICE, Nasdaq stage the "Three Kingdoms Kill"?

- CME grabbed the bitcoin option market, why did this "unbelievable land" cause giants to grab?

- BTC's short-term trend is sluggish, and some mainstream currencies are still strong

- Wuzhen · than the original chain CTO James, a detailed explanation of the ecological development progress and ecological closed loop than the original chain technology

- The real scene data of “blockchain+”: 8 million live monthly is an extreme case.

- Blockchain Weekly | Ministry of Industry and Information Technology, Hong Kong Securities Regulatory Commission regulates supervision, paving the way for industry development