Who has been the ultimate beneficiary of Stellar's four years of inflation?

Author | Hash Pie-Adeline

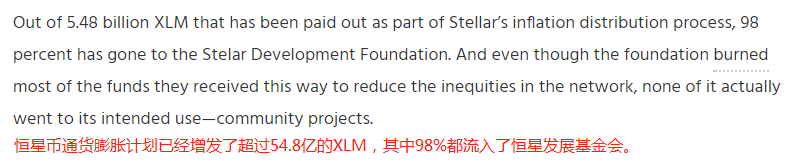

In October last year, Stellar (Stellar, XLM Coin) announced the suspension of the implementation of the four-year inflation system . It stands to reason that this is a story that has ended and there is no room for further discussion. Of the tokens issued by the Stellar inflation plan, 98% went to the Stellar Development Foundation (SDF) , and this matter was brought back to the table.

Speaking of Stellar's inflation system, the cryptocurrencies are different from our usual impressions. Remember that cryptocurrencies led by Bitcoin all have deflationary characteristics .

- Viewpoint | Witnessing History: Global interest rate cuts will give birth to Bitcoin's elder bull

- ING economist: If the dollar does not go digital, it will fall out of favor

- BitMEX follow-up impact, UK strengthens supervision of cryptocurrency exchanges

From a public perspective, many people seem to have a natural fear of inflation, and because of the illusion of an increase in real purchasing power brought about by deflation, people mistakenly believe that deflation is better than inflation. But in fact, deflation will reduce the flow of cash and cause a recession.

The gap between reality and ideal

"This will be a cure for the deflationary pitfalls of cryptocurrency ."

Stellar co-founder Jeb McCaleb said ambitiously.

In Stellar, exactly to prevent the decrease in XLM circulation, this project has an inflation plan set up from the beginning. Jeb McCaleb said in an email to the XLM development mailing list: "This plan will allocate rewards generated throughout the system and encourage people to collaborate. It is believed that over time, this plan will address the initial Unfair distribution. "

Stellar basics

The annual inflation plan generates tokens equivalent to 1% of Stellar's total supply. Accounts that account for more than 0.05% of Stellar's total share can receive additional XLM coins. The establishment of the Inflation Pool can allow accounts with shares below 0.05% but assets with more than 100XLM to vote collectively, so that the total share in the pool exceeds 0.05%, so that small scattered assets with more than 100XLM can also be divided. Get additional XLM tokens. According to the plan, these XLM coins will be distributed on a weekly basis.

According to Jeb McCaleb's original intention, an additional 1% issue per year is equivalent to an incentive mechanism, allowing XLM coins generated by inflation to in turn act on stellar-based projects, solving system economic growth issues and preventing token loss, and supporting the ecosystem Development and growth.

This seems like a good way.

However, the ideal is full and the reality is partial.

As early as October 2018, there have been many voices in the Stellar project community hoping to cancel the inflation plan . After a year-long discussion, they finally announced the removal of this plan in the 12th edition agreement at the end of October 2019 .

Stellar's project team gave reasons for stopping the plan: The additional XLM in the plan did not solve the original unfair distribution problem , and a large amount of XLM coins in the additional issuance went to the Stellar Coin Development Foundation (SDF) , which did not make the Stellar project itself Benefit .

Then the question comes, why did the Stellar Development Foundation, as the custodian of the Stellar program, get a large number of additional XLMs that should have flown to the market as planned? At the same time, it is reasonable to say that the increase of the foundation's tokens will allow the team's work to operate better, but why will it eventually drag down the entire system?

Earlier this year, a report published by Coinmetrics gave us the answer . This report analyzes the entire process from the opening to the termination of the agreement by looking at the data on the chain, exploring the reasons for its elimination, and evaluating the impact of this plan on the Stellar chain's indicators.

The truth behind the surface

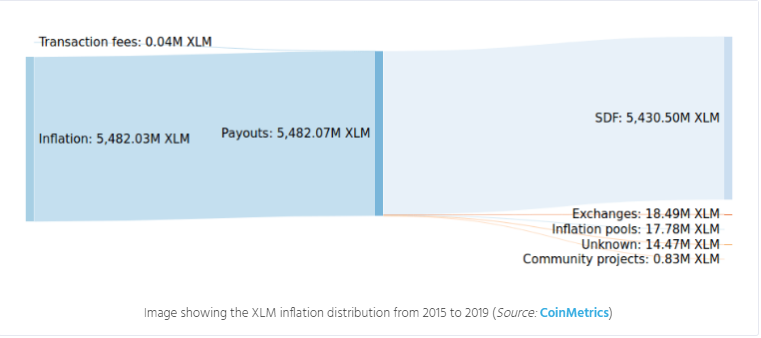

First of all, according to the analysis of coinmetrics, in the past 4 years (from July 2014 to October 2019), the inflation plan has been executed a total of 280 times. From the perspective of receiving additional XLM coin addresses, It can be roughly divided into the Stellar Development Foundation, cryptocurrency exchanges, community projects, and inflation pools. 2 3 accounts accounted for up to 5.482 billion additional XLM coins, of which 98% went to the Stellar Development Foundation.

Token flow after Stellar issuance Image credit: Coinmetrics

According to the final destination of the additional XLM, there are 1,087,306 addresses participating in the inflation plan, accounting for 18.3% of the total number of users. However, it is worth noting that most of them are SDF accounts and other large currency holders, and only 6.6% of them are small retail investors. Therefore, in the end, only tens of thousands of people can really enjoy the benefits of the inflation plan on a regular basis.

As for why this plan does not attract a lot of retail investors? This has to start with the rise of XLM. According to many other altcoins of XLM, XLM, which was originally unknown, ushered in explosive development in 2017. Many participants entered the market around this node, and funds It has been participating in the inflation plan since 2014.

XLM Coin Price Trend Data Source: Not Small

In addition, according to the Stellar Foundation blog, the Foundation controlled over 80% of Stellar's circulation before the XLM destruction plan and the cancellation of the inflation plan . That is to say, with a huge body weight and a low degree of participation in Xiaosan, the Foundation naturally absorbed more XLM by virtue of the "additional issue" tool.

Foundation token control image source: SDF blog

What is the team doing?

If the Coinmetrics report lets us know why the foundation can obtain such a high share in the additional issue, then the data disclosed in the article by CryptoSlate's crypto analyst can let us know why the foundation's tokens have increased, but failed to Help XLM projects work better .

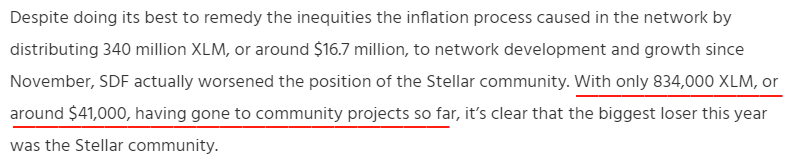

It is reported that, so far, only about 40,000 US dollars in the huge amount of funds of the Stellar Foundation are used for community projects , which is very small for XLM, which ranks in the top of the crypto market capitalization. In other words, the inflation issuance plan has neither benefited the majority of XLM holders nor gained much system gain.

Source of Fund Flow Information: CryptoSlate

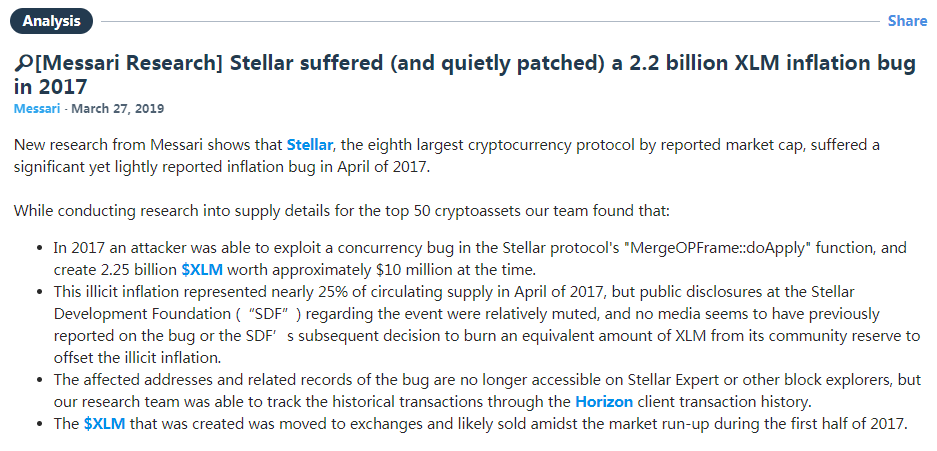

What's even more ironic is that according to the research of cryptocurrency research institute Messari, Stellar encountered a major inflation loophole of 2.25 billion XLM and valued at $ 10 million in April 2017, but this loophole has hardly been reported.

Cryptocurrency research agency Messari reports

Cryptocurrency research agency Messari reports

In addition, the entire market continues to weaken in 2018. Although the currency in the wallet has increased, the total value has remained unchanged, which has also become an embarrassment for the inflation plan.

All in all, for the Stellar ecosystem and for the non-profit Stellar Development Foundation, this four-year inflation plan has almost no winners . In addition to the hackers who stole XLM, the rest benefited only a small number of large capitalists and a small number of retail investors. The foundation's performance throughout the planning process can be described as negligent.

Dead sheep make up for it, too late?

After more than a year of discussions, the inflation plan was cancelled at the end of October 2019. At this time, the total number of XLM coins has reached 105 billion.

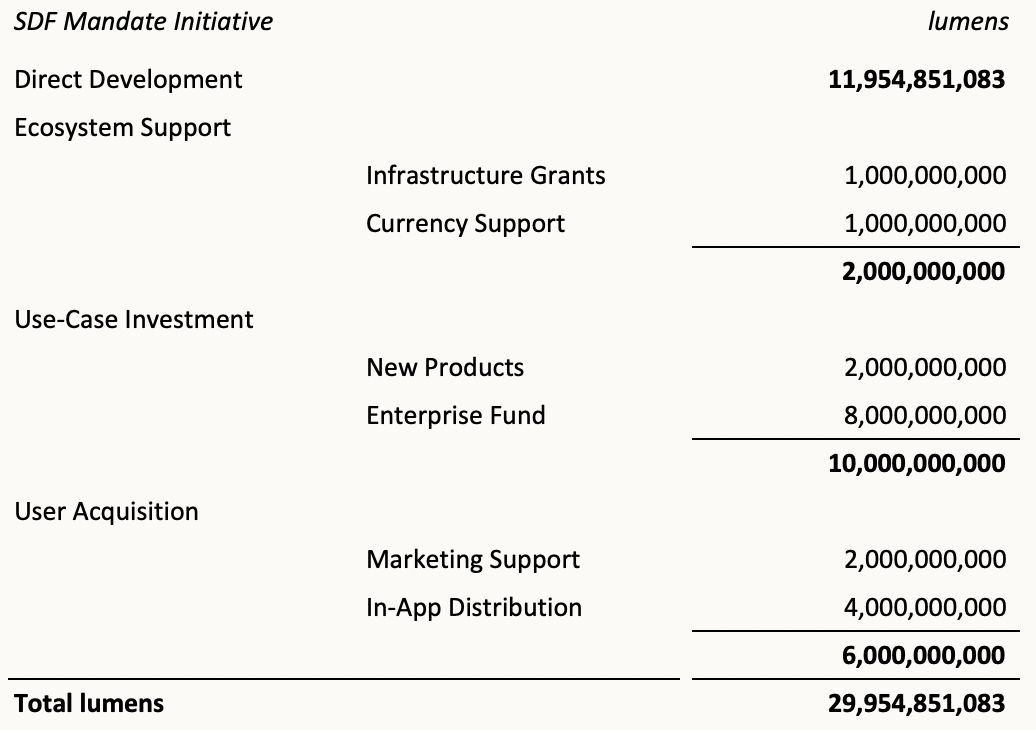

In the following month, facing the skepticism of the community and the inconvenience caused by the excessive amount of XLM, Stellar stopped the global gift program (for personal airdrops) and partner gift programs, and removed funds from the foundation and gift programs. The Chinese Communist Party destroyed 55 billion XLM tokens, which accounted for more than half of Stellar's total supply, and actively announced the use of the foundation's tokens and specific holding addresses.

Source of Foundation token usage information: SDF Blog

In terms of motivation, the original surplus tokens lacked real demand for use, and the dumping effect in the secondary market was not good. At this time, a story of "destruction" was promoted to promote the influx of speculative buying. In the short term, it is indeed true. Achieved results. As soon as the news of the destruction came out, the price of XLM rose rapidly, and within a day the price quickly recovered all the previous one and a half months of decline. Supply has decreased and demand has increased since the news came out. There is no doubt that the currency price will rise under the double stimulus.

However, the story about "destruction" is obviously not too long. What we need to pay more attention to is the intrinsic value of the token . The inflation plan has been suspended, but the problems in the operation of the exposed team are still worth studying. Not doing anything is an important factor in the sustainability of the Stellar project.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introduction | tBTC: A New Bitcoin Sidechain Design

- Exchange service provider AlphaPoint raises $ 5.6 million, Galaxy Digital takes another shot

- Loss of $ 98 billion per year! Nike, CK, Tommy Hilfiger seek to use blockchain technology to tackle counterfeiting

- Japan-Korea exchange stolen, U.S. sanctions Chinese OTC money changer? 3800BTC transaction reveals the process behind

- Market analysis: market trading sentiment has recovered, and the bulls have begun to exert their strength?

- World Economic Forum: Can the blockchain get rid of the speculation in 2020?

- Top conversation! Coinbase CEO's Fireside Talk with A16z Founder: Blockchain and the Internet Resemble Each Other