When the bull market knocks, will you choose HOLD?

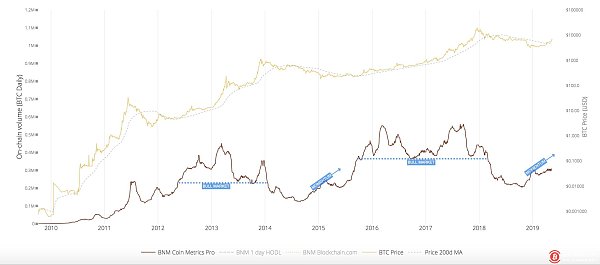

“In the 10 years of BTC trading history, the (market price) is higher than the 200-day moving average (blue line) for a period of time (such as more than 8 weeks), which marks the bullish cycle, even the super conservative trend line. We are above 200DMA. Now, the bull market has reached 99% confirmation.

“We are now waiting for the volume of trading in the chain to climb. The volume of trading on the chain is a sign of long-term investor activity. This is what I want to see, 100% confirm the bull market signal…”

- Can the price of XRP reach $1 in the coming months?

- Xinhuanet: BTC broke through 8,000 US dollars, is the long-term chess game still a safe haven?

- With three factors superimposed, Bitcoin rushed to $8,000 overnight, and the currency was boiling.

(Data from: http://charts.woobull.com, the current situation is very similar to mid-2015)

The bullish cycle of digital assets such as Bitcoin seems to be really open, and the days of tightening the belts and gimmicks will come to an end.

"Even if life is hard, don't forget to applaud yourself." – Picture from "When Happiness Comes Knocking"

When the bull market knocks on the door, then, do we have to open the door blindly?

Fortunately, in the r/Bitcoin forum, in addition to the words "replace gold" and "bull market" which make people blind, I also saw the administrator put a post on themmos: "A certain reckless Investment.

… Bitcoin prices are in an incredible upswing phase, which is likely to be a bubble. If you want to invest $10,000 in the bitcoin market to get rich quickly, then your "investment strategy" is no better than those who put all their money on roulette gambling. High-risk, high-return investments are not necessarily bad, but you must carefully review your thinking process to make sure you don't:

1. The dream of getting rich quickly blinds your eyes, similar to those who put a lot of money into the lottery. 2, surrounded by "HODL" memes, reddit comments or other information, which is sometimes very interesting, but it is not a good investment advice; 3, based on panic thinking investment, for example, "OMG, bitcoin prices will reach 1 million US dollars, if I don't buy now, I will always miss my chance," or "OMG, bitcoin price will fall to 0.01 US dollars, if I don't sell now, I will lose it." 4, too much investment The funds are so much that they can exceed the range of losses that they can afford. Bitcoin is still highly speculative. No investment adviser will tell you to put your life savings into MSFT or other projects…

Although the background of this post is written at the end of 2017, which is the climax of a bull market on Bitcoin, some of the content is also worth learning (even if it is now), because blind investment is the biggest investment. One of the taboos (in the impression that he had been operating indiscriminately during the period of 15-16 years, the more the coin is the more tossed).

Finally, add a few more thoughts of your own:

Since there is a high probability of entering the “Thigh” cycle, “HODL” will truly show its true value, treating itself as a 90% “stupid” trader, not sending money to the exchange. Don't want to make money from others;

Seeing that the price of the currency has risen, the method of all in is still unacceptable, because even if it is the beginning of the cow, there will be a callback, and the fixed investment is still a good choice, but the time interval of the fixed vote is to be adjusted (ie shortened) );

The choice of "left-hand" for futures contracts is extremely cautious. The market will have a one-sided market trend with a high probability. Although there are some callbacks, the probability of winning will be much lower than the probability of losing money, and even the situation of being pulled out will occur. This will be the most common mistake for bear market bearers in the current environment. For the vast majority of investors, not doing the contract is still the safest choice (including the author);

What should I do with a bunch of altcoins (competition coins) in my hand? If you only occupy a small proportion of the portfolio, and the asset has at least one large exchange listed and there is no risk of being removed, then you can keep them as lottery tickets (the bull market may increase more than Bitcoin later). If the large positions are all small competitors, the large proportions will be replaced by mainstream digital assets such as bitcoin, while the French currency investment is still preferred to BTC;

Look at the price of the currency, but it is not appropriate to look at it, or even stare at it, otherwise, there will be the impulse of handcuffs…

Study the top judgment plan of the bull market and formulate a fixed sale plan;

Eat, sleep and sleep…

The above views only represent individuals. If you are not optimistic, you can of course choose to reject this cow and reject HODL. This is everyone's freedom. (Babbit)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin rose above $8,000: the incentive for this bull market is not in the circle, but outside the circle

- V God: Four major regulatory trends worthy of attention

- Bitcoin broke through $8,000, where is the future of cryptocurrency?

- Starbucks, the whole food supermarket and other US retail giants collectively announced the acceptance of encrypted goods

- Analysis of the madman market on May 14: BTC's rise is good to be exposed to the boots into a bad?

- How does the cryptocurrency Ponzi scheme work?

- BTC rose more than 10% and broke the total market value of cryptocurrency of $8,200 to exceed $200 billion.